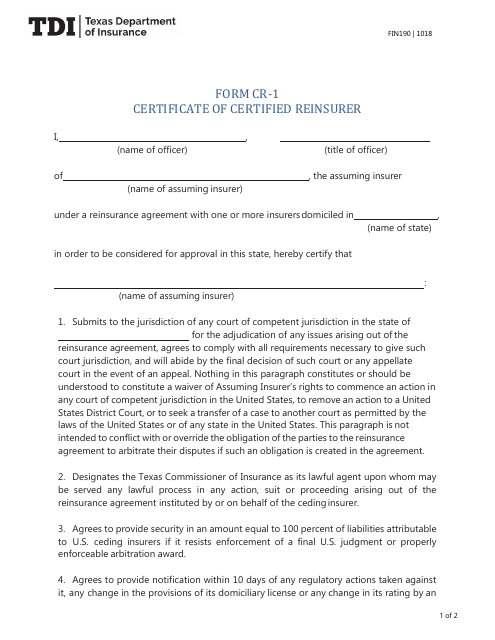

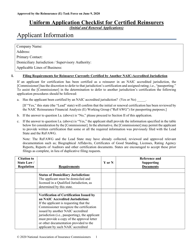

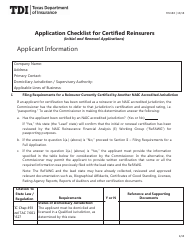

Form FIN190 (CR-1) Certificate of Certified Reinsurer - Texas

What Is Form FIN190 (CR-1)?

This is a legal form that was released by the Texas Department of Insurance - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FIN190 (CR-1)?

A: Form FIN190 (CR-1) is the Certificate of Certified Reinsurer for companies operating in Texas.

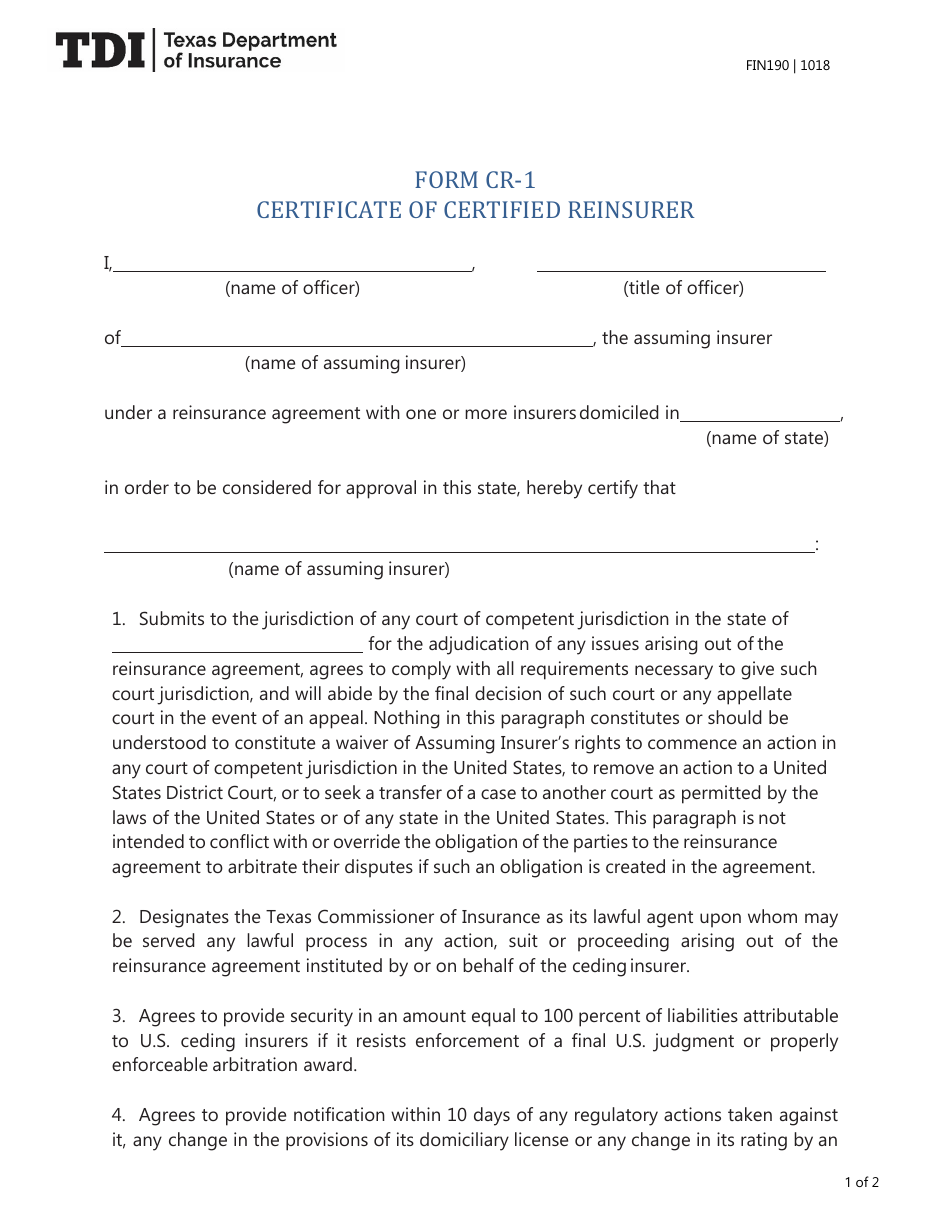

Q: Who is required to file Form FIN190 (CR-1)?

A: Companies engaged in reinsurance business in Texas are required to file Form FIN190 (CR-1).

Q: What is the purpose of Form FIN190 (CR-1)?

A: The purpose of Form FIN190 (CR-1) is to certify that a reinsurer meets certain financial and regulatory requirements.

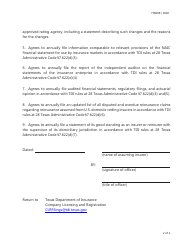

Q: What information is required on Form FIN190 (CR-1)?

A: Form FIN190 (CR-1) requires information about the reinsurer's financial statements, credit ratings, and other relevant details.

Q: When is Form FIN190 (CR-1) due?

A: The due date for Form FIN190 (CR-1) varies and is determined by the Texas Department of Insurance. It is typically required on an annual basis.

Q: Is Form FIN190 (CR-1) required for reinsurers operating in other states?

A: No, Form FIN190 (CR-1) is specific to companies operating in Texas. Reinsurers operating in other states may have different requirements.

Q: Are there any penalties for not filing Form FIN190 (CR-1) on time?

A: Yes, there may be penalties for not filing Form FIN190 (CR-1) on time. The specific penalties are determined by the Texas Department of Insurance.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Texas Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FIN190 (CR-1) by clicking the link below or browse more documents and templates provided by the Texas Department of Insurance.