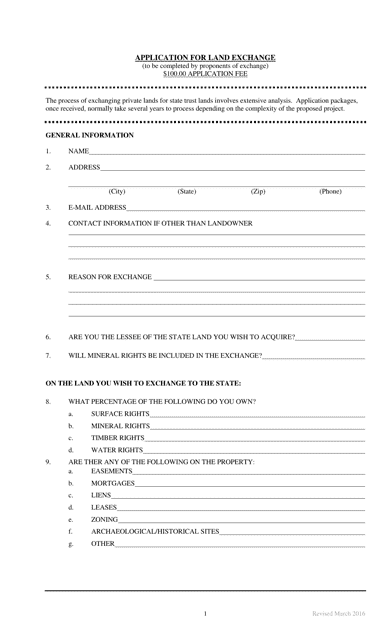

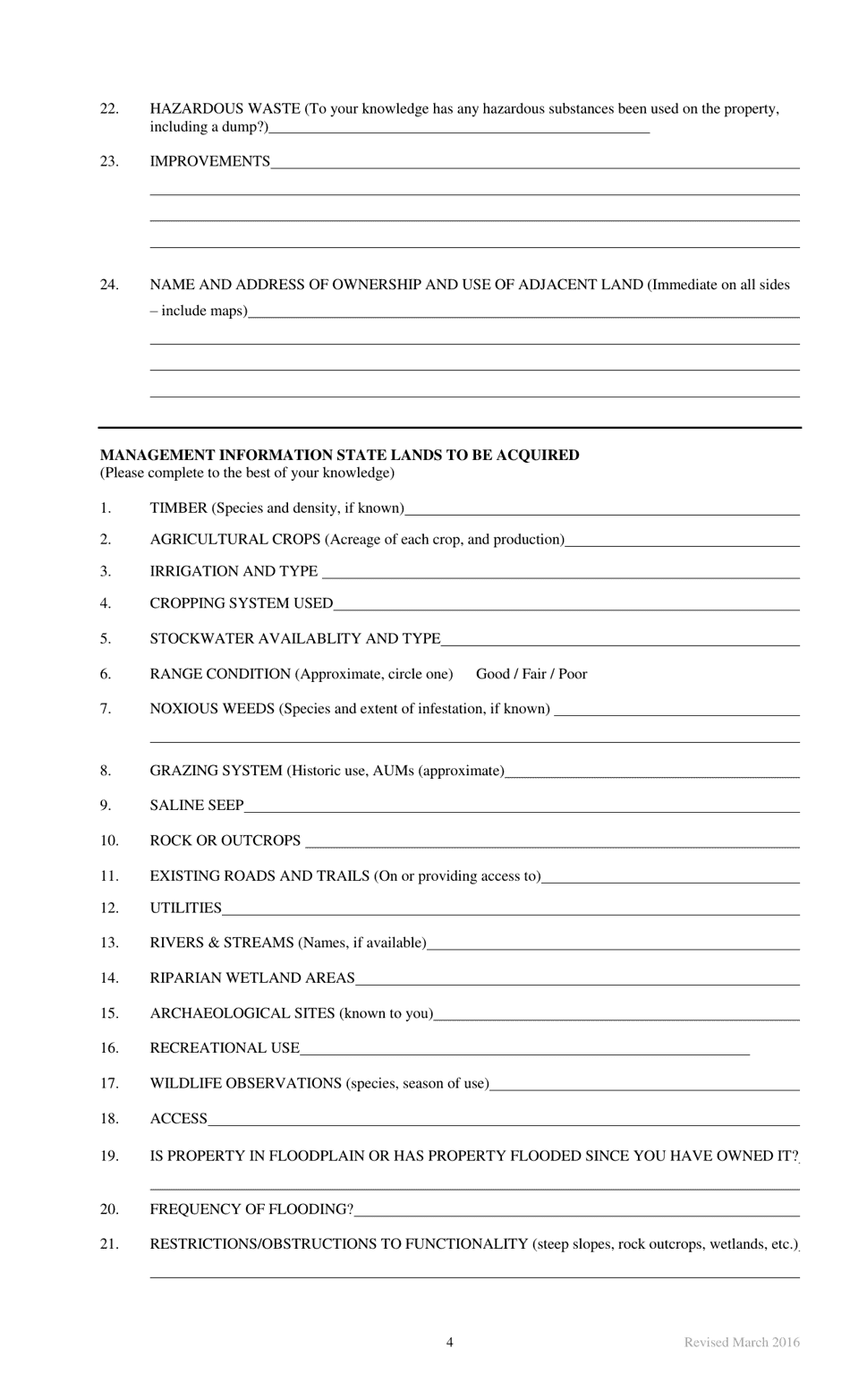

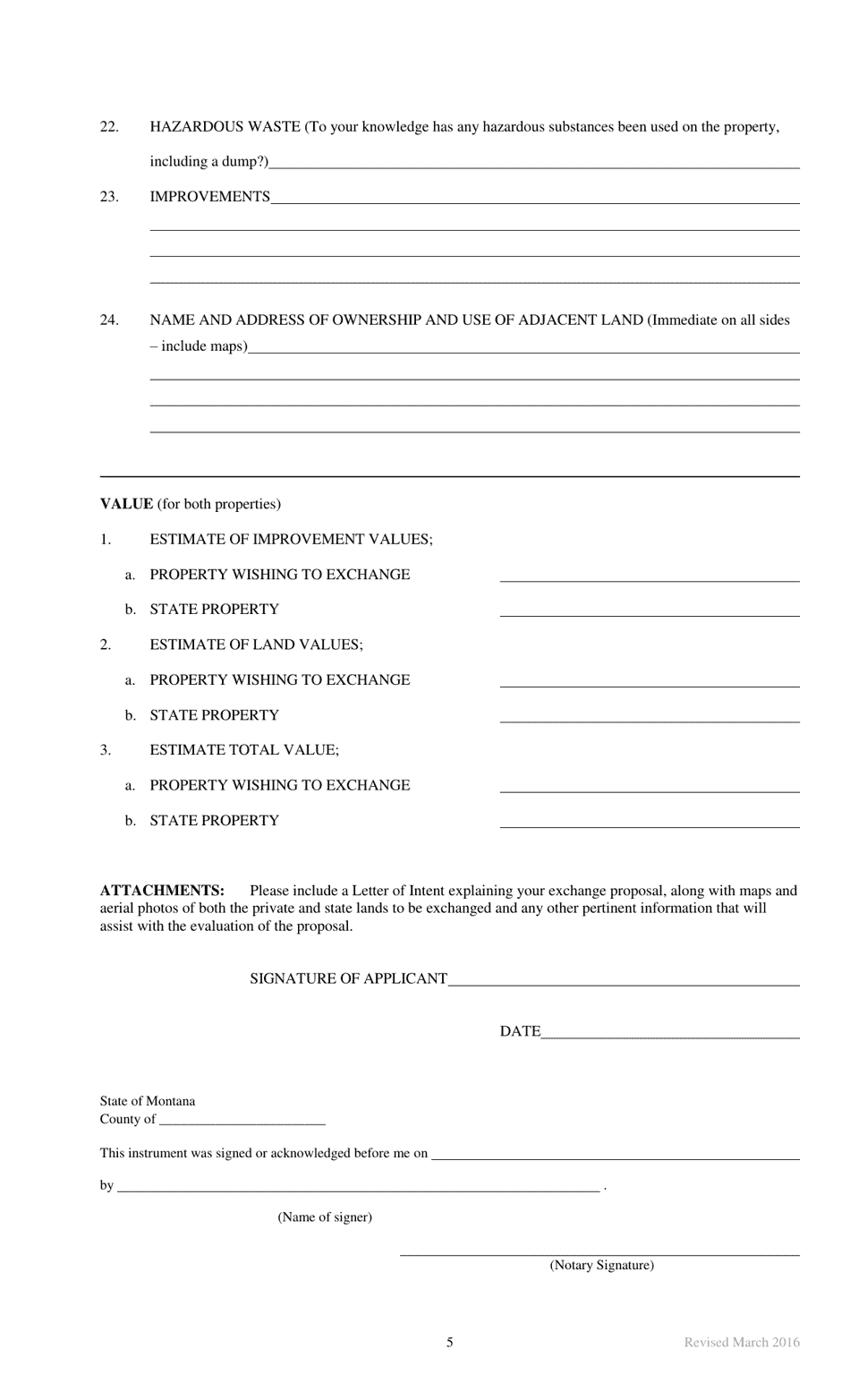

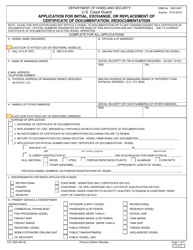

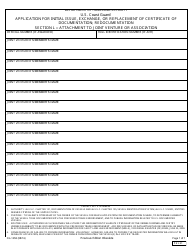

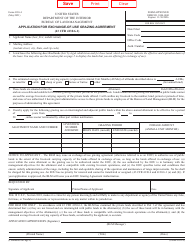

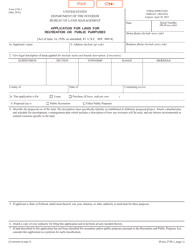

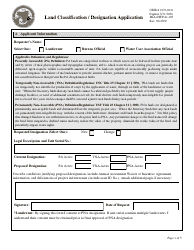

Application for Land Exchange - Montana

Application for Land Exchange is a legal document that was released by the Montana Department of Natural Resources and Conservation - a government authority operating within Montana.

FAQ

Q: What is a land exchange?

A: A land exchange is a transaction where two parties swap or trade parcels of land.

Q: Why would someone apply for a land exchange?

A: Land exchanges can be done for various reasons, such as consolidating land ownership, improving land management, or resolving boundary disputes.

Q: Who can apply for a land exchange in Montana?

A: Any individual, corporation, or government agency that owns land in Montana can apply for a land exchange.

