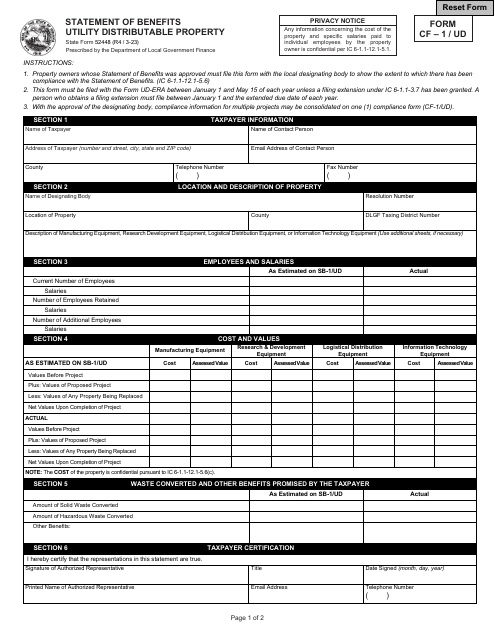

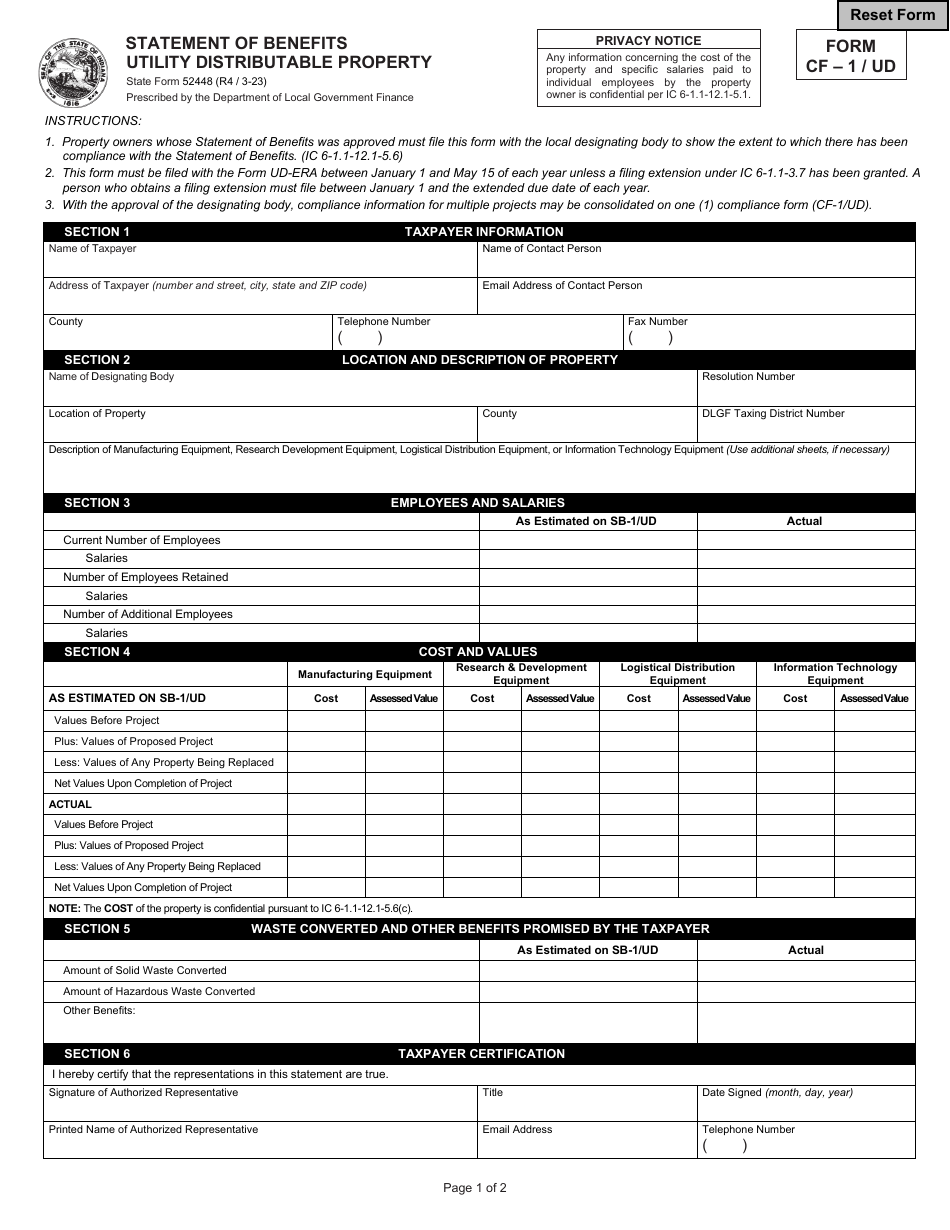

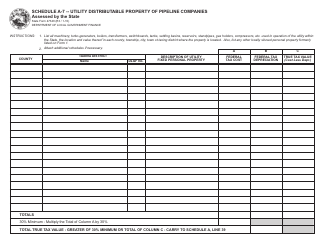

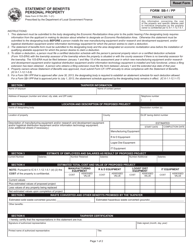

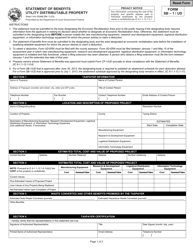

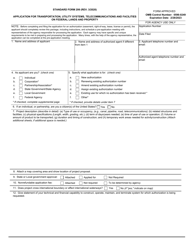

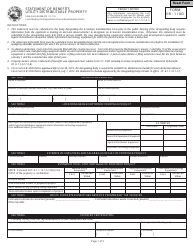

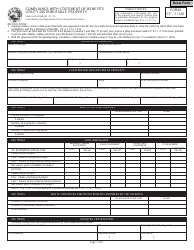

State Form 52448 (CF-1 / UD) Statement of Benefits Utility Distributable Property - Indiana

