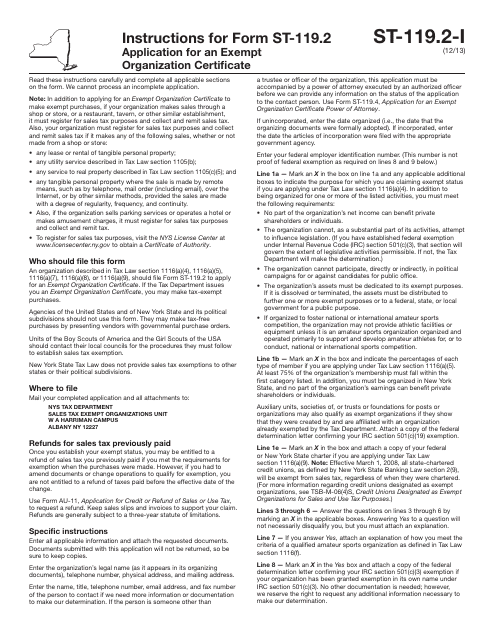

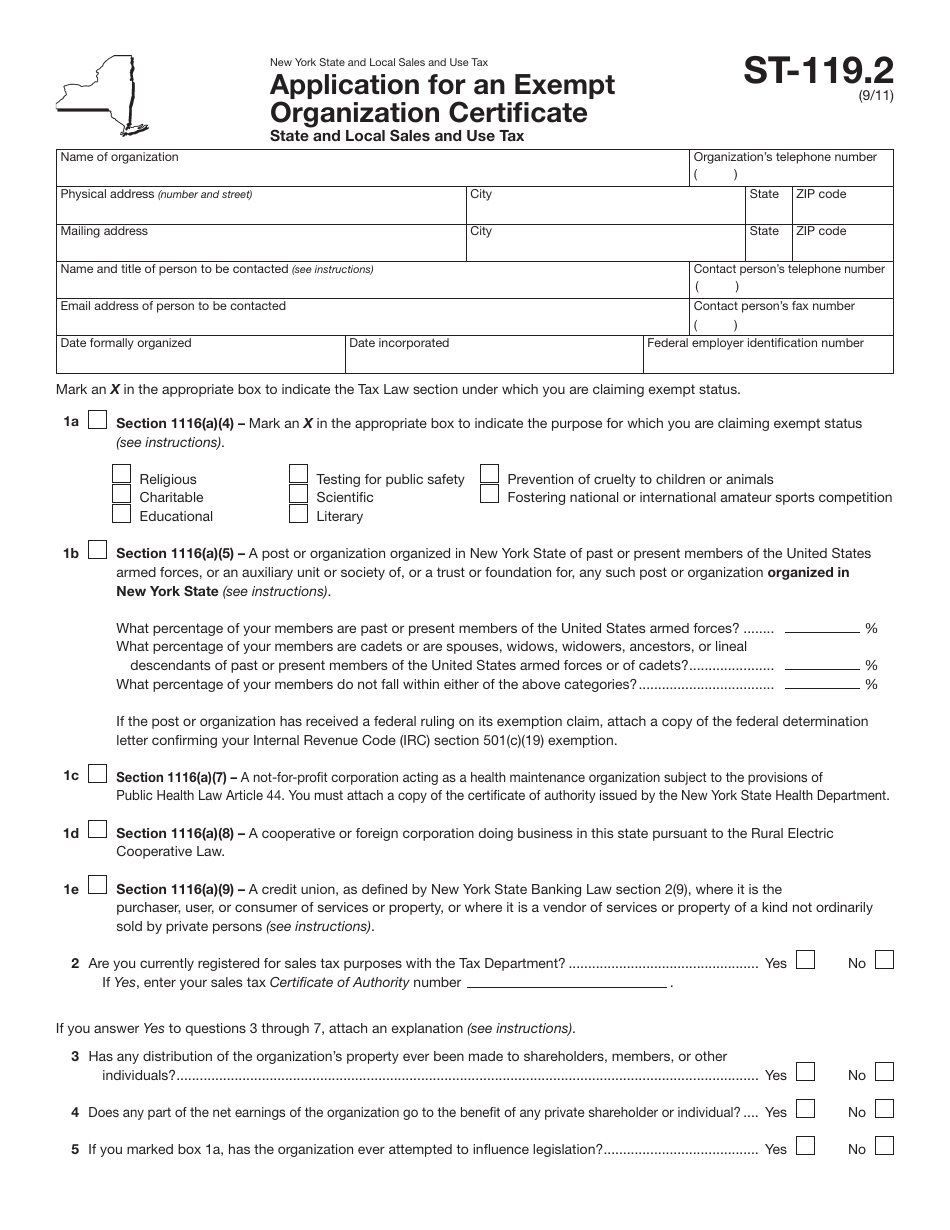

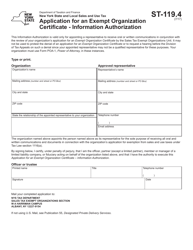

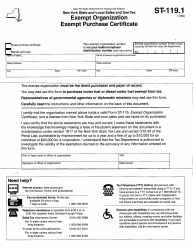

