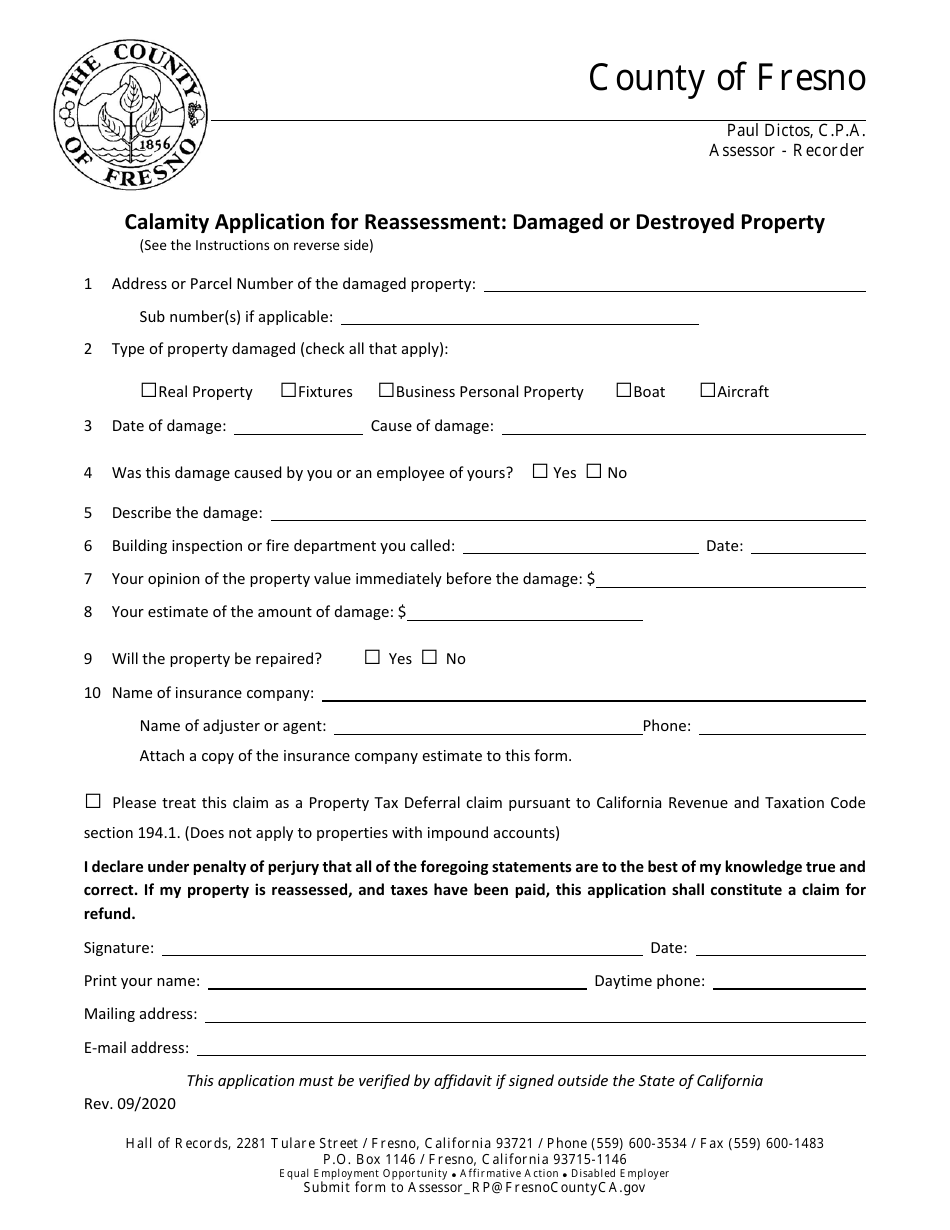

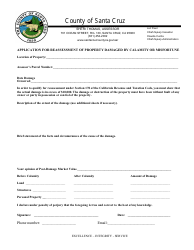

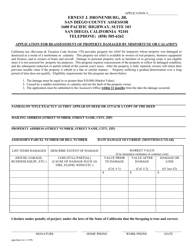

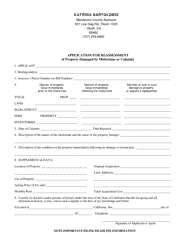

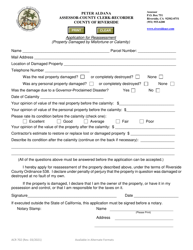

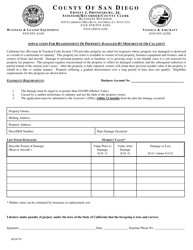

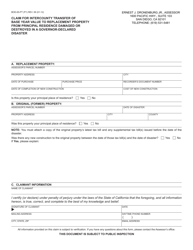

Calamity Application for Reassessment: Damaged or Destroyed Property - County of Fresno, California

Calamity Application for Reassessment: Damaged or Destroyed Property is a legal document that was released by the County Assessor - County of Fresno, California - a government authority operating within California. The form may be used strictly within County of Fresno.

FAQ

Q: What is the Calamity Application for Reassessment?

A: The Calamity Application for Reassessment is a form used in the County of Fresno, California to request reassessment of property that has been damaged or destroyed by a calamity.

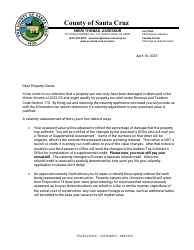

Q: Why would I need to file a Calamity Application for Reassessment?