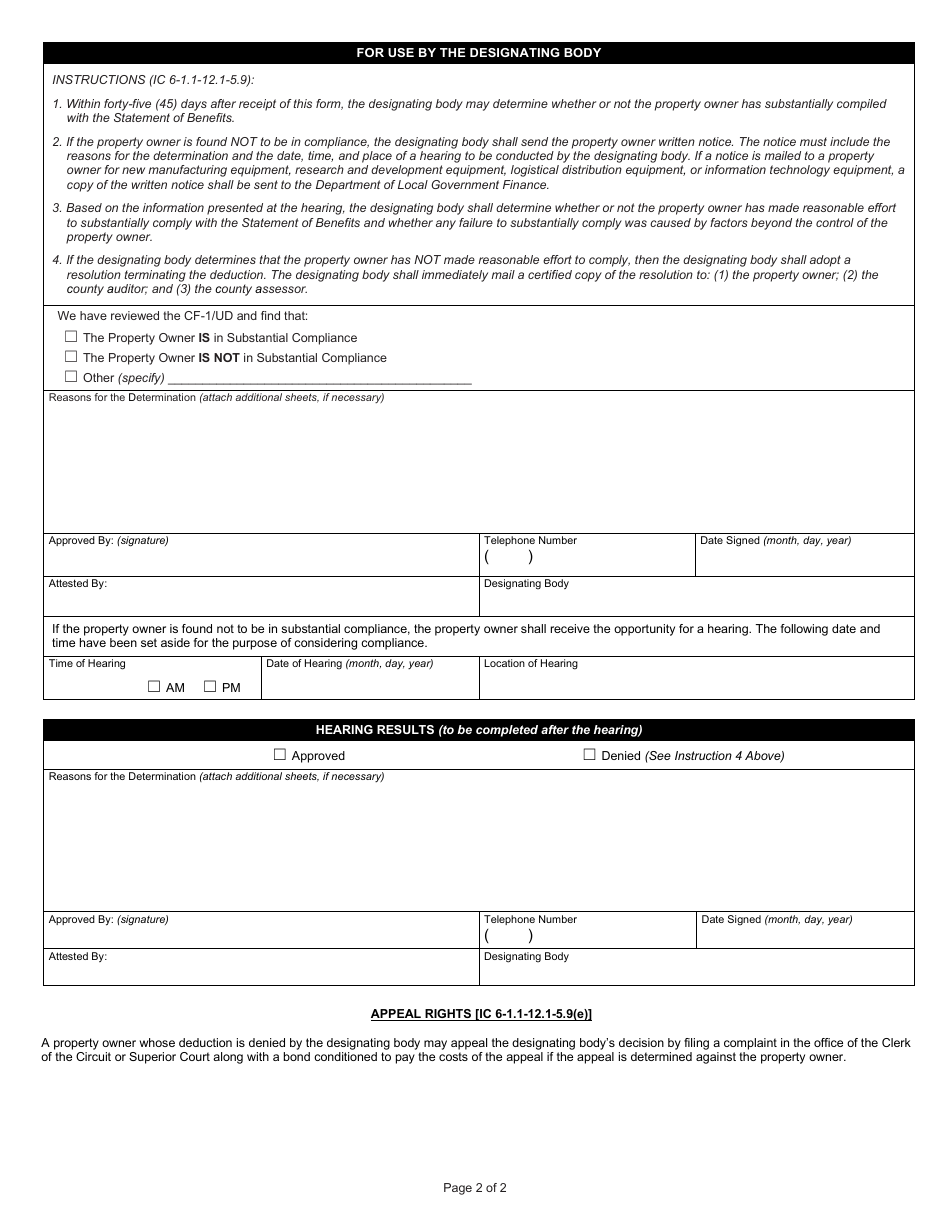

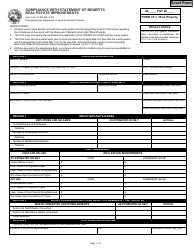

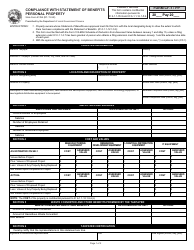

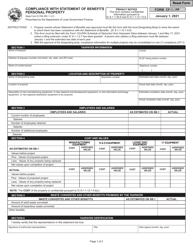

State Form 52448 (CF-1/UD) Statement of Benefits Utility Distributable Property - Indiana is a document used by utility companies in Indiana. The purpose of this document is to report the estimated cost of the utility service that is provided and how these costs are distributed among the users. The form also outlines the benefits received from any tax abatements that utility companies may be granted. Essentially, it is a reporting tool for utility distributable property planned for investment by a company, and its usage helps ensure tax compliance and fairness in cost distribution.

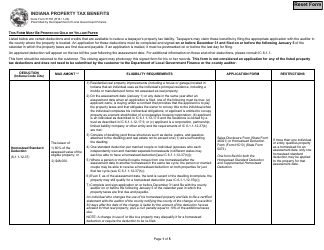

The State Form 52448 (CF-1/UD) Statement of Benefits Utility Distributable Property in Indiana is typically filed by companies or businesses that are utility service providers. These can include organizations involved in gas or electric distribution, water management and sewer services, among others. This form is used to apply for tax abatement in Indiana, or to confirm and provide annual proof of the compliance for a previously granted tax abatement. It is essential for those seeking assistance or benefits related to their distribution property from the appropriate state bodies.

