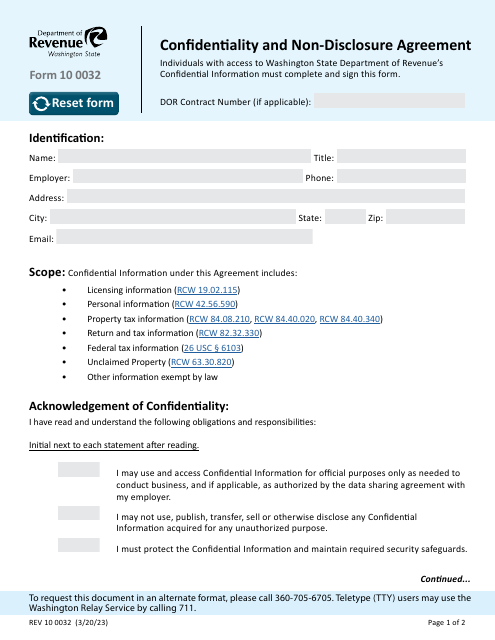

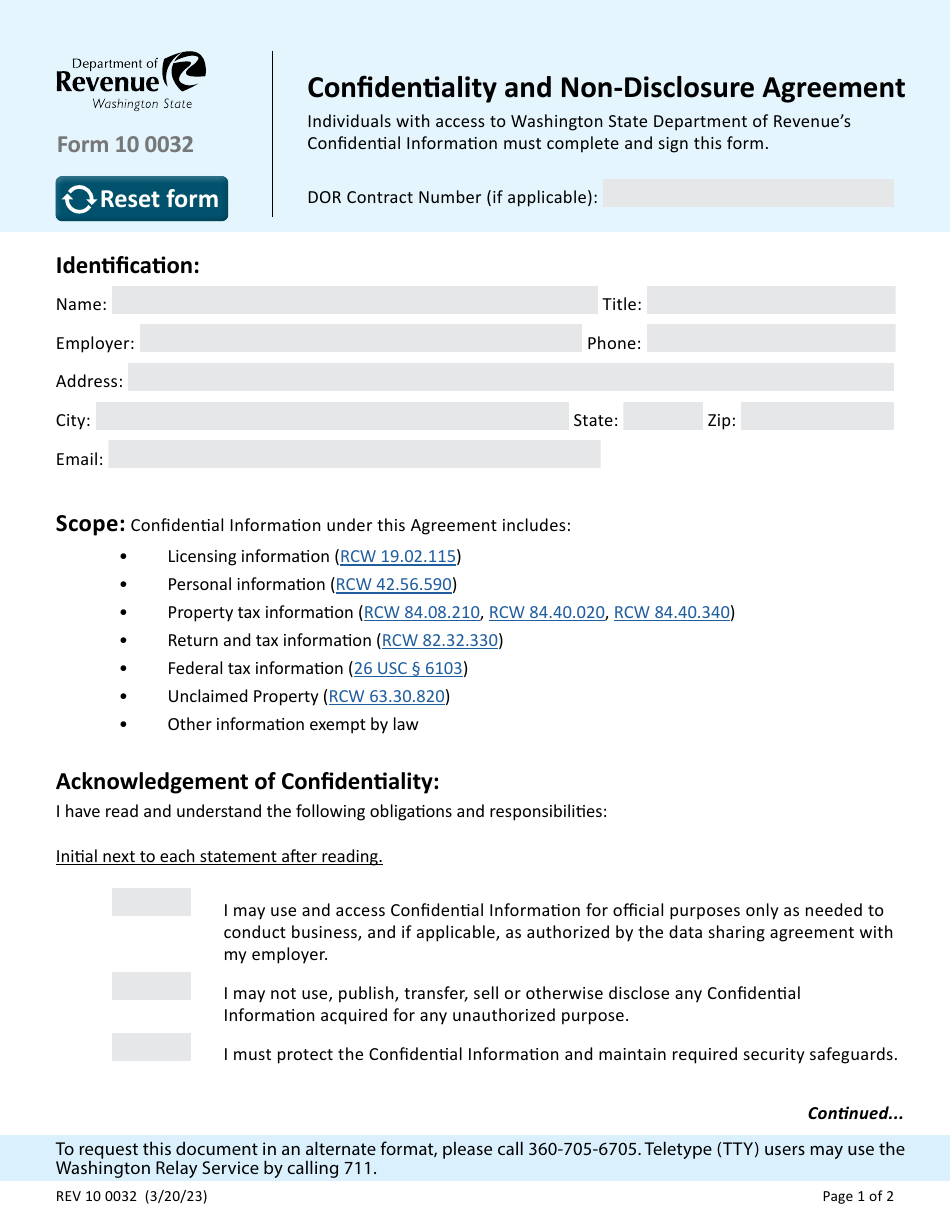

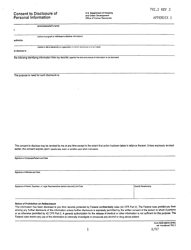

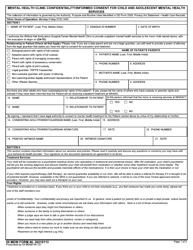

Form 10 0032 Confidentiality and Non-disclosure Agreement - Washington

What Is Form 10 0032?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

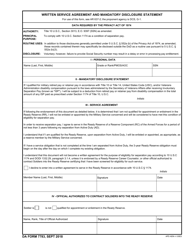

Q: What is Form 10 0032?

A: Form 10 0032 is a Confidentiality and Non-disclosure Agreement.

