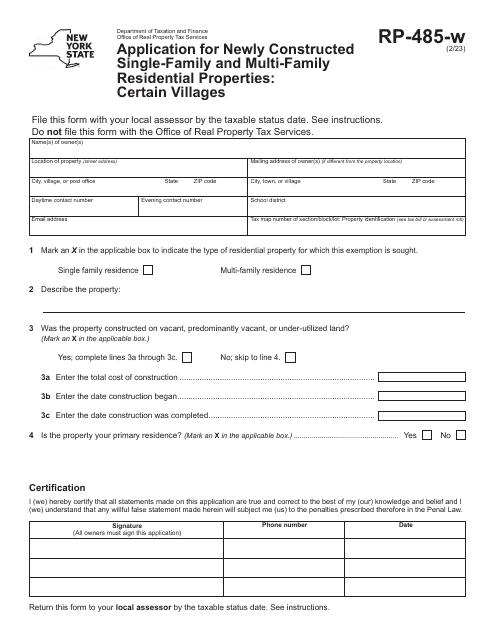

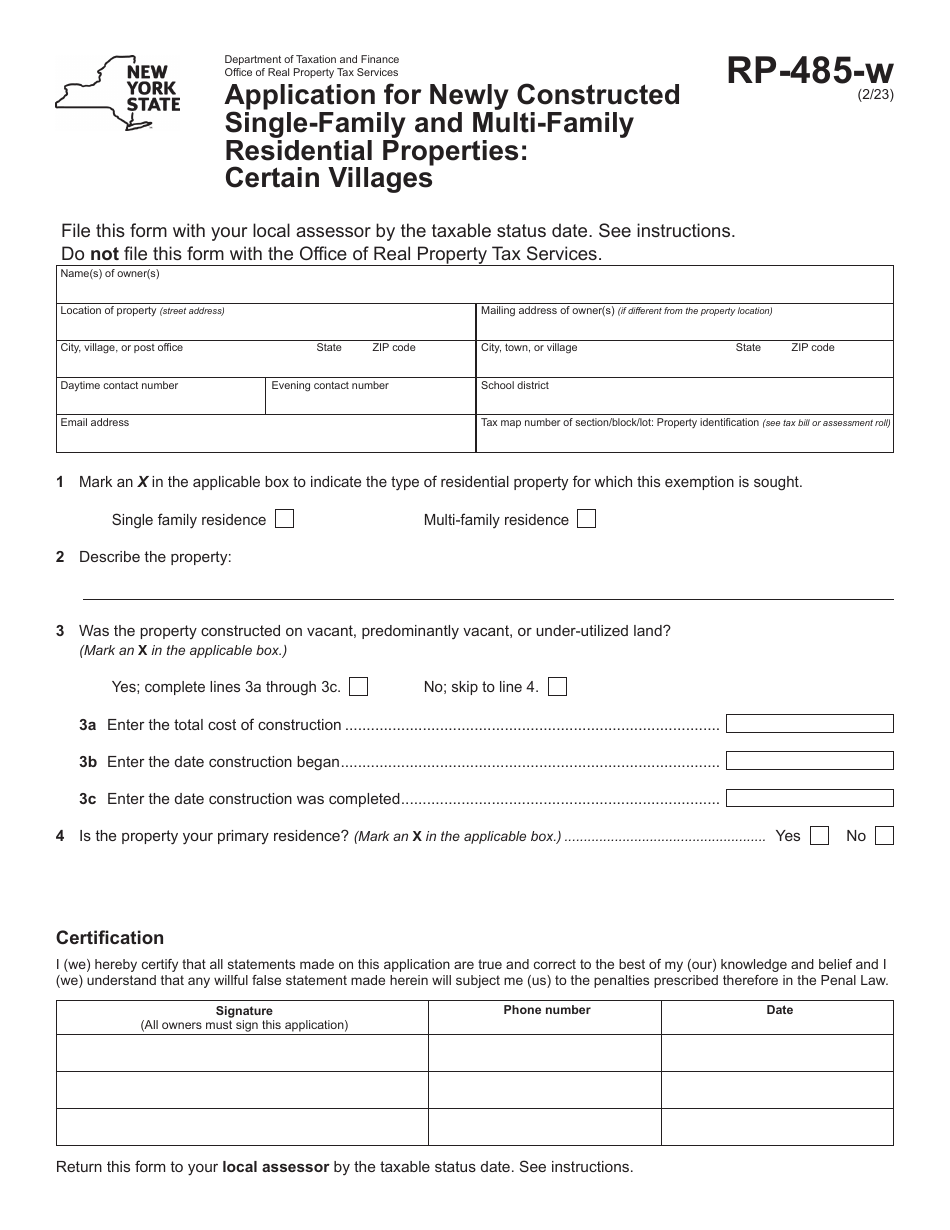

Form RP-485-W Application for Newly Constructed Single-Family and Multi-Family Residential Properties: Certain Villages - New York

What Is Form RP-485-W?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RP-485-W?

A: Form RP-485-W is an application for newly constructed single-family and multi-family residential properties in certain villages in New York.

Q: Who should use Form RP-485-W?

A: Form RP-485-W should be used by individuals or developers who have newly constructed single-family or multi-family residential properties in certain villages in New York.

Q: What is the purpose of Form RP-485-W?

A: The purpose of Form RP-485-W is to apply for a real property tax exemption for newly constructed residential properties in certain villages in New York.

Q: What is the eligibility criteria for the tax exemption?

A: The eligibility criteria for the tax exemption include the property being located in a qualifying village and meeting certain construction and usage requirements.

Q: Are there any fees associated with filing Form RP-485-W?

A: There is no fee for filing Form RP-485-W.

Q: When should Form RP-485-W be filed?

A: Form RP-485-W should be filed within one year of the completion of construction or the date the property is first used or occupied, whichever is later.

Q: What supporting documents are required to be submitted with Form RP-485-W?

A: Supporting documents such as copies of building permits, certificates of occupancy, and other construction-related documentation may be required.

Q: What is the deadline for filing Form RP-485-W?

A: The deadline for filing Form RP-485-W varies depending on the specific village's exemption administration period. It is important to check with the local assessor's office for the deadline.

