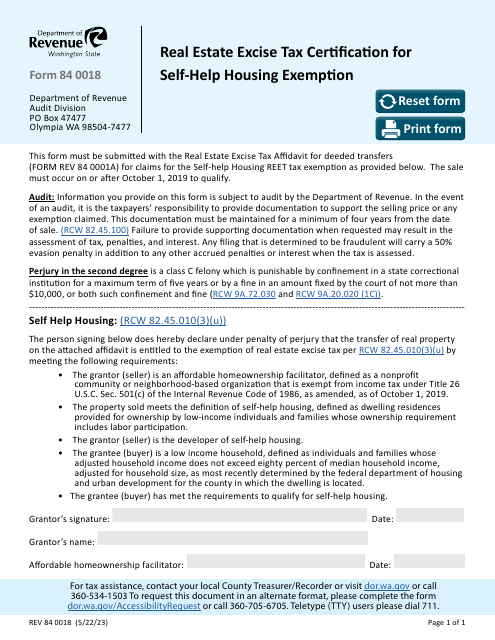

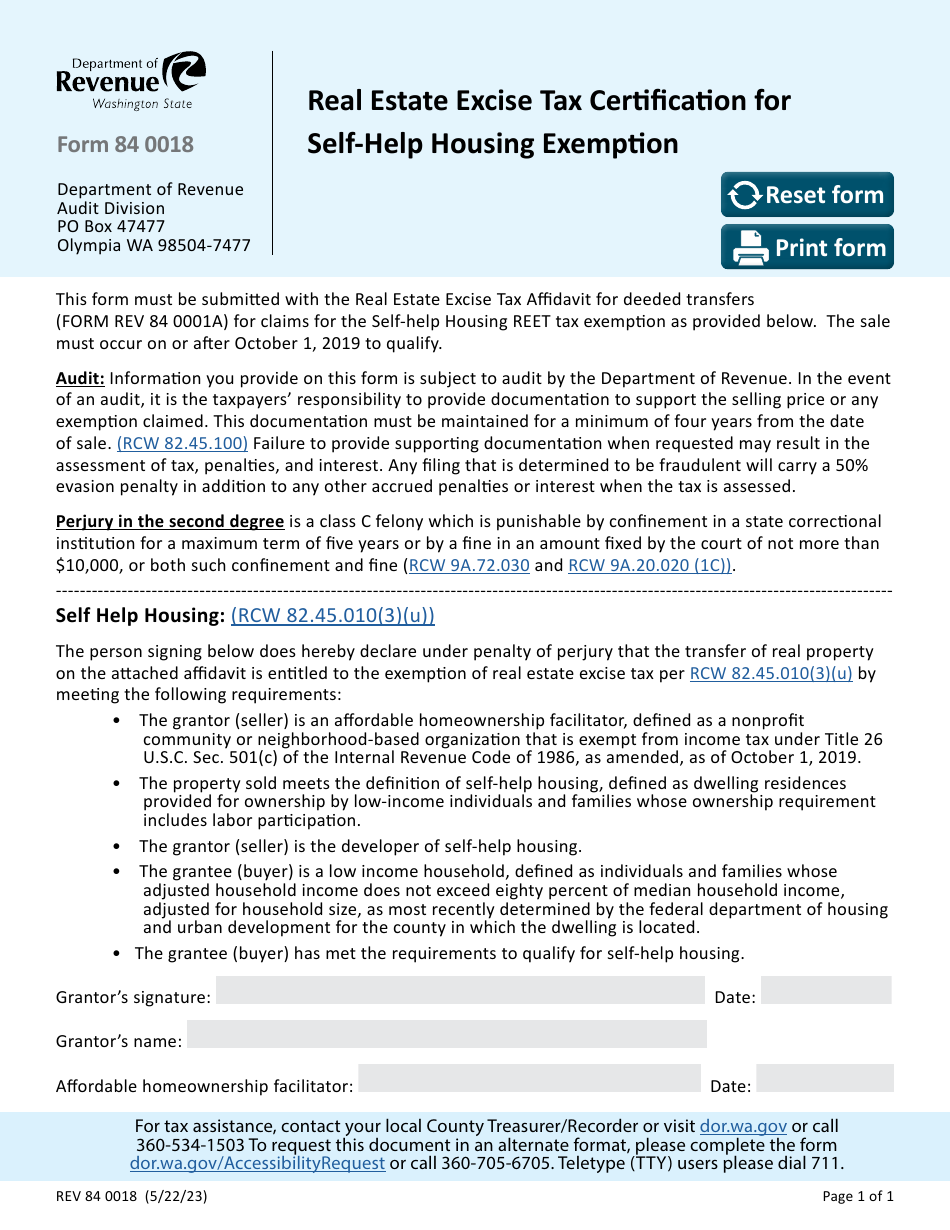

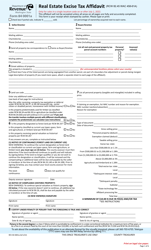

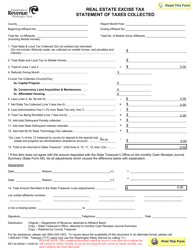

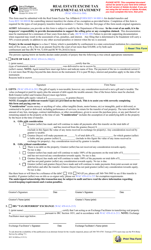

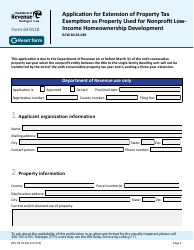

Form REV84 0018 Real Estate Excise Tax Certification for Self-help Housing Exemption - Washington

Form REV84 0018, also known as the Real Estate Excise Tax Certification for Self-help Housing Exemption in Washington, is a document used when selling or transferring property that qualifies as self-help housing. This form is filled out to apply for an exemption from the Real Estate Excise Tax. Self-help housing, in this context, refers to housing that is built using a significant amount of labor provided by the homebuyer or by volunteers. To qualify for this exemption, certain conditions must be met, such as the homebuyer not exceeding certain income limits and the property being used as the primary residence of the buyer.

The Form REV84 0018 Real Estate Excise Tax Certification for Self-help Housing Exemption is usually filed by the buyer or transferee of a property in Washington state. This specific form is used for claiming a tax exemption on real estate transfers under certain self-help housing conditions. This means if the transferee of the property is qualifying to build or renovate their primary residence through a self-help housing method, they may be eligible for this tax exemption. Always consult with a tax advisor or real estate professional to ensure you qualify for this exemption.

FAQ

