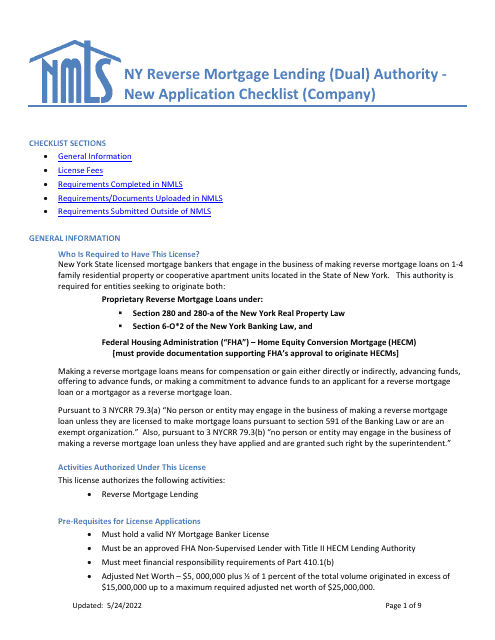

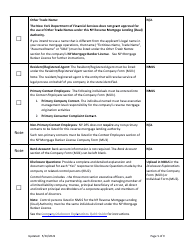

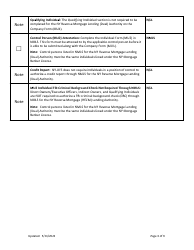

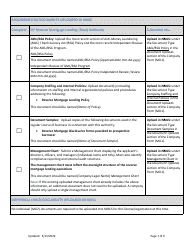

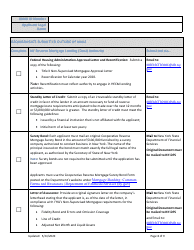

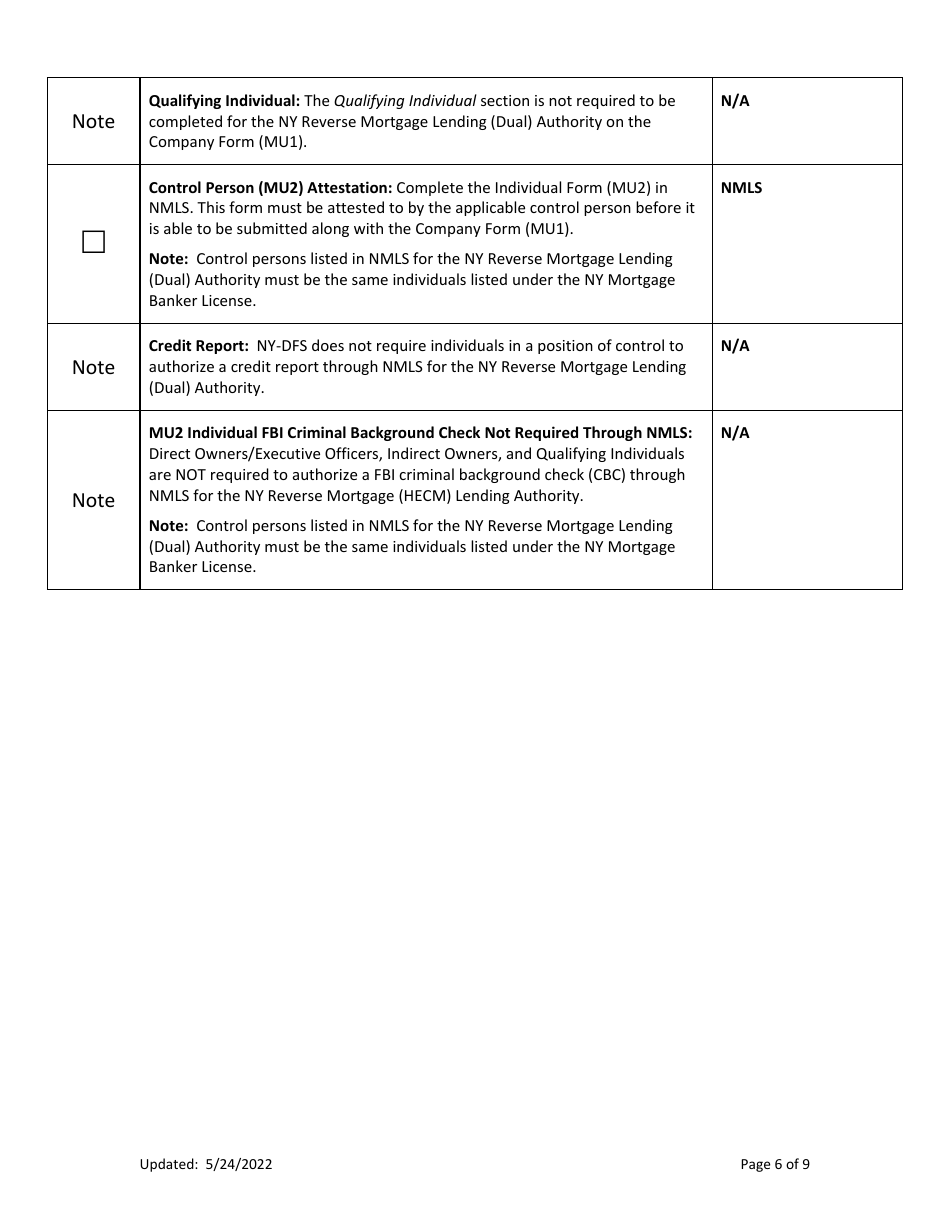

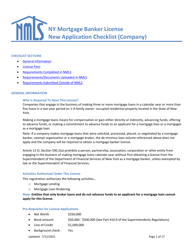

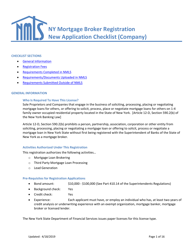

New Application Checklist (Company) - Ny Reverse Mortgage Lending (Dual) Authority - New York

New Application Checklist (Company) - Ny Reverse Mortgage Lending (Dual) Authority is a legal document that was released by the New York State Department of Financial Services - a government authority operating within New York.

FAQ

Q: What is the New Application Checklist?

