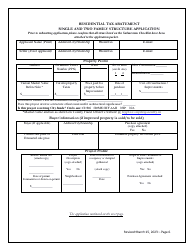

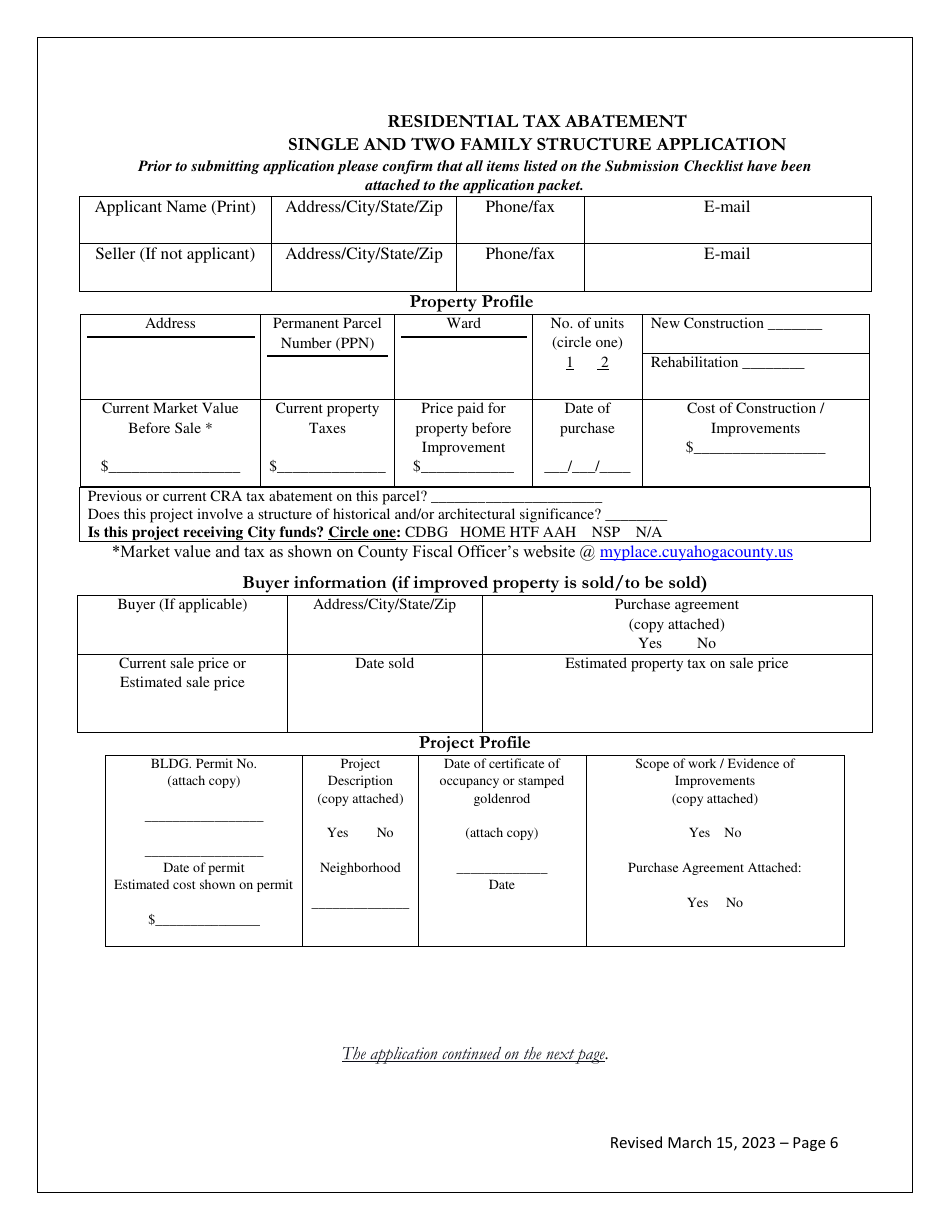

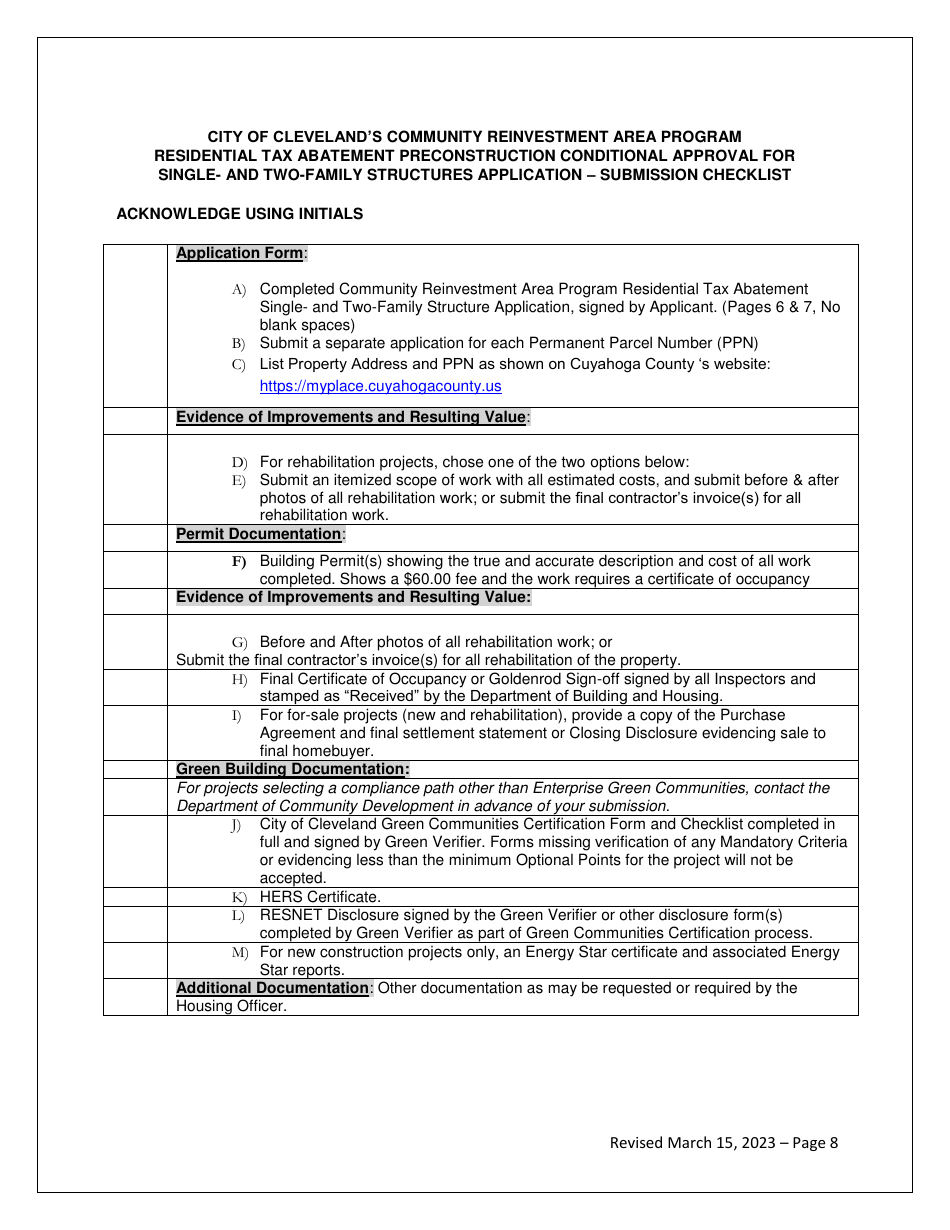

Residential Tax Abatement Single and Two Family Structure Application - City of Cleveland, Ohio

Residential Tax Abatement Single and Two Family Structure Application is a legal document that was released by the Department of Community Development - City of Cleveland, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Cleveland.

FAQ

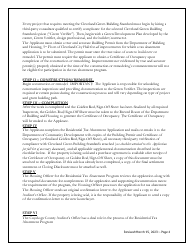

Q: What is the Residential Tax Abatement Single and Two Family Structure Application?