Q: What is Form REV84 0018 in Washington?

A: Form REV84 0018 is a Real Estate Excise Tax Certification for Self-help Housing Exemption document in Washington. This form is used when transferring real estate and it attests that the property is a self-help housing project and thus exempt from certain taxes.

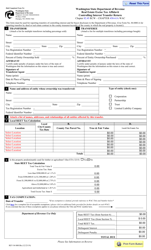

Q: What is the purpose of this Form REV84 0018?

A: The purpose of this form is to certify that a certain property qualifies for the self-help housing exemption, which is designed to help low-income families build their own housing. By filing this form, a property could be exempt from the real estate excise tax.

Q: Who can use the Form REV84 0018?

A: This form is typically used by non-profit organizations, which run self-help housing programs in the state of Washington, or low-income families who are participating in a self-help housing program.

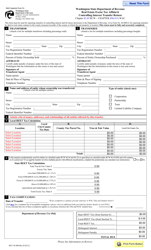

Q: How to apply for a Self-help Housing Exemption in Washington?

A: To apply for a Self-help Housing Exemption in Washington, the eligible entity needs to fill out the Form REV84 0018 and submit it to the Washington State Department of Revenue. The form needs to be filled out completely and correctly for the exemption to be approved.

Q: Is there a deadline to filing REV84 0018 form in Washington?

A: There may not be a specific deadline for filing the REV84 0018 form. However, it's essential to file this form before the real estate transaction completes. For the specific timeline, one should consult the Washington State Department of Revenue.