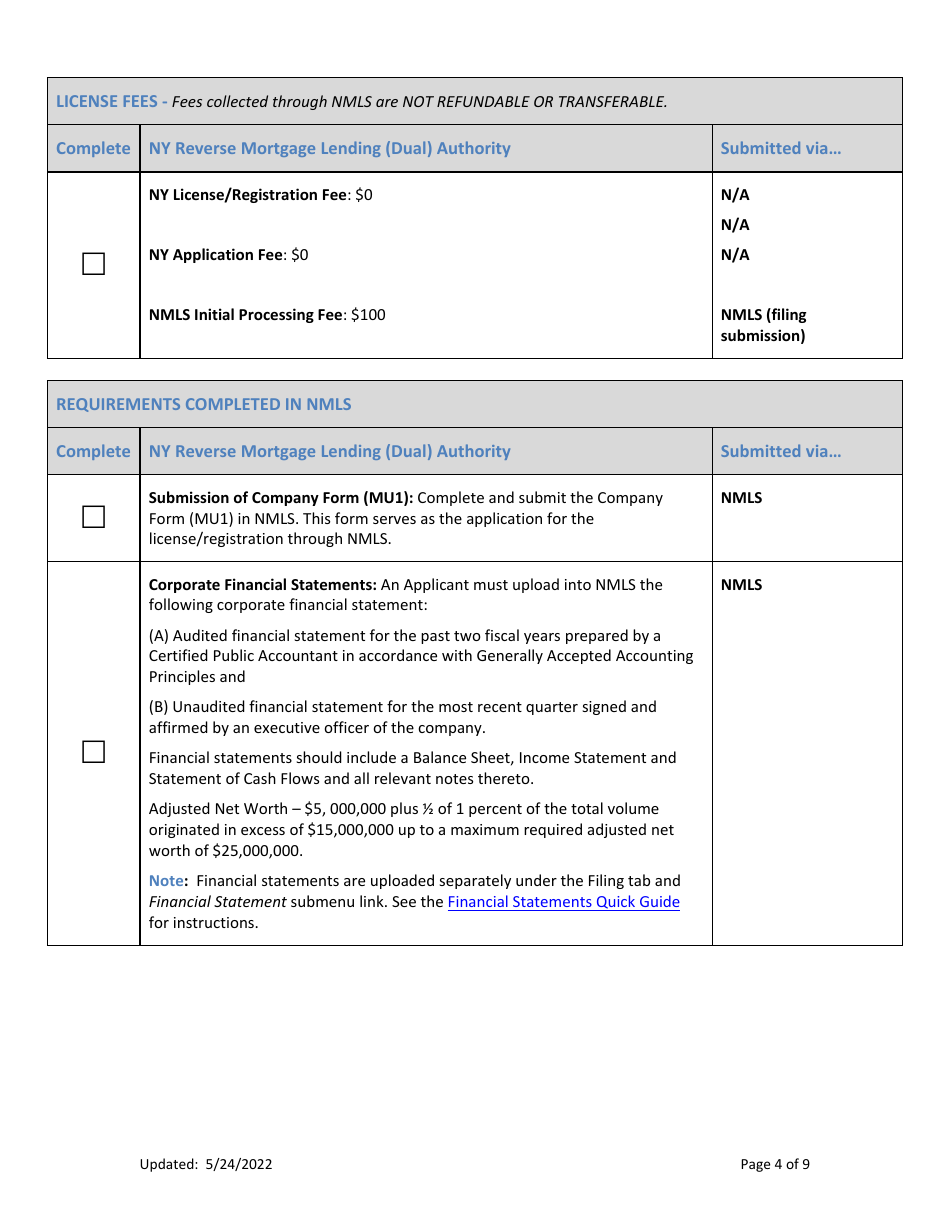

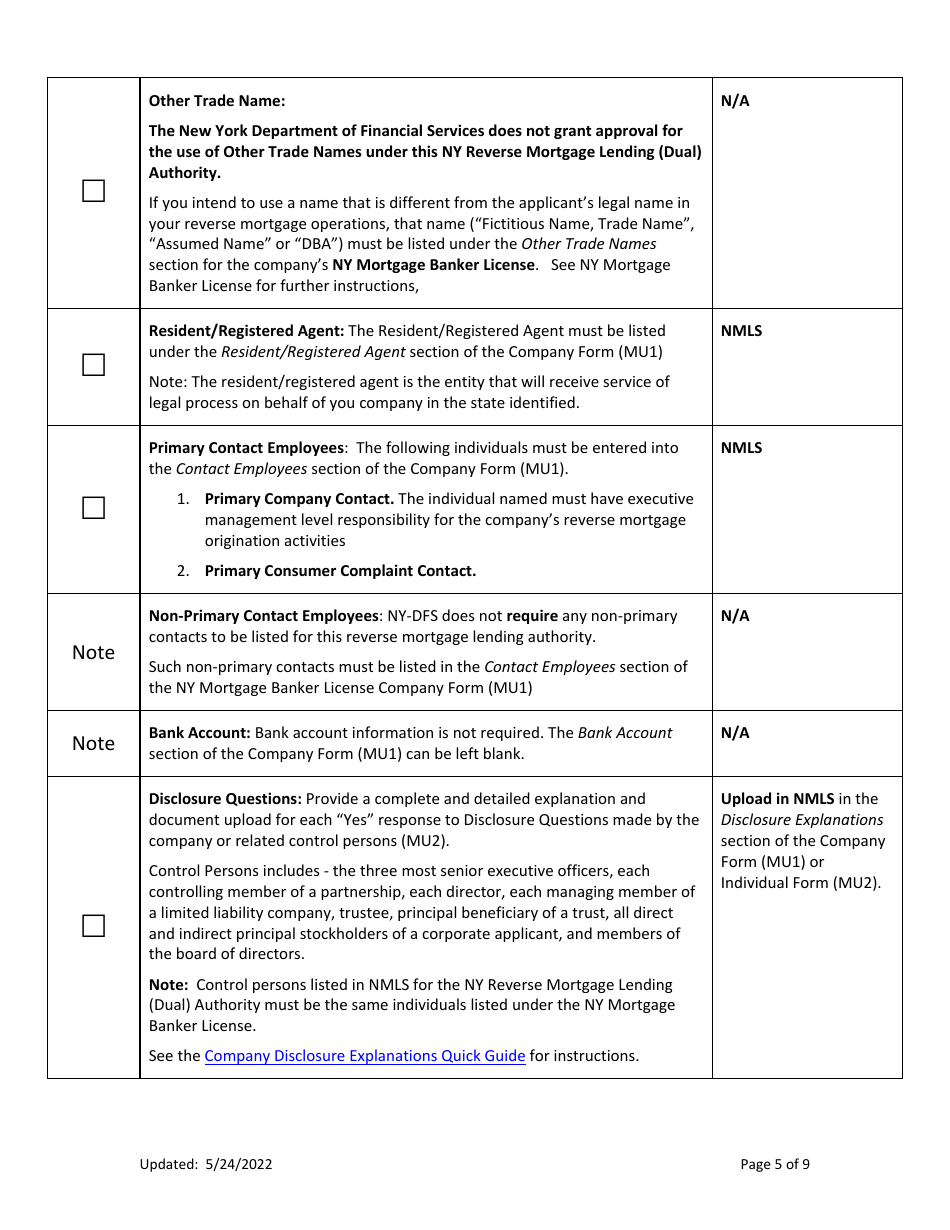

A: The New Application Checklist is a list of requirements and documents needed for a company to apply for a Reverse Mortgage Lending Authority in New York.

Q: What is a Reverse Mortgage?

A: A Reverse Mortgage is a type of loan for homeowners who are at least 62 years old that allows them to convert a portion of their home's equity into cash.

Q: What is the Dual Authority in New York?

A: The Dual Authority in New York refers to the authority for a company to originate both traditional mortgages and reverse mortgages.

Q: Who can apply for Reverse Mortgage Lending Authority in New York?

A: Companies that meet the requirements set by the regulatory authorities in New York can apply for Reverse Mortgage Lending Authority.

