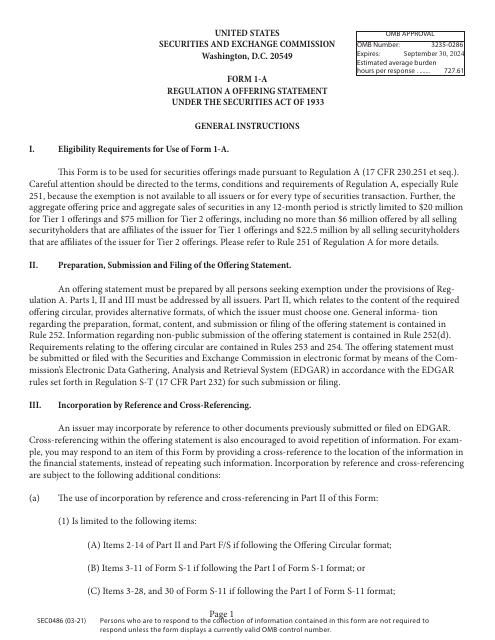

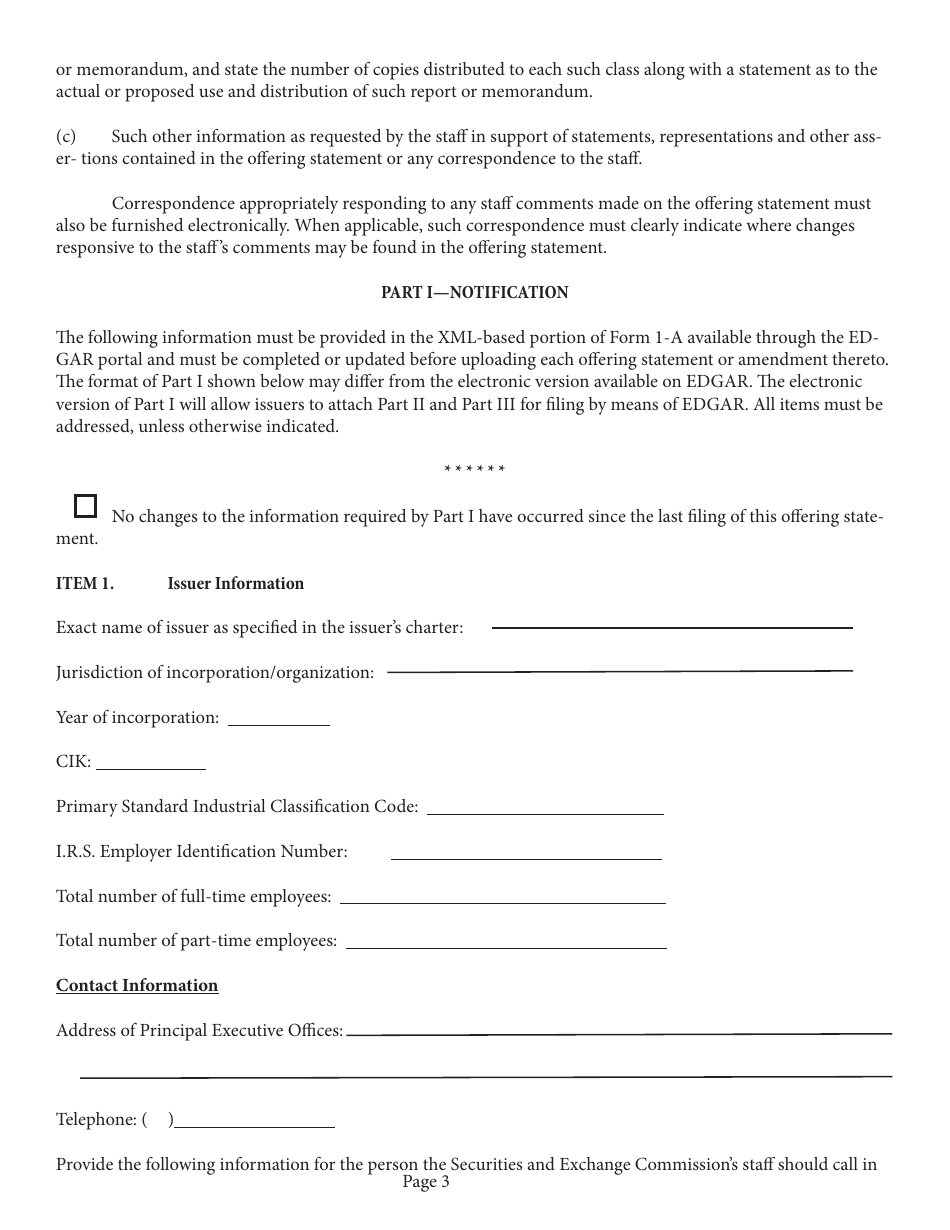

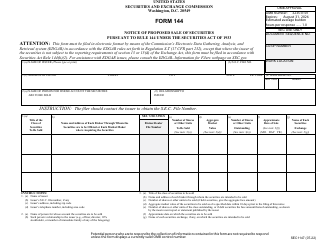

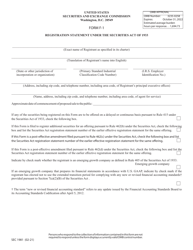

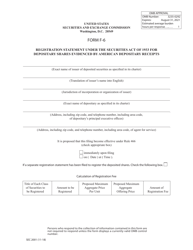

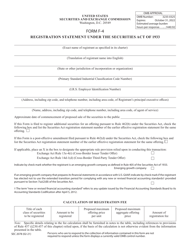

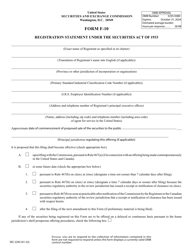

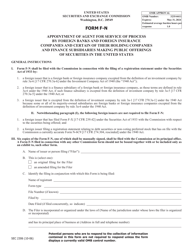

Form 1-A (SEC0486) Regulation a Offering Statement Under the Securities Act of 1933

What Is Form 1-A (SEC0486)?

This is a legal form that was released by the U.S. Securities and Exchange Commission on March 1, 2021 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1-A?

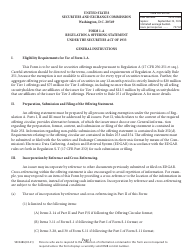

A: Form 1-A is a regulatory filing required by the Securities and Exchange Commission (SEC) for companies seeking to conduct a Regulation A offering under the Securities Act of 1933.

Q: What is a Regulation A offering?

A: A Regulation A offering is a type of securities offering that allows companies to raise capital from the public without having to file a full registration statement with the SEC.

