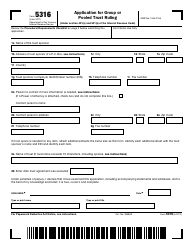

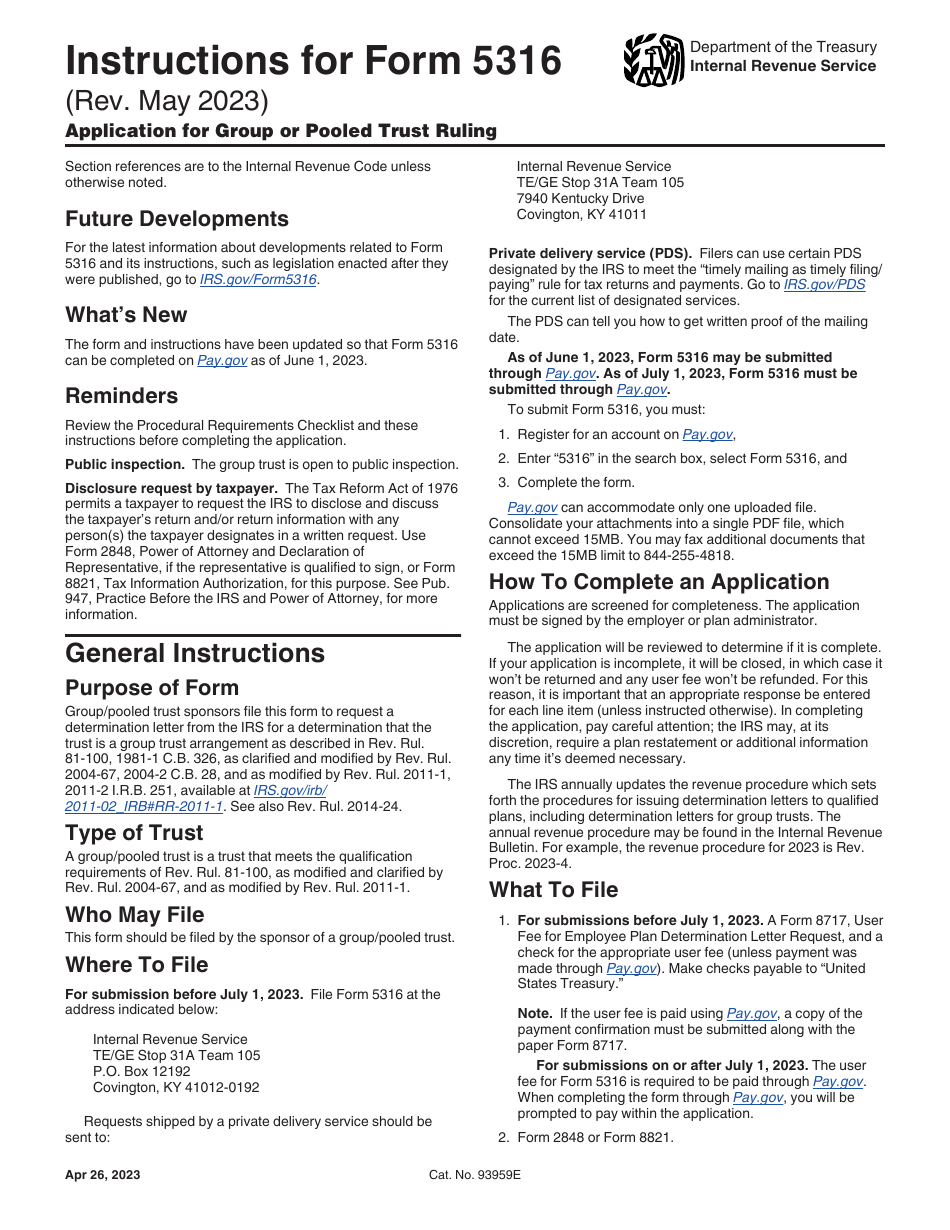

Instructions for IRS Form 5316 Application for Group or Pooled Trust Ruling

This document contains official instructions for IRS Form 5316 , Application for Group or Pooled Trust Ruling - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 5316 is available for download through this link.

FAQ

Q: What is IRS Form 5316?

A: IRS Form 5316 is an application for a ruling on a group or pooled trust.

Q: Who needs to use IRS Form 5316?

A: Individuals or entities that want to establish a group or pooled trust need to use IRS Form 5316.

Q: What is a group or pooled trust?

A: A group or pooled trust is a trust that is established and maintained by a non-profit organization for the benefit of individuals with disabilities.

Q: What is the purpose of IRS Form 5316?

A: The purpose of IRS Form 5316 is to request a ruling from the IRS on whether a group or pooled trust meets the requirements for tax exemption.

Q: What information is required on IRS Form 5316?

A: IRS Form 5316 requires detailed information about the trust, the non-profit organization, and the individuals who will benefit from the trust.

Q: Is there a deadline for submitting IRS Form 5316?

A: There is no specific deadline for submitting IRS Form 5316, but it is recommended to submit the form well in advance of when the trust will be established.

Q: Are there any fees associated with IRS Form 5316?

A: Yes, there is a user fee that must be paid when submitting IRS Form 5316. The fee amount can be found in the instructions for the form.

Q: How long does it take to get a ruling on IRS Form 5316?

A: The timeframe for receiving a ruling on IRS Form 5316 can vary, but it typically takes several months for the IRS to process the application.

Q: What should I do if my application for a ruling is denied?

A: If your application for a ruling on IRS Form 5316 is denied, you can request a conference with the IRS Appeals Office to discuss the denial and potentially seek resolution.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.