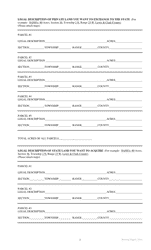

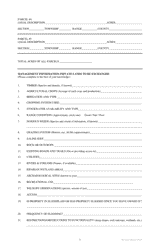

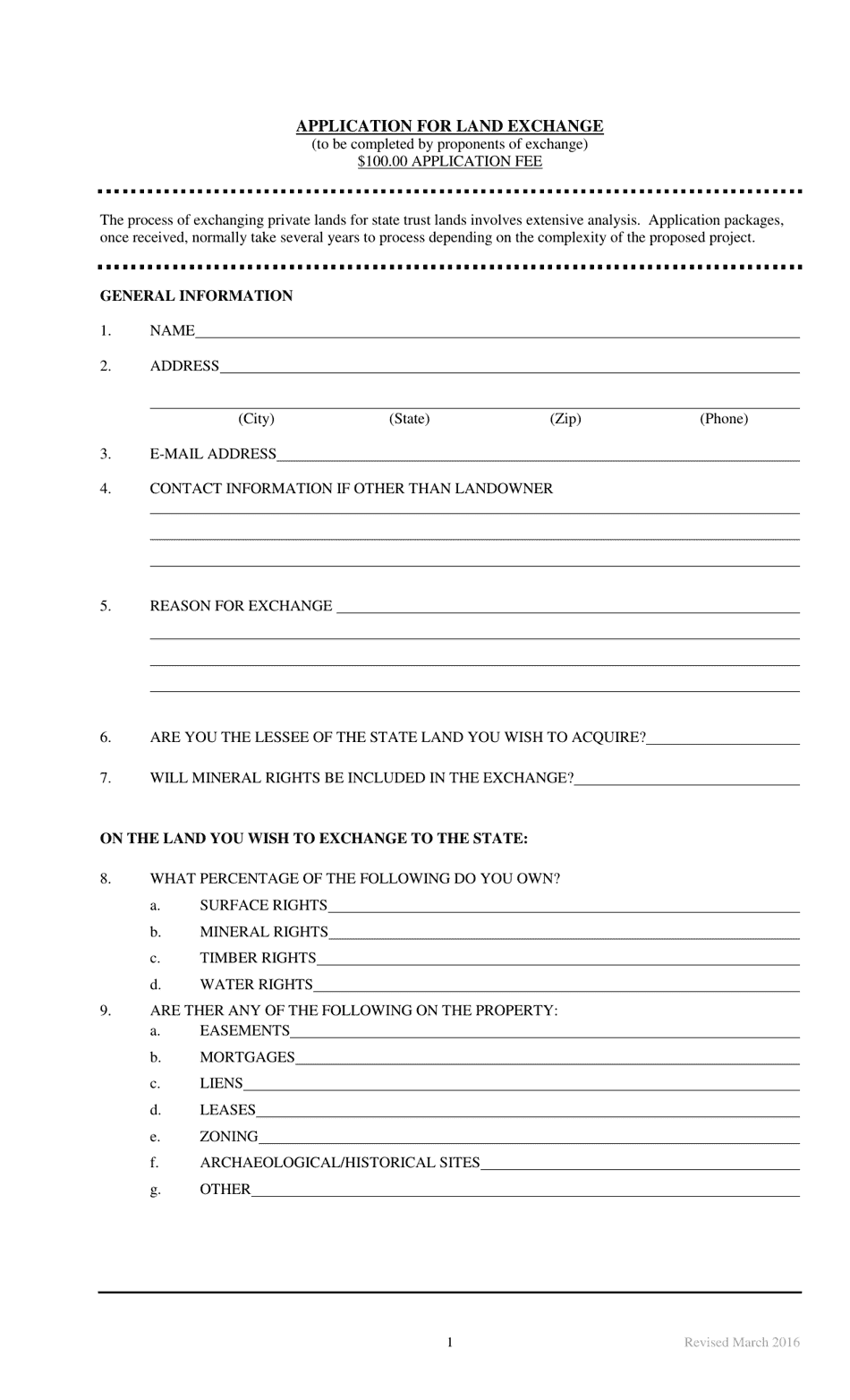

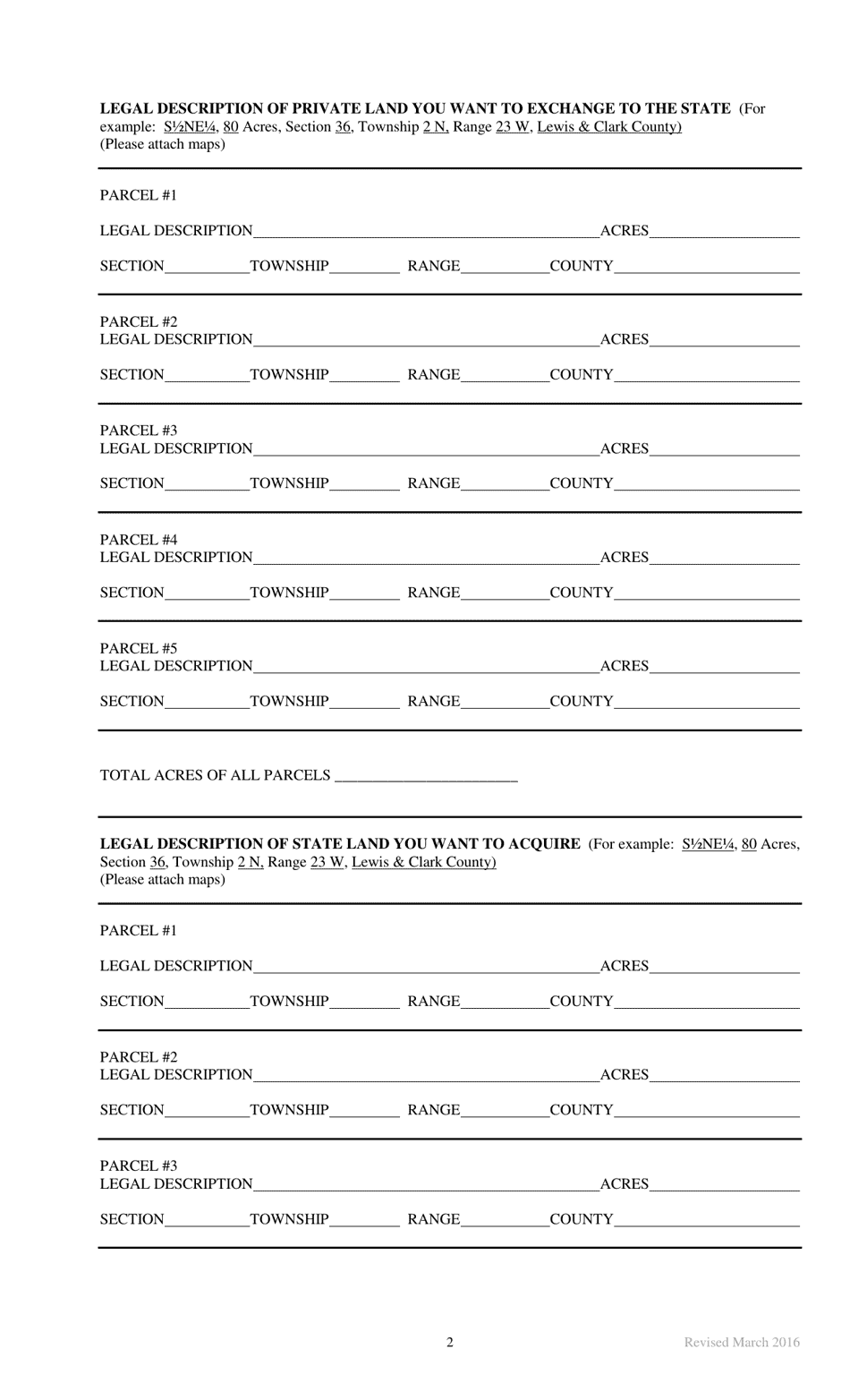

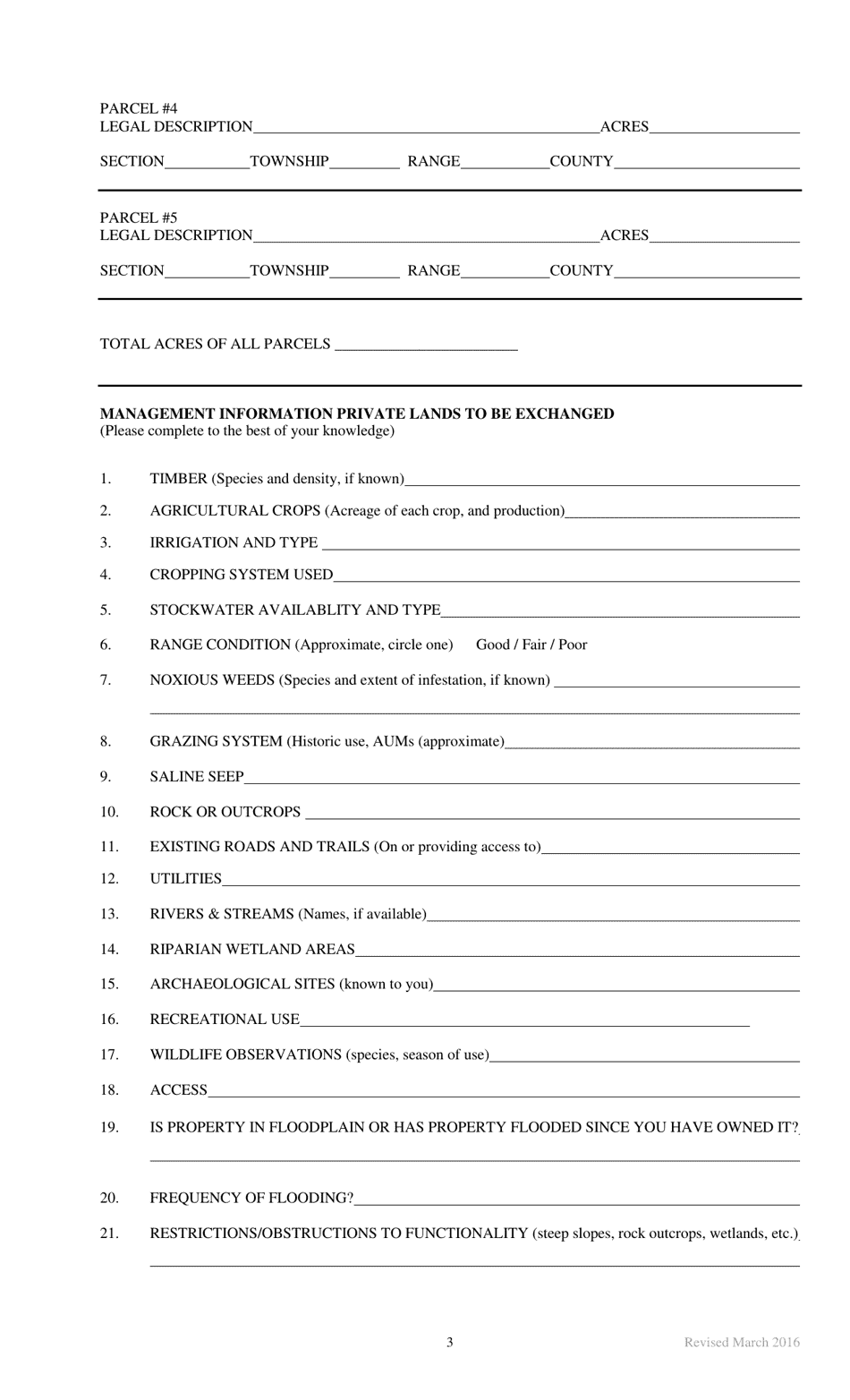

Q: What is the process for applying for a land exchange in Montana?

A: The process typically involves submitting an application to the appropriate government agency, providing detailed information about the lands involved, and complying with any legal requirements.

Q: Are there any fees associated with applying for a land exchange in Montana?

A: Yes, there are usually fees associated with applying for a land exchange, including application fees, appraisal fees, and processing fees.

Q: How long does the land exchange process take in Montana?

A: The timeline for a land exchange can vary depending on the complexity of the transaction and the workload of the government agency involved. It can take several months to several years to complete a land exchange.

Q: What are the benefits of a land exchange?

A: Some potential benefits of a land exchange include consolidating fragmented land ownership, facilitating better land management, and resolving disputes over land boundaries.

Q: Can individuals participate in a land exchange?

A: Yes, individuals can participate in a land exchange. It is not limited to corporations or government agencies.

Q: Is there a limit to the size of the parcels of land that can be exchanged?

A: There is no specific limit to the size of the parcels of land that can be exchanged, but it is subject to the regulations and policies of the government agency overseeing the land exchange.

Q: Are land exchanges taxable in Montana?

A: Land exchanges may have tax consequences. It is advisable to consult with a tax professional or attorney to understand the potential tax implications before proceeding with a land exchange.

Form Details:

- Released on March 1, 2016;

- The latest edition currently provided by the Montana Department of Natural Resources and Conservation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Montana Department of Natural Resources and Conservation.