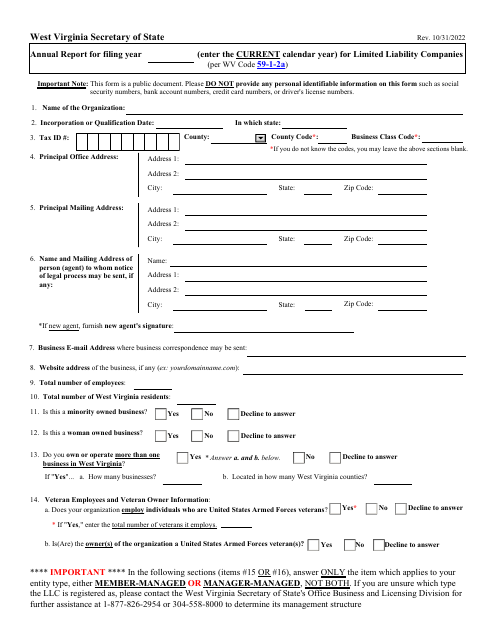

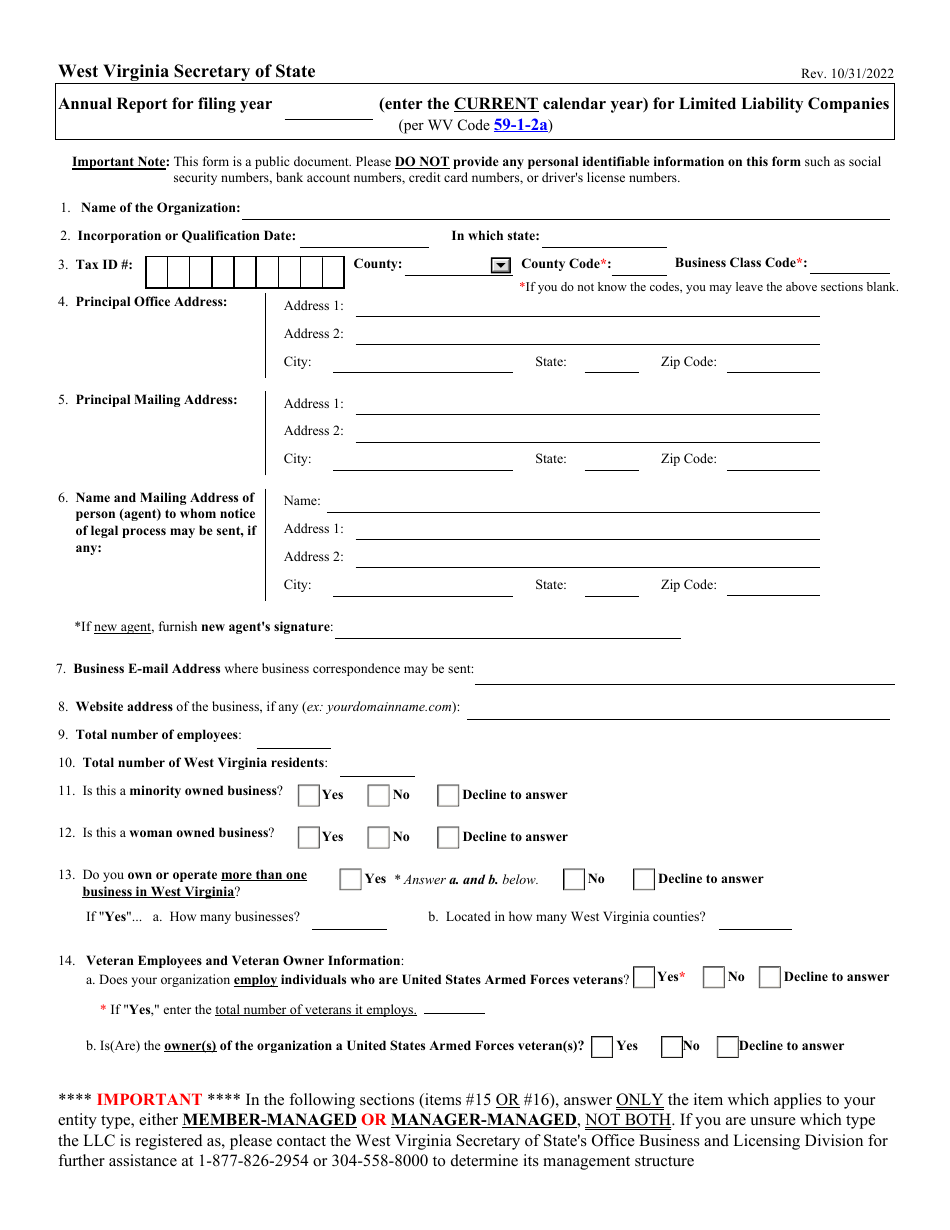

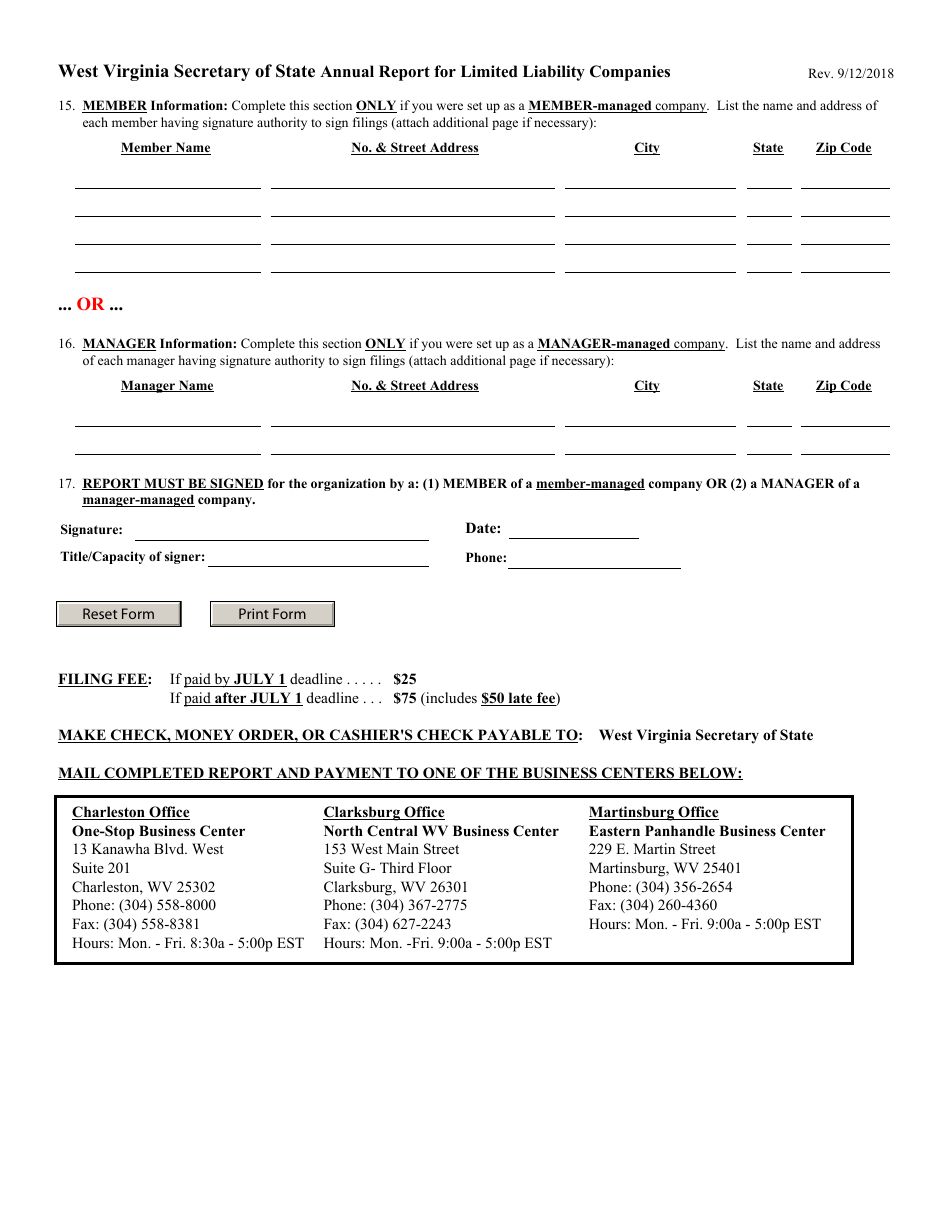

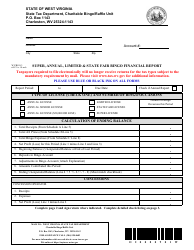

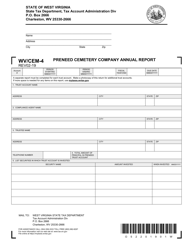

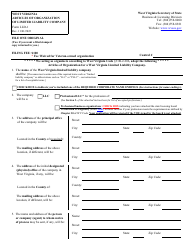

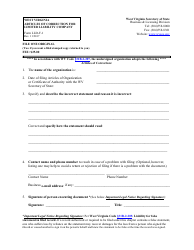

Annual Report for Limited Liability Companies - West Virginia

Annual Report for Limited Liability Companies is a legal document that was released by the West Virginia Secretary of State - a government authority operating within West Virginia.

FAQ

Q: What is an Annual Report for Limited Liability Companies?

A: An Annual Report for Limited Liability Companies is a required filing to maintain the legal status of the company.

Q: Who needs to file an Annual Report for Limited Liability Companies in West Virginia?

A: All Limited Liability Companies registered in West Virginia are required to file an Annual Report.

Q: When is the deadline to file an Annual Report for Limited Liability Companies in West Virginia?

A: The deadline to file an Annual Report for Limited Liability Companies in West Virginia is July 1st of each year.

