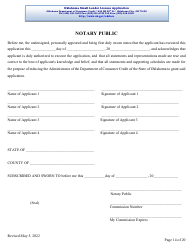

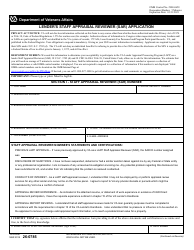

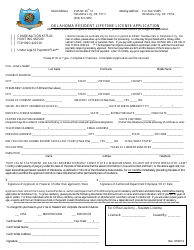

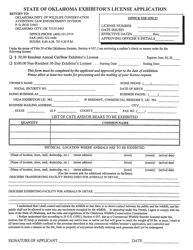

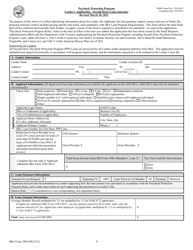

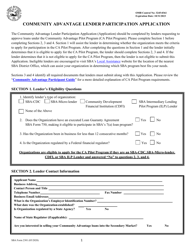

Oklahoma Small Lender License Application - Oklahoma

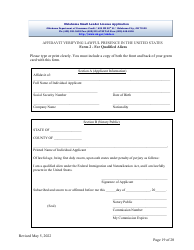

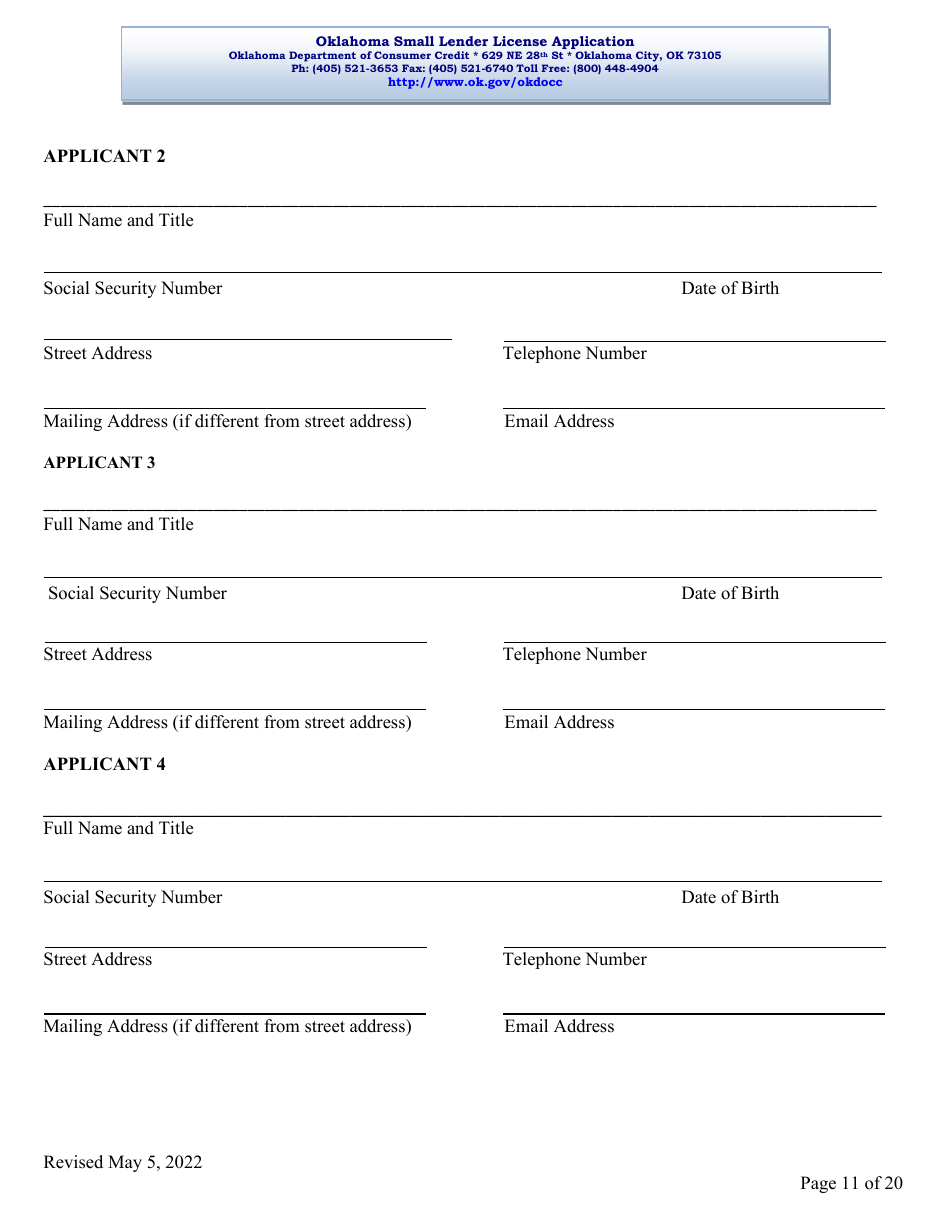

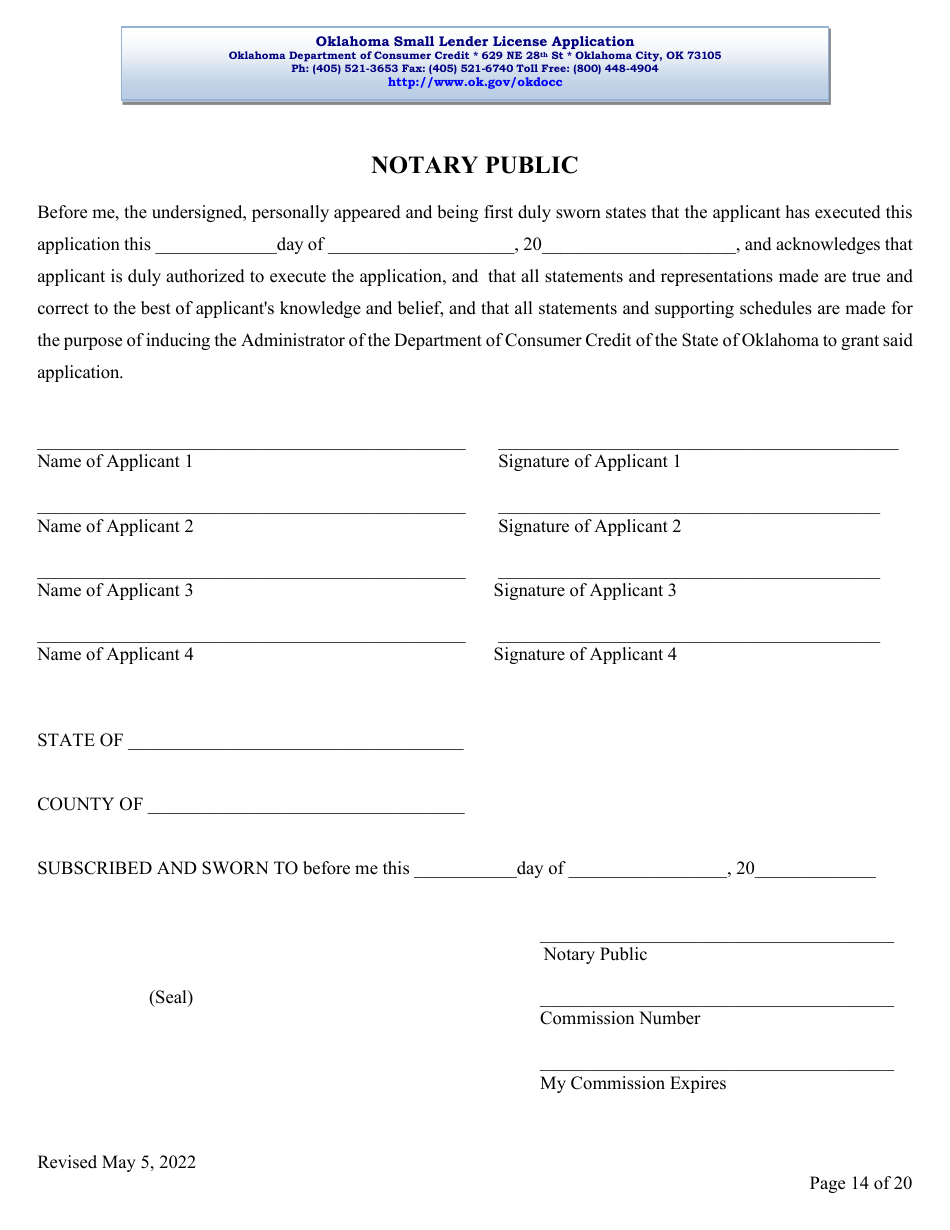

Oklahoma Small Lender License Application is a legal document that was released by the Oklahoma Department of Consumer Credit - a government authority operating within Oklahoma.

FAQ

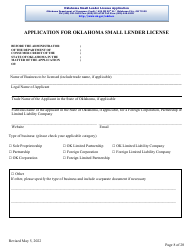

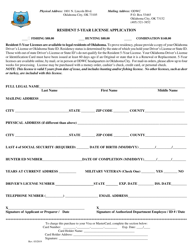

Q: What is the Oklahoma Small Lender License?

A: The Oklahoma Small Lender License is a license required for individuals or entities engaging in small lending activities in Oklahoma.

Q: Who needs to apply for the Oklahoma Small Lender License?

A: Individuals or entities that want to engage in small lending activities in Oklahoma need to apply for the license.

Q: What is considered a small lending activity?

A: A small lending activity is the act of lending money, credit, or goods in amounts of $1,000 or less.