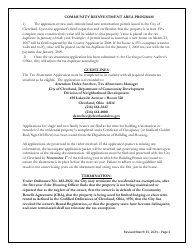

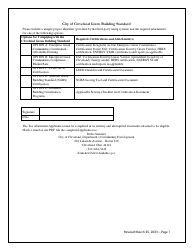

A: The Residential Tax Abatement Single and Two Family Structure Application is a program in the City of Cleveland, Ohio that provides tax incentives for residential property owners.

Q: Who can apply for the Residential Tax Abatement?

A: Residential property owners in the City of Cleveland, Ohio can apply for the Residential Tax Abatement.

Q: What types of properties are eligible for the Residential Tax Abatement?

A: Single and two family structures are eligible for the Residential Tax Abatement.

Q: What are the benefits of the Residential Tax Abatement?

A: The Residential Tax Abatement provides a reduction or elimination of property taxes for a specified number of years.

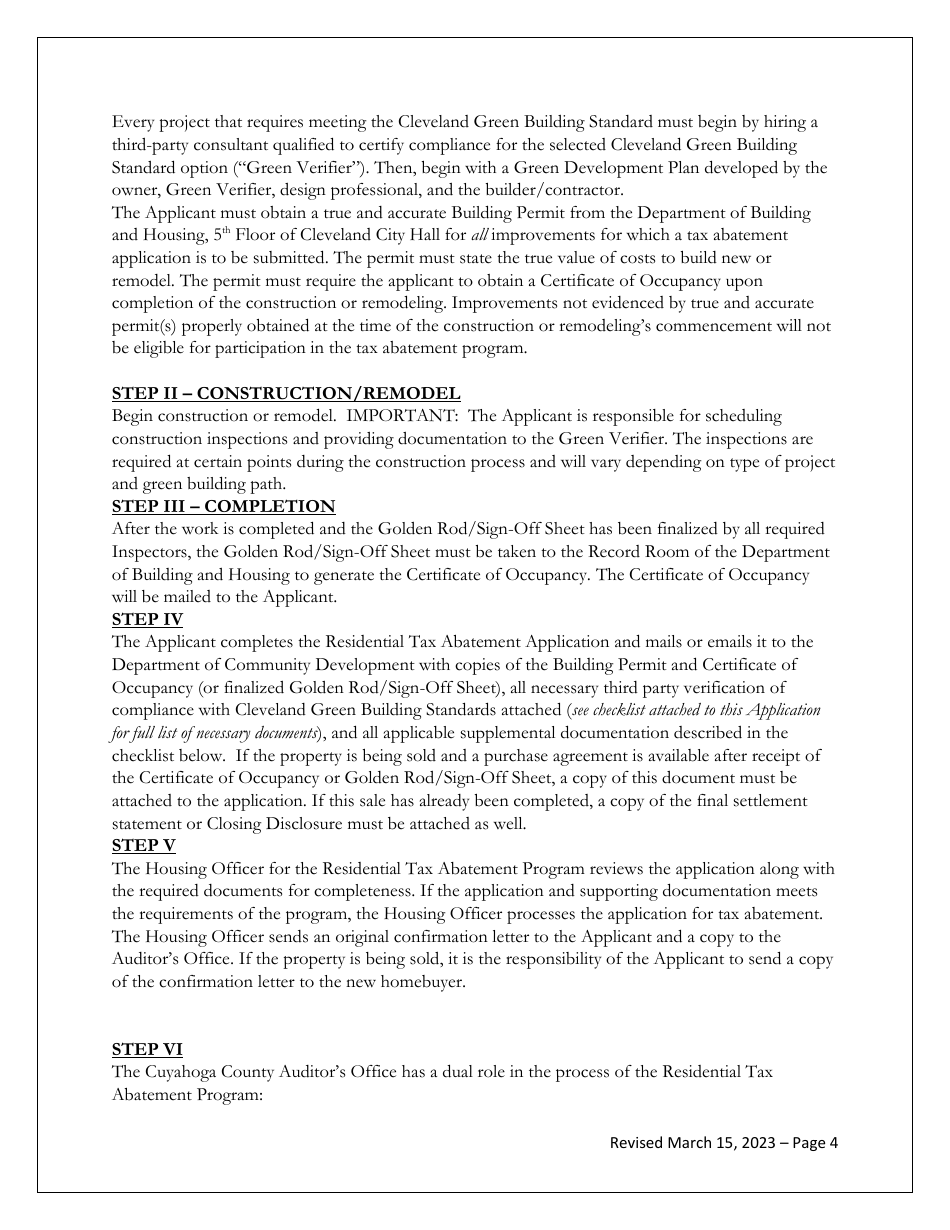

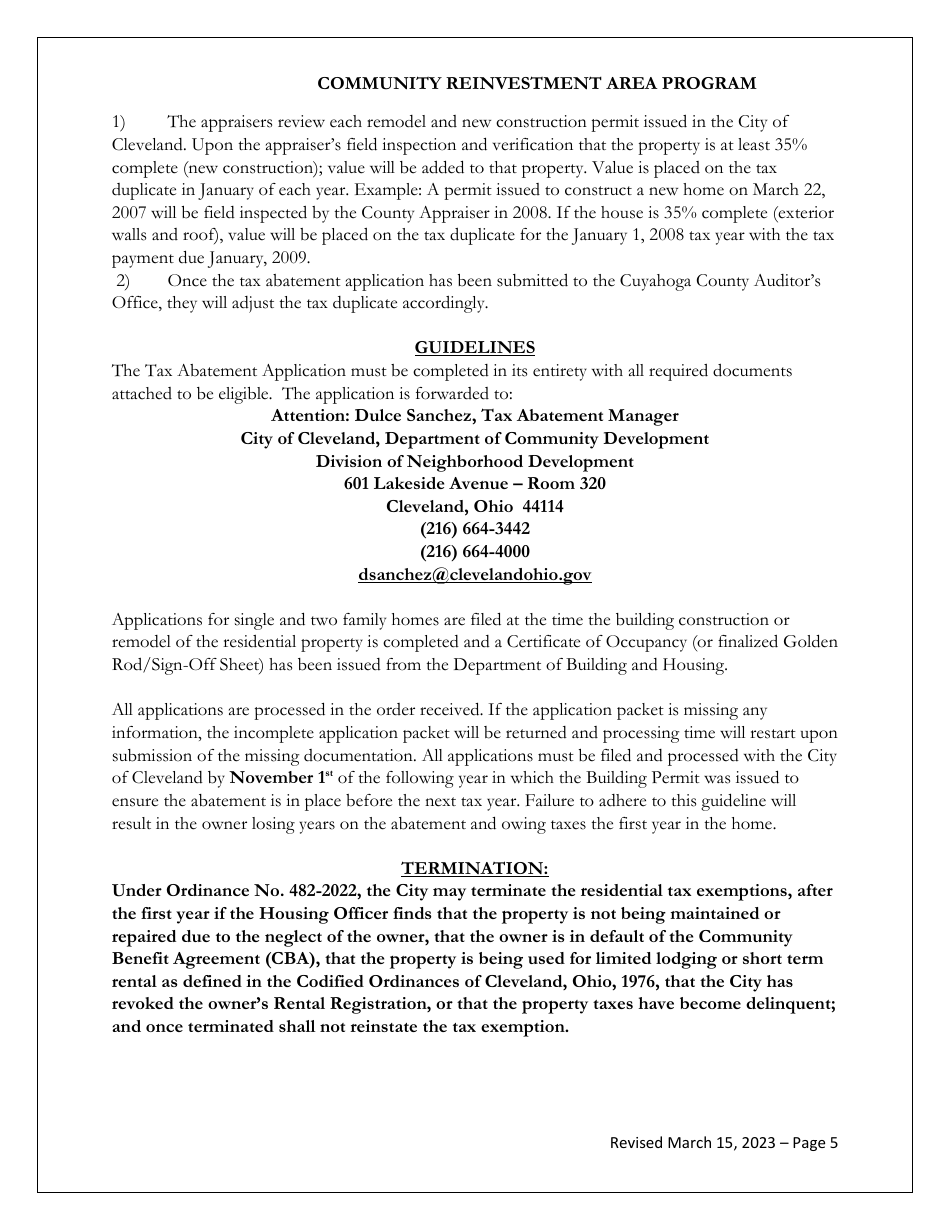

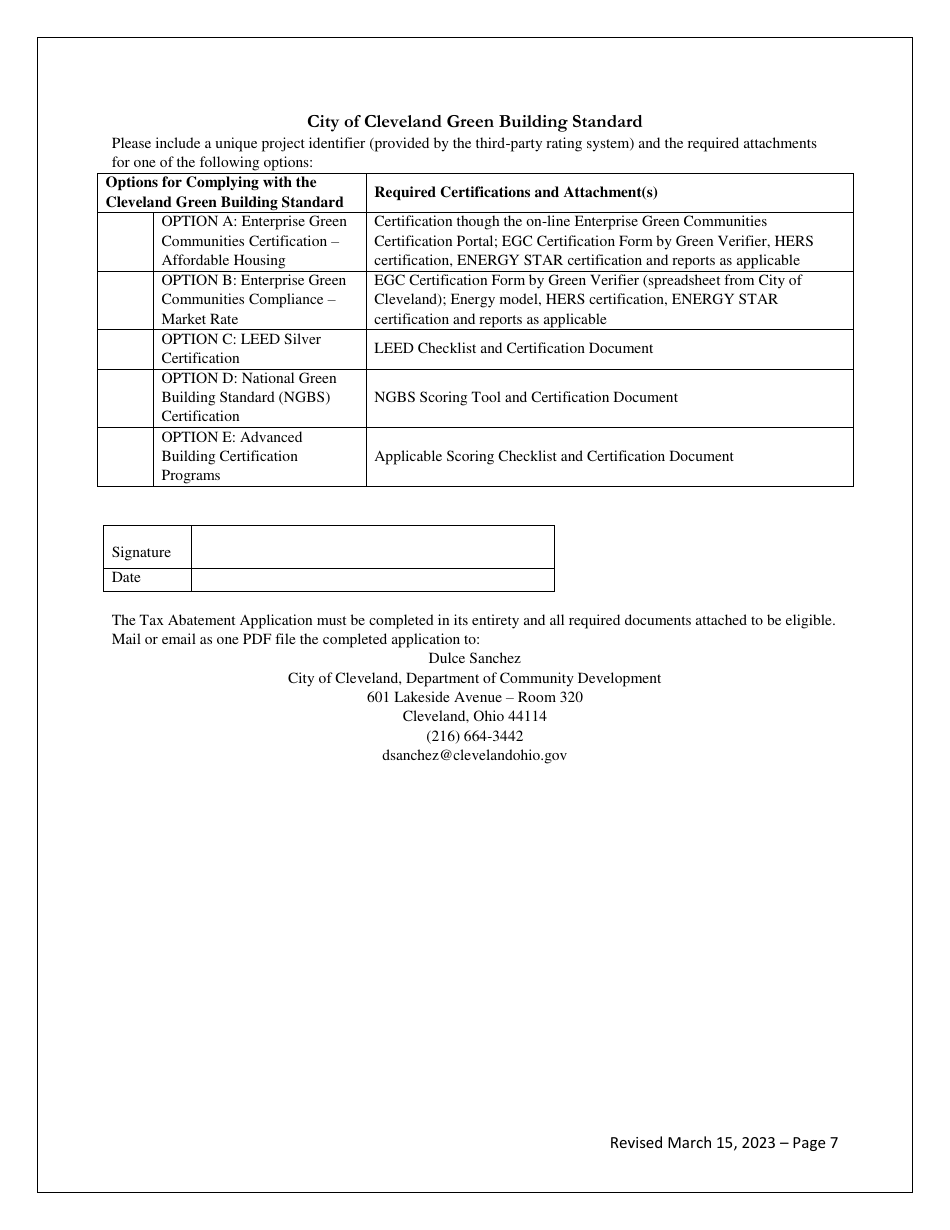

Q: How can I apply for the Residential Tax Abatement?

A: You can apply for the Residential Tax Abatement by completing the application form and submitting it to the City of Cleveland, Ohio.

Form Details:

- Released on March 15, 2023;

- The latest edition currently provided by the Department of Community Development - City of Cleveland, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Community Development - City of Cleveland, Ohio.