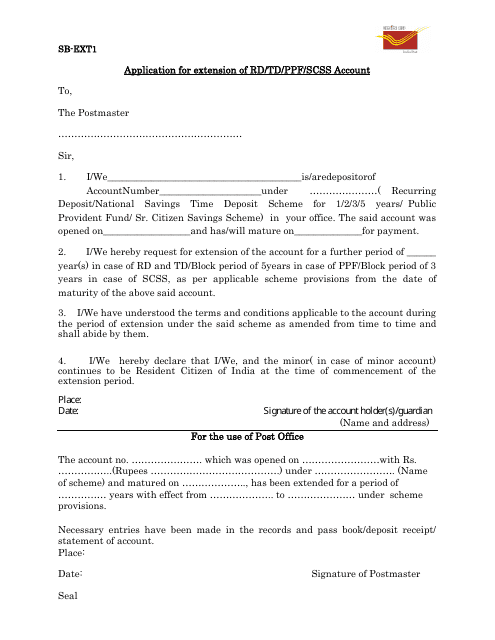

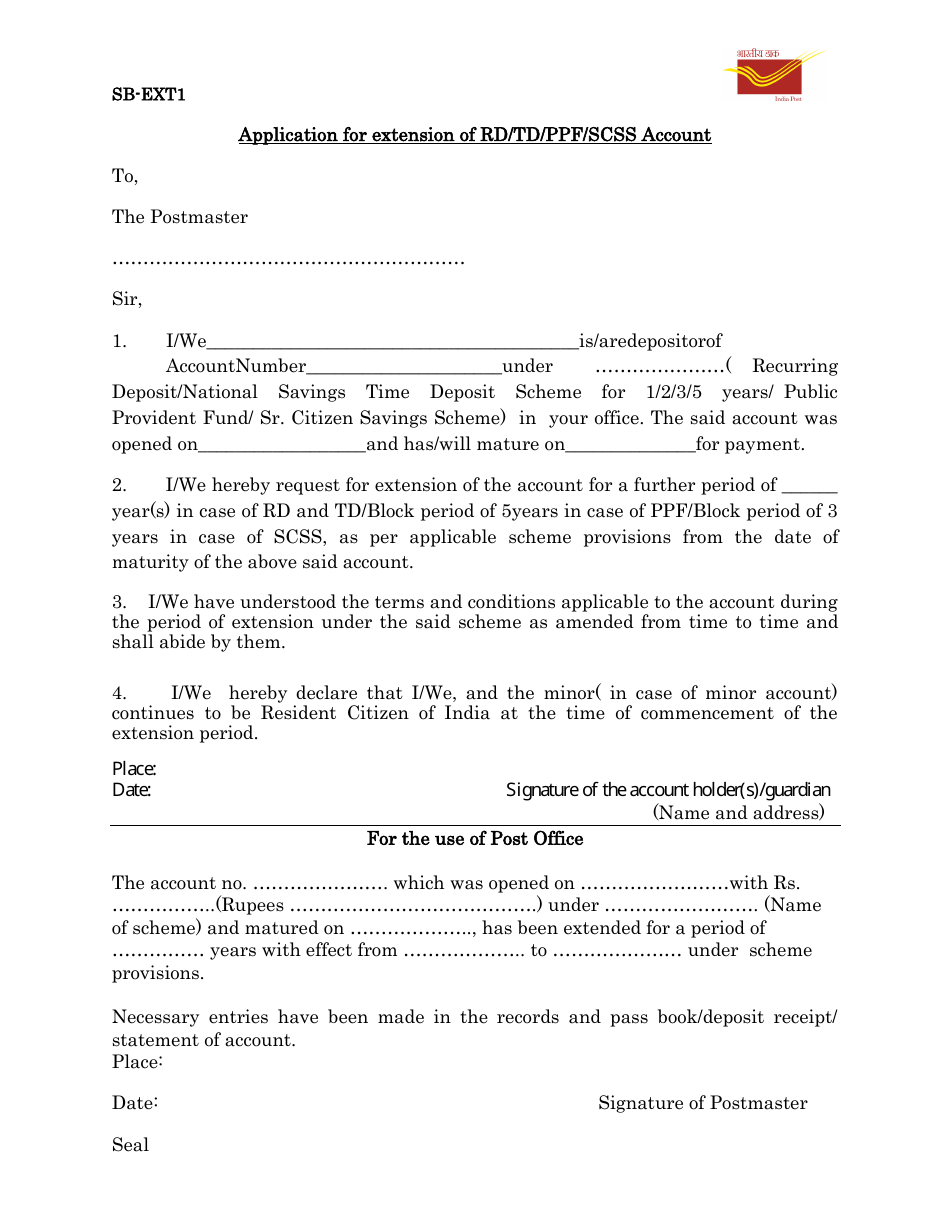

Form SB-EXT1 Application for Extension of Rd / Td / Ppf / Scss Account - India

Form SB-EXT1 Application for Extension of RD/TD/PPF/SCSS account is an official document used in India. This form is used when an account holder of a Recurring Deposit (RD), Time Deposit (TD), Public Provident Fund (PPF), or Senior Citizen Savings Scheme (SCSS) wishes to extend the maturity date of their account.

This means the account will continue to exist and accrue interest for a further specified period beyond its original maturity date. This form needs to be submitted to the bank or post office where the account was initially opened. It's important to note that the eligibility and terms for extension may vary depending on the specific scheme and its governing rules.

The Form SB-EXT1 Application for Extension of Rd/Td/Ppf/Scss Account is filed by individuals in India who want to extend the maturity period of their respective Post Office Savings Schemes such as Recurring Deposit (RD), Time Deposit (TD), Public Provident Fund (PPF), and Senior Citizen Savings Scheme (SCSS). Typically, these individuals are account holders of these savings schemes and are looking to continue their investments beyond the original maturity period.

FAQ

Q: What is the Form SB-EXT1 in India?

A: Form SB-EXT1 is a formal document in India used for applying for an extension of an Rd/Td/Ppf/Scss Account. An Rd account refers to a Recurring Deposit account, a Td account is a Time Deposit or fixed deposit account, a PPF account is a Public Provident Fund account, and an SCSS account is a Senior Citizen Savings Scheme account.

Q: What happens after you submit the Form SB-EXT1?

A: After you submit the Form SB-EXT1 in India, the post office will review your request for extension. If approved, you will be able to continue contributing to and earning interest on your Rd/Td/Ppf/Scss Account for the extended period.

Q: Who can apply for an extension using Form SB-EXT1?

A: Any Indian resident who has reached the end of the tenure of their Rd, Td, PPF, or SCSS account, and wishes to extend it can apply using Form SB-EXT1.

Q: What is the Public Provident Fund (PPF) Account in India?

A: A Public Provident Fund (PPF) is a long-term investment option offered by the Government of India. It offers an attractive interest rate and returns that are fully exempted from tax. The PPF tenure is 15 years, at the end of which, investors have the option to extend it for a block of 5 years using Form SB-EXT1.

Q: What is a Recurring Deposit account?

A: A Recurring Deposit (RD) account is a type of term deposit account opened by an individual that allows them to deposit a fixed amount every month. It is a systematic way of saving money and is offered by banks and postal departments in India.

Q: What is the Senior Citizen Saving Scheme (SCSS)?

A: The Senior Citizen Saving Scheme (SCSS) is a government-backed savings instrument offered to Indian residents aged over 60 years. The scheme offers a regular stream of income with the highest degree of safety and tax-saving benefits.