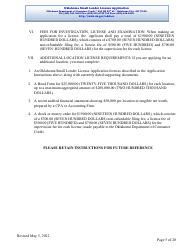

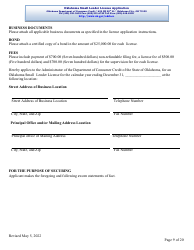

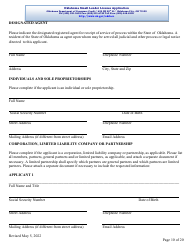

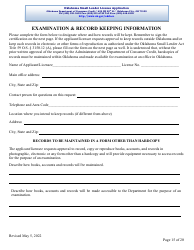

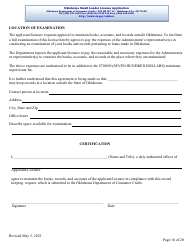

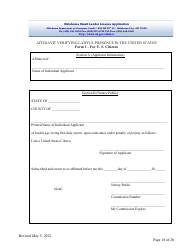

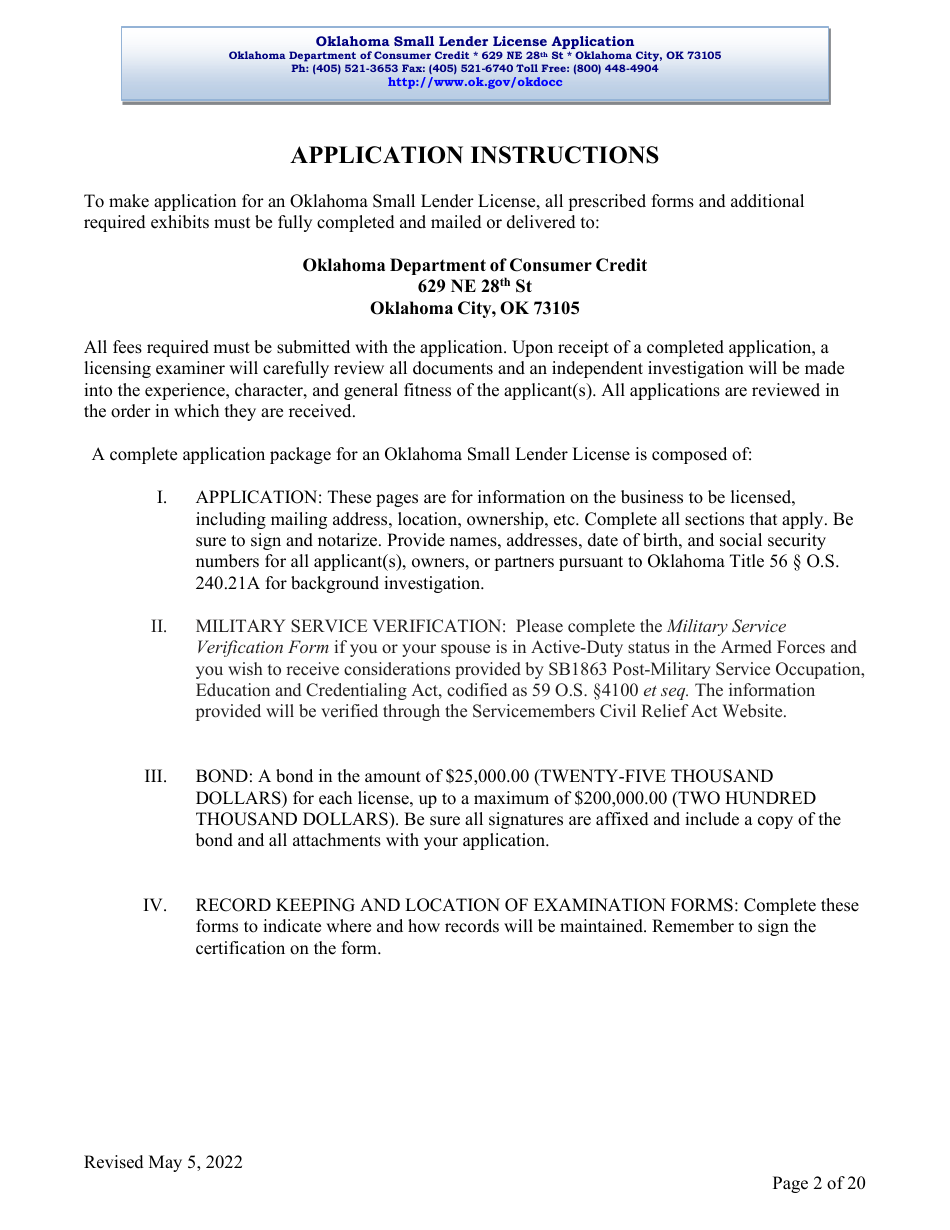

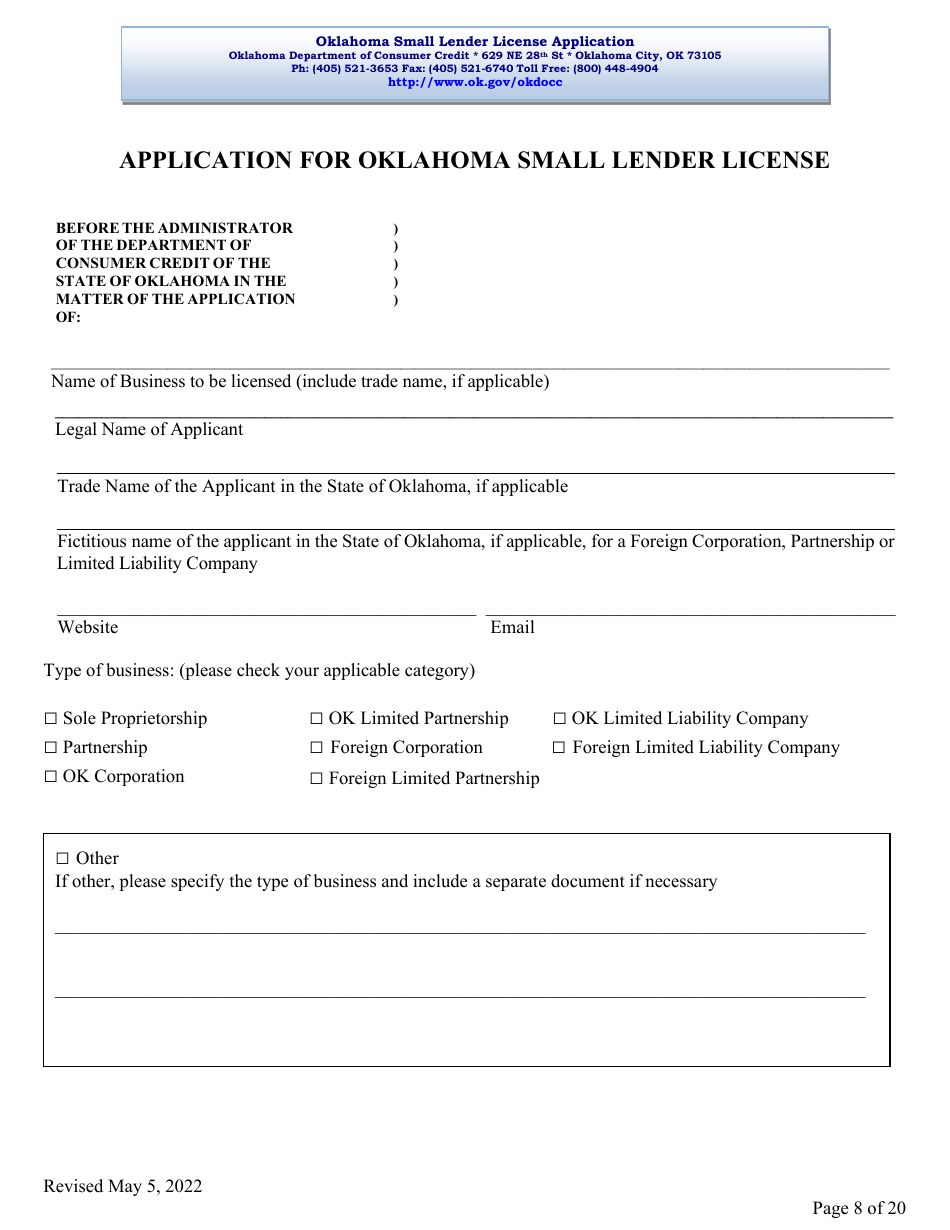

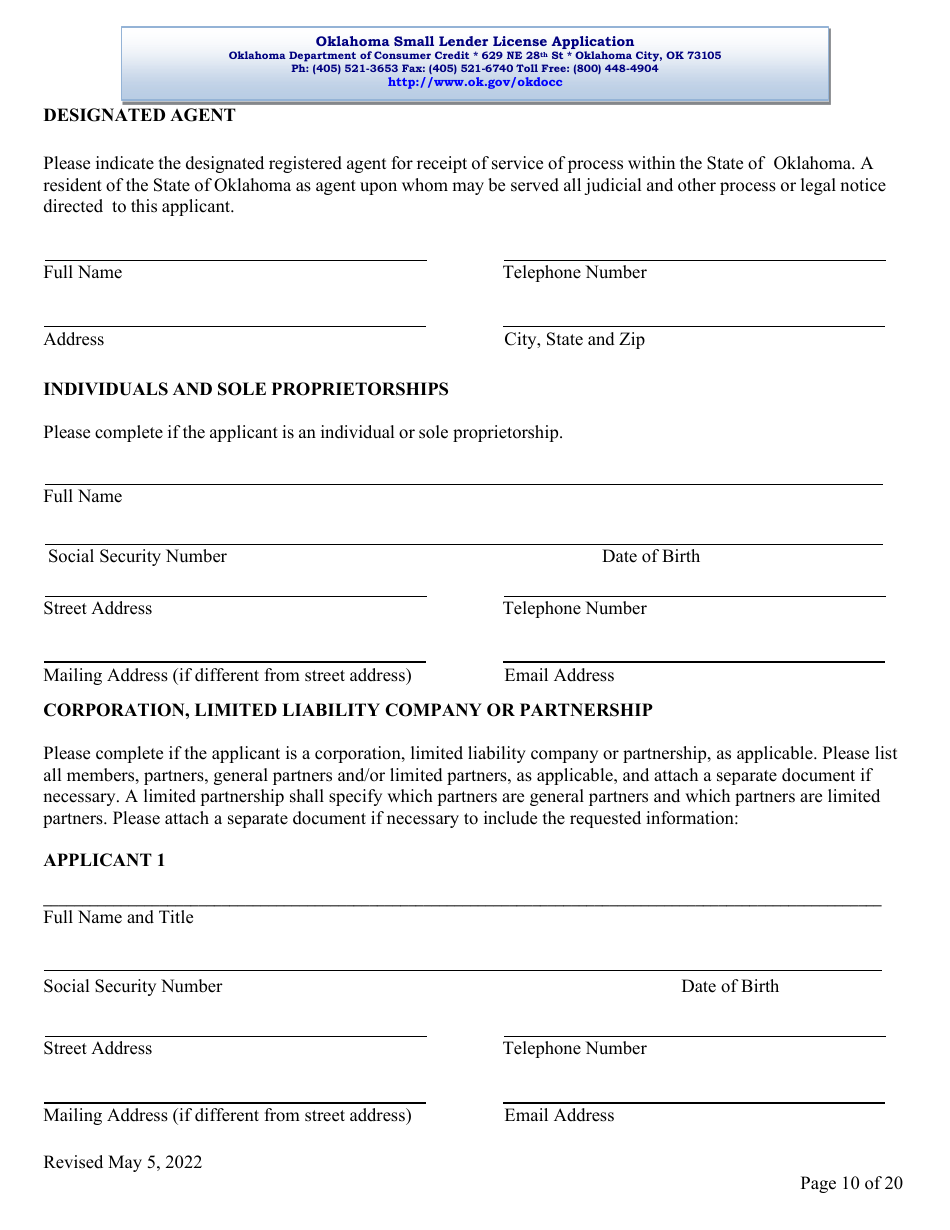

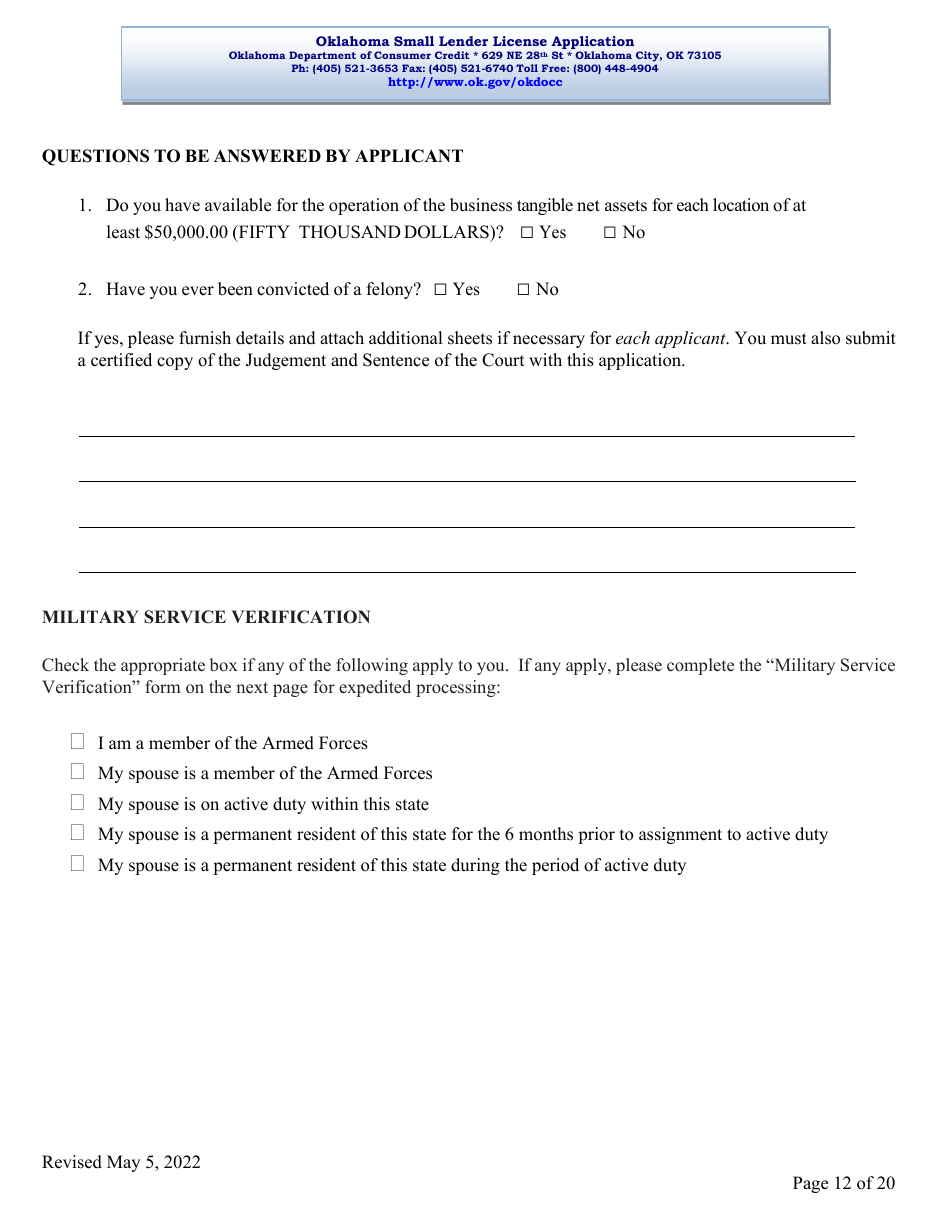

