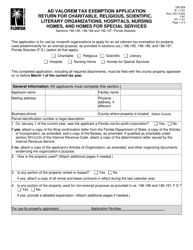

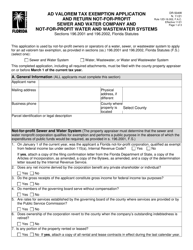

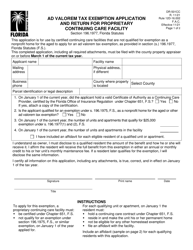

Exemption Application - Florida

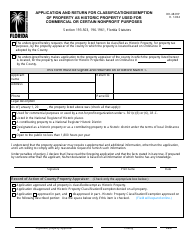

The Exemption Application in Florida is typically used for applying for different types of property tax exemptions - the most common one being the homestead exemption. This application allows residents to potentially reduce the taxable value of their property, thus lowering the amount they owe in property taxes. There are also exemptions available for seniors, veterans, people with disabilities, and survivors of first responders or military members who died in the line of duty. To apply, one would need to submit the application to the property appraiser's office in their county.

In Florida, the Exemption Application is typically filed by the property owner. They may be applying for exemptions like Homestead, Widow/Widower, Disability, Veteran, Senior Citizen, etc. The application must be filed with the County Property Appraiser's office in the county where the property is located. If approved, these exemptions can reduce the property tax owed.

FAQ

Q: What is an Exemption Application in Florida?

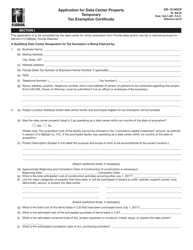

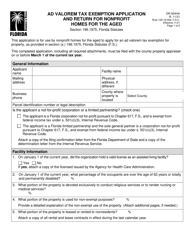

A: An Exemption Application in Florida refers to the process of applying for tax exemptions available to homeowners, seniors, veterans, disabled individuals, and other applicable parties under Florida law. The most common is the Homestead Exemption which can decrease the taxable value of a home by as much as $50,000, thus reducing the amount of property taxes that are owed.

Q: Who qualifies for a Homestead Exemption in Florida?

A: To qualify for a Homestead Exemption in Florida, you must be a permanent resident of Florida and own and occupy the property as your primary residence as of January 1st of the year the exemption is sought. Documentation such as a Florida driver's license or ID card, Florida vehicle registration, and voter registration or declaration of domicile may be required to establish residency.

Q: Are there other types of tax exemptions available in Florida?

A: Yes, besides the Homestead Exemption, Florida offers several other types of property tax exemptions. These include exemptions for veterans, surviving spouses of veterans and first responders, blind and disabled individuals, and seniors who meet certain income criteria.

Q: What is the benefit of getting a Homestead Exemption in Florida?

A: A Homestead Exemption can decrease the assessed value of a home for property tax purposes by up to $50,000, leading to substantial savings on property taxes. Additionally, it provides homeowners with protection from creditors and limits the amount by which the assessed value of the home can increase each year.