Fiscal Responsibility Policy - Kentucky

Fiscal Responsibility Policy is a legal document that was released by the Kentucky Department for Libraries and Archives - a government authority operating within Kentucky.

FAQ

Q: What is the Fiscal Responsibility Policy in Kentucky?

A: The Fiscal Responsibility Policy in Kentucky is a set of guidelines and principles aimed at ensuring responsible and effective management of the state's finances.

Q: What are the objectives of the Fiscal Responsibility Policy?

A: The objectives of the Fiscal Responsibility Policy in Kentucky are to improve financial management, promote transparency and accountability, and maintain long-term fiscal sustainability.

Q: How does the Fiscal Responsibility Policy promote financial management in Kentucky?

A: The Fiscal Responsibility Policy promotes financial management by setting standards for budgeting, forecasting, expenditure control, and reporting financial information.

Q: What role does transparency and accountability play in the Fiscal Responsibility Policy?

A: Transparency and accountability are important aspects of the Fiscal Responsibility Policy as they ensure that the government's fiscal decisions and actions are open and accountable to the public.

Q: Why is long-term fiscal sustainability important in the Fiscal Responsibility Policy?

A: Long-term fiscal sustainability is important in the Fiscal Responsibility Policy as it ensures that the state's finances are managed in a way that meets current needs without compromising the ability to meet future obligations and objectives.

Q: Who is responsible for implementing the Fiscal Responsibility Policy in Kentucky?

A: The responsibility for implementing the Fiscal Responsibility Policy in Kentucky lies with the state government, particularly the agencies and departments involved in financial management and budgeting.

Q: How does the Fiscal Responsibility Policy impact the residents of Kentucky?

A: The Fiscal Responsibility Policy in Kentucky impacts the residents by ensuring that their tax dollars are managed responsibly and efficiently, leading to effective public services and investments in the state's future.

Q: Does the Fiscal Responsibility Policy in Kentucky include any measures for addressing debt and liabilities?

A: Yes, the Fiscal Responsibility Policy includes measures for addressing debt and liabilities by establishing guidelines for borrowing, managing debt levels, and addressing unfunded liabilities.

Q: Are there any mechanisms in place to monitor the implementation of the Fiscal Responsibility Policy?

A: Yes, mechanisms such as regular financial audits, performance assessments, and reporting requirements are in place to monitor the implementation of the Fiscal Responsibility Policy in Kentucky.

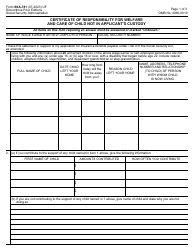

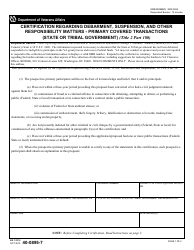

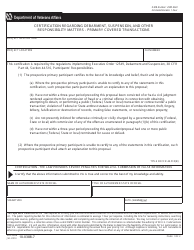

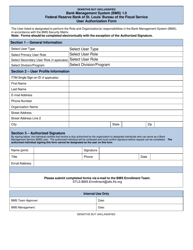

Form Details:

- Released on April 8, 2020;

- The latest edition currently provided by the Kentucky Department for Libraries and Archives;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kentucky Department for Libraries and Archives.