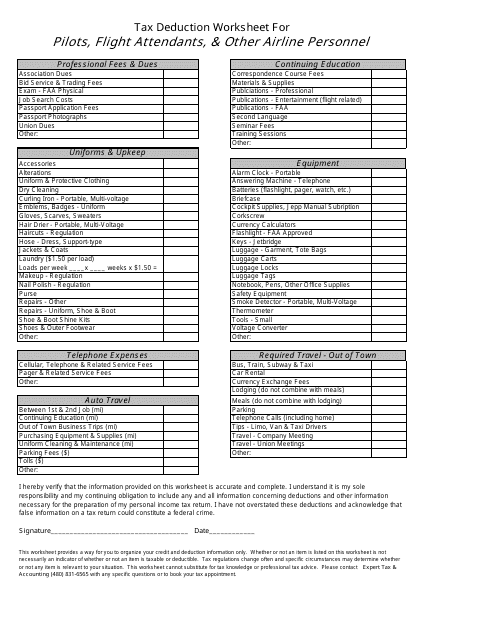

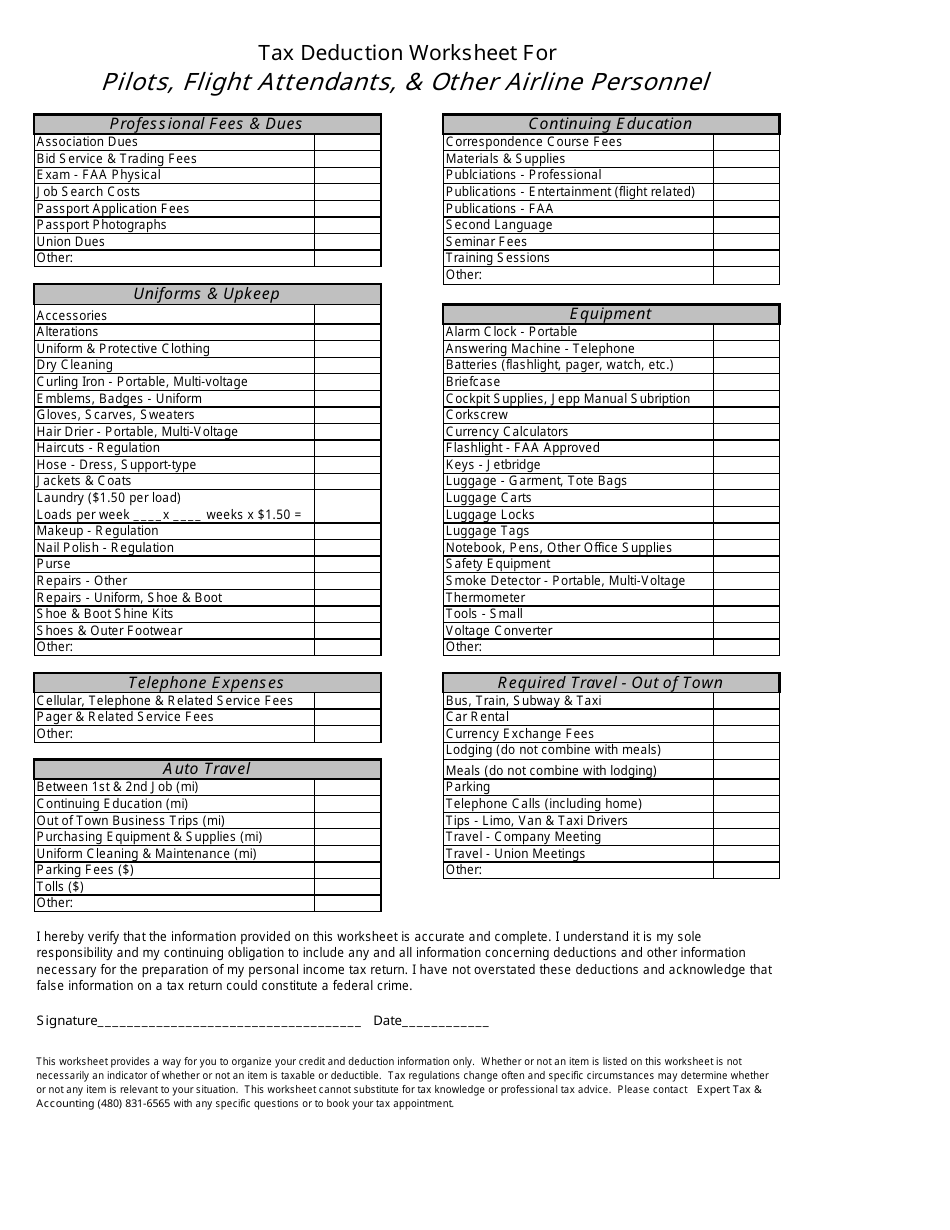

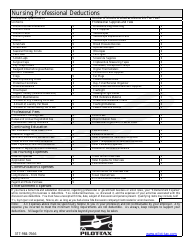

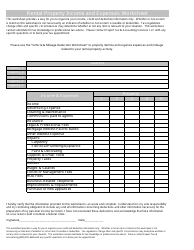

Tax Deduction Worksheet for Pilots, Flight Attendants, & Other Airline Personnel

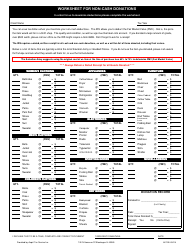

The Tax Deduction Worksheet for Pilots, Flight Attendants, & Other Airline Personnel is a tool used to calculate eligible tax deductions specifically for individuals working in the airline industry. It helps them determine the expenses they can deduct from their income in order to reduce their taxable income and potentially lower their overall tax liability.

The pilots, flight attendants, and other airline personnel themselves file the tax deduction worksheet.

FAQ

Q: What is a tax deduction?

A: A tax deduction is an expense that can be subtracted from your taxable income, reducing the amount of tax you owe.

Q: Who can use the tax deduction worksheet for pilots, flight attendants, and other airline personnel?

A: This worksheet is specifically designed for pilots, flight attendants, and other airline personnel who incur job-related expenses.

Q: What types of expenses can be deducted?

A: Common job-related expenses that may be deductible for airline personnel include uniform costs, union dues, training expenses, travel expenses, and meal expenses during layovers.

Q: How do I calculate my tax deduction?

A: To calculate your tax deduction, you need to keep track of your job-related expenses throughout the year and then fill out the tax deduction worksheet, following the instructions provided.

Q: Can I deduct the cost of my uniform?

A: Yes, the cost of purchasing and maintaining your required uniform is generally deductible.

Q: Are union dues deductible?

A: Yes, union dues paid by airline personnel are typically tax deductible.

Q: Can I deduct my training expenses?

A: Yes, certain training expenses required by your job, such as recurrent training, may be deductible.

Q: Can I deduct my travel expenses?

A: Yes, if you incur travel expenses as part of your job duties, such as transportation and lodging during layovers, those expenses may be deductible.

Q: Are meal expenses during layovers deductible?

A: Yes, in most cases, the cost of meals incurred during layovers away from your tax home can be deducted.

Q: What records do I need to keep for my tax deduction?

A: You should keep detailed records, such as receipts, invoices, and mileage logs, to substantiate your job-related expenses and support your tax deduction.