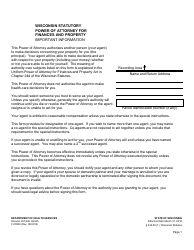

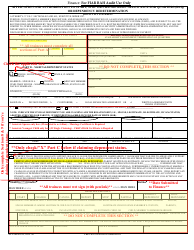

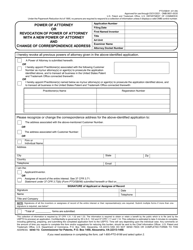

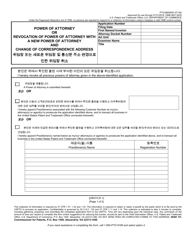

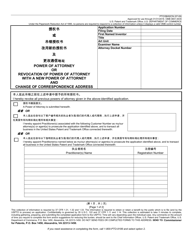

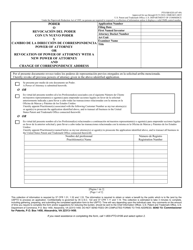

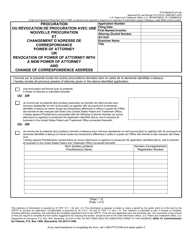

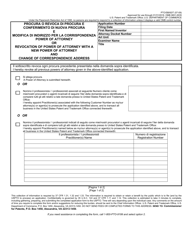

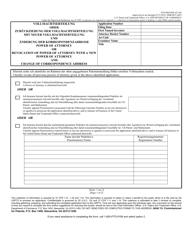

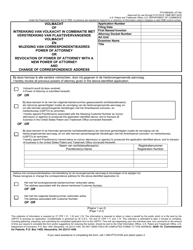

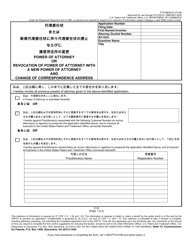

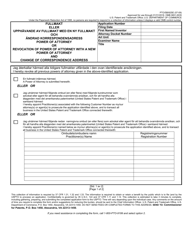

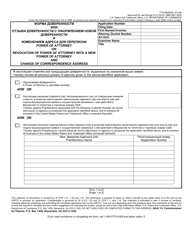

