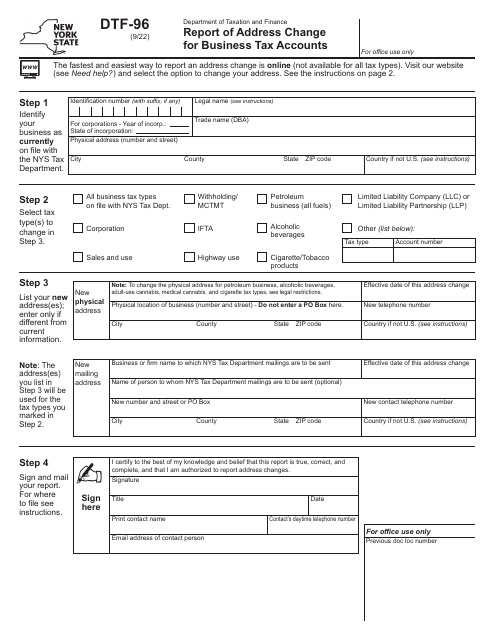

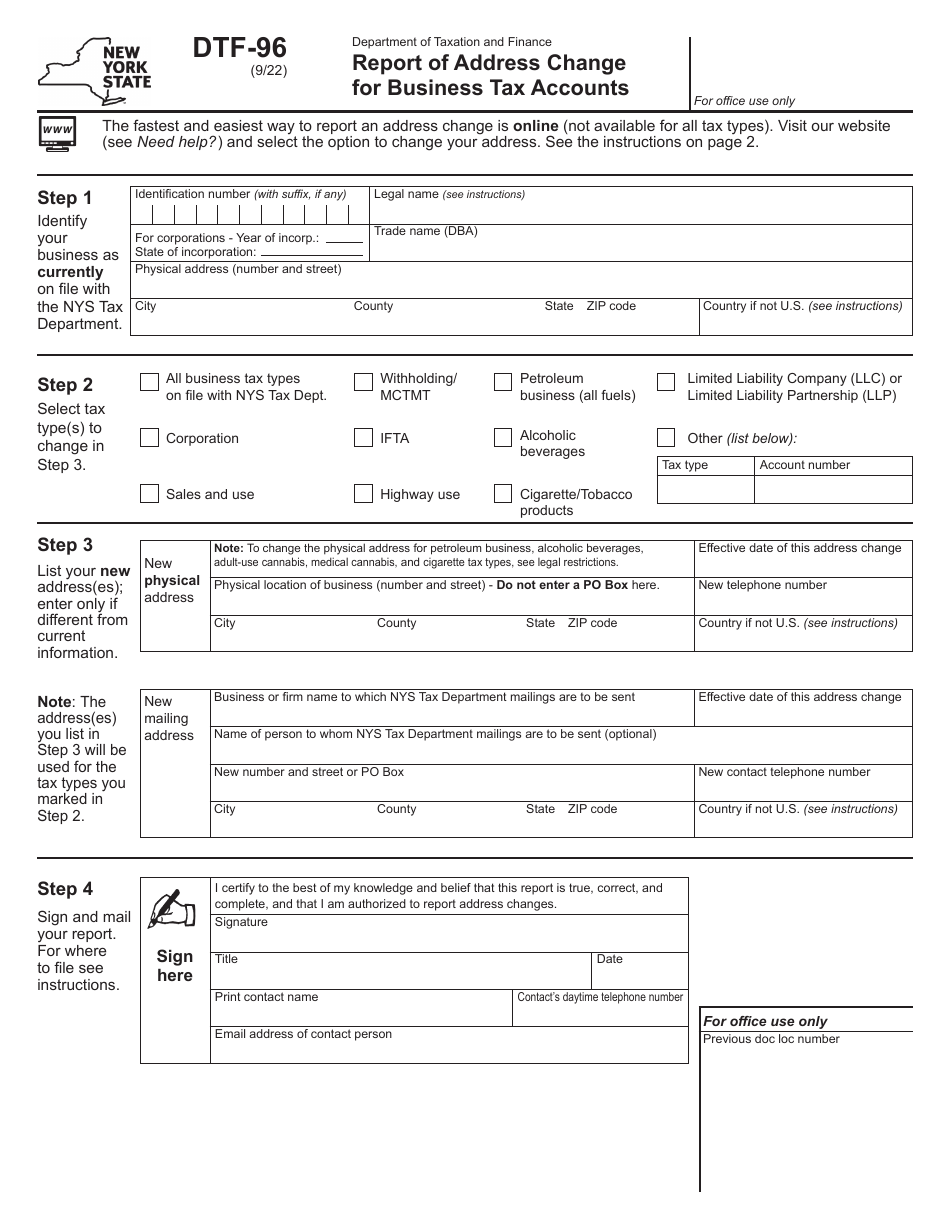

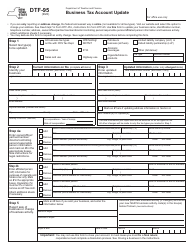

Form DTF-96 Report of Address Change for Business Tax Accounts - New York

Form DTF-96, Report of Address Change for Business Tax Accounts, is a document used in the state of New York, USA. This form is to be completed by businesses when they need to officially report a change in their physical or mailing address. It ensures the state's Tax Department has the most up-to-date and accurate information for communication purposes and sending important tax documents. The form includes information about the business such as its Tax Identification Number, previous address, new address, and the date of the address change.

