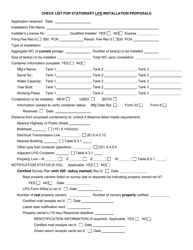

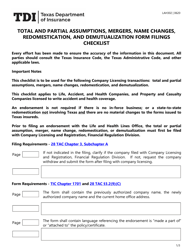

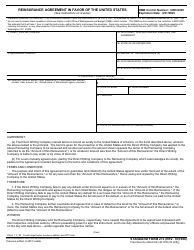

Form FIN346 Checklist for Total and Partial Reinsurance Agreements - Texas

What Is Form FIN346?

This is a legal form that was released by the Texas Department of Insurance - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

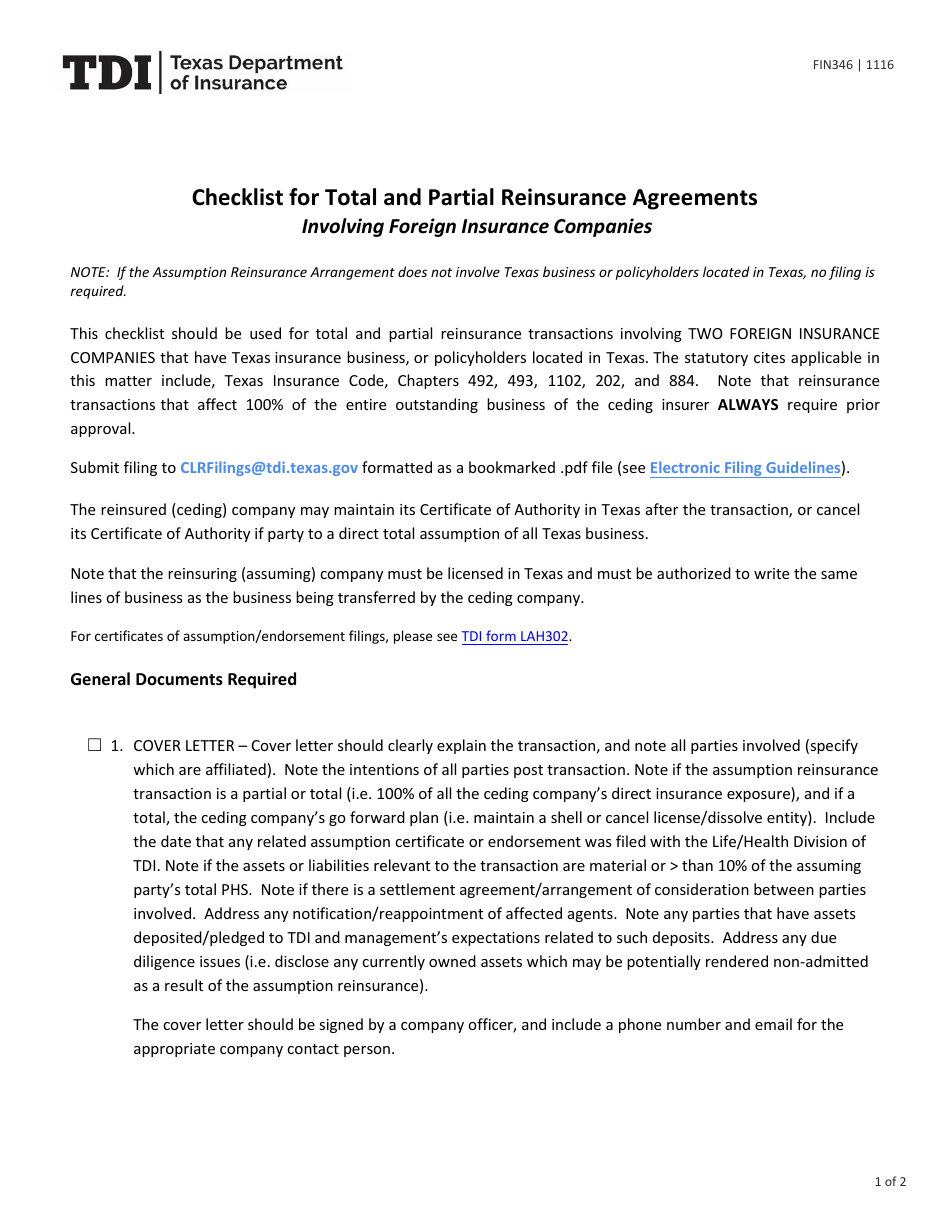

Q: What is FIN346?

A: FIN346 is a checklist for Total and Partial Reinsurance Agreements in Texas.

