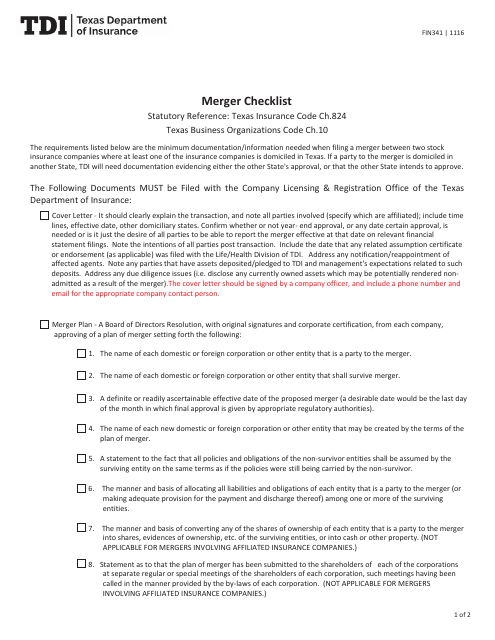

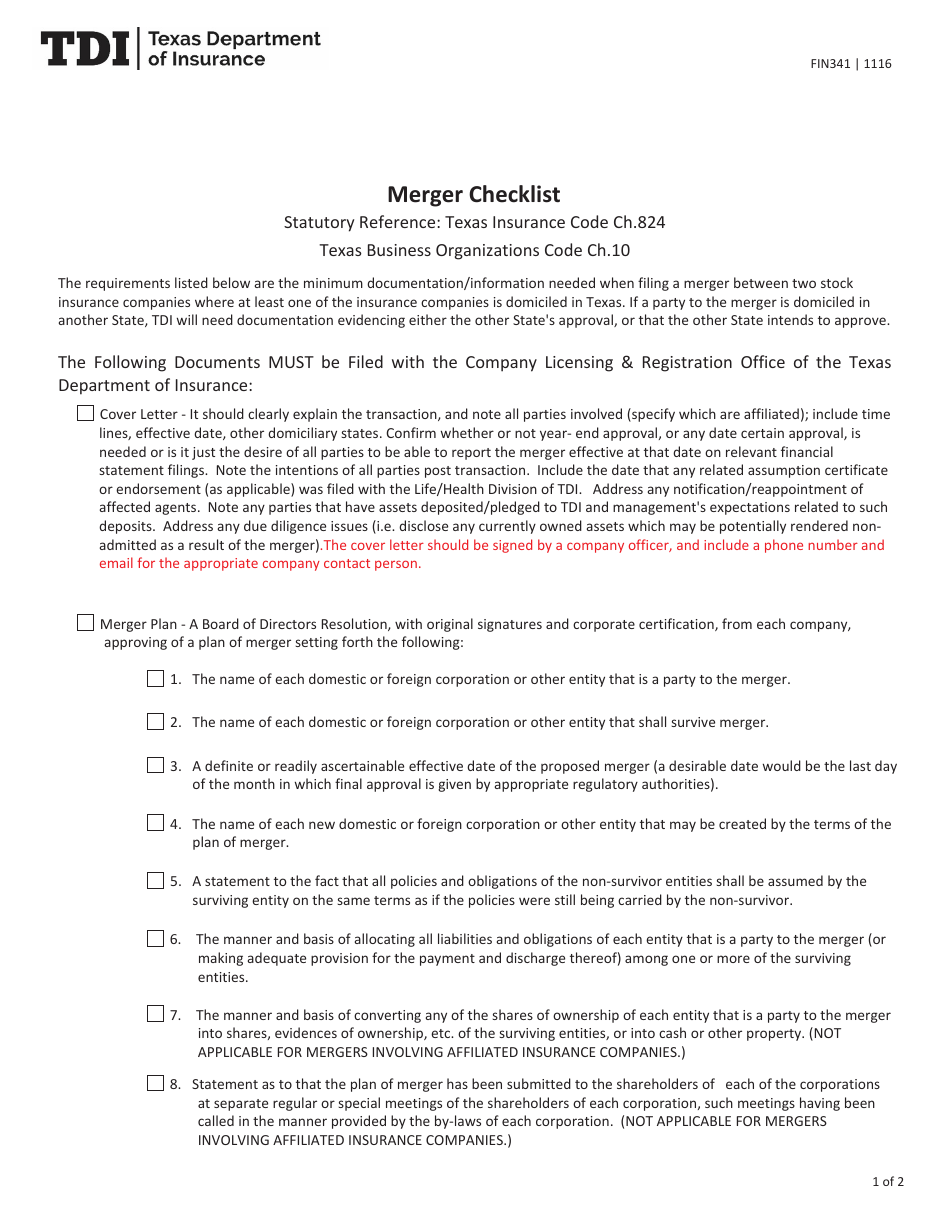

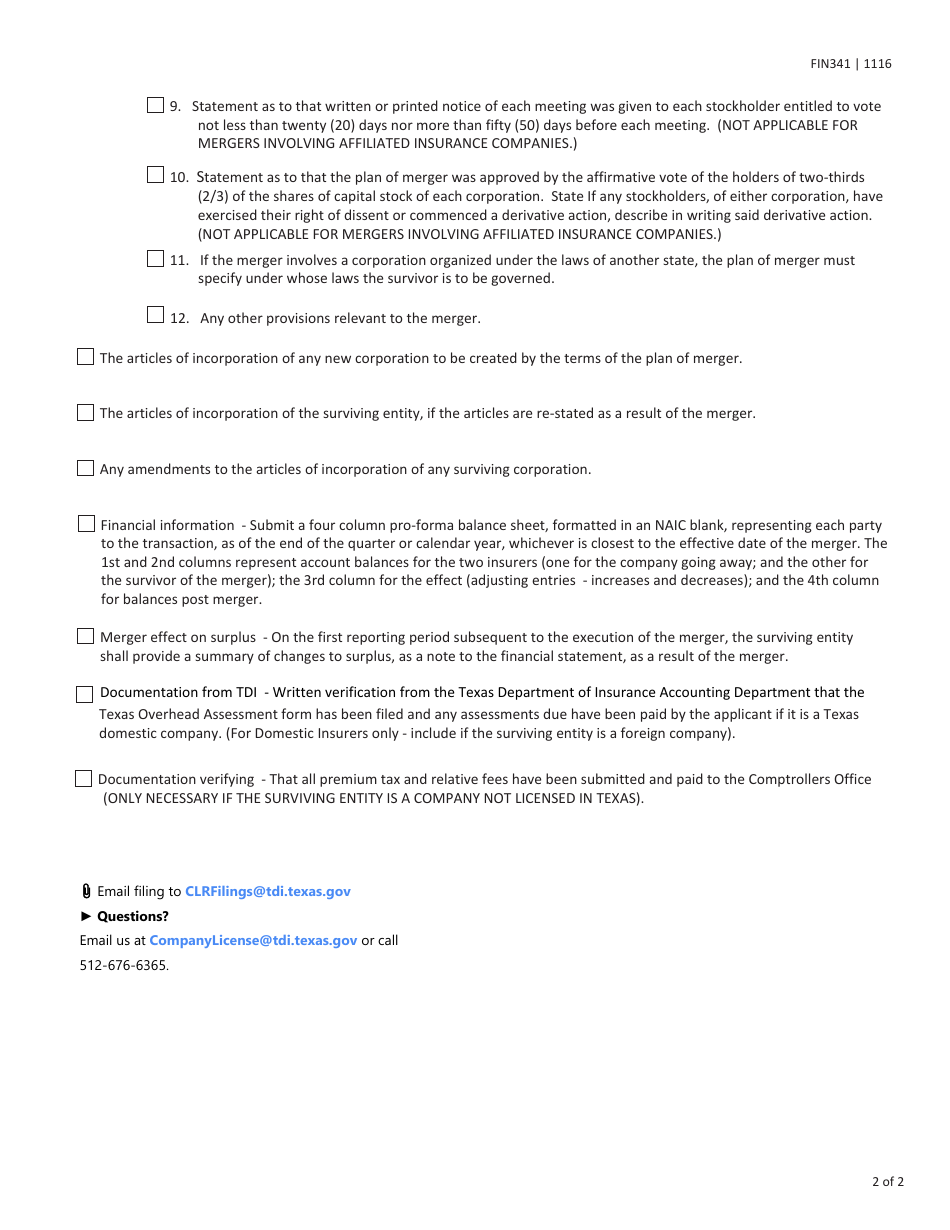

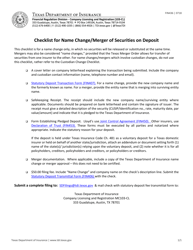

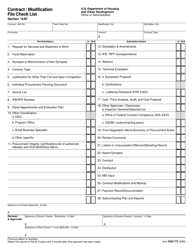

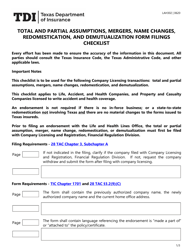

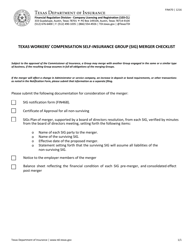

Form FIN341 Merger Checklist - Texas

What Is Form FIN341?

This is a legal form that was released by the Texas Department of Insurance - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FIN341?

A: Form FIN341 is a merger checklist that is required by the state of Texas for merger transactions.

Q: Who needs to complete Form FIN341?

A: The parties involved in a merger transaction in Texas, including the merging entities, must complete and submit Form FIN341.

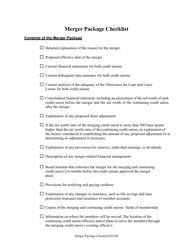

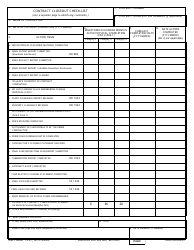

Q: What information is required on Form FIN341?

A: Form FIN341 requires detailed information about the merging entities, including their names, addresses, and a description of the merger transaction.

Q: When must Form FIN341 be submitted?

A: Form FIN341 must be submitted to the Texas Secretary of State's office at least 10 days prior to the effective date of the merger.

Q: What happens after Form FIN341 is submitted?

A: Once Form FIN341 is submitted, the Texas Secretary of State's office will review the form and process the merger transaction.

Q: Are there any other requirements for completing a merger in Texas?

A: In addition to Form FIN341, there may be other requirements and filings that need to be completed for a merger transaction in Texas. It is recommended to consult with legal counsel for guidance.

Q: What are the consequences of not filing Form FIN341?

A: Failure to file Form FIN341 or comply with other merger requirements in Texas may result in penalties and the invalidation of the merger transaction.

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Texas Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FIN341 by clicking the link below or browse more documents and templates provided by the Texas Department of Insurance.