FAQ

Q: What is State Form 52448 (CF-1/UD) Statement of Benefits Utility Distributable Property in Indiana?

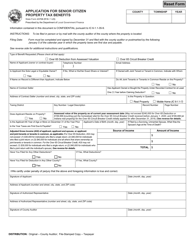

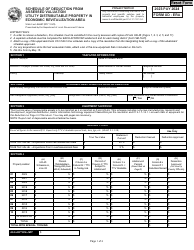

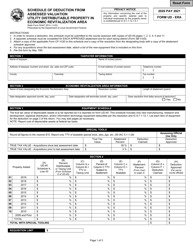

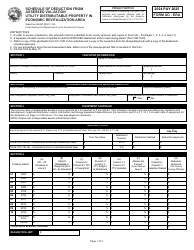

A: State Form 52448, also known as CF-1/UD, is a document used in Indiana to declare the qualitative and quantitative details of the public utility distributable property. This form is part of the annual tax process for utility companies that have property located in multiple tax districts.

Q: Who needs to fill out the State Form 52448 (CF-1/UD) in Indiana?

A: Utility companies that own property distributed in multiple taxation districts in the state of Indiana are required to fill out the State Form 52448 (CF-1/UD).

Q: What is the purpose of State Form 52448 (CF-1/UD) in Indiana?

A: The purpose of the CF-1/UD form is to allow the state of Indiana to properly tax utility companies based on the physical assets they have in various tax districts. The form gives a detailed account of these assets, aiding in the correct distribution of tax responsibility.

Q: How often does State Form 52448 (CF-1/UD) need to be submitted in Indiana?

A: The State Form 52448 (CF-1/UD) is usually required to be submitted annually as a part of the tax filing process for utility companies in Indiana.