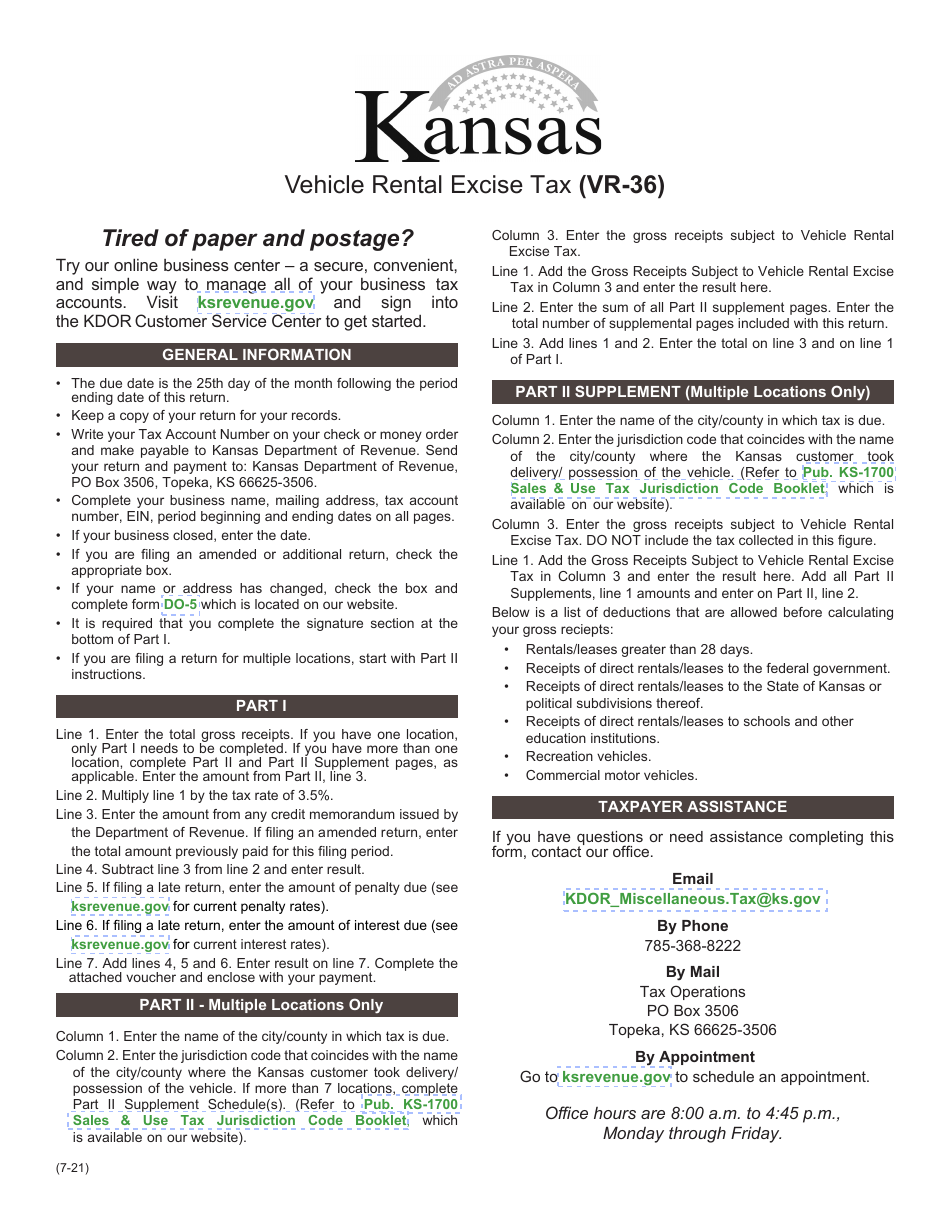

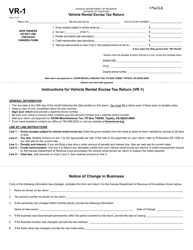

Form VR-36 Vehicle Rental Excise Tax Return - Kansas

What Is Form VR-36?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form VR-36?

A: Form VR-36 is the Vehicle Rental Excise Tax Return for the state of Kansas.

Q: Who needs to file Form VR-36?

A: Any individual or business engaged in the vehicle rental industry in Kansas needs to file Form VR-36.