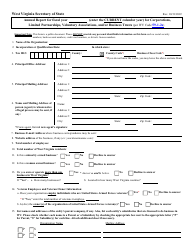

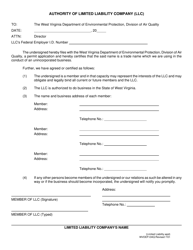

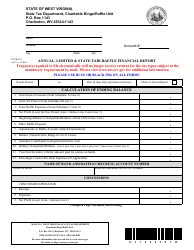

Q: What information is required in an Annual Report for Limited Liability Companies in West Virginia?

A: The Annual Report requires information such as the company's name, principal place of business, registered agent, and a brief description of its business activities.

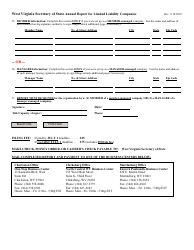

Q: What are the filing fees for an Annual Report for Limited Liability Companies in West Virginia?

A: The filing fee for an Annual Report for Limited Liability Companies in West Virginia is $25.

Q: What happens if an Annual Report for Limited Liability Companies is not filed in West Virginia?

A: Failure to file an Annual Report may result in the company being administratively dissolved or losing its legal status.

Form Details:

- Released on October 31, 2022;

- The latest edition currently provided by the West Virginia Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the West Virginia Secretary of State.