Form ST-119.2 Application for an Exempt Organization Certificate - New York

What Is Form ST-119.2?

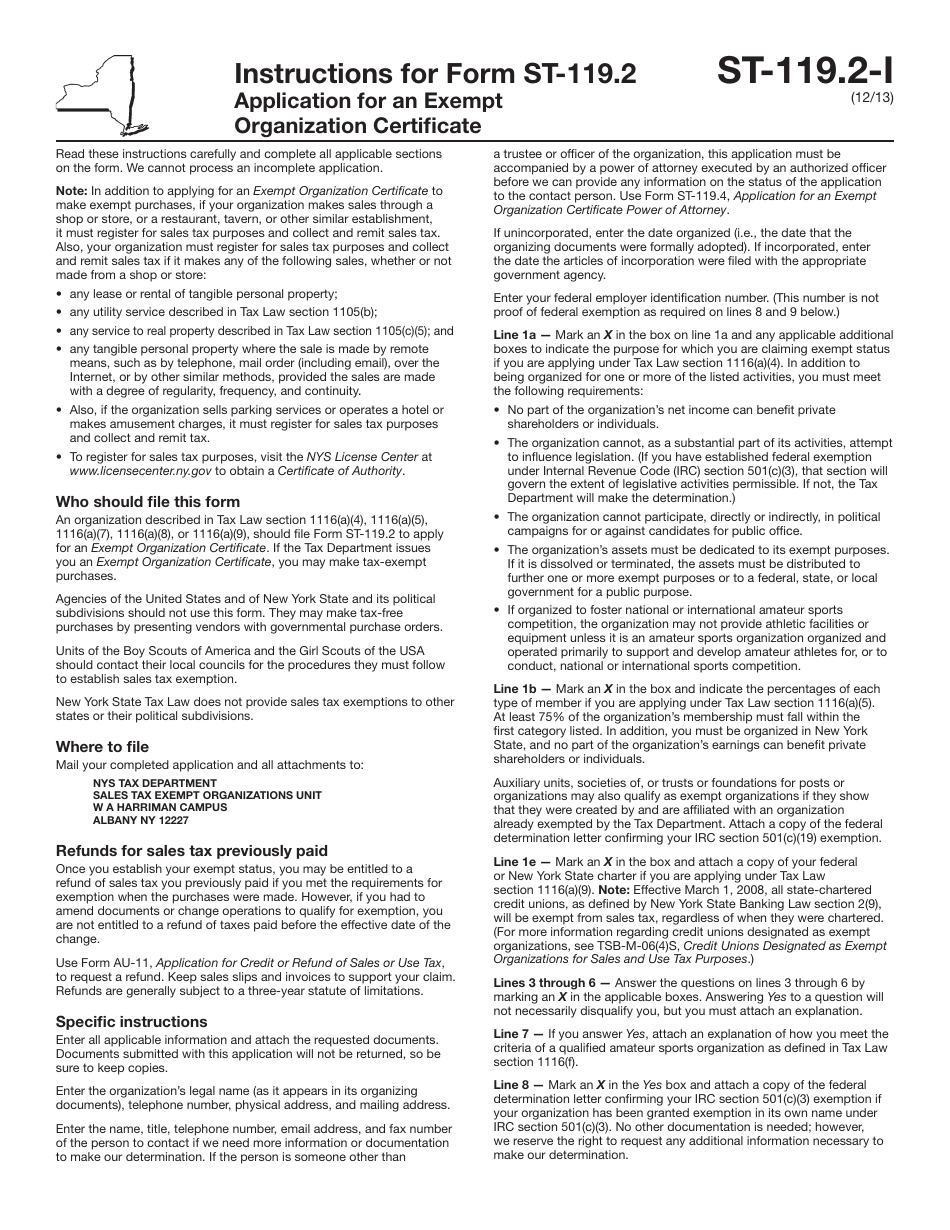

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-119.2?