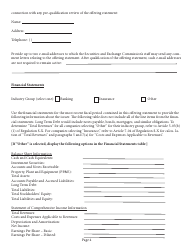

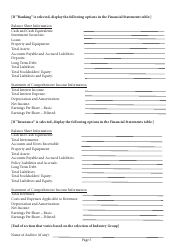

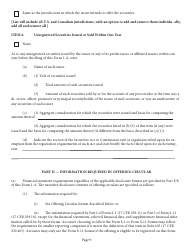

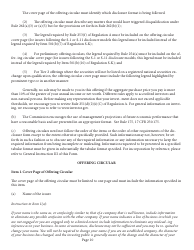

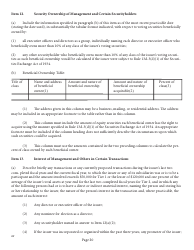

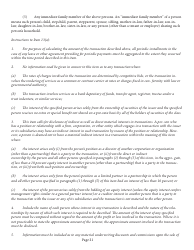

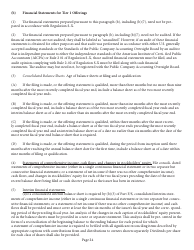

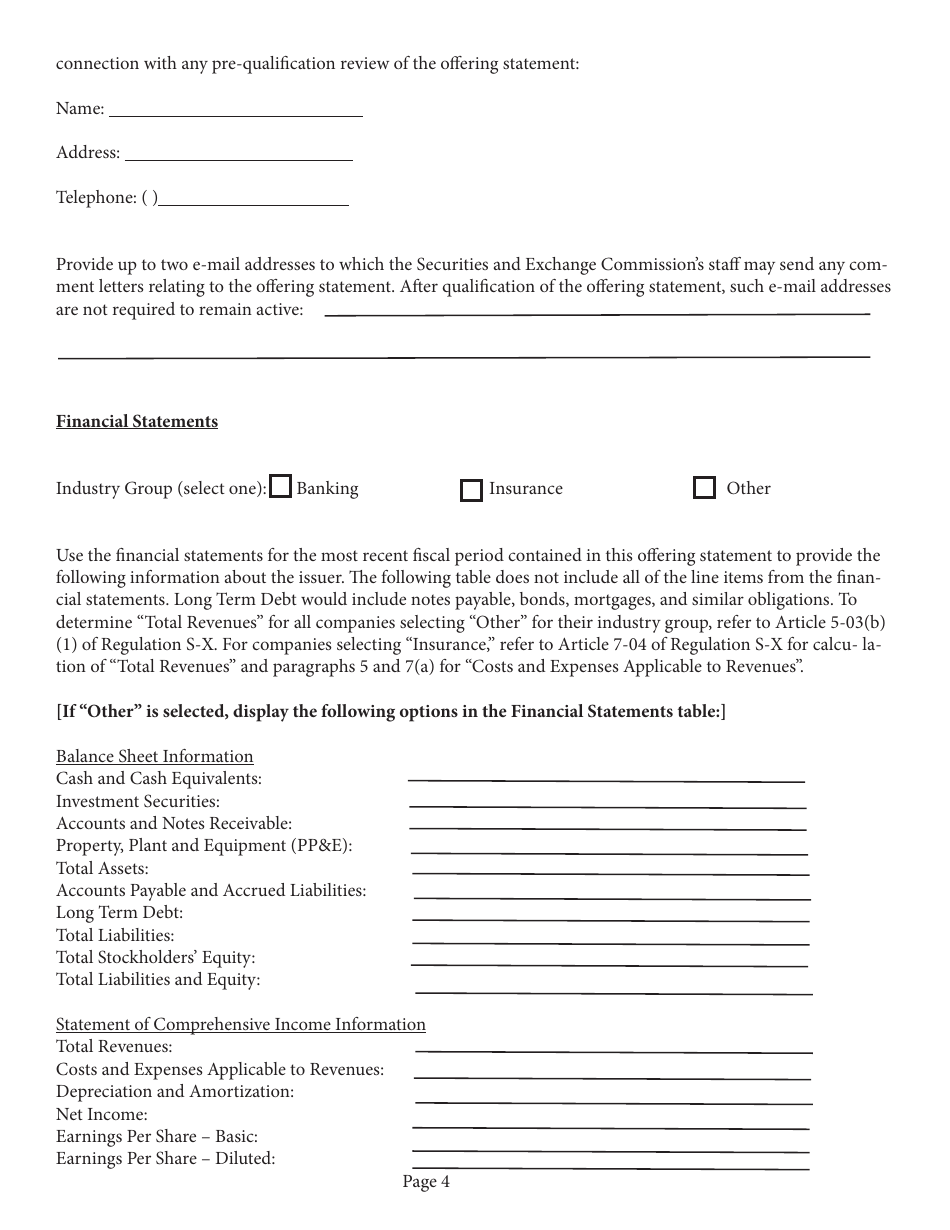

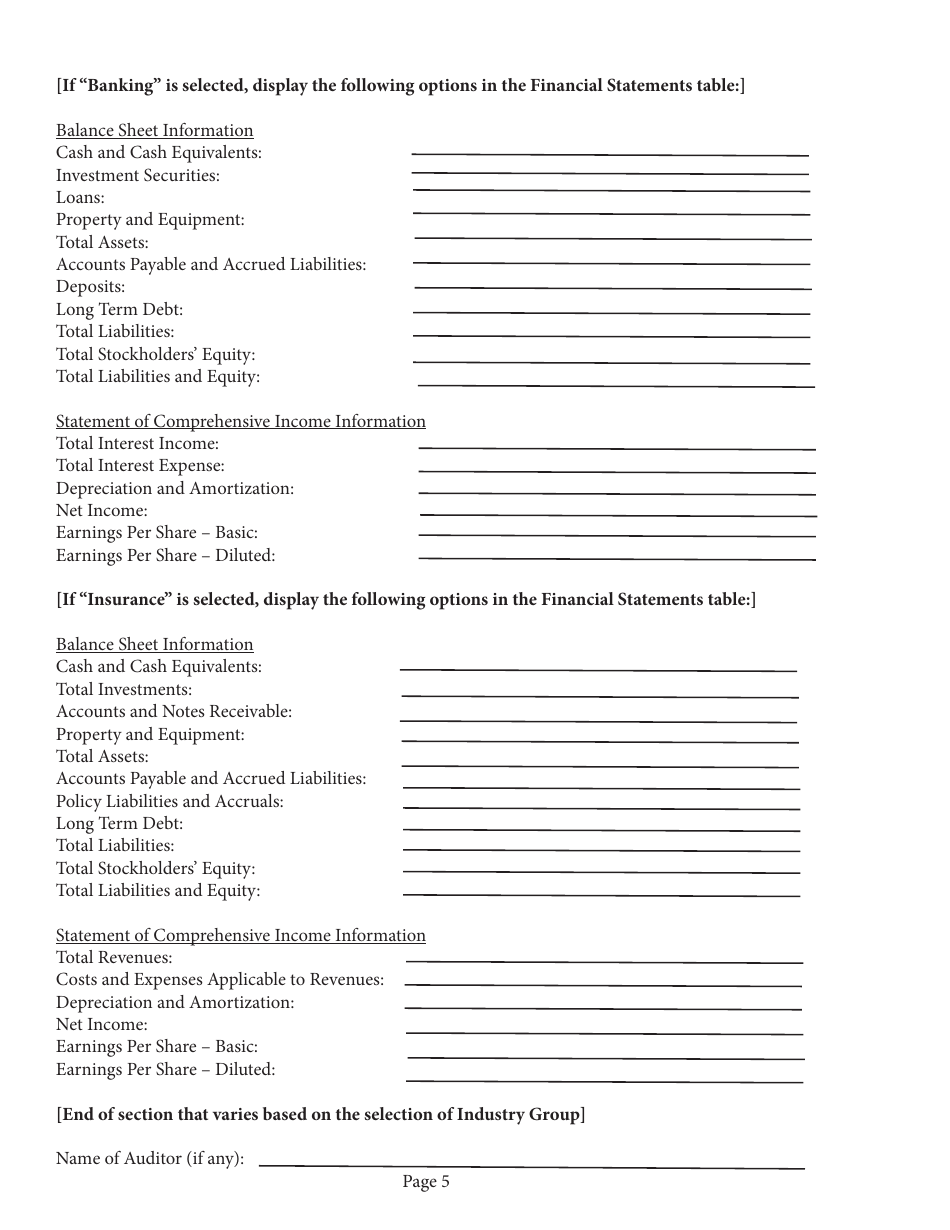