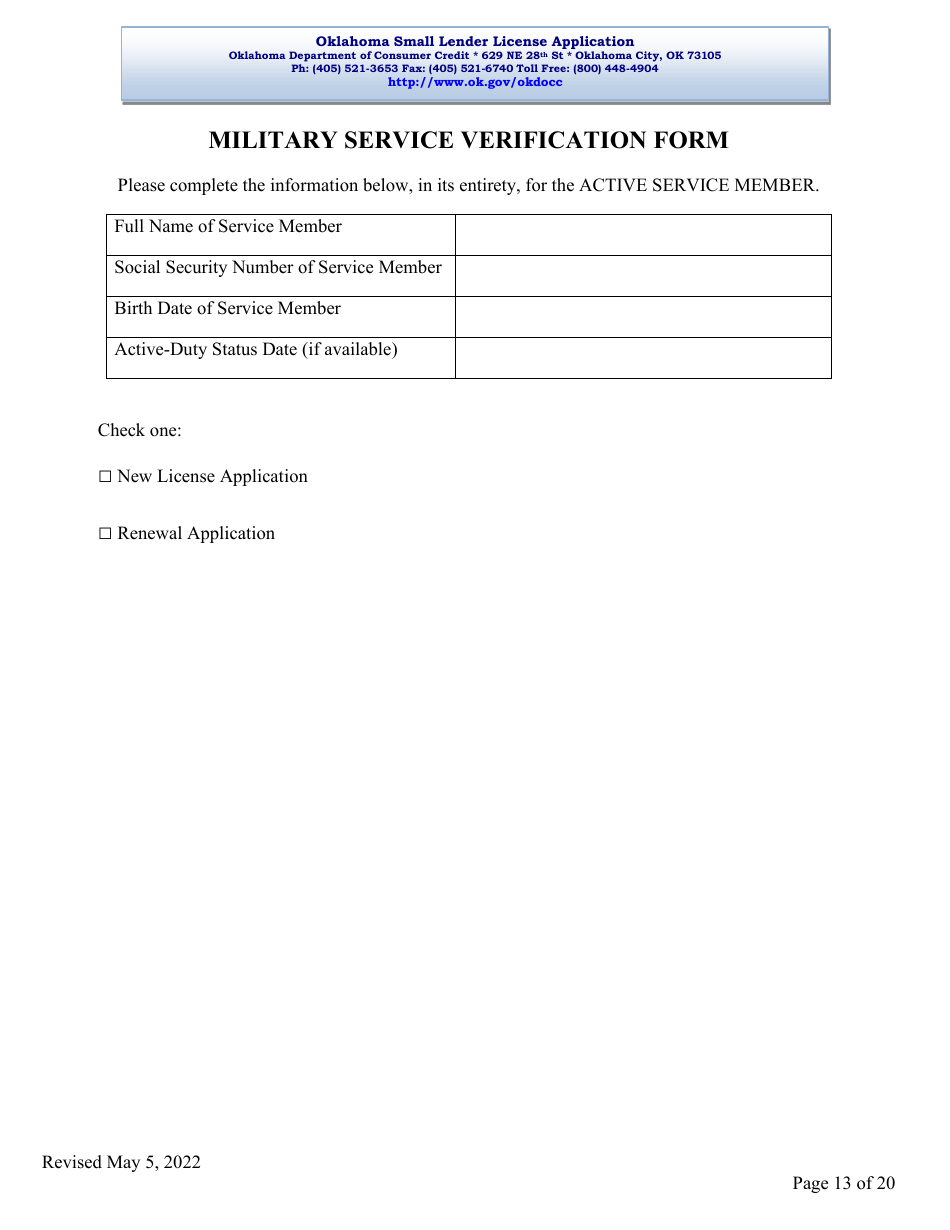

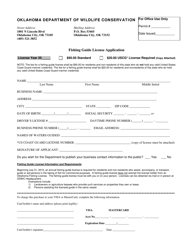

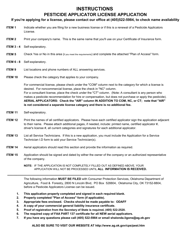

Q: What are the requirements to obtain the Oklahoma Small Lender License?

