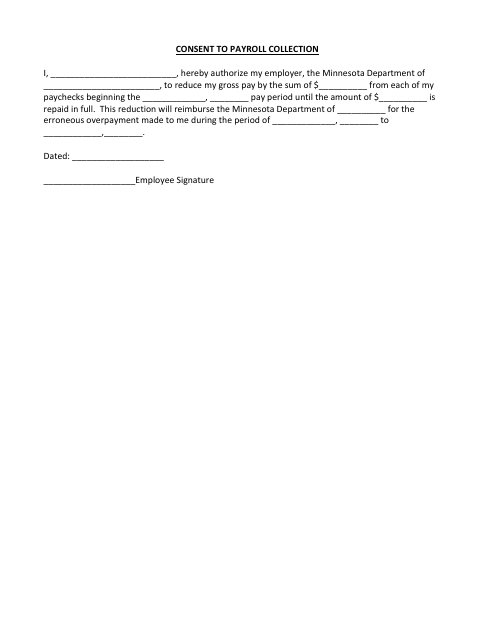

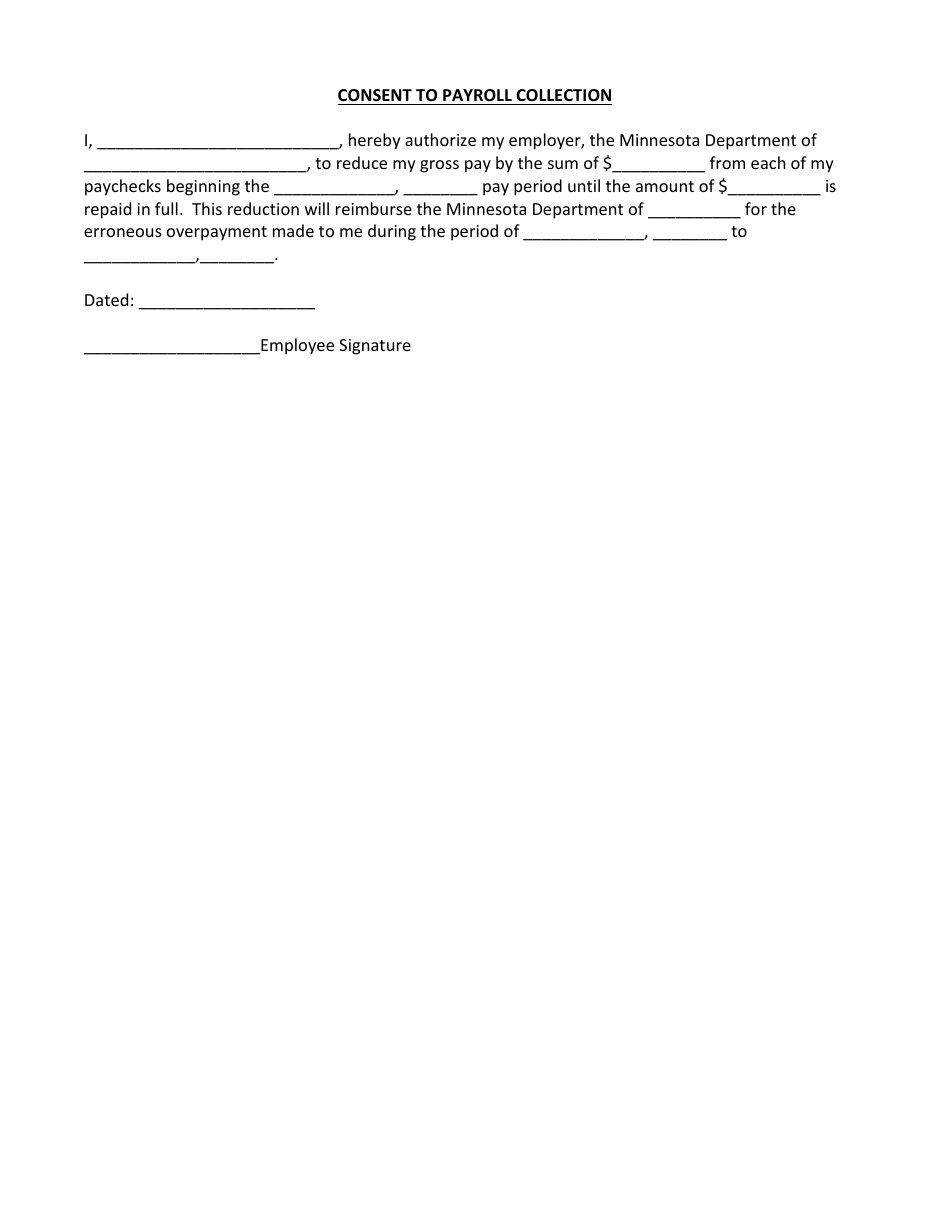

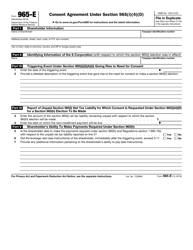

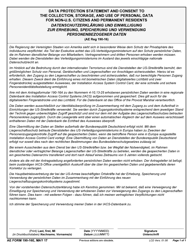

Consent to Payroll Collection - Minnesota

Consent to Payroll Collection is a legal document that was released by the Minnesota Management and Budget - a government authority operating within Minnesota.

FAQ

Q: What is the Consent to Payroll Collection?

A: The Consent to Payroll Collection is an agreement between an employee and their employer regarding the collection of certain payments from the employee's wages.

Q: What does the Consent to Payroll Collection allow?

A: The Consent to Payroll Collection allows the employer to deduct specific amounts from the employee's wages for purposes such as repayment of loans or contributions to employee benefit plans.

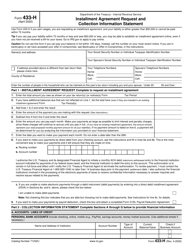

Q: Is the Consent to Payroll Collection mandatory in Minnesota?

A: No, the Consent to Payroll Collection is not mandatory in Minnesota. It is an agreement that the employee and employer can voluntarily enter into.

Q: What should be included in the Consent to Payroll Collection?

A: The Consent to Payroll Collection should include details such as the specific amounts or percentages to be deducted, the purpose of the deductions, and the frequency of deductions.

Q: Can the employee revoke their consent to payroll collection?

A: Yes, the employee can revoke their consent to payroll collection at any time by providing written notice to their employer.

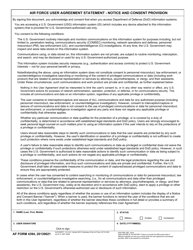

Form Details:

- The latest edition currently provided by the Minnesota Management and Budget;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

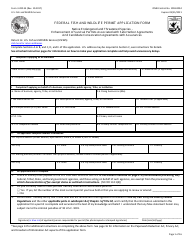

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Management and Budget.