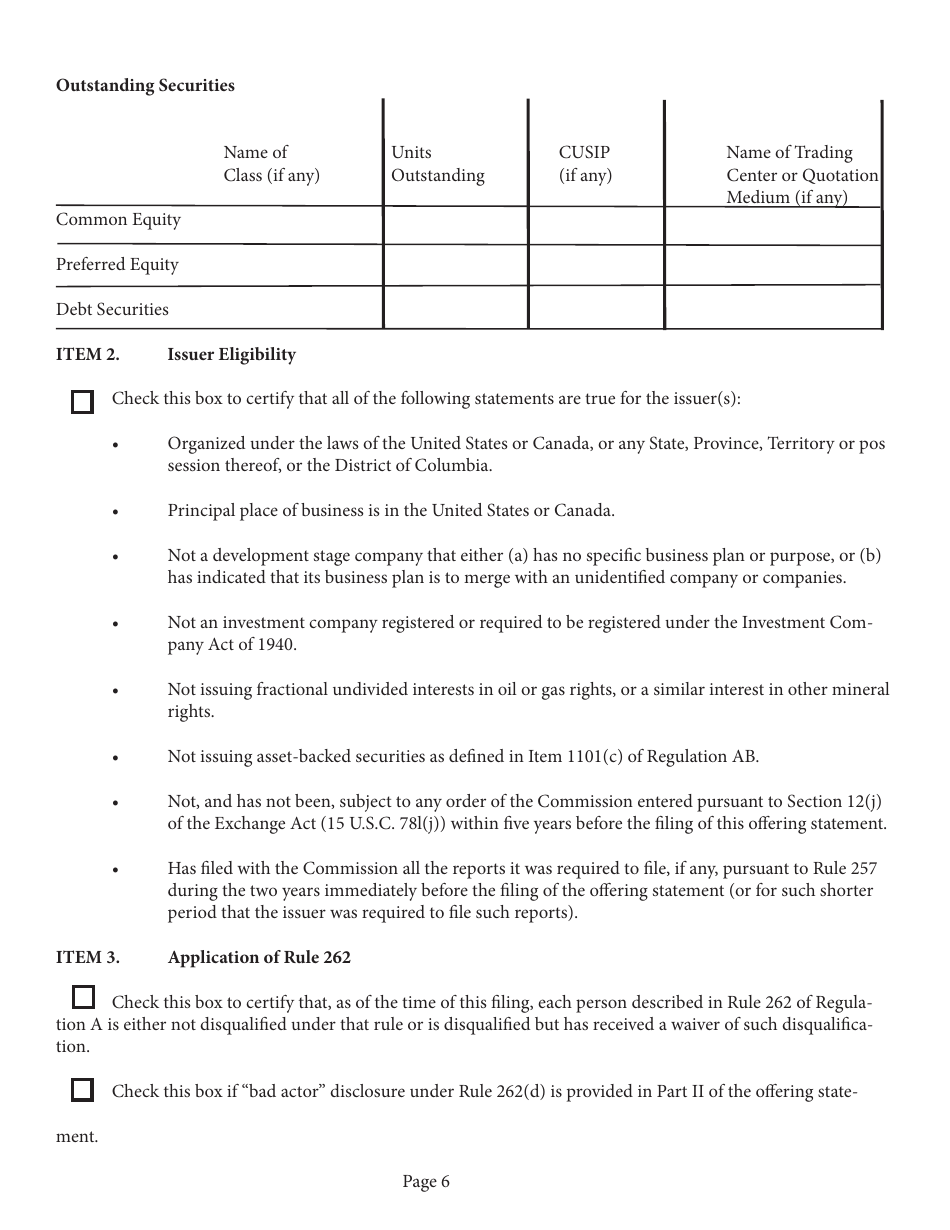

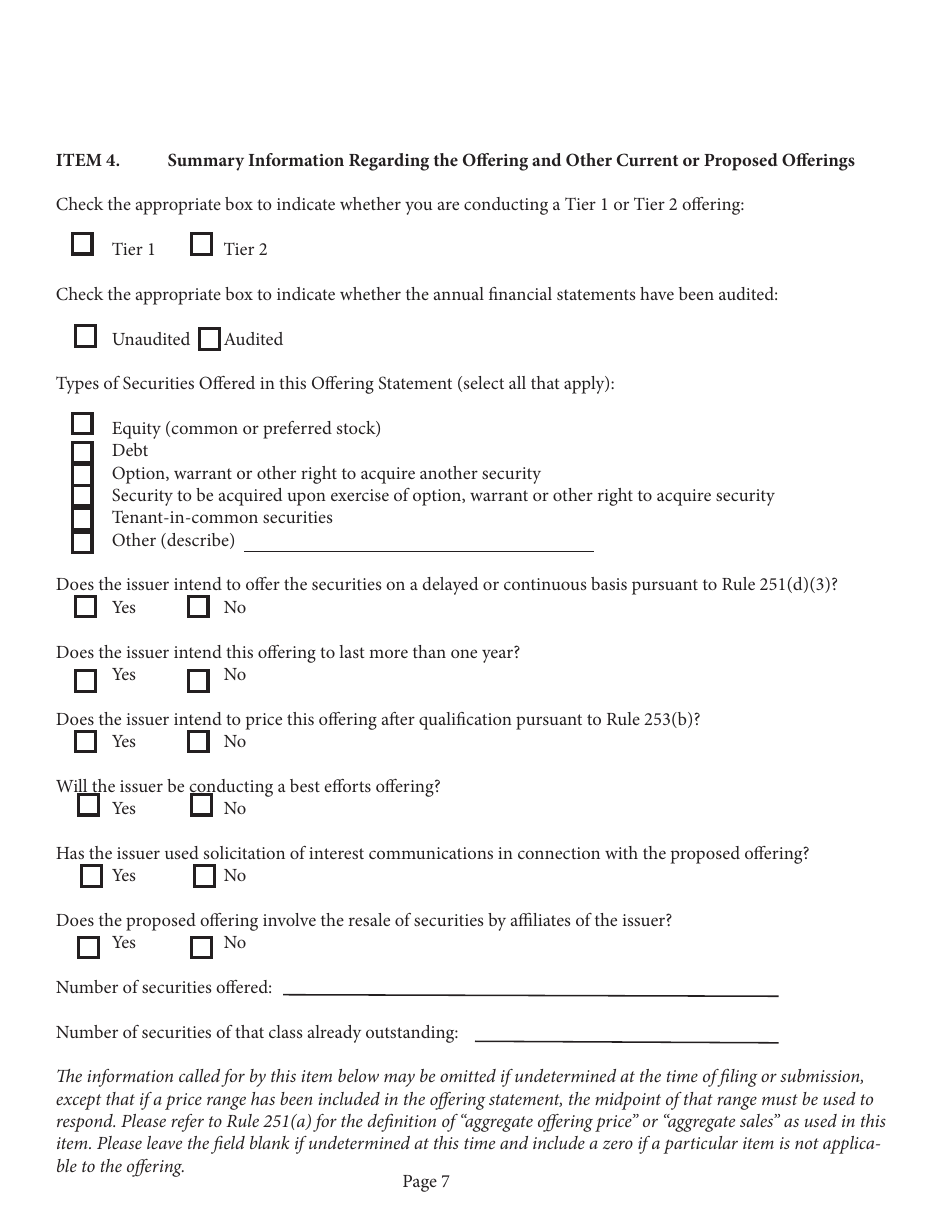

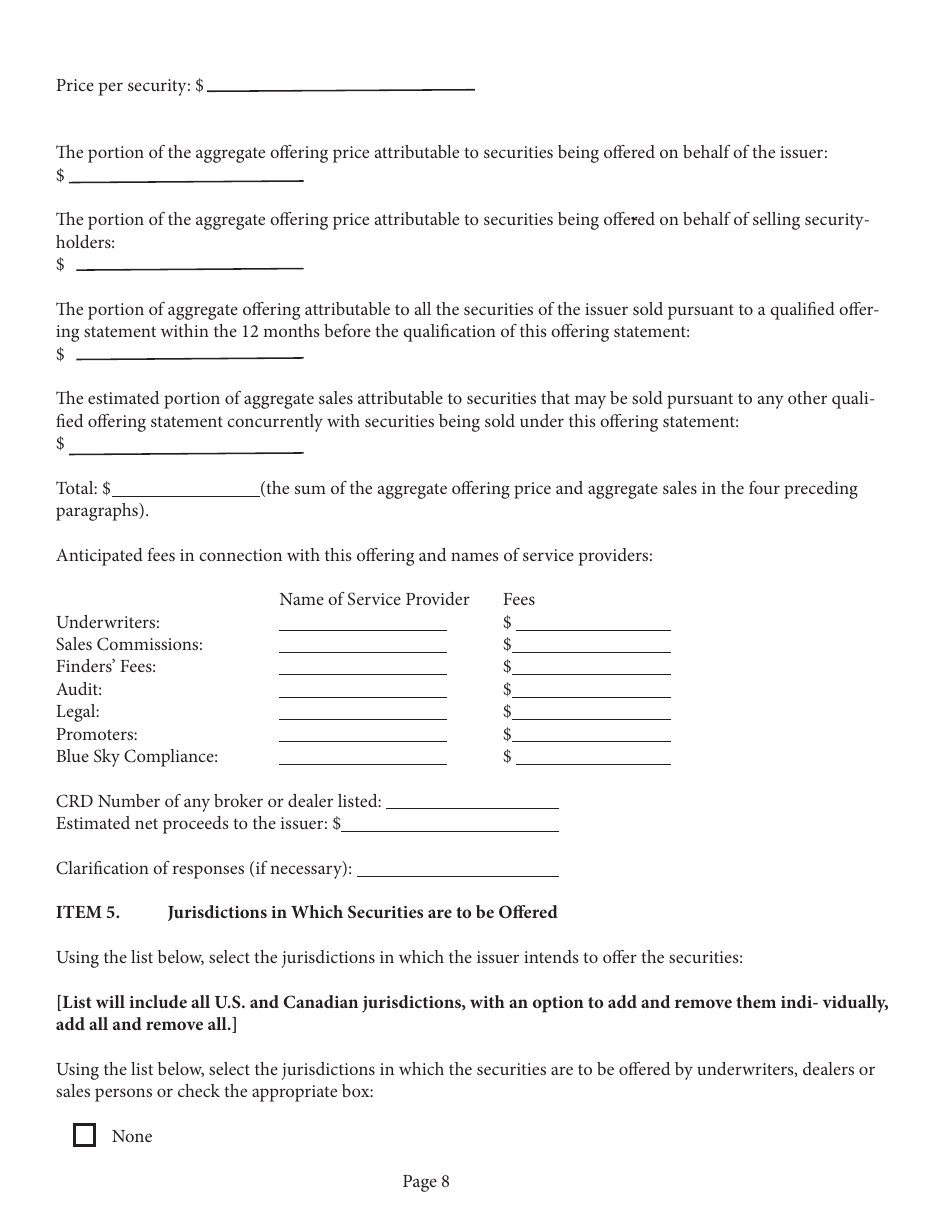

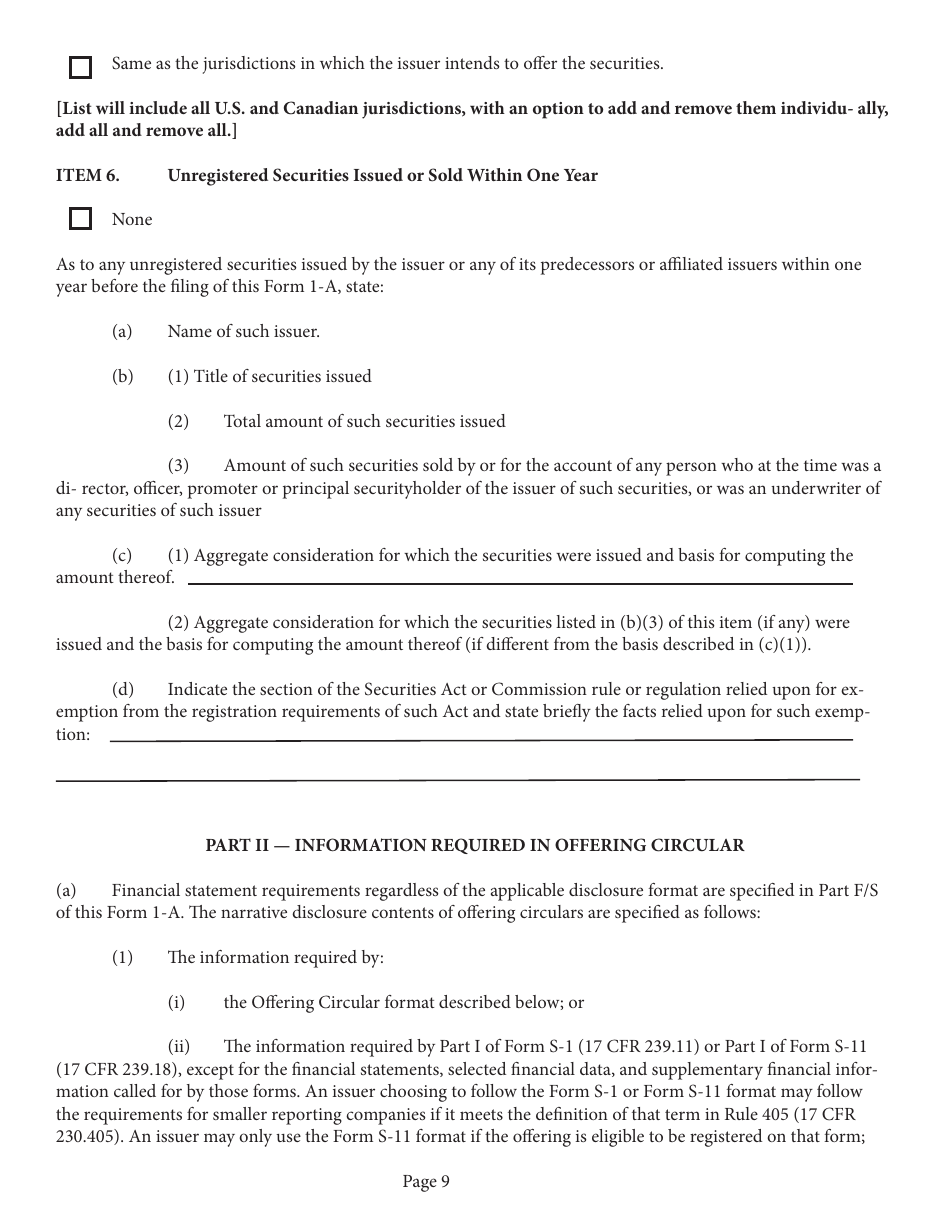

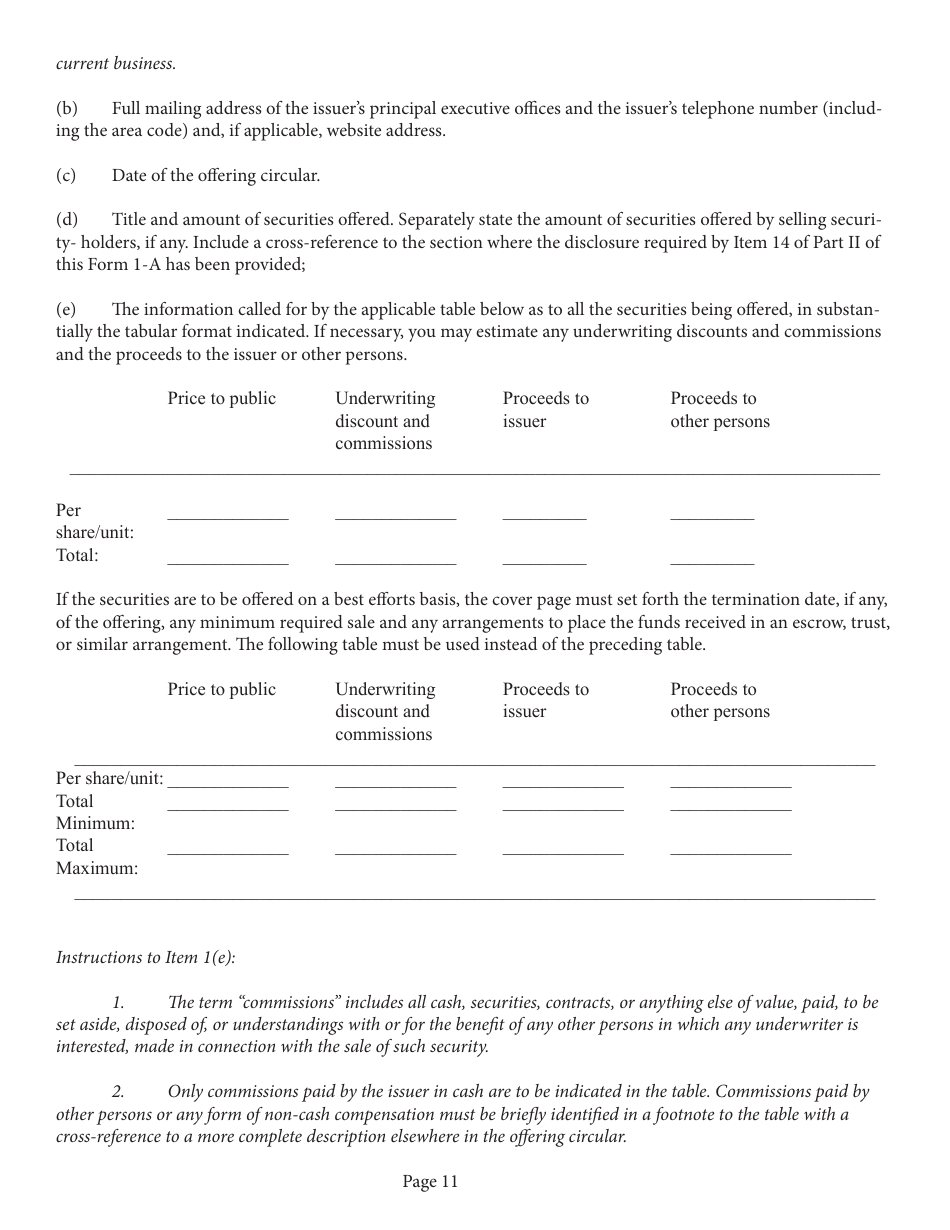

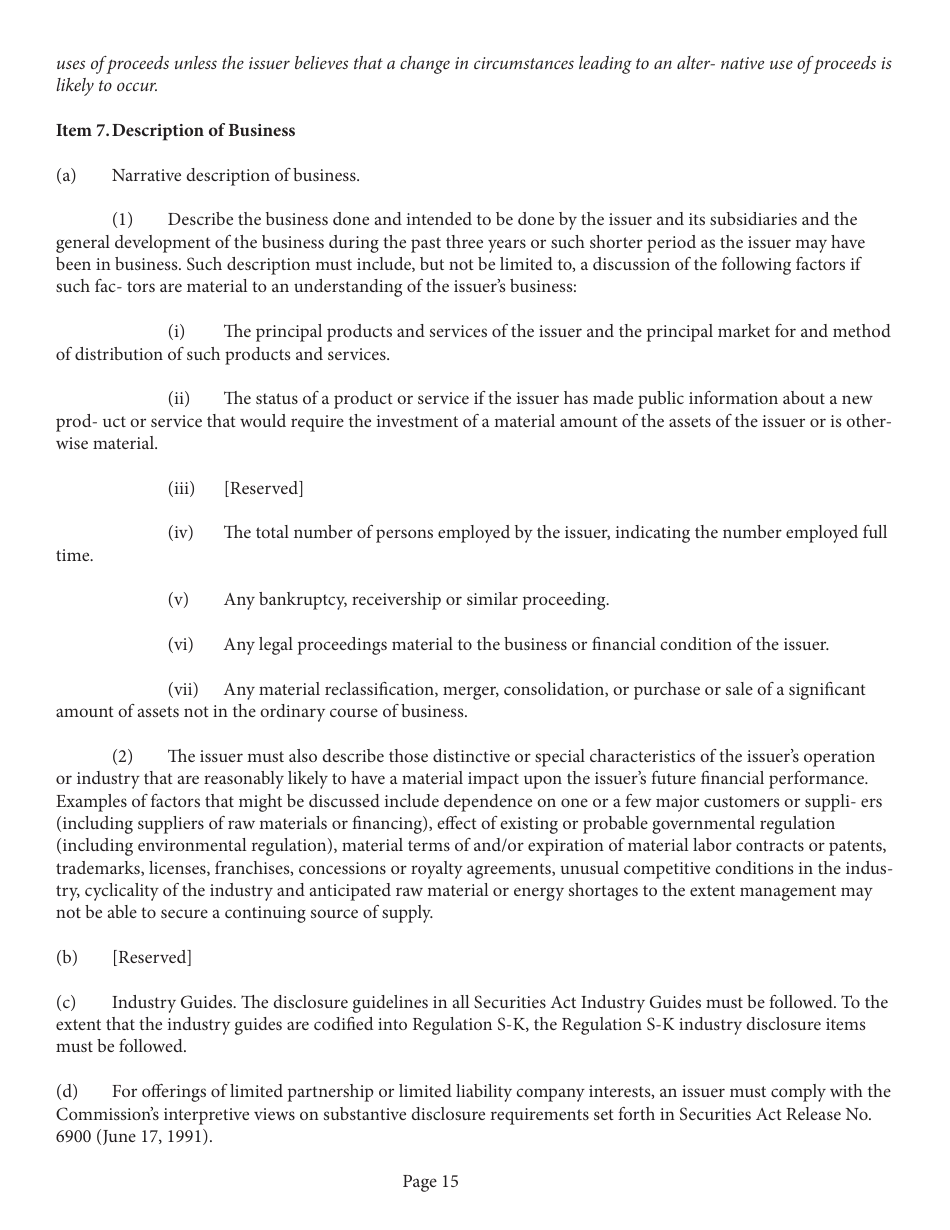

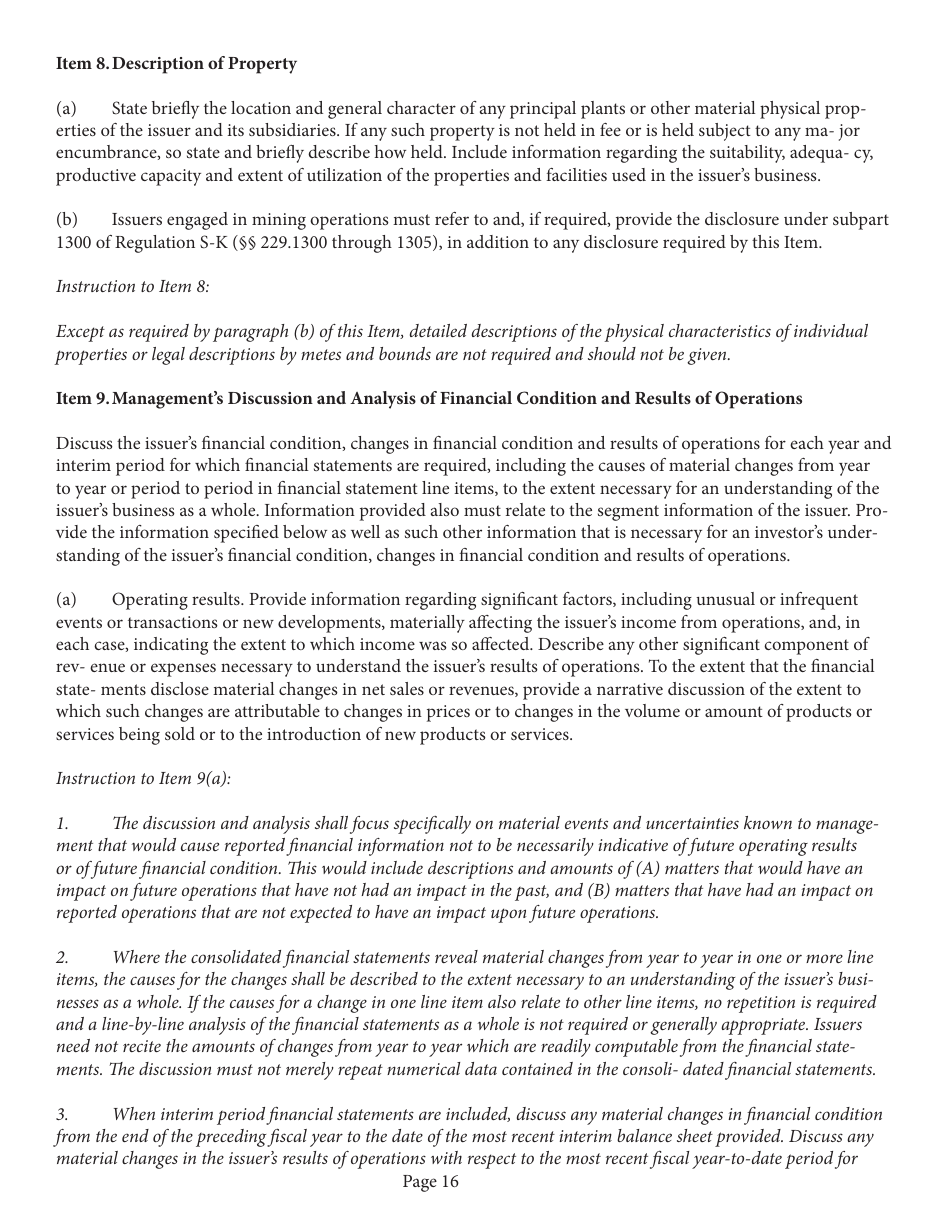

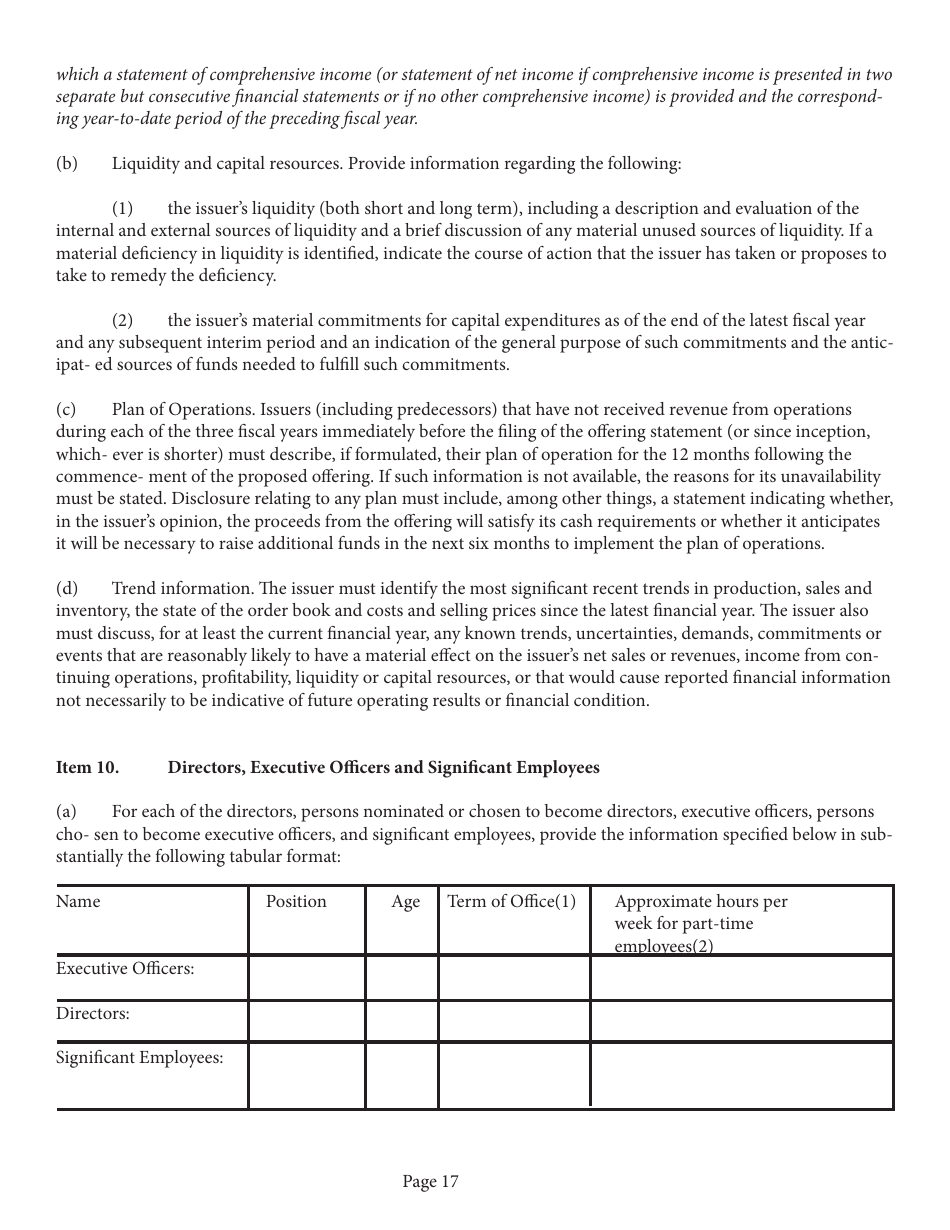

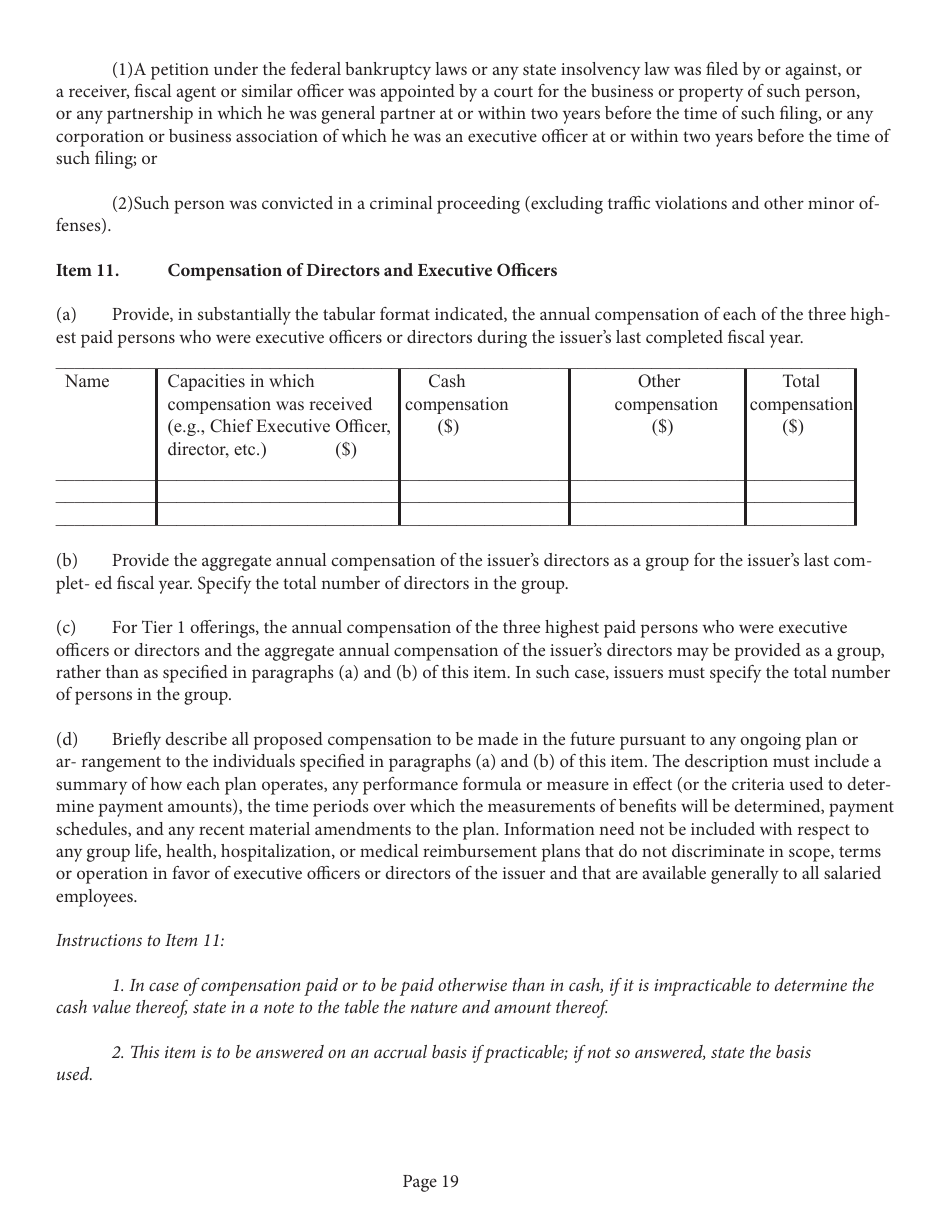