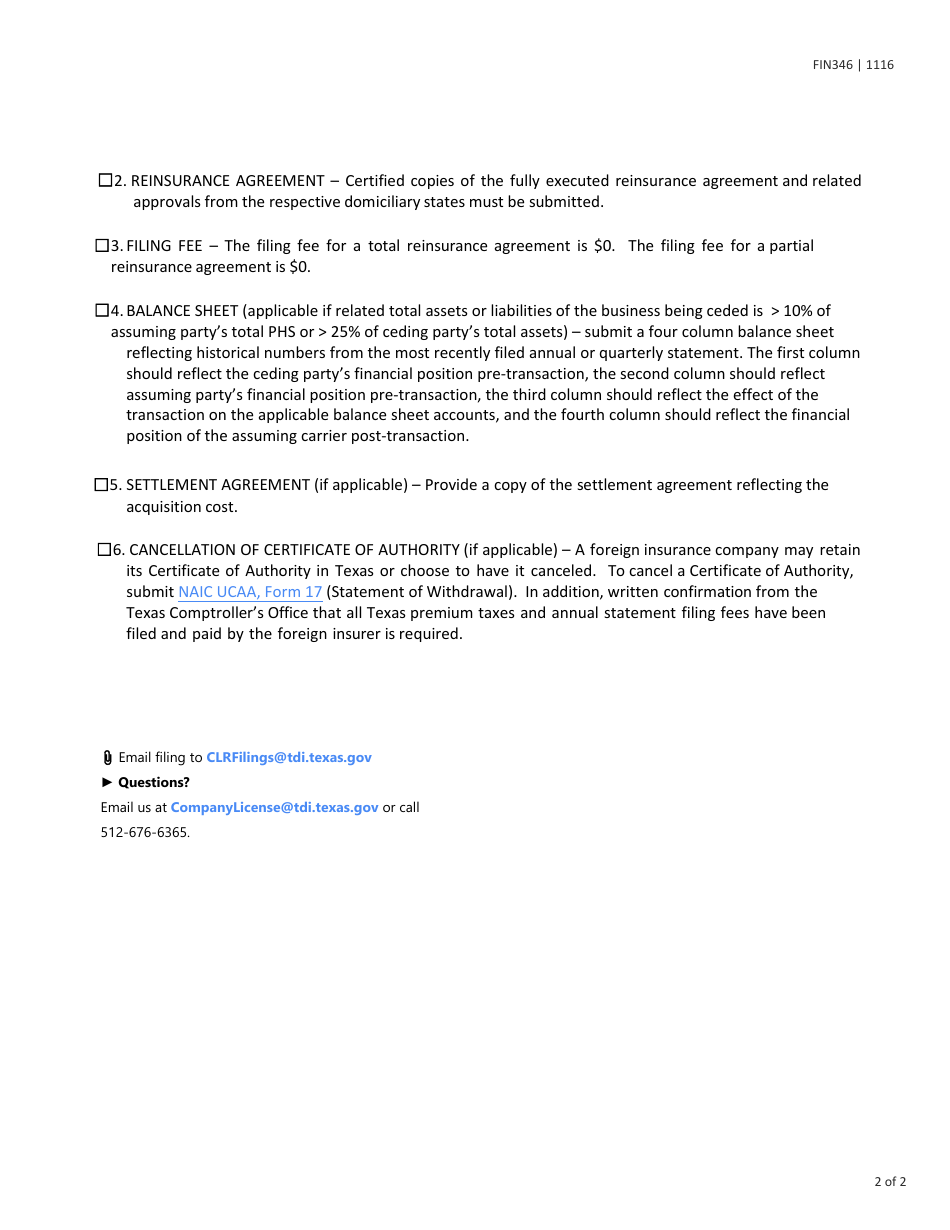

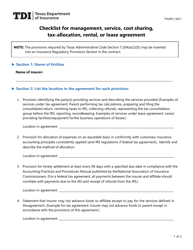

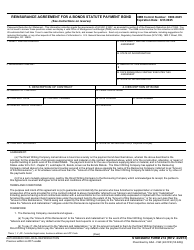

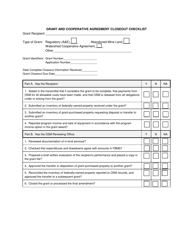

Q: What does the checklist cover?

A: The checklist covers the requirements and considerations for total and partial reinsurance agreements in Texas.

Q: What is total reinsurance?

A: Total reinsurance is when the reinsurer assumes 100% of the risk from the original insurer.

Q: What is partial reinsurance?

A: Partial reinsurance is when the reinsurer assumes a portion of the risk from the original insurer.

Q: What are some key considerations for reinsurance agreements?

A: Some key considerations include the terms and conditions, financial stability of the reinsurer, and regulatory compliance.

Q: Why is financial stability of the reinsurer important?

A: Financial stability ensures that the reinsurer has the capacity to pay claims in case of a loss.

Q: What is regulatory compliance in reinsurance agreements?

A: Regulatory compliance refers to meeting the legal and regulatory requirements set by the state or country.

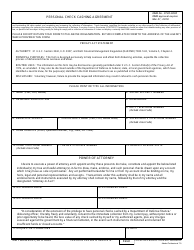

Q: Who should use the FIN346 checklist?

A: Insurance companies and reinsurers involved in total and partial reinsurance agreements in Texas should use the FIN346 checklist.

Q: Is the FIN346 checklist mandatory?

A: The FIN346 checklist may be required by the Texas Department of Insurance, so it is important for insurance companies to comply with it.

Q: Are there any specific legal requirements for reinsurance agreements in Texas?

A: Yes, Texas has specific legal requirements for reinsurance agreements, and compliance with these requirements is essential.

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Texas Department of Insurance;

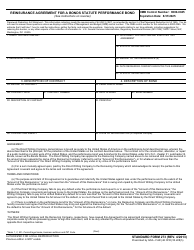

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FIN346 by clicking the link below or browse more documents and templates provided by the Texas Department of Insurance.