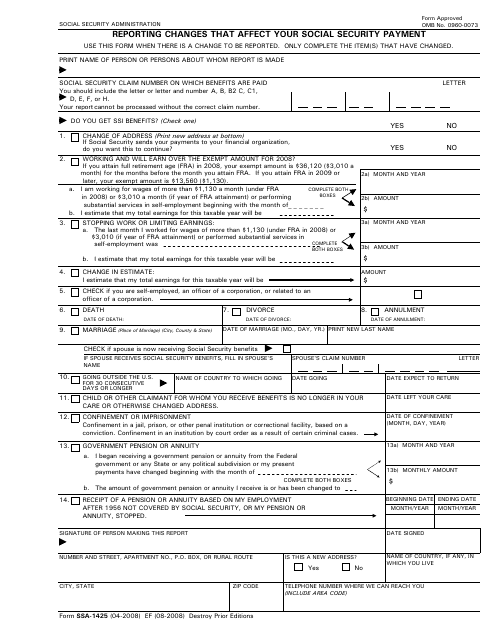

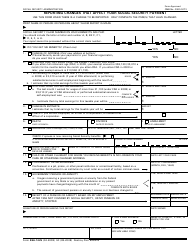

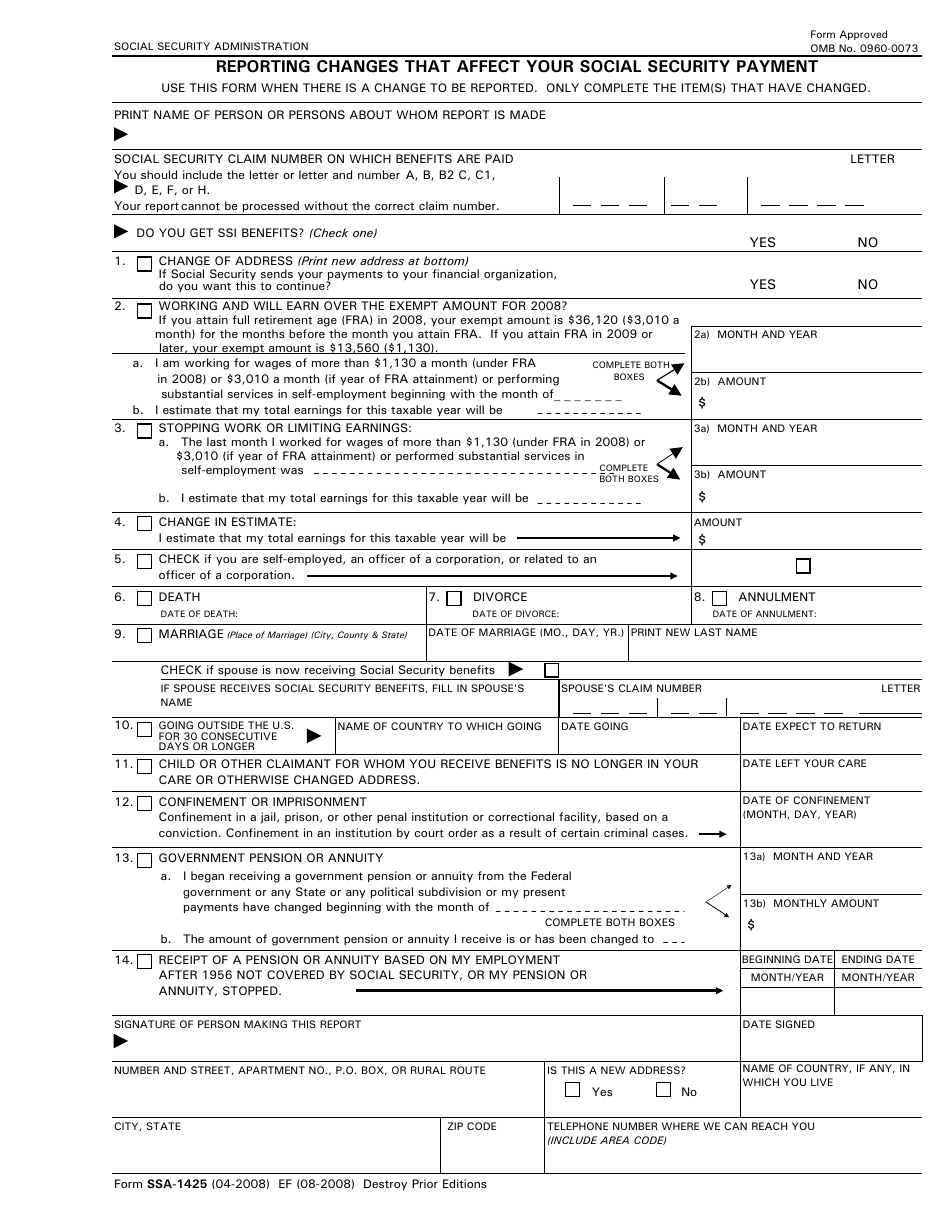

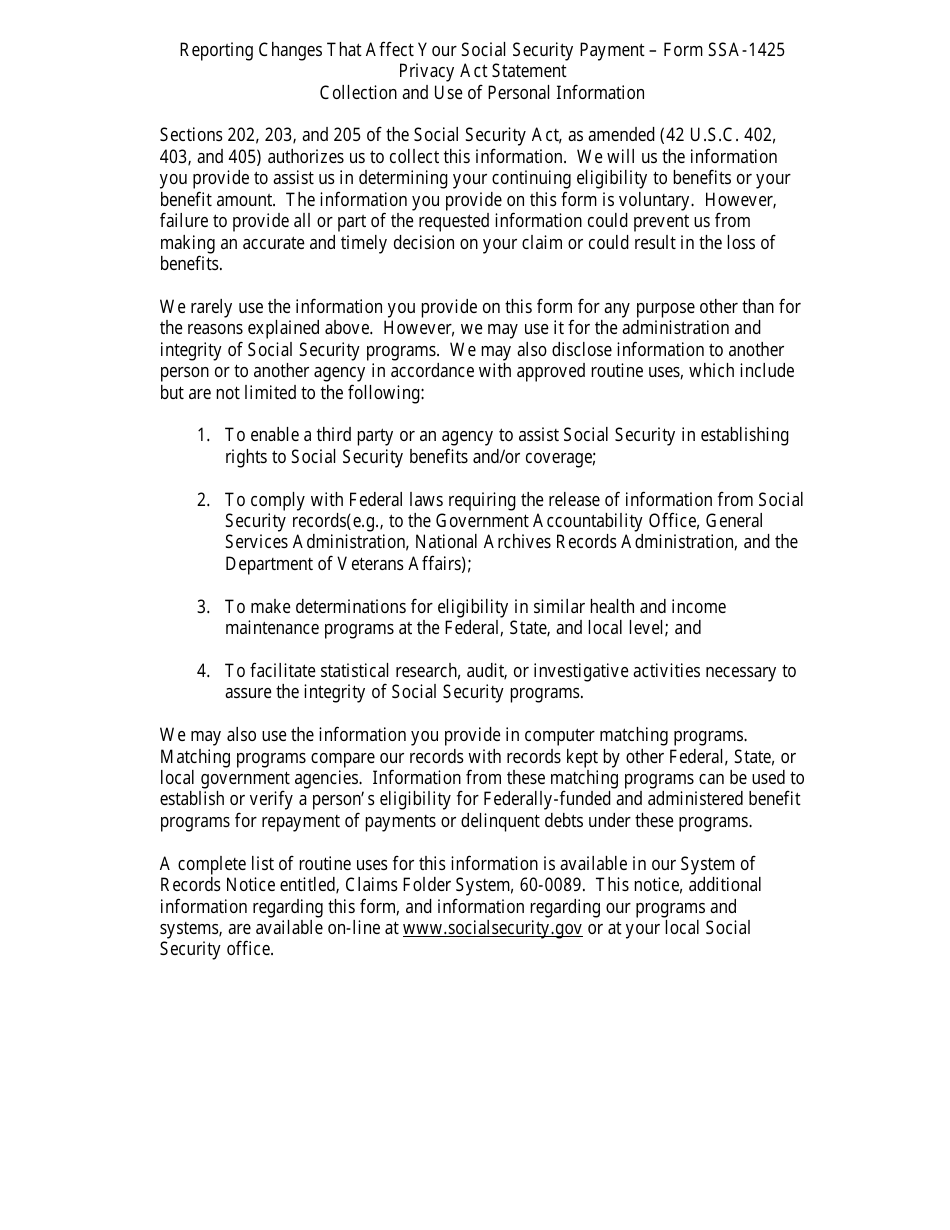

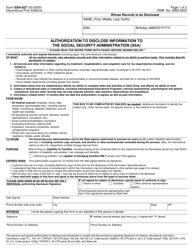

Form SSA-1425 Reporting Changes That Affect Your Social Security Payment

What Is Form SSA-1425?

