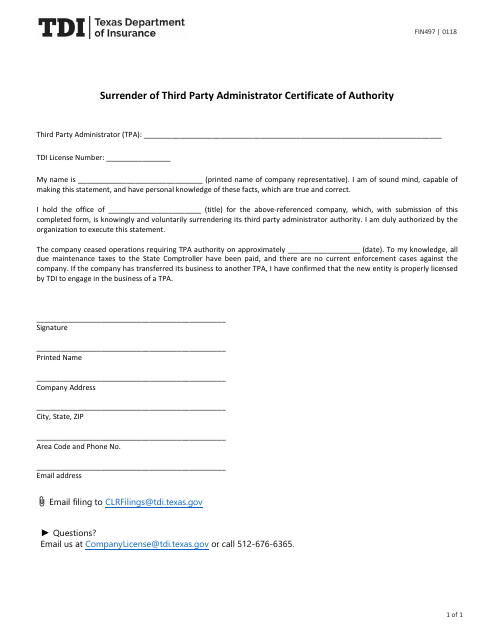

Form FIN497 Surrender of Third Party Administrator Certificate of Authority - Texas

What Is Form FIN497?

This is a legal form that was released by the Texas Department of Insurance - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FIN497?

A: Form FIN497 is the Surrender of Third Party Administrator Certificate of Authority form in Texas.

Q: What is a Third Party Administrator?

A: A Third Party Administrator is a company or individual that administers benefits such as insurance claims on behalf of another organization.

Q: Who needs to use Form FIN497?

A: Any Third Party Administrator in Texas that wants to surrender or terminate their Certificate of Authority needs to use Form FIN497.

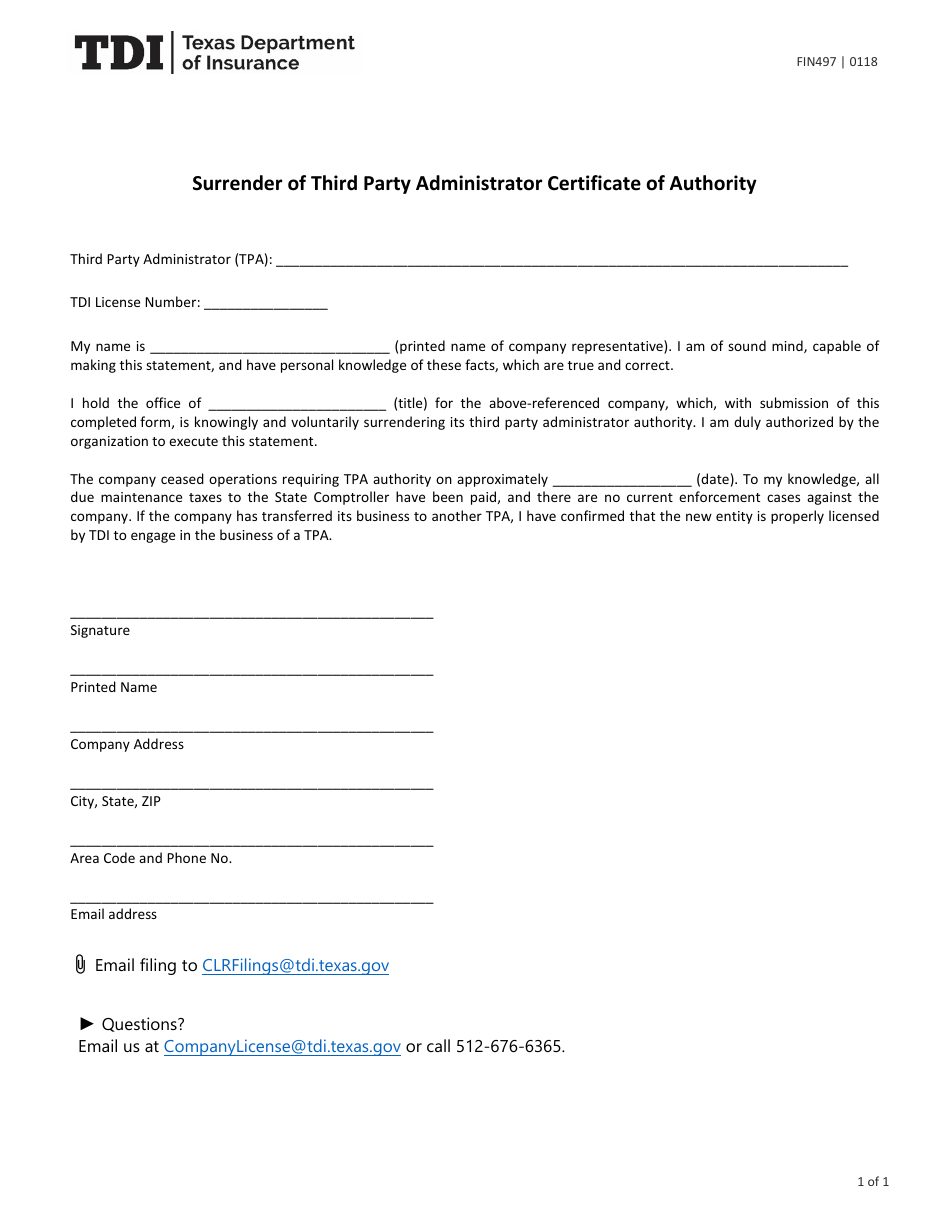

Q: What information is required on Form FIN497?

A: Form FIN497 requires basic information such as the name and contact details of the Third Party Administrator, the reason for surrendering the Certificate of Authority, and any outstanding obligations.

Q: Are there any fees associated with submitting Form FIN497?

A: Yes, there may be fees associated with surrendering the Certificate of Authority. You should check the current fee schedule provided by the Texas Department of Insurance.

Q: What happens after submitting Form FIN497?

A: Once Form FIN497 is submitted and processed by the Texas Department of Insurance, the Third Party Administrator's Certificate of Authority will be surrendered or terminated.

Q: Is there a deadline for submitting Form FIN497?

A: There may not be a specific deadline, but it is recommended to submit Form FIN497 in a timely manner to ensure proper handling of the surrender or termination process.

Q: Can I reinstate a surrendered Certificate of Authority?

A: In some cases, it may be possible to reinstate a surrendered Certificate of Authority. You should consult with the Texas Department of Insurance for more information.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Texas Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FIN497 by clicking the link below or browse more documents and templates provided by the Texas Department of Insurance.