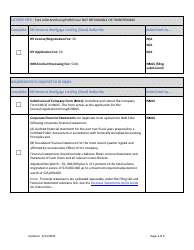

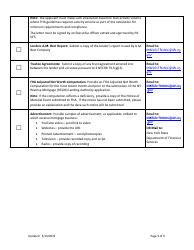

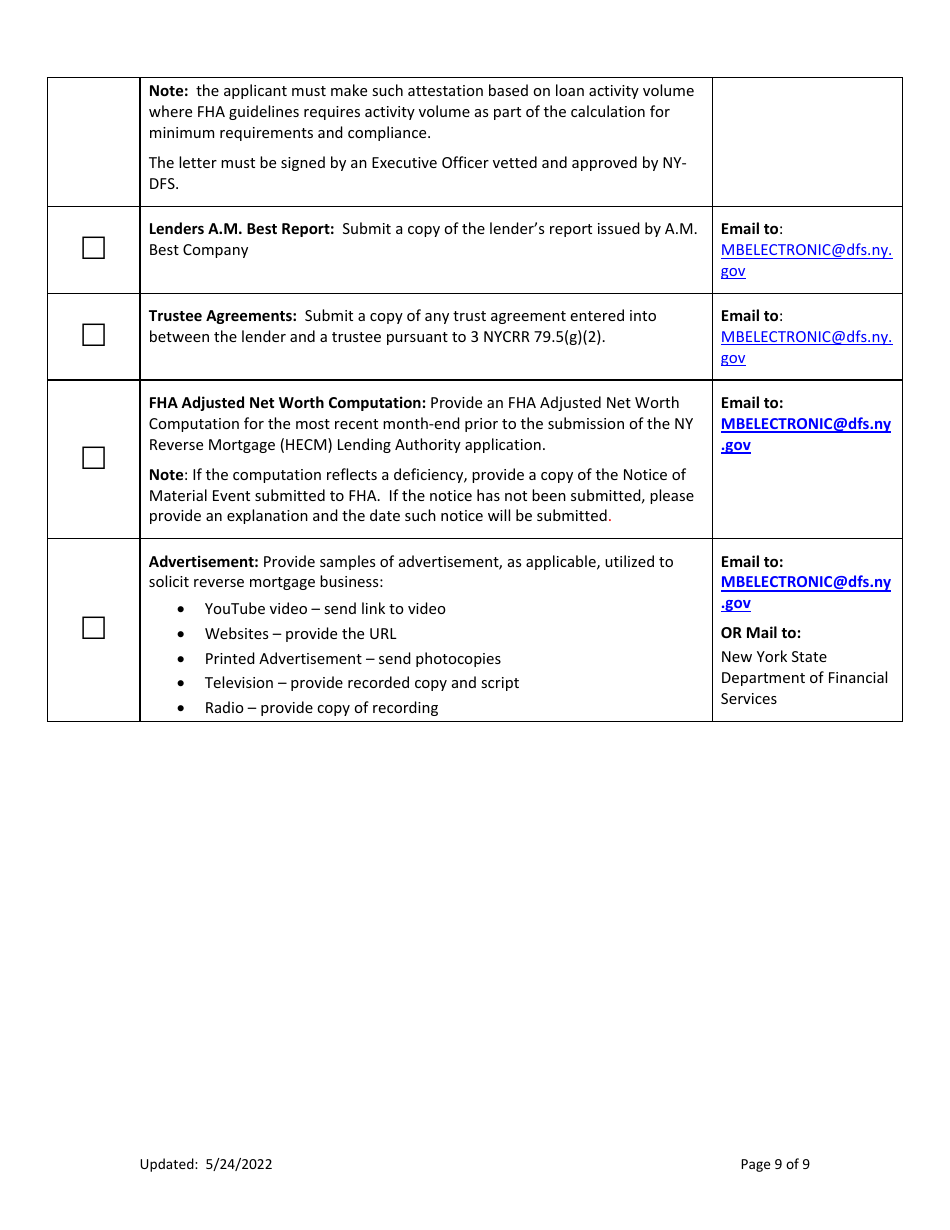

Q: What documents are needed for the application?

A: The application requires various documents including financial statements, background checks, and licensing information.

Q: What is the purpose of the checklist?

A: The purpose of the checklist is to ensure that companies applying for Reverse Mortgage Lending Authority in New York meet all the necessary requirements and provide the required documentation.

Q: What is the benefit of obtaining Reverse Mortgage Lending Authority?

A: Obtaining Reverse Mortgage Lending Authority allows a company to offer reverse mortgage loans to eligible homeowners in New York, expanding their business and potential revenue streams.

Form Details:

- Released on May 24, 2022;

- The latest edition currently provided by the New York State Department of Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York State Department of Financial Services.