The Form DTF-96 Report of Address Change for Business Tax Accounts - New York is filed by businesses located in or with operations in New York state who need to inform the Department of Taxation and Finance about a change in their business address. This could include corporations, partnerships, sole proprietorships, non-profit organizations, and other types of business entities. It's important to keep business address information up to date for tax purposes so the state can correctly send tax notices, refunds, or other official communications. The representative of the business, such as a business owner or designated officer, usually has the responsibility to file this form.

FAQ

Q: What is the purpose of Form DTF-96 in New York?

A: Form DTF-96 is a document in New York used by businesses to report a change in their physical or mailing address for tax accounts.

Q: How to fill and submit Form DTF-96 in New York?

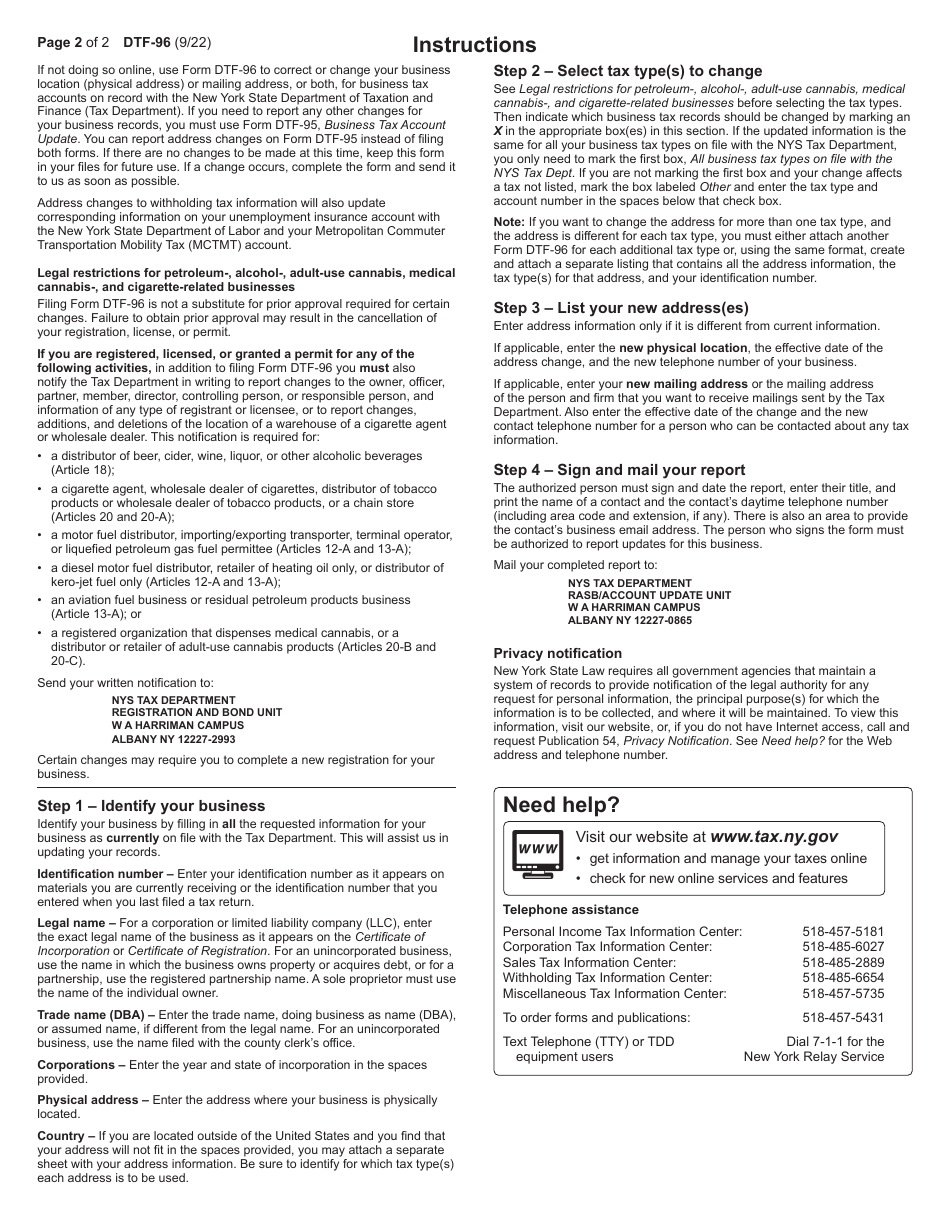

A: Form DTF-96 must be filled with accurate business and address information. Once completed, it can be mailed to the address given on the New York Department of Taxation and Finance's website.

Q: Who must submit a Report of Address Change for Business Tax Accounts in New York?

A: Any business with tax accounts registered in New York that has changed its physical or mailing address should submit a Report of Address Change, Form DTF-96.

Q: When do I need to submit Form DTF-96 in New York?

A: You should submit Form DTF-96 as soon as possible after your business's address changes, to ensure the New York Department of Taxation and Finance has your current information for correspondence.

Q: Do I need a professional to fill out New York's Form DTF-96 for my business?

A: While having a professional (like a tax consultant or accountant) can make the process easier, it is not required. The form requires basic information about your business and the new address.