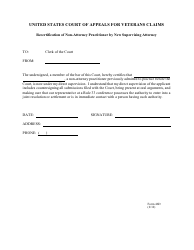

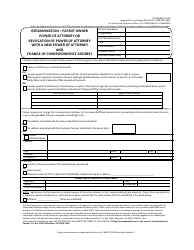

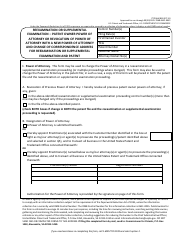

Form F-00036 Power of Attorney for Finance and Property - Wisconsin

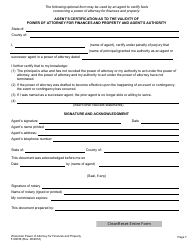

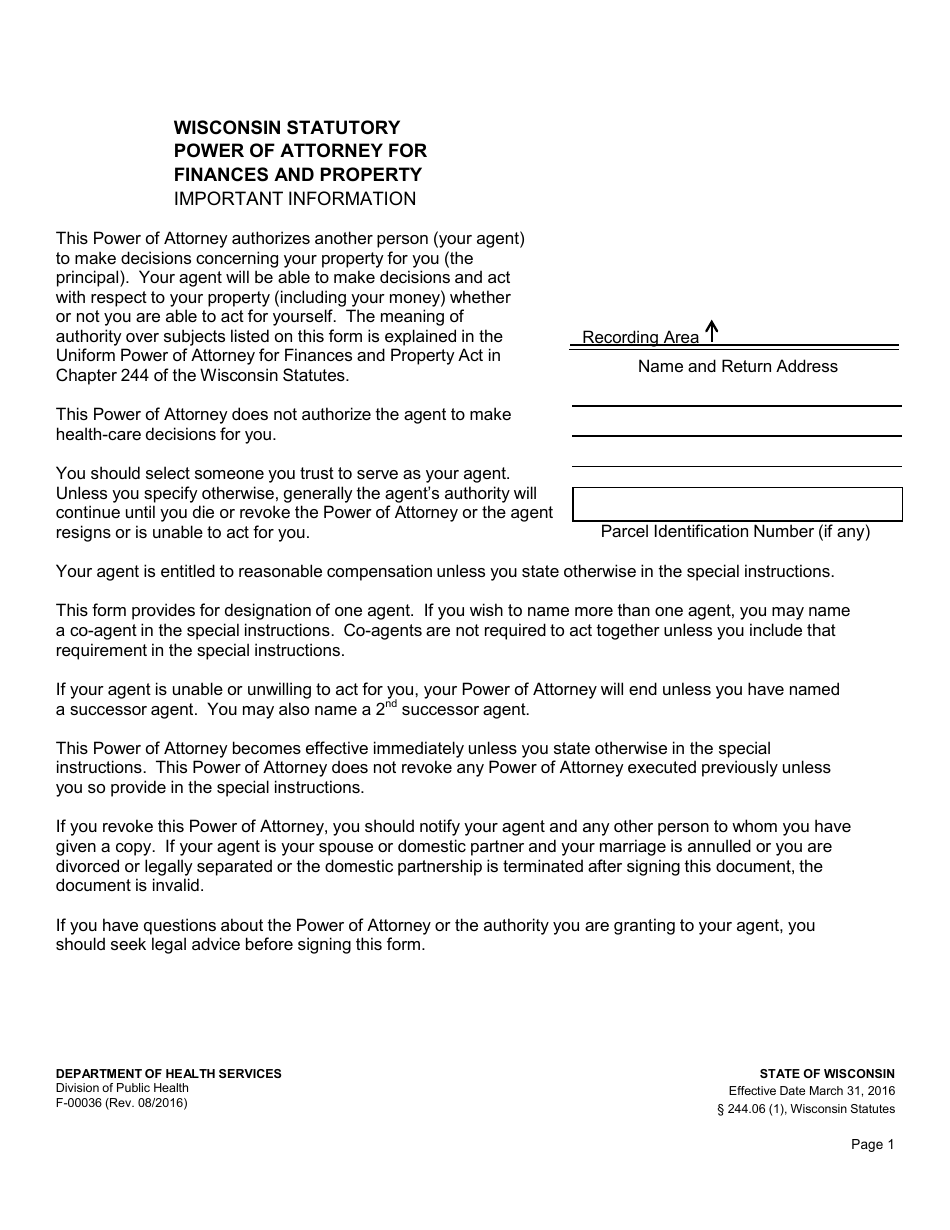

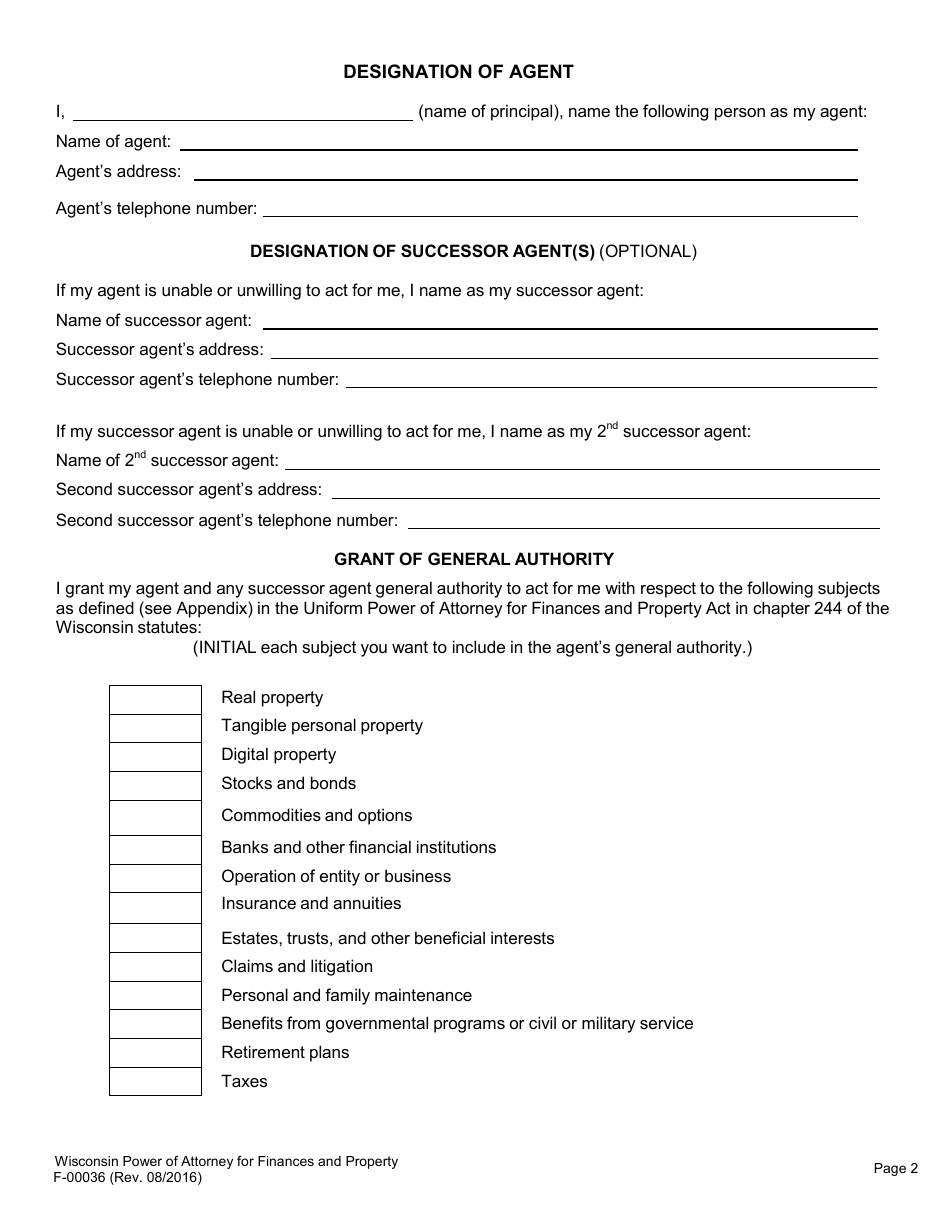

Form F-00036, the Power of Attorney for Finance and Property in Wisconsin, is a legal document that allows you to designate another individual as your agent to manage your financial affairs. It gives the person you assign, known as your "attorney-in-fact," the power to handle transactions such as purchasing insurance, managing your properties, conducting your business activities, investing your assets, and handling your taxes in case you are unable to do so on your own due to reasons like absence, disability, or incapacity. The powers granted can be broad or limited, depending upon your preference. It's important to choose a trusted individual to ensure your finances and property are handled appropriately.

