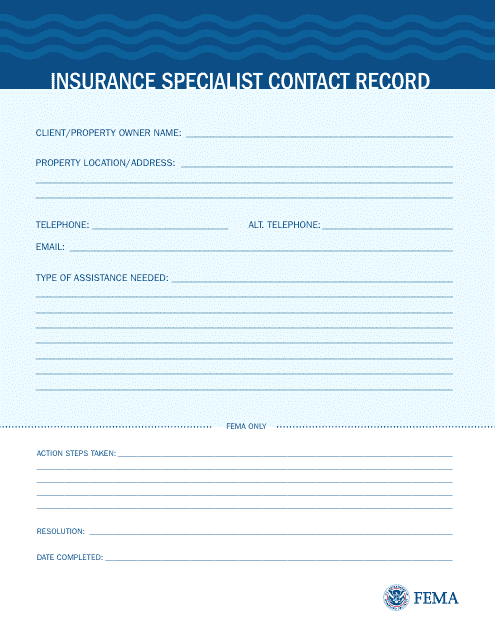

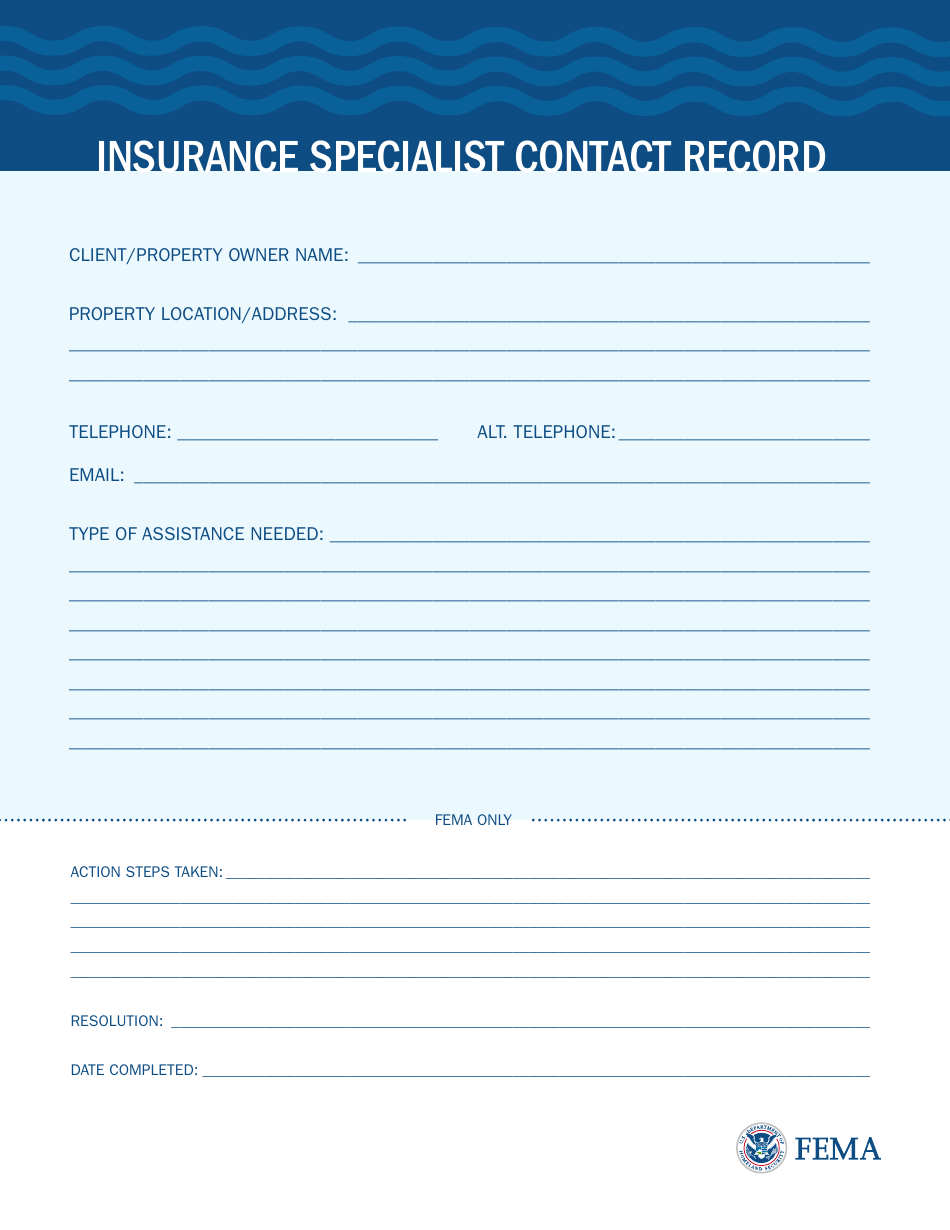

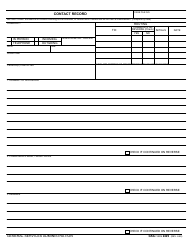

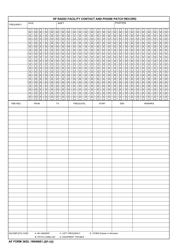

Insurance Specialist Contact Record

An Insurance Specialist Contact Record is used to document and organize all contact information and communication related to a specific insurance specialist. This record can include details like the insurance specialist's name, contact information, specialty, company they work for, as well as records of conversations, meetings, emails, and other relevant interactions. Having this record can be beneficial for tracking past communication and ensuring cohesive and consistent future correspondences. It provides a central place for all interactions with the specialist which can be very useful for reference and correspondence tracking.

The Insurance Specialist Contact Record is typically filed by an insurance specialist. This individual could be a representative from an insurance company or possibly a third party agency providing insurance services. They would use the contact record to document interactions and maintain communications with the insured, potential clients, or other types of correspondences. These records help to maintain consistent service, document any changes or updates, and track communication history.

FAQ

Q: What is an Insurance Specialist Contact Record?

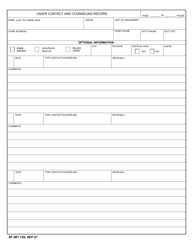

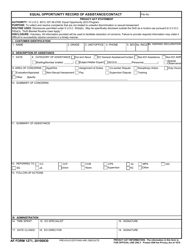

A: An Insurance Specialist Contact Record is a document where all communication details, conversations and transactions associated with a particular insurance specialist are recorded. This document helps in tracking and managing all client interactions, insurance claims, and policy updates effectively.