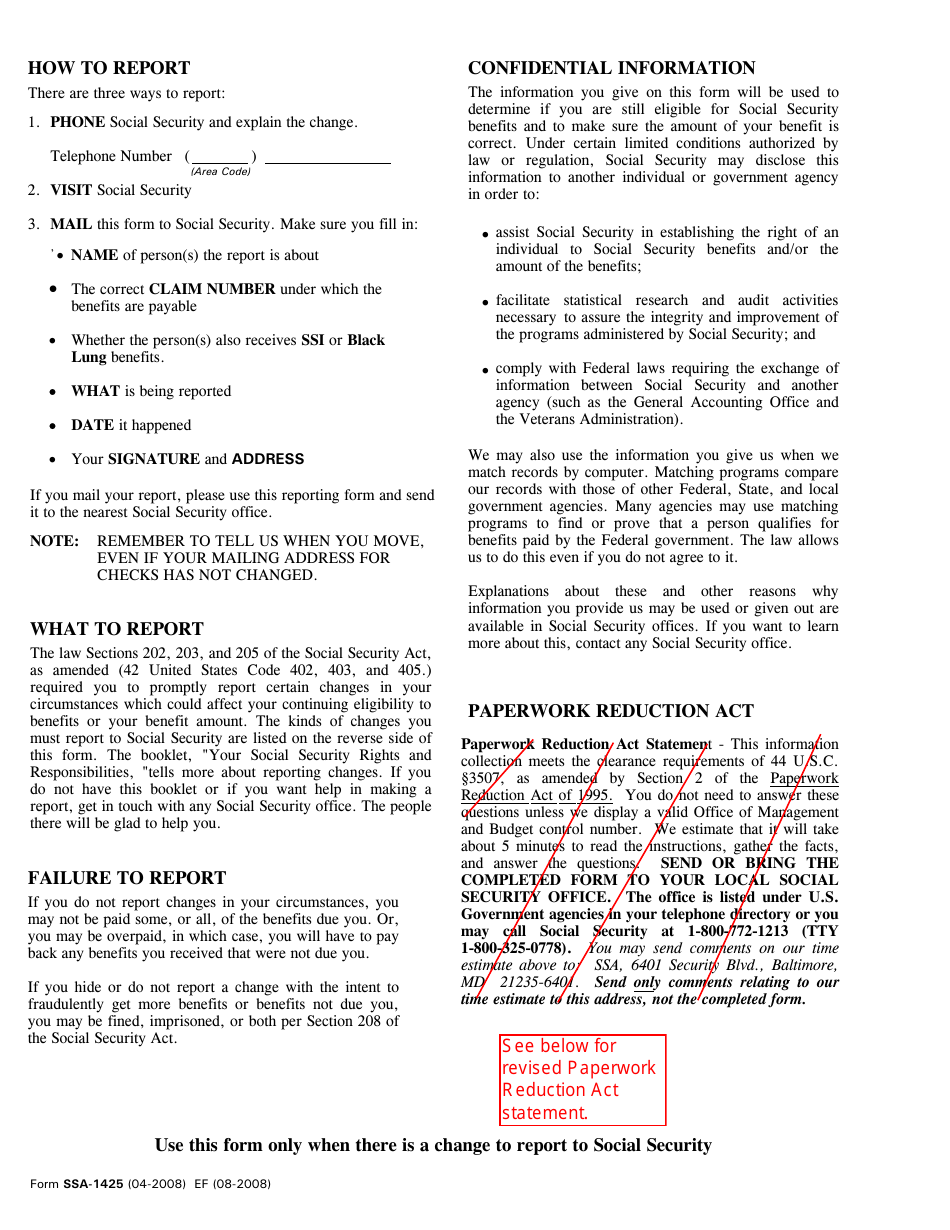

This is a legal form that was released by the U.S. Social Security Administration on April 1, 2008 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SSA-1425?

A: Form SSA-1425 is a form used to report changes that may affect your Social Security payment.

Q: When should I use Form SSA-1425?

A: You should use Form SSA-1425 to report any changes in your life that may affect your Social Security payment.

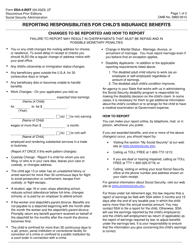

Q: What kind of changes should I report using Form SSA-1425?

A: You should report changes such as a new address, a change in your marital status, changes in your income, or changes in your living arrangements.

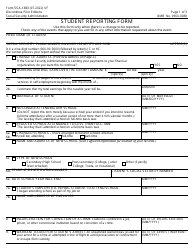

Q: How do I fill out Form SSA-1425?

A: You need to provide your personal information and details about the changes you are reporting. Follow the instructions on the form carefully.

Q: What happens after I submit Form SSA-1425?

A: After you submit Form SSA-1425, the Social Security Administration will update your information and adjust your payment if necessary.

Q: Is there a deadline for submitting Form SSA-1425?

A: There is no specific deadline for submitting Form SSA-1425, but it is better to report changes as soon as possible to avoid any potential issues with your Social Security payment.

Form Details:

- Released on April 1, 2008;

- The latest available edition released by the U.S. Social Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SSA-1425 by clicking the link below or browse more documents and templates provided by the U.S. Social Security Administration.