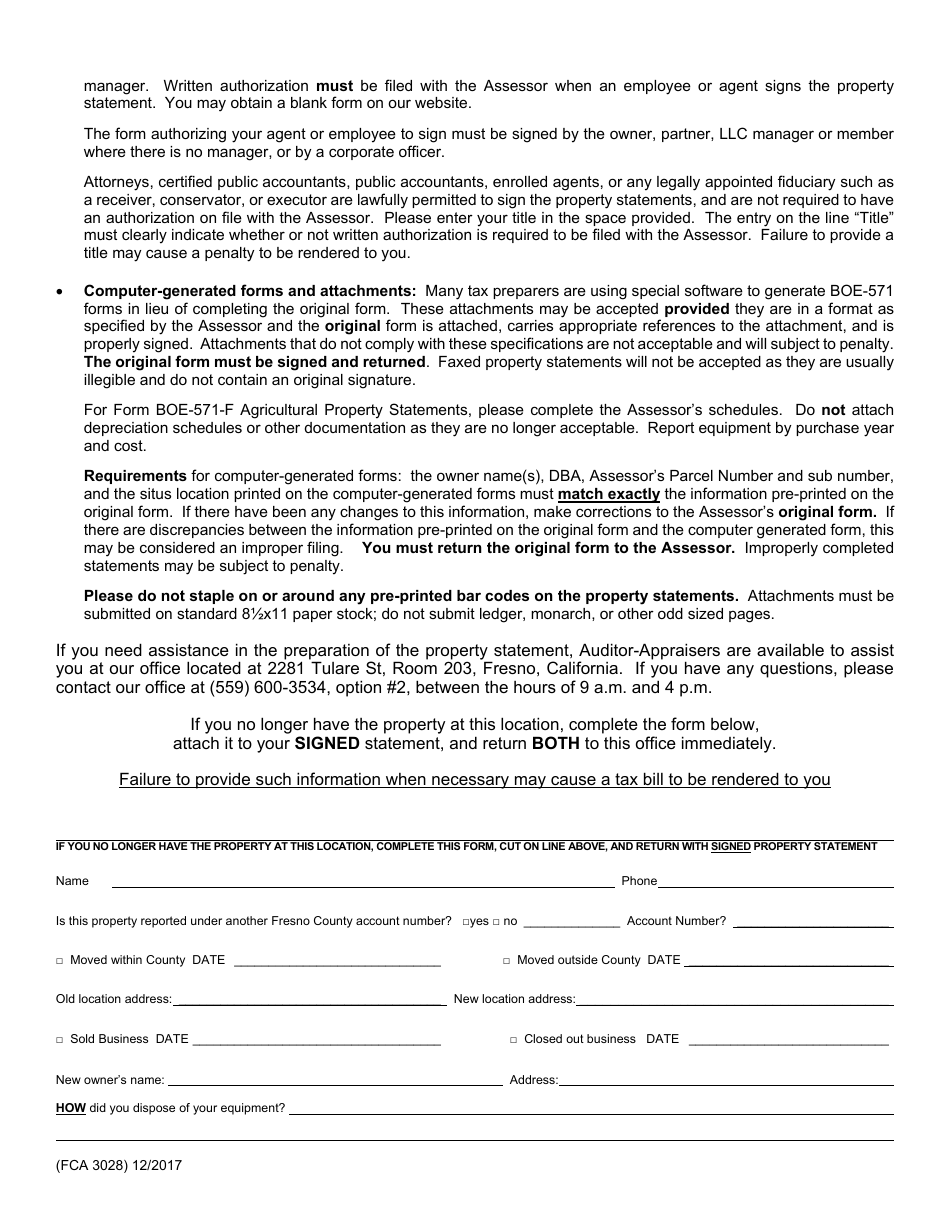

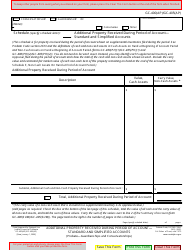

Form FCA3028 Additional Instructions for Filing Property Statements - County of Fresno, California

What Is Form FCA3028?

This is a legal form that was released by the County Assessor - County of Fresno, California - a government authority operating within California. The form may be used strictly within County of Fresno. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is FCA3028?

A: FCA3028 is a form used to file property statements for the County of Fresno, California.

Q: What are property statements?

A: Property statements are documents that provide information about a taxpayer's real and personal property.

Q: What are the additional instructions for filing property statements in Fresno County?

A: The additional instructions for filing property statements in Fresno County can be found in the FCA3028 form.

Q: Is the FCA3028 form specific to Fresno County?

A: Yes, the FCA3028 form is specific to Fresno County, California.

Q: Are there any other requirements for filing property statements in Fresno County?

A: Yes, in addition to the FCA3028 form, you may be required to provide other supporting documents or information as specified by the county.

Q: Who should file property statements?

A: Property statements should be filed by taxpayers who own real or personal property in Fresno County, California.

Q: What is the purpose of filing property statements?

A: The purpose of filing property statements is to provide an inventory of a taxpayer's property for assessment and taxation purposes.

Q: Are there any deadlines for filing property statements in Fresno County?

A: Yes, property statements in Fresno County are typically due by April 1st of each year.

Q: What happens if property statements are not filed?

A: Failure to file property statements may result in penalties or fines imposed by the county tax assessor.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the County Assessor - County of Fresno, California;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FCA3028 by clicking the link below or browse more documents and templates provided by the County Assessor - County of Fresno, California.