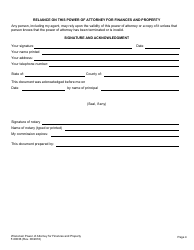

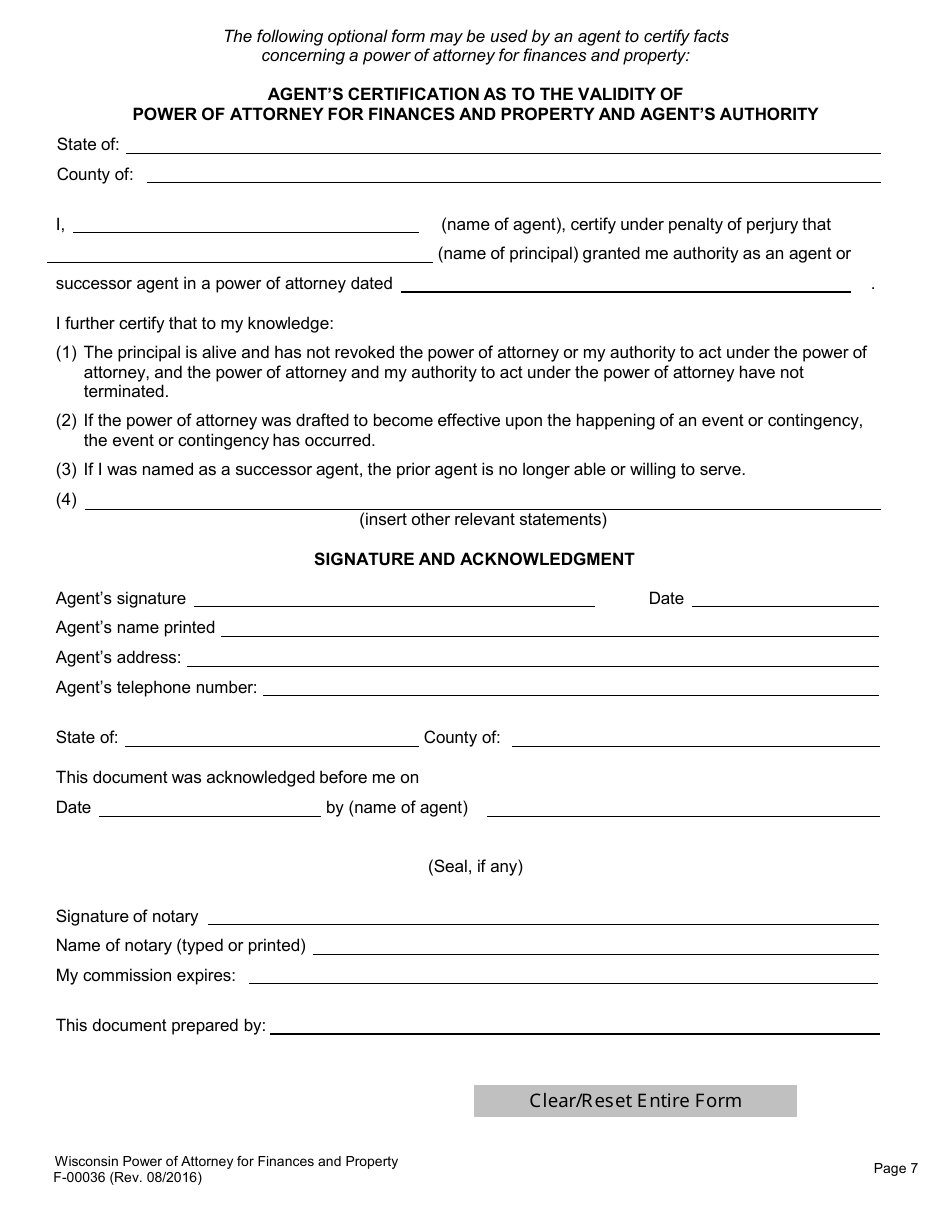

The Form F-00036 Power of Attorney for Finance and Property for Wisconsin is usually filed by an individual (known as the Principal) who wishes to appoint another person or entity (known as the Agent) to manage their financial affairs and property matters in the State of Wisconsin. This can include managing bank accounts, real estate, insurance policies, tax affairs and more. In some cases, this form may be filed in anticipation of future incapacity, illness, or out-of-state travel. It's important to note that this is a legal document and all parties involved should thoroughly understand the responsibilities and implications before signing.

FAQ

Q: What is Form F-00036 Power of Attorney for Finance and Property in Wisconsin?

A: Form F-00036 is a Power of Attorney document specific to Wisconsin. This legal paperwork allows an individual, known as the 'principal', to delegate their financial and property management responsibilities to another trusted person, called the 'agent'.

Q: Can anyone become an agent in Wisconsin power of Attorney?

A: Yes, any adult with sound mind can serve as an agent in power of Attorney in Wisconsin. However, certain roles like healthcare agent have certain restrictions.

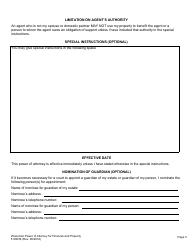

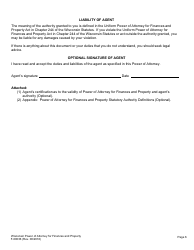

Q: What are the responsibilities of an agent in Wisconsin power of Attorney?

A: The agent's responsibilities can vary depending on what powers the principal chooses to give. Generally, it includes managing the principal's finances, property, and being responsible for making decisions in the best interest of the principal.

Q: What happens if principal becomes incapacitated in Wisconsin?

A: If the principal becomes incapacitated, a durable Power of Attorney remains in effect. The agent continues to act in the best interest of the principal, making important decisions related to finances and property.