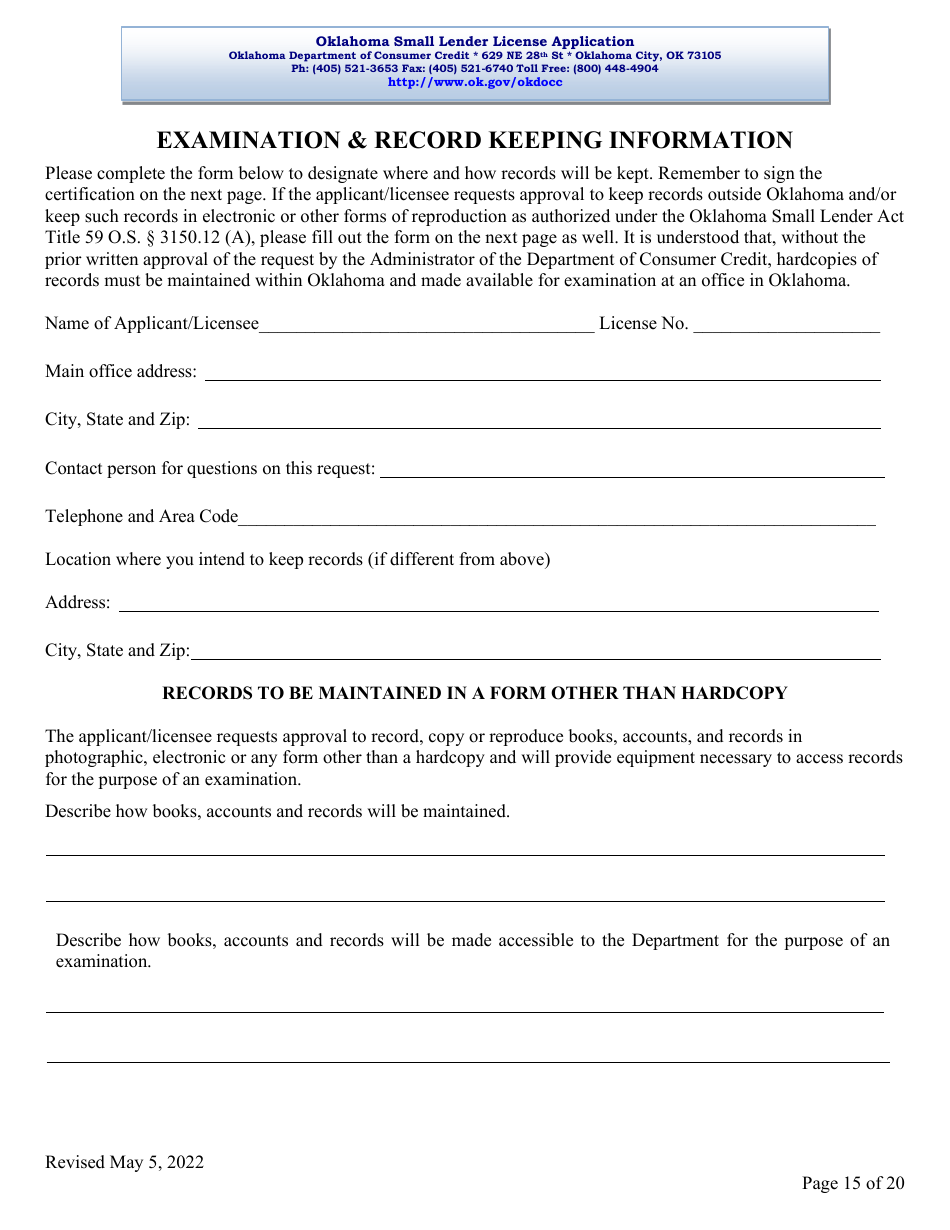

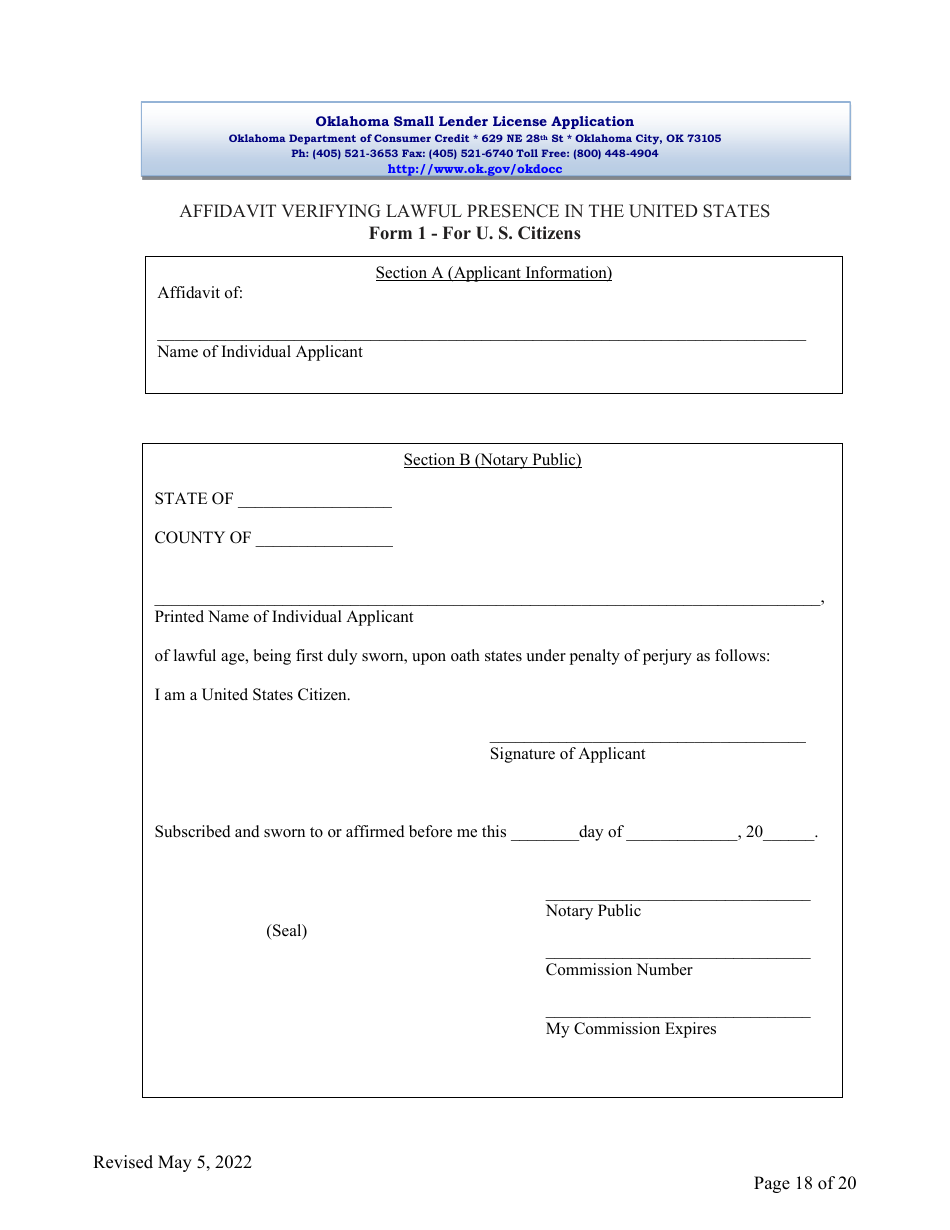

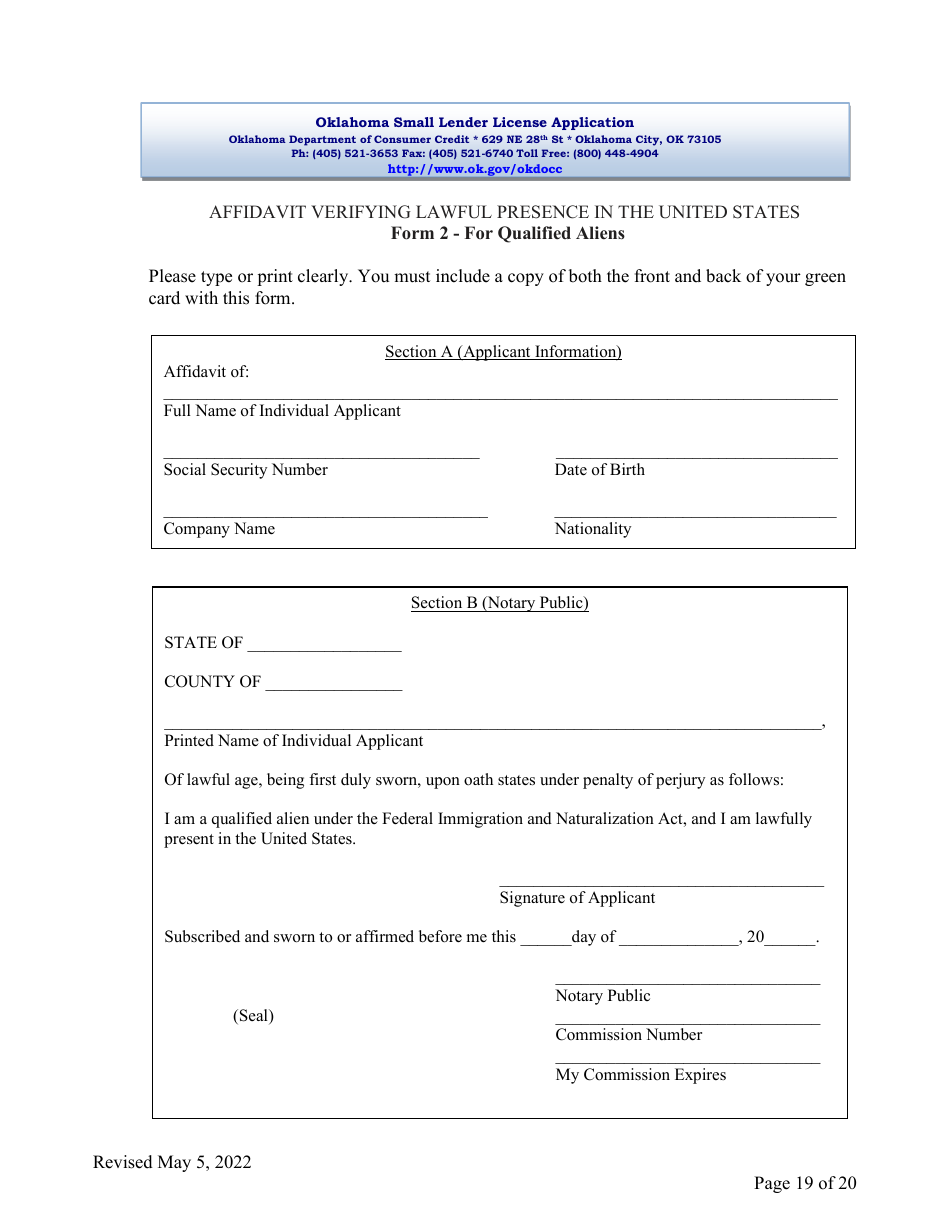

A: The requirements include submitting a completed application form, paying the required fee, providing financial statements, and meeting certain character and fitness requirements.

