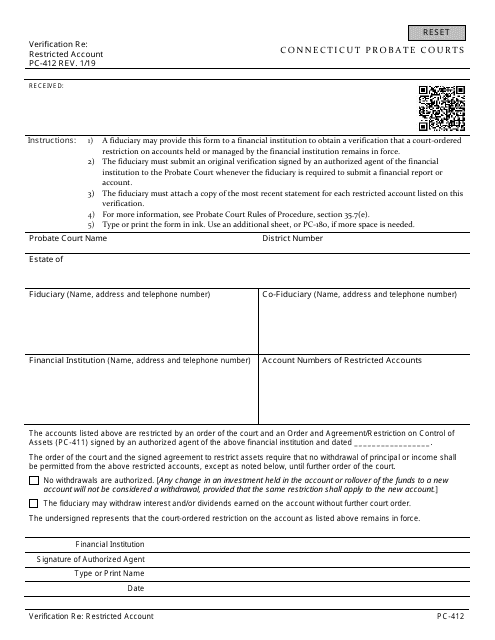

Form PC-412 Verification Re: Restricted Account - Connecticut

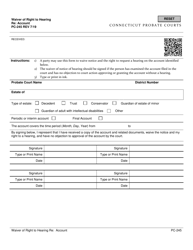

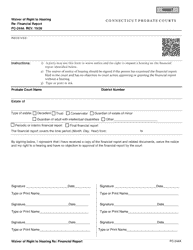

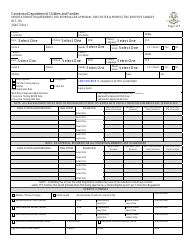

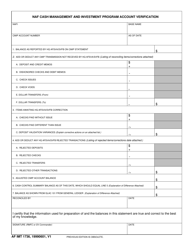

Form PC-412 Verification Re: Restricted Account - Connecticut is a legal document used in the state of Connecticut, USA. This form is specifically used for the verification of restricted accounts. It is often utilized by executors or administrators of an estate, where restricted accounts have been set up. The purpose of this verification is to ensure that the funds within these restricted accounts are being managed appropriately according to the terms of the estate or trust. The form typically requires the individual in charge of the estate or trust (like the executor or administrator) to provide detailed information regarding the accounts such as account numbers, financial institutions, balances, and any transactions made.

The Form PC-412 Verification Re: Restricted Account - Connecticut is typically filed by the conservator or a lawyer who has been appointed to manage the estate of a person who is unable to manage their own affairs. They use this form to inform the Probate Court that they have established a restricted account in a financial institution for the person's estate as required under Connecticut law. This restricted account prevents unauthorized withdrawal or transfer of funds without the approval of the Probate Court.

FAQ

Q: What is Form PC-412 for the state of Connecticut?

A: Form PC-412, Verification Re: Restricted Account, is a document required by Connecticut's probate courts. It is used to verify that funds are deposited in a restricted account. This often involves trusts, conservatorships, or guardianships where the account holder has limited access.

Q: Who uses Connecticut Verification Re: Restricted Account Form PC-412?

A: The PC-412 form is used by fiduciaries, such as trustees or conservators, who manage a restricted account. They must fill it out and submit it to the probate court to provide proof that the funds are deposited as per the court's order.

Q: When to use Form PC-412 in Connecticut?

A: The PC-412 form should be used whenever a fiduciary is establishing, or making changes to a restricted account in Connecticut. The court typically requests this form to ensure all court orders regarding the account are properly executed.

Q: How to submit Form PC-412 in the state of Connecticut?

A: After filling out the Form PC-412, it must be submitted to the Connecticut probate court in the jurisdiction where the account resides. It's advisable to retain a copy for your own records, as well as to provide a copy to all involved parties.

Q: What information is needed for completing Form PC-412?

A: Form PC-412 typically requires the fiduciary's name and address, the name of the restricted account holder, details about the court case associated with the account, details about the financial institution holding the funds, and information about the funds themselves, including the balance.