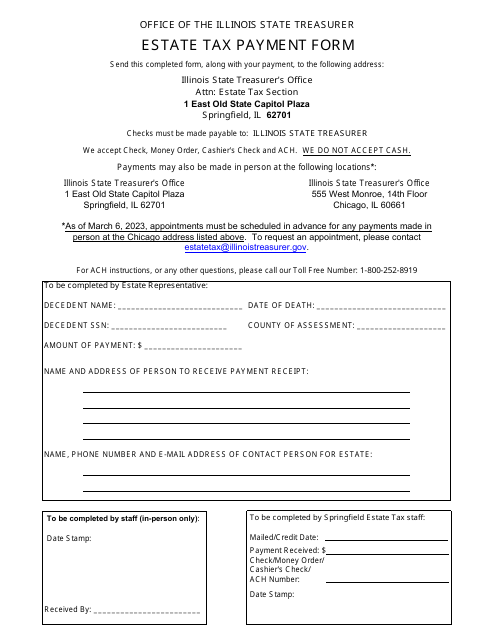

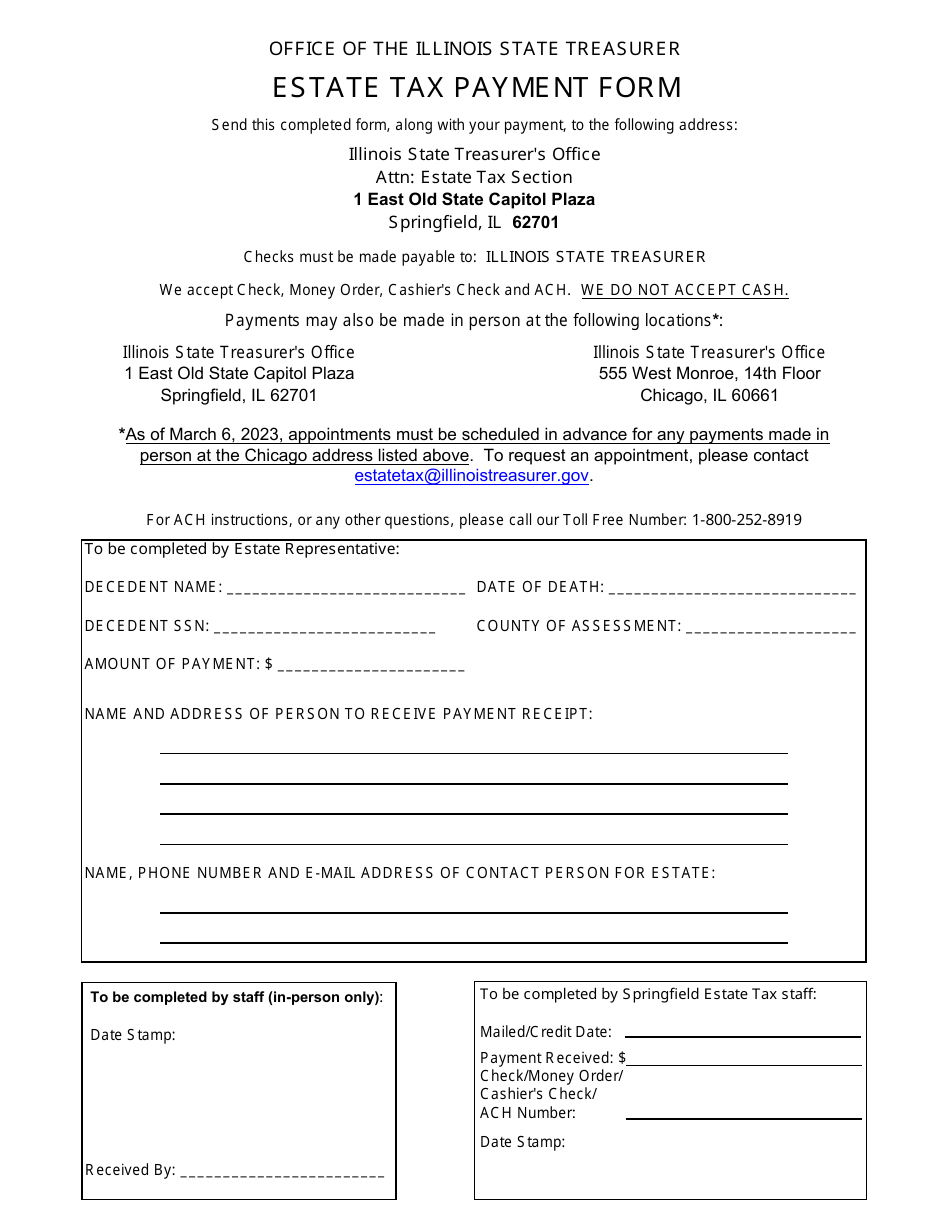

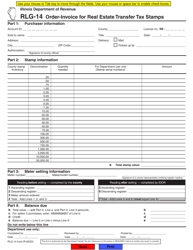

Estate Tax Payment Form - Illinois

Estate Tax Payment Form is a legal document that was released by the Illinois State Treasurer - a government authority operating within Illinois.

FAQ

Q: What is the estate tax payment form for Illinois?

A: The estate tax payment form for Illinois is Form IL-706.

Q: Who is required to file the estate tax payment form in Illinois?

A: The executor or administrator of an estate is usually required to file the estate tax payment form in Illinois if the estate is subject to estate tax.

Q: When is the estate tax payment form due in Illinois?

A: The estate tax payment form is due 9 months after the decedent's date of death in Illinois.

Q: What information is required to complete the estate tax payment form in Illinois?

A: To complete the estate tax payment form in Illinois, you will need information about the decedent's assets, debts, and beneficiaries, as well as any applicable exemptions or deductions.

Q: Is there a penalty for late filing of the estate tax payment form in Illinois?

A: Yes, there may be a penalty for late filing of the estate tax payment form in Illinois. It is important to file the form and pay any taxes owed on time to avoid penalties and interest.

Form Details:

- The latest edition currently provided by the Illinois State Treasurer;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Illinois State Treasurer.