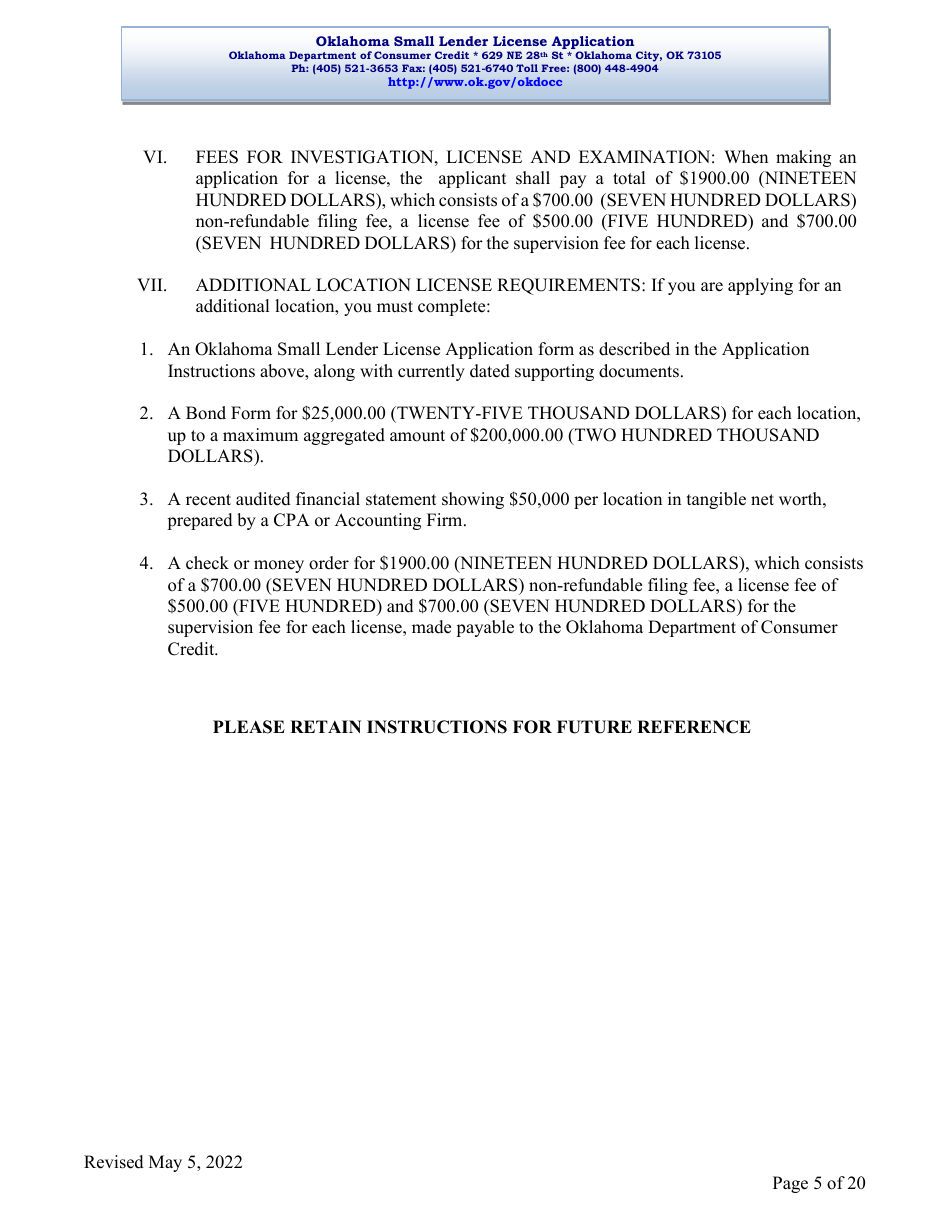

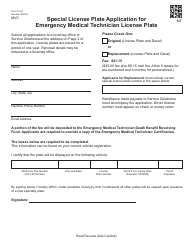

Q: How much is the fee for the Oklahoma Small Lender License?

A: The fee for the license is $500.

Q: How long does it take to process the Oklahoma Small Lender License application?

A: The processing time can vary, but it typically takes around 6 to 8 weeks.

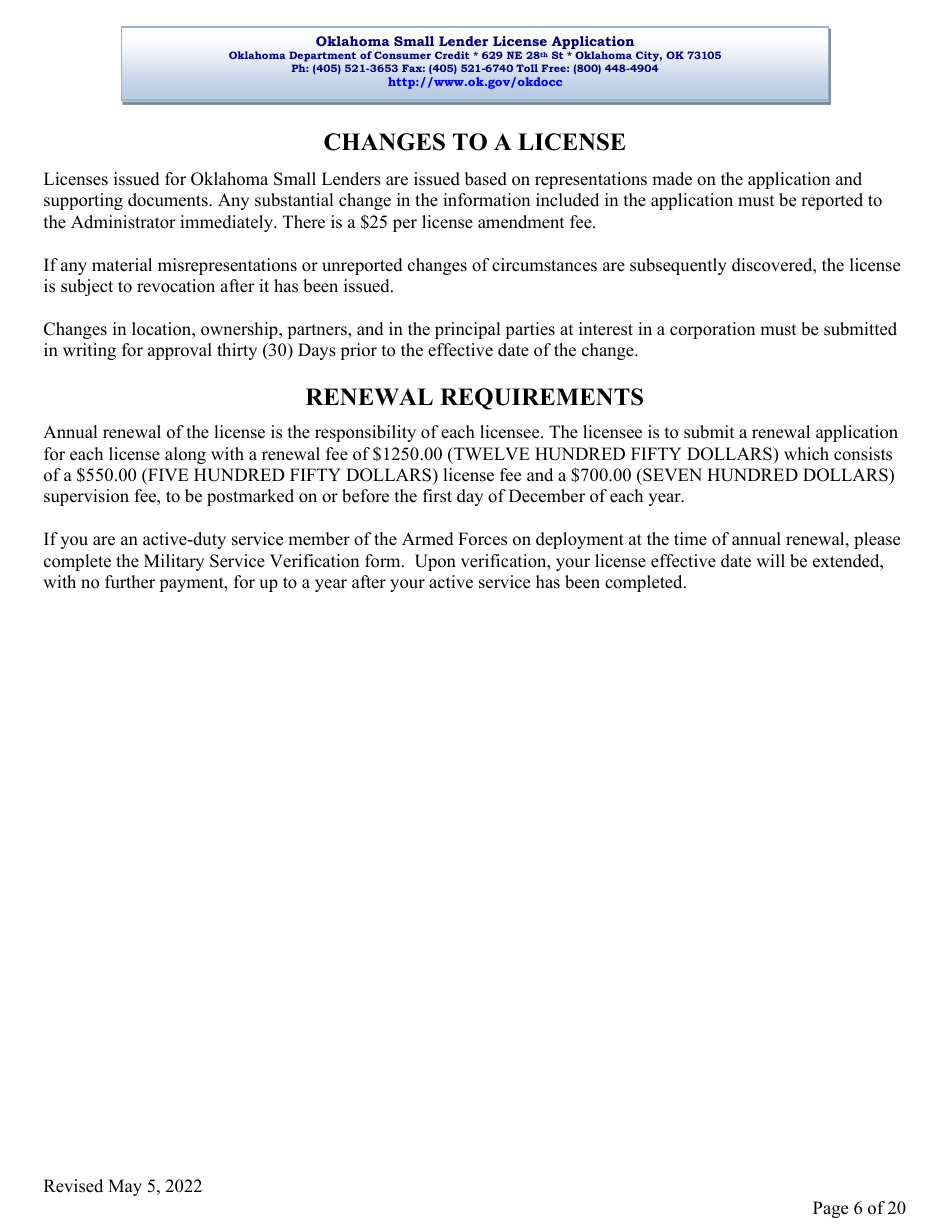

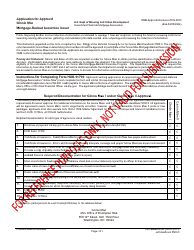

Q: Is there a renewal requirement for the Oklahoma Small Lender License?

A: Yes, the license needs to be renewed annually by submitting a renewal application and paying the renewal fee.

Q: Are there any additional requirements or regulations for small lenders in Oklahoma?

A: Yes, small lenders are subject to various regulations and requirements, including interest rate limitations and disclosure obligations.

Form Details:

- Released on May 5, 2022;

- The latest edition currently provided by the Oklahoma Department of Consumer Credit;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Oklahoma Department of Consumer Credit.