A: Form ST-119.2 is the application for an Exempt Organization Certificate in New York.

Q: Who needs to file Form ST-119.2?

A: Exempt organizations in New York who wish to obtain a tax exemption.

Q: What is the purpose of Form ST-119.2?

A: The purpose of Form ST-119.2 is to apply for a tax exemption for qualifying organizations.

Q: Is there a fee for filing Form ST-119.2?

A: There is no fee for filing Form ST-119.2.

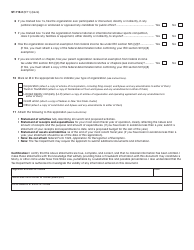

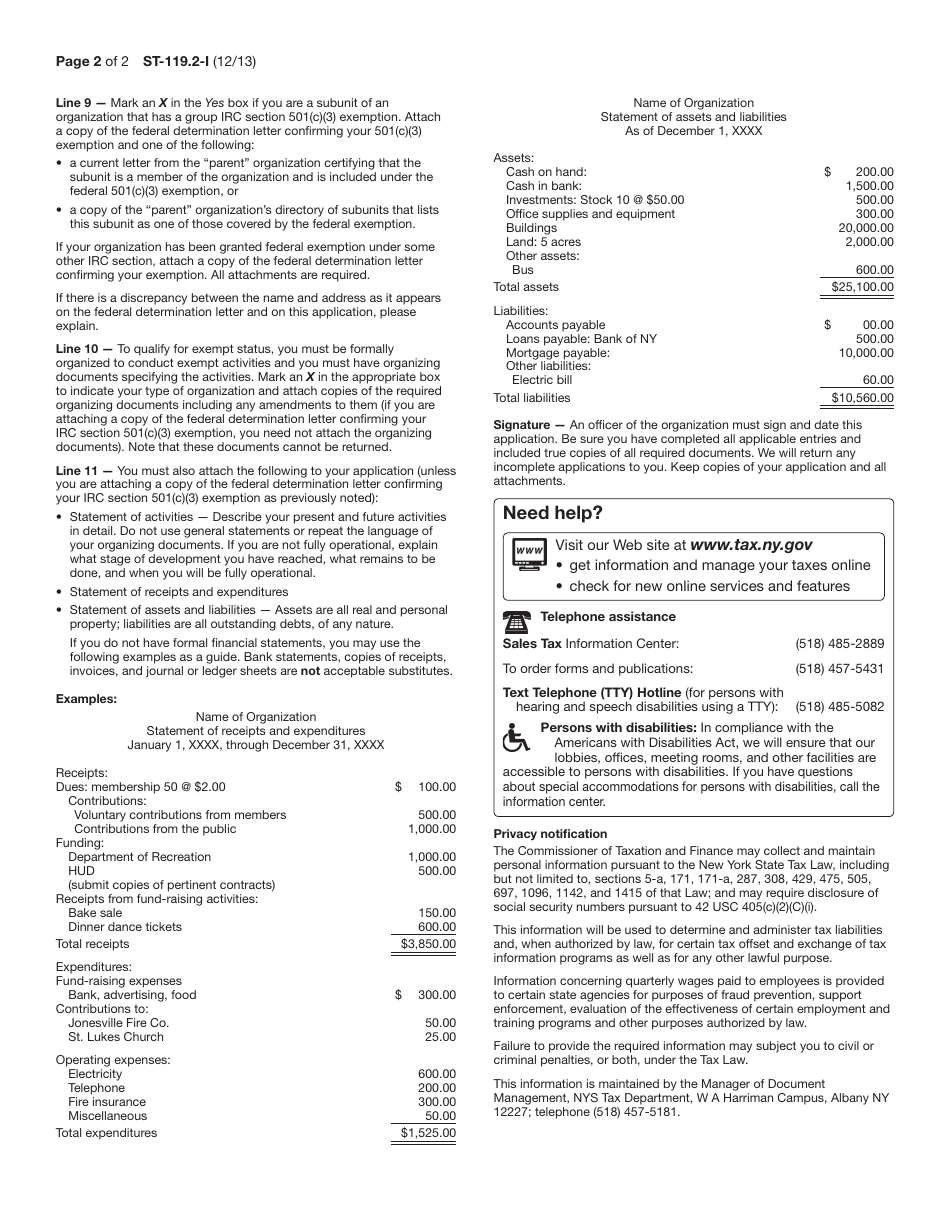

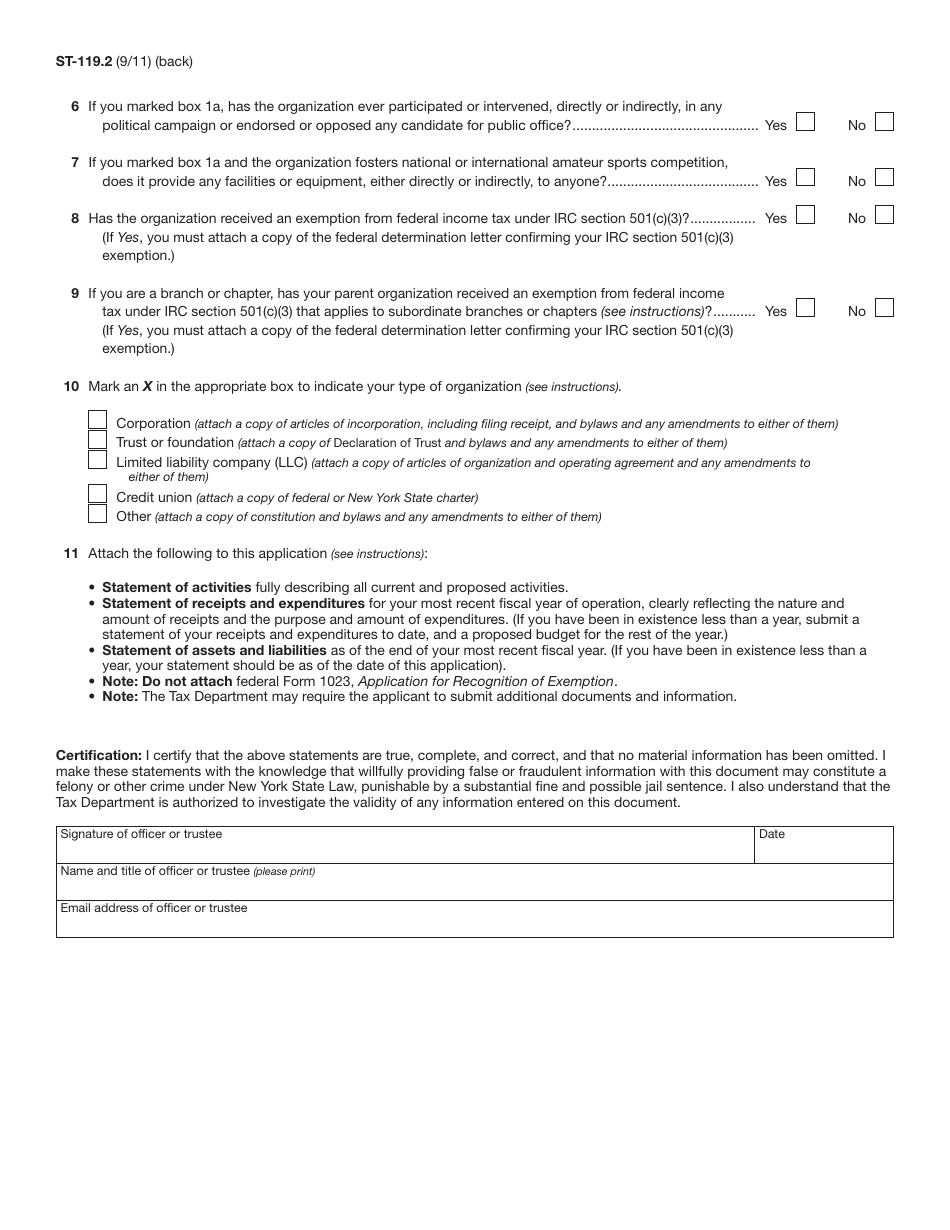

Q: What supporting documents are required with Form ST-119.2?

A: Supporting documents may include proof of tax-exempt status, financial statements, and other relevant documentation.

Q: What is the processing time for Form ST-119.2?

A: The processing time for Form ST-119.2 varies, and it is recommended to allow sufficient time for processing.

Q: How often do I need to file Form ST-119.2?

A: Form ST-119.2 may need to be filed periodically, depending on the requirements of the New York State Department of Taxation and Finance.

Form Details:

- Released on September 1, 2011;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-119.2 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.