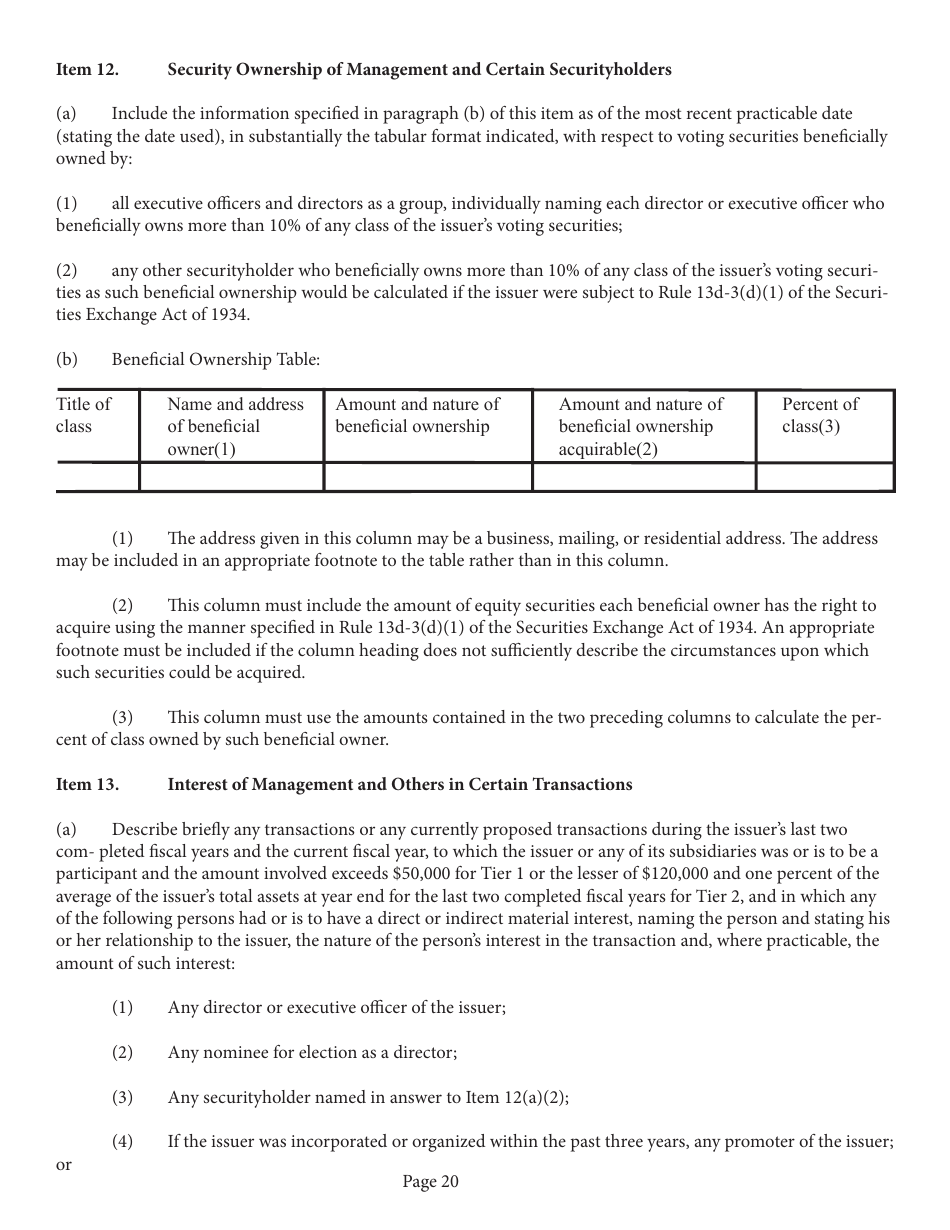

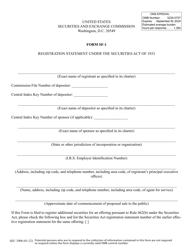

Q: What information is included in Form 1-A?

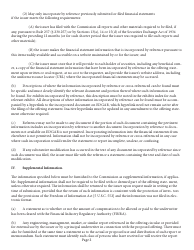

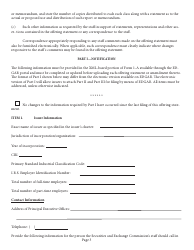

A: Form 1-A includes information about the offering, the company, its management, its financial statements, and other relevant details.

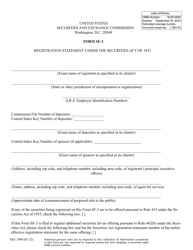