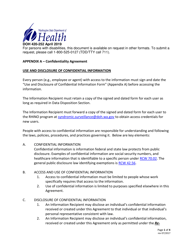

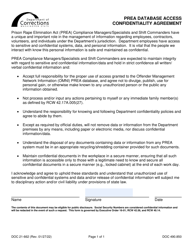

Q: What does this form do?

A: This form is used to protect confidential or sensitive information and prevent its disclosure.

Q: Who uses this form?

A: This form is typically used by individuals or organizations in Washington.

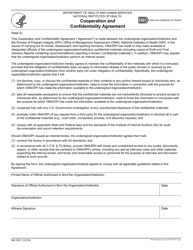

Q: What is the purpose of a Confidentiality and Non-disclosure Agreement?

A: The purpose of this agreement is to ensure that confidential information is kept private and not disclosed to unauthorized parties.

Q: What kind of information can be protected with this agreement?

A: This agreement can protect any type of confidential information, such as trade secrets, business plans, or customer data.

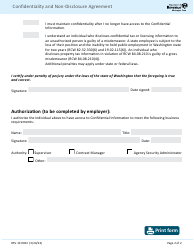

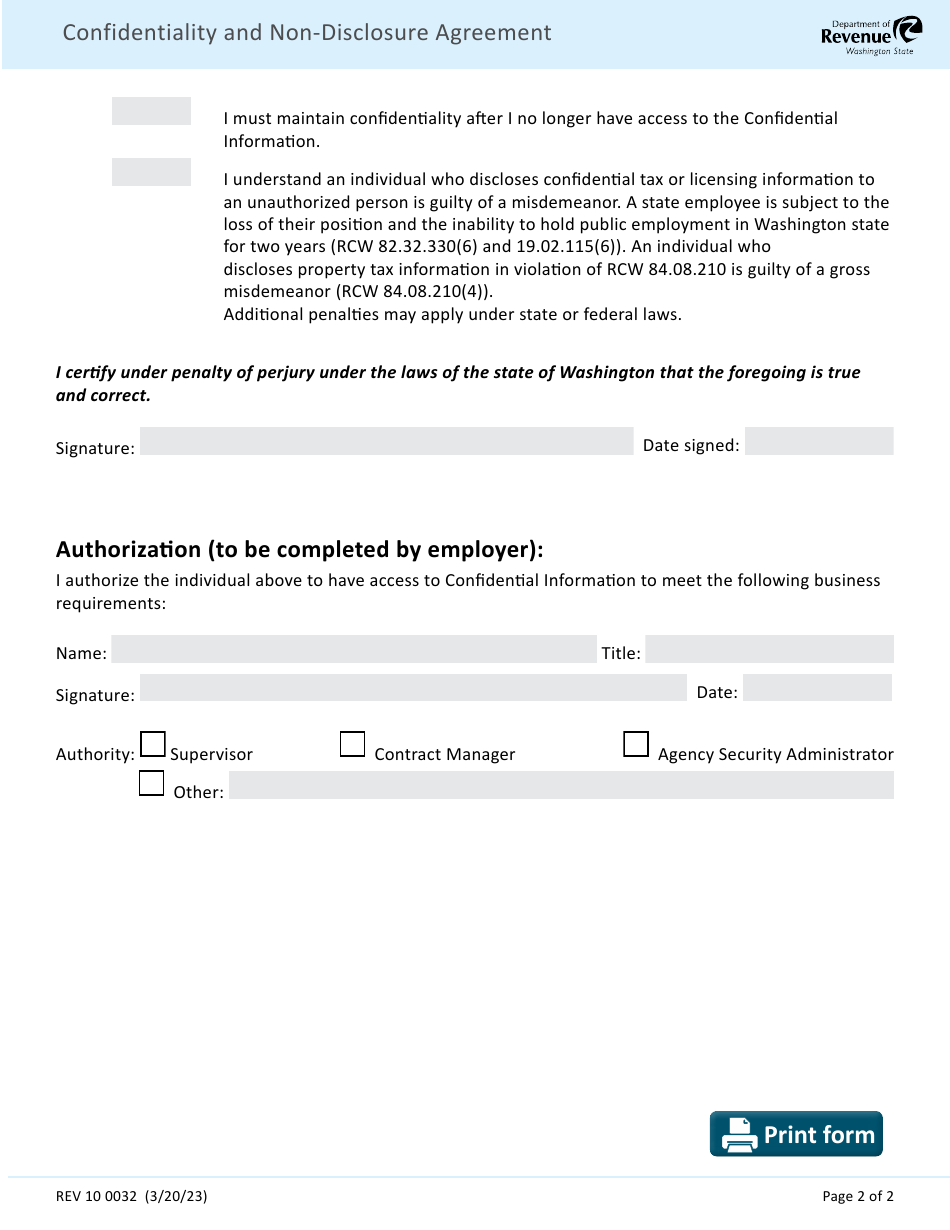

Q: Is this agreement legally binding?

A: Yes, this agreement is legally binding once both parties have signed it.

Q: What happens if someone violates the agreement?

A: If someone violates the agreement, they may be subject to legal consequences, such as damages or injunctive relief.

Q: Do both parties need to sign the agreement?

A: Yes, both parties involved in the sharing of confidential information should sign the agreement.

Q: Can this form be customized?

A: Yes, this form can be customized to fit the specific needs and requirements of the parties involved.

Form Details:

- Released on March 20, 2023;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 10 0032 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.