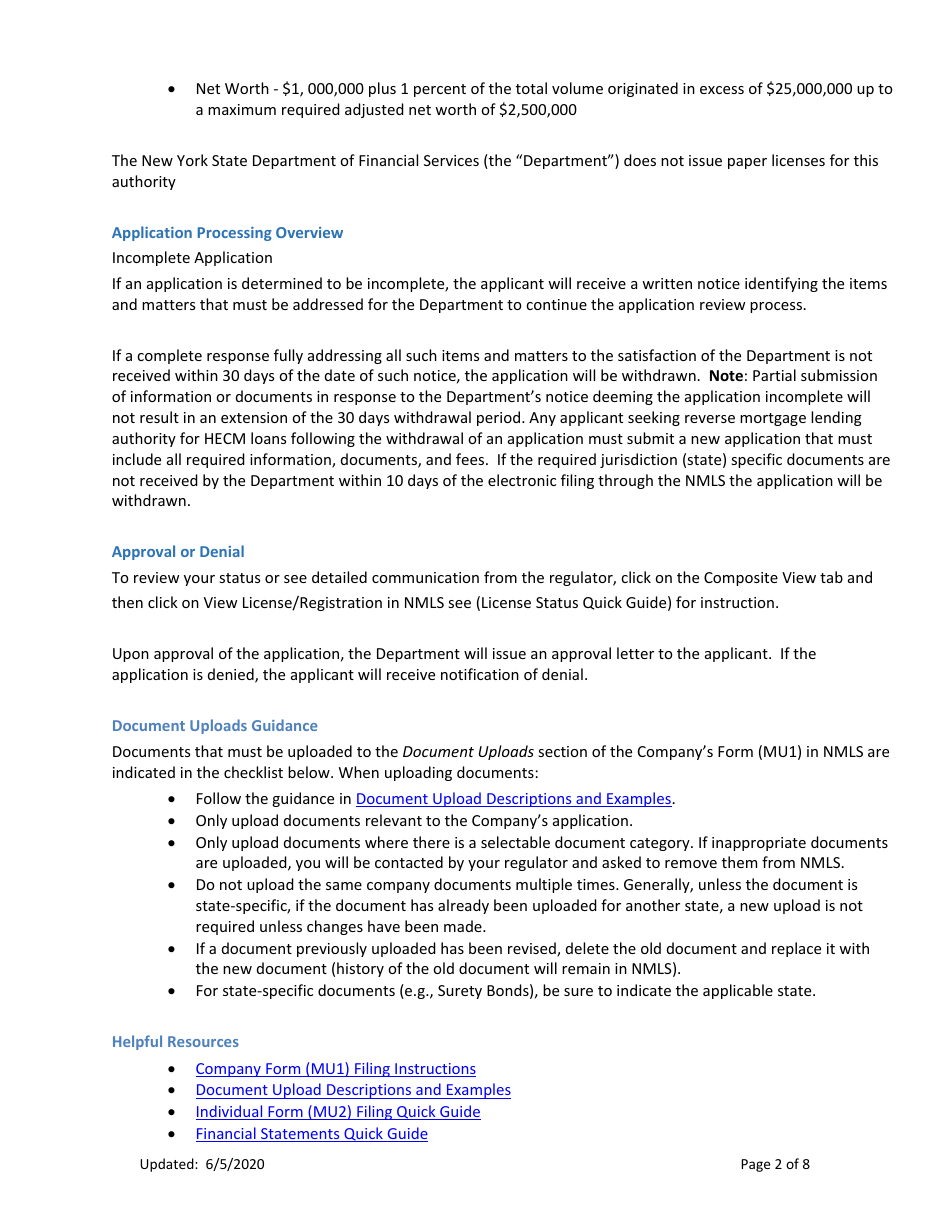

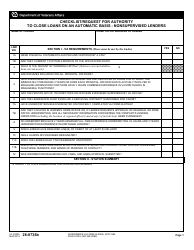

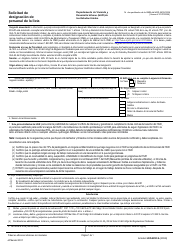

New Application Checklist (Company) - Ny Reverse Mortgage (Hecm) Lending Authority - New York

New Application Checklist (Company) - Ny Reverse Mortgage (Hecm) Lending Authority is a legal document that was released by the New York State Department of Financial Services - a government authority operating within New York.

FAQ

Q: What is the application checklist for a new company in New York?

A: The application checklist for a new company in New York varies depending on the type of business. It is best to consult with the relevant government agency or professional to obtain the specific checklist for your business.