Q: What is the purpose of Form VR-36?

A: Form VR-36 is used to report and pay the excise tax on vehicle rentals in Kansas.

Q: How often do I need to file Form VR-36?

A: Form VR-36 must be filed on a monthly basis.

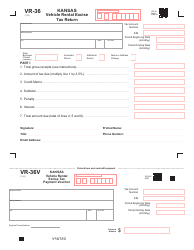

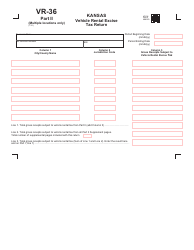

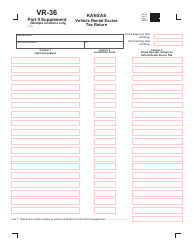

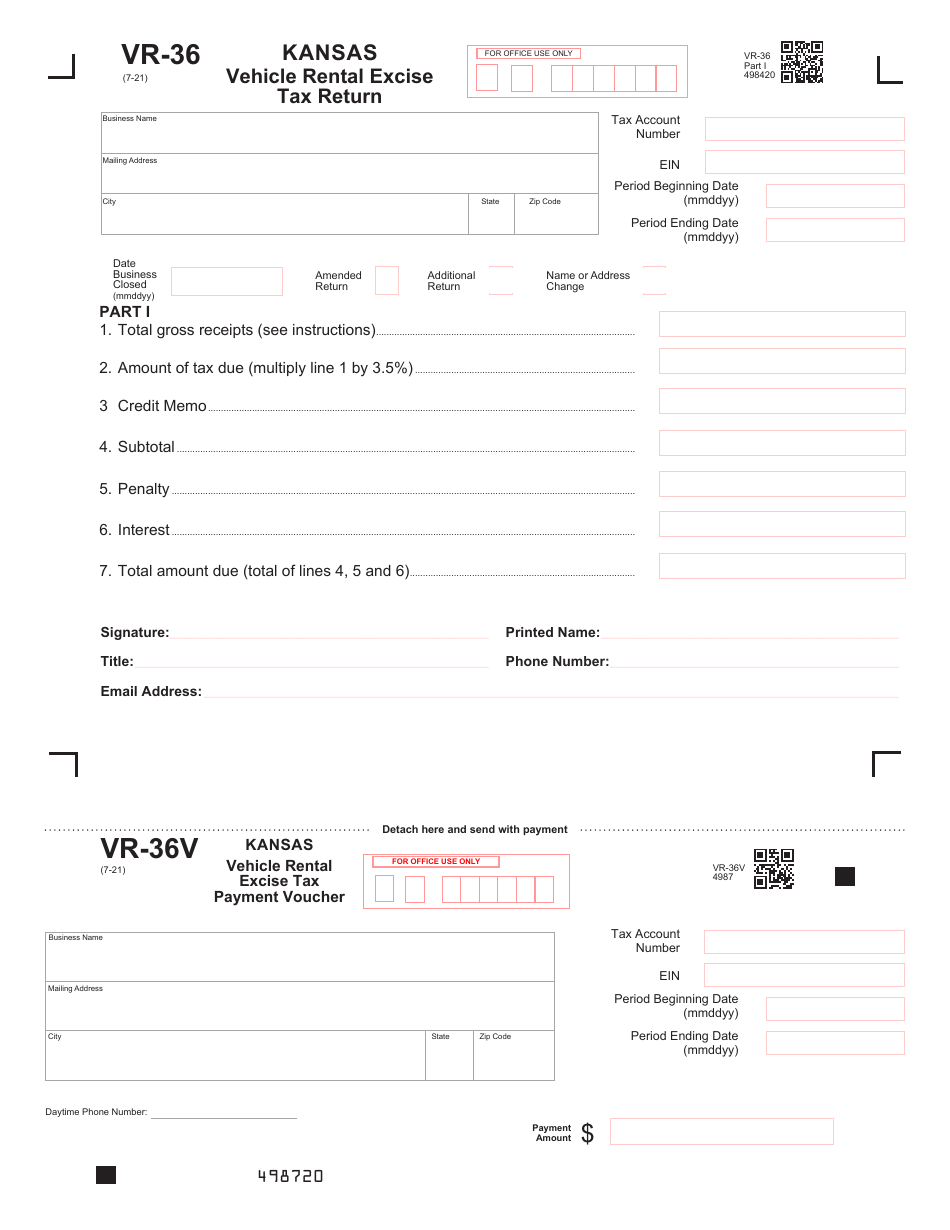

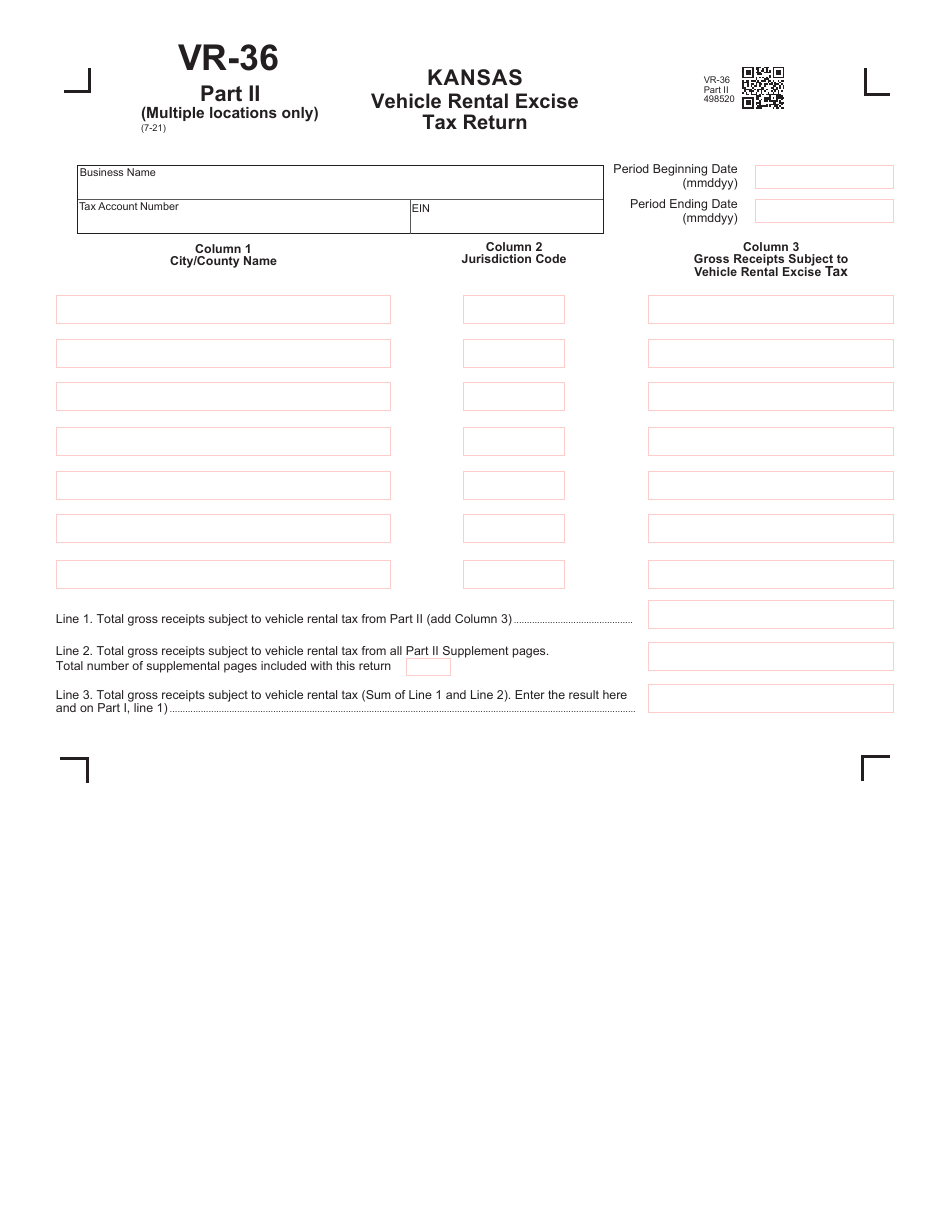