Q: Who needs to file Form 1-A?

A: Companies seeking to conduct a Regulation A offering need to file Form 1-A with the SEC.

Q: What is the purpose of filing Form 1-A?

A: The purpose of filing Form 1-A is to provide potential investors with comprehensive information about the offering and the company, as required by the SEC.

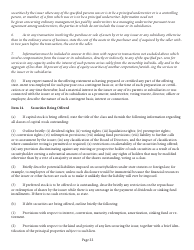

Q: What are the key requirements for a Regulation A offering?

A: Some key requirements for a Regulation A offering include limitations on the amount of money that can be raised, restrictions on the types of investors, and ongoing reporting obligations for the company.

Q: What are the benefits of a Regulation A offering?

A: Some benefits of a Regulation A offering include the ability to raise capital from the public, reduced filing requirements compared to a full registration statement, and potential exemptions from state securities laws.

Q: Are there any limitations or restrictions on Regulation A offerings?

A: Yes, Regulation A offerings have certain limitations and restrictions, including limitations on the amount of money that can be raised and restrictions on the types of investors.

Form Details:

- Released on March 1, 2021;

- The latest available edition released by the U.S. Securities and Exchange Commission;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 1-A (SEC0486) by clicking the link below or browse more documents and templates provided by the U.S. Securities and Exchange Commission.