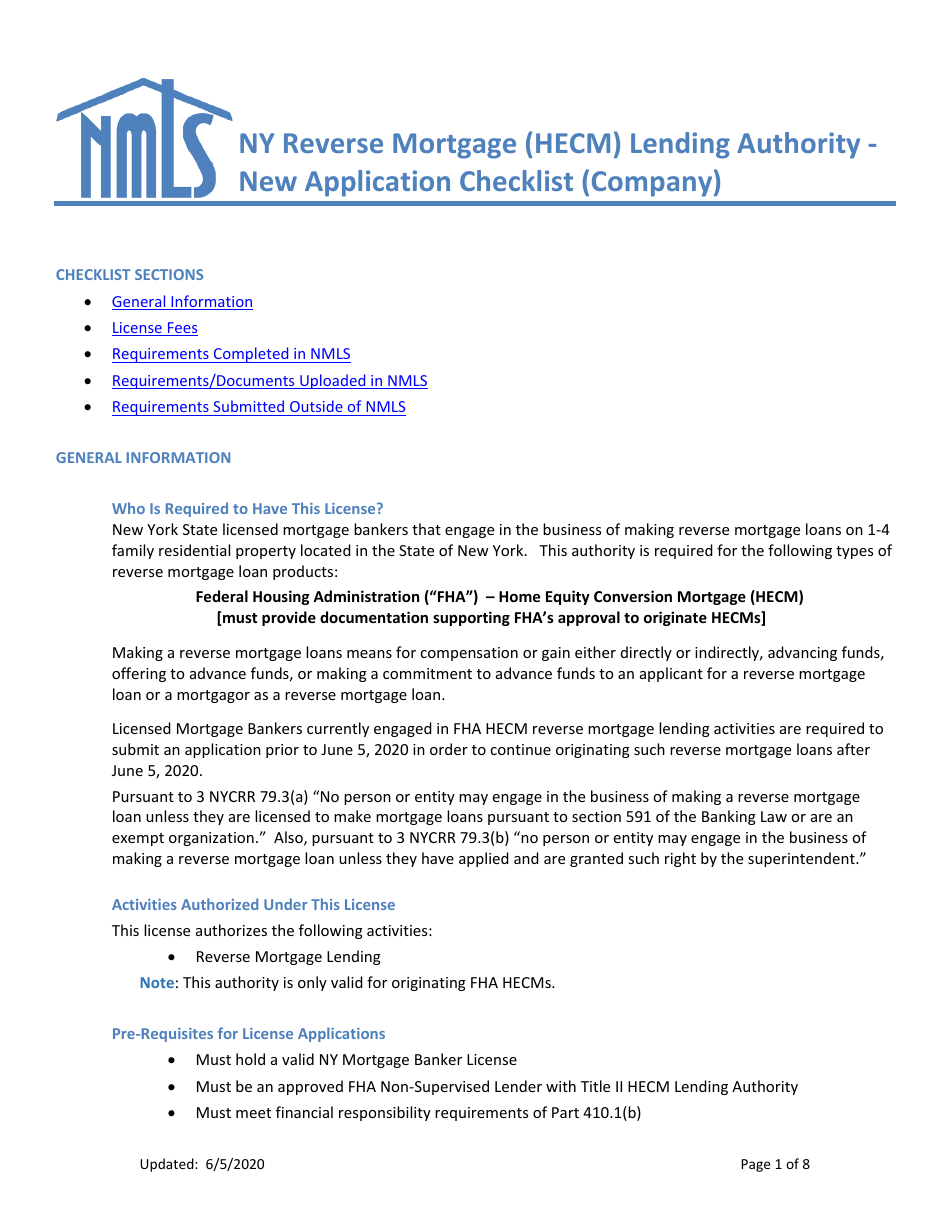

Q: What is a reverse mortgage (HECM) lending authority?

A: A reverse mortgage HECM (Home Equity Conversion Mortgage) lending authority is the permission or certification granted to a lender or company to offer reverse mortgages, specifically HECM loans, in New York.

Q: What is a reverse mortgage?

A: A reverse mortgage is a type of loan available to homeowners aged 62 or older that allows them to access a portion of their home equity without having to sell their home.

Q: What is HECM?

A: HECM stands for Home Equity Conversion Mortgage, which is a specific type of reverse mortgage insured by the federal government.

Form Details:

- Released on June 5, 2020;

- The latest edition currently provided by the New York State Department of Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York State Department of Financial Services.