A: You would need to file a Calamity Application for Reassessment if your property has been damaged or destroyed by a calamity, such as a fire or a natural disaster.

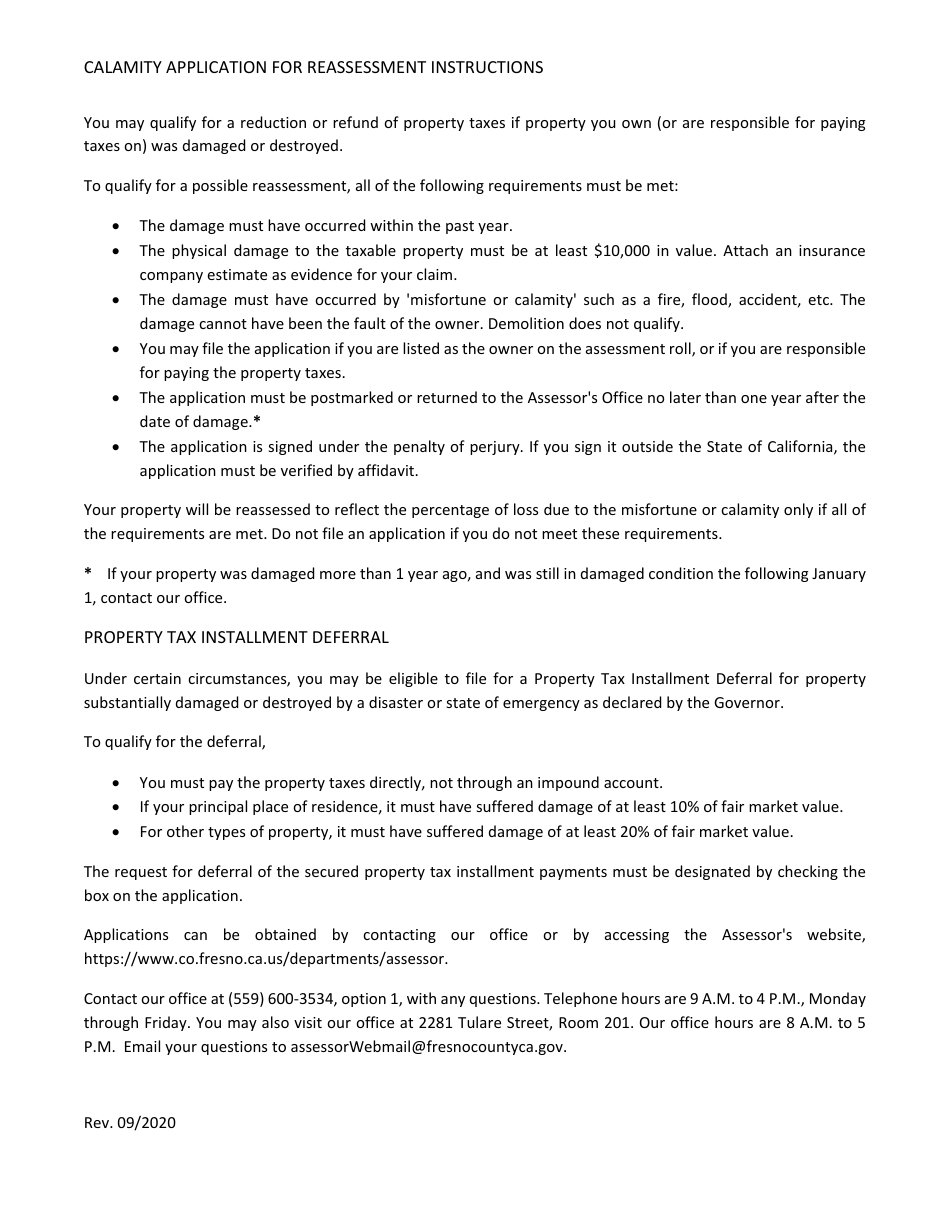

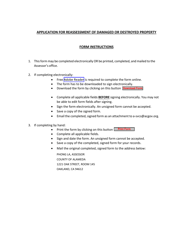

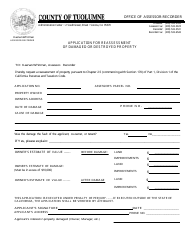

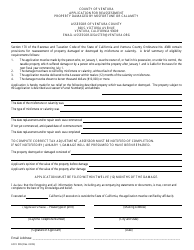

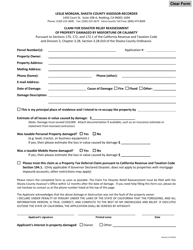

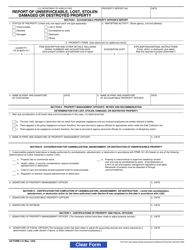

Q: What should I include in the Calamity Application for Reassessment?

A: You should include information about your property, the type of calamity that caused the damage or destruction, and any supporting documentation.

Q: What happens after I file a Calamity Application for Reassessment?

A: After you file a Calamity Application for Reassessment, the Assessor's Office will review your application and determine if a reassessment is warranted.

Q: Will filing a Calamity Application for Reassessment lower my property taxes?

A: If a reassessment is approved, it may result in a temporary reduction in your property taxes due to the damage or destruction of your property.

Q: Is there a deadline for filing a Calamity Application for Reassessment?

A: Yes, there is a deadline for filing a Calamity Application for Reassessment. You should file the application within 12 months of the calamity event.

Form Details:

- Released on September 1, 2020;

- The latest edition currently provided by the County Assessor - County of Fresno, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the County Assessor - County of Fresno, California.