Q: Why is an Insurance Specialist Contact Record important?

A: Insurance Specialist Contact Record serves as a vital tool for insurance companies to manage client relationships, keep track of all conversations, claims and transactions, as well as, ensures accurate and effective communication for future references.

Q: Who uses an Insurance Specialist Contact Record?

A: Insurance Specialists, insurance companies, and their patient care teams typically use an Insurance Specialist Contact Record. It allows them to provide accurate and consistent responses to client inquiries, track the status of claims and policy changes, and monitor their interactions with clients.

Q: How to maintain an effective Insurance Specialist Contact Record?

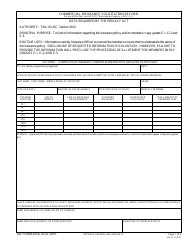

A: To maintain an effective Insurance Specialist Contact Record, it is essential to consistently update all interactions and transactions, ensure the information is accurate and organized, and securely protect client information to maintain confidentiality.

Q: What are the key details recorded in an Insurance Specialist Contact Record?

A: Key details in an Insurance Specialist Contact Record usually include client's personal and contact details, insurance coverage information, claims history, policy updates, dates and summaries of interactions, and any other related transactions.

Q: How does an Insurance Specialist Contact Record enhance customer service?

A: An Insurance Specialist Contact Record enhances customer service by providing a comprehensive record of all customer interactions and transactions. This allows insurance specialists to provide quick, personalized and consistent service, making clients feel valued and improving their overall customer experience.