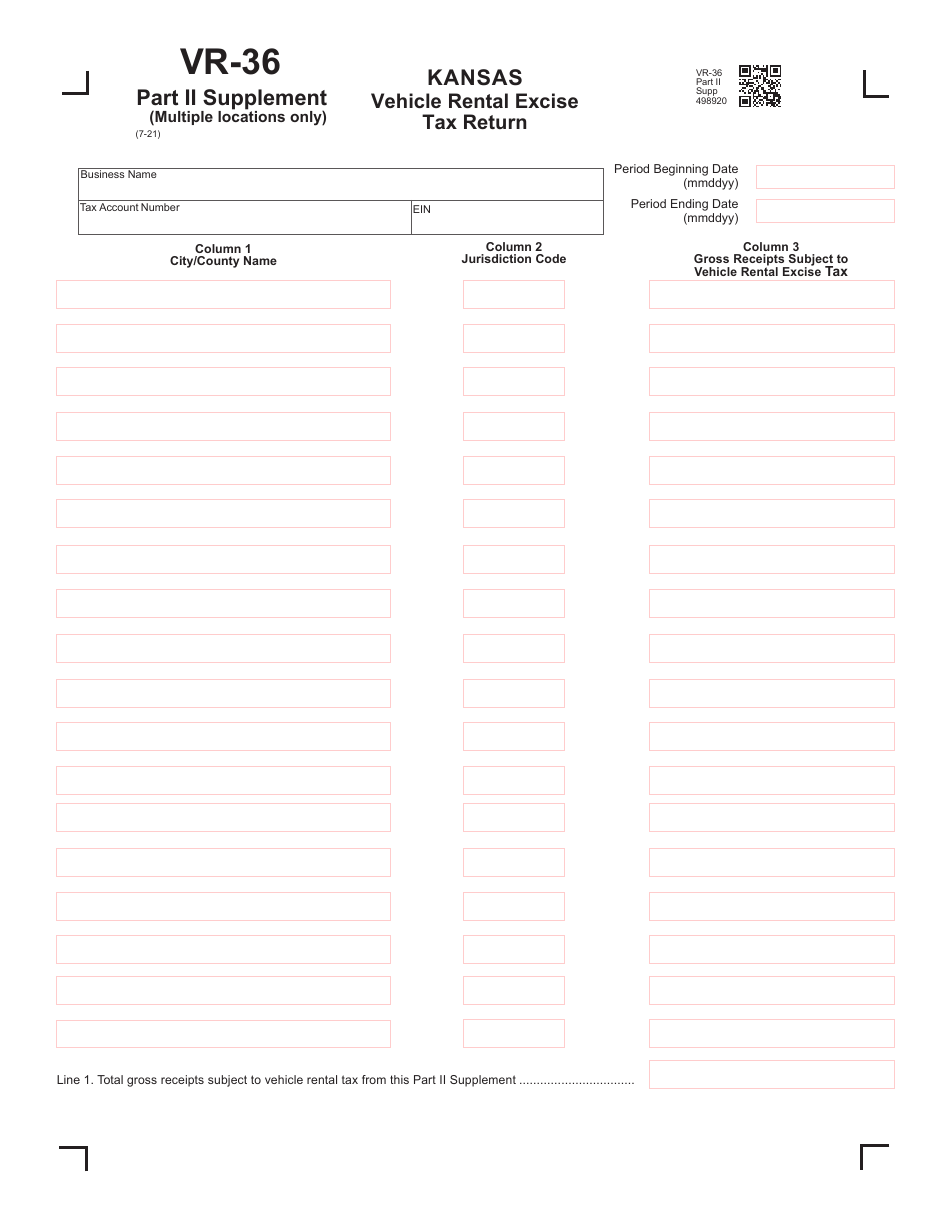

Q: What information is required on Form VR-36?

A: You will need to provide information about the total number of vehicles rented, gross receipts from the rentals, and the amount of tax due.

Q: When is the deadline to file Form VR-36?

A: Form VR-36 must be filed by the 25th day of the month following the month being reported.

Q: What happens if I don't file Form VR-36?

A: Failure to file Form VR-36 or pay the required tax may result in penalties and interest charges.

Q: Are there any exemptions to the vehicle rental excise tax?

A: Yes, certain vehicles and transactions may be exempt from the vehicle rental excise tax. Please refer to the instructions for Form VR-36 for more information.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VR-36 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.