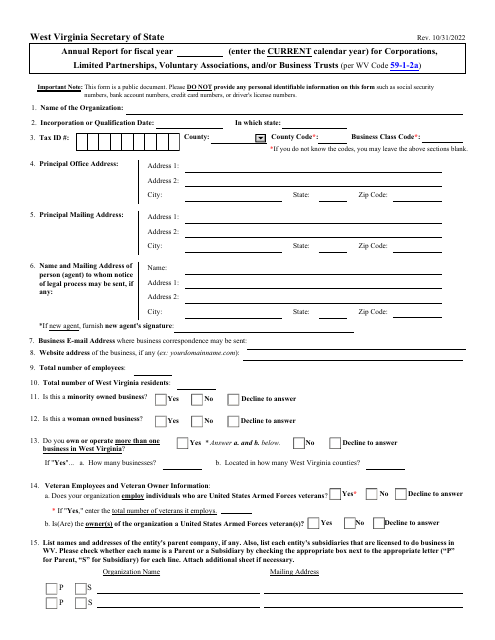

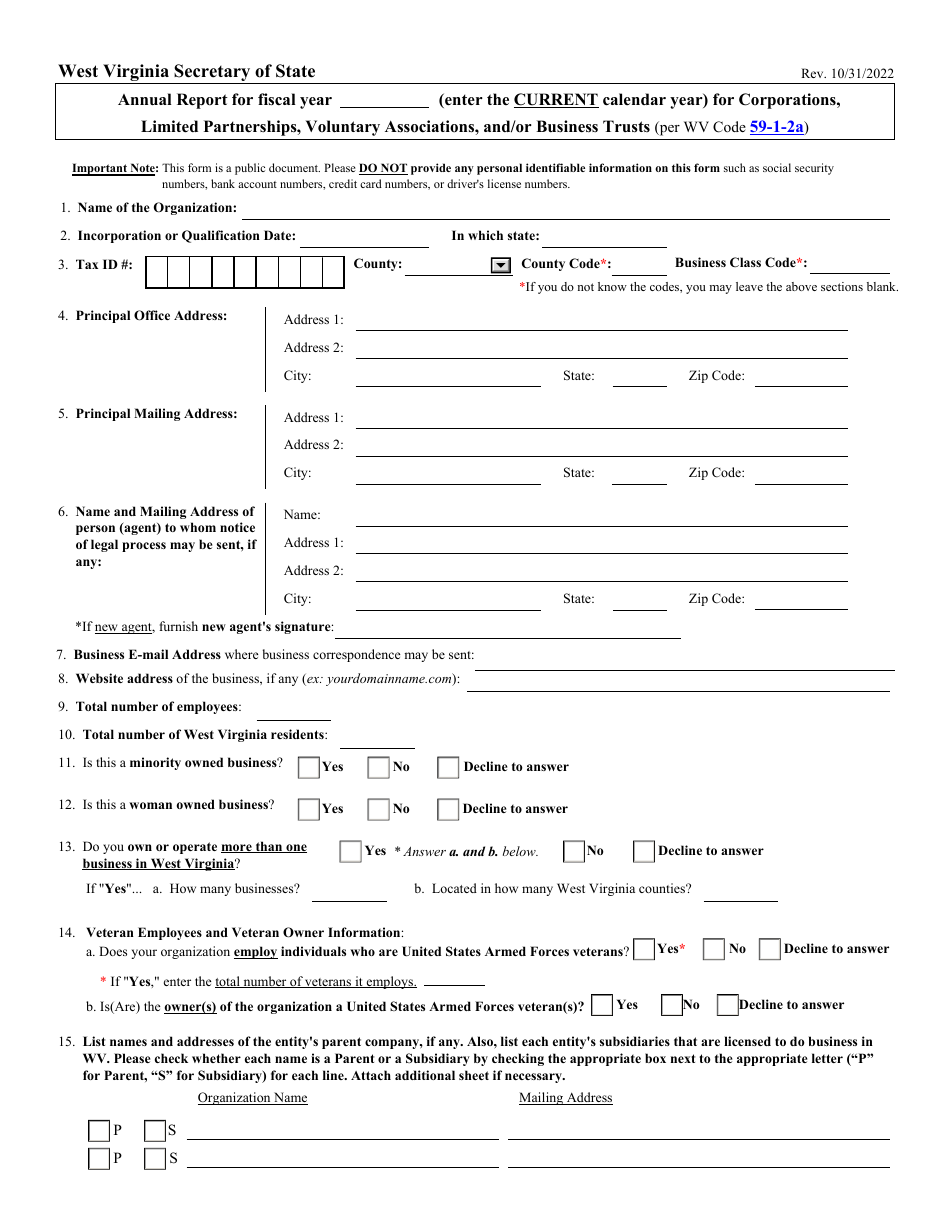

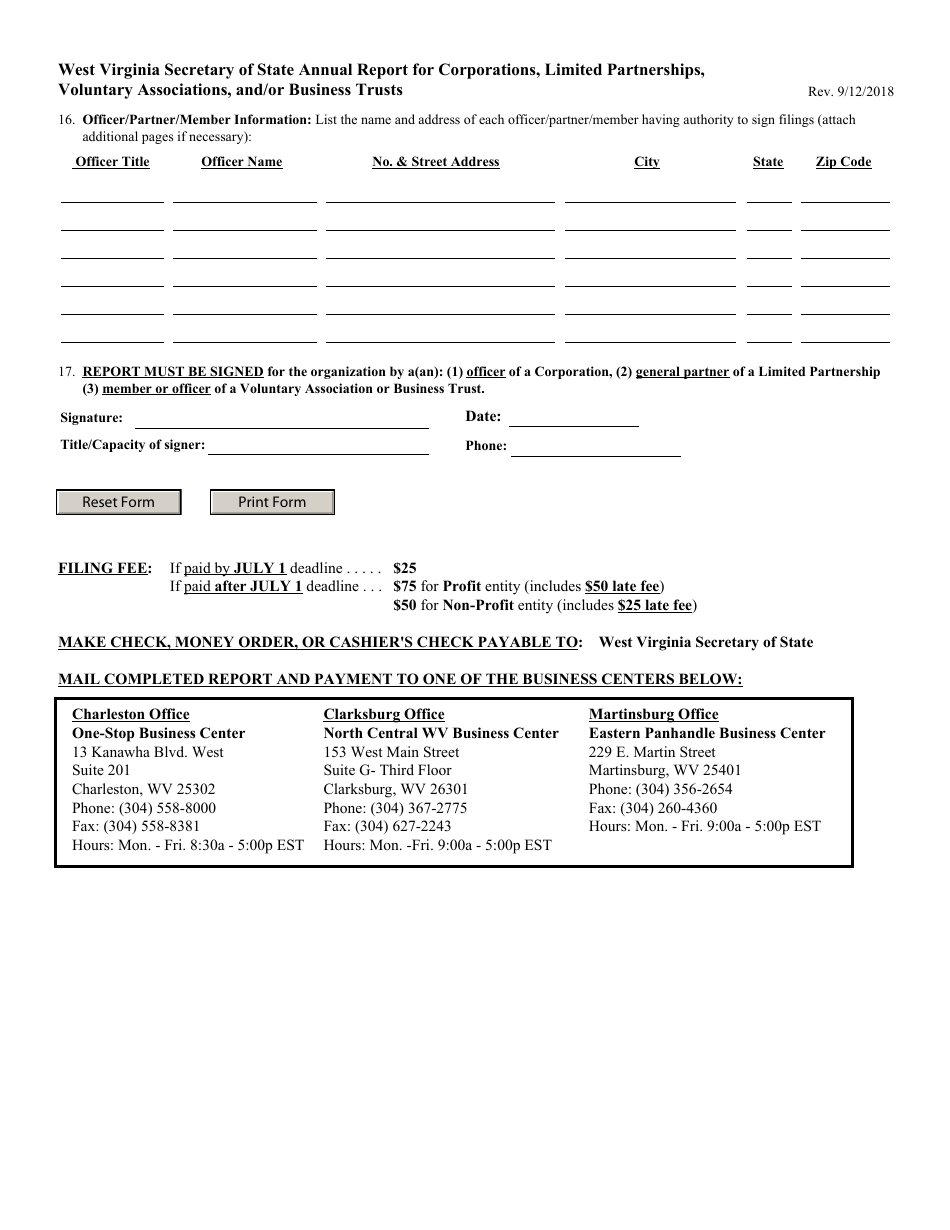

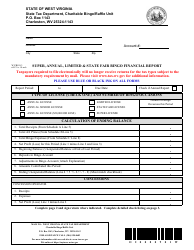

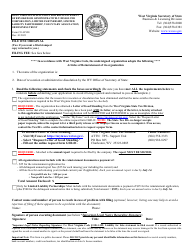

Annual Report for Corporations, Limited Partnerships, Voluntary Associations, and / or Business Trusts - West Virginia

Annual Report for Corporations, Voluntary Associations, and/or Business Trusts is a legal document that was released by the West Virginia Secretary of State - a government authority operating within West Virginia.

FAQ

Q: Who needs to file an annual report in West Virginia?

A: Corporations, limited partnerships, voluntary associations, and/or business trusts need to file an annual report in West Virginia.

Q: When is the deadline to file an annual report in West Virginia?

A: The deadline to file an annual report in West Virginia is by July 1st.

Q: What information is required to file an annual report in West Virginia?

A: The required information to file an annual report in West Virginia includes the entity's name, address, registered agent, and any changes to directors or officers.

Q: Is there a fee to file an annual report in West Virginia?

A: Yes, there is a fee to file an annual report in West Virginia. The fee amount depends on the type of entity.

Form Details:

- Released on October 31, 2022;

- The latest edition currently provided by the West Virginia Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the West Virginia Secretary of State.