Q: Who can I contact for more information about Form RP-485-W?

A: For more information about Form RP-485-W, you can contact the local assessor's office or the New York State Department of Taxation and Finance.

Form Details:

- Released on February 1, 2023;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-485-W by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.

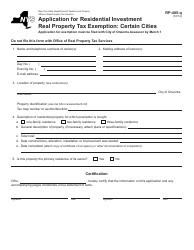

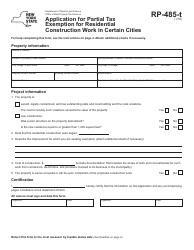

![Document preview: Form RP-485-I [ROME] Application for Residential Investment Real Property Tax Exemption; Certain Cities - New York](https://data.templateroller.com/pdf_docs_html/1733/17334/1733439/form-rp-485-i-rome-application-residential-investment-real-property-tax-exemption-certain-cities-new-york.png)

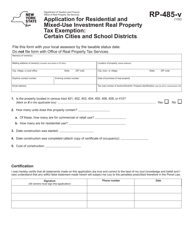

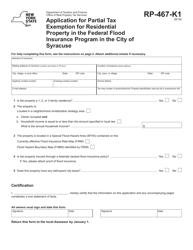

![Document preview: Form RP-485-M [ROME SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733929/form-rp-485-m-rome-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)

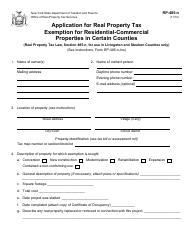

![Document preview: Form RP-485-L [AMHERST] Application for Residential Property Improvement; Certain Towns - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733926/form-rp-485-l-amherst-application-residential-property-improvement-certain-towns-new-york.png)

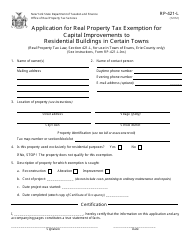

![Document preview: Form RP-485-K [UTICA SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - City of Utica, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349829/form-rp-485-k-utica-sd-application-for-residential-investment-real-property-tax-exemption-certain-school-districts-city-of-utica-new-york.png)

![Document preview: Form RP-485-I [JAMESTOWN SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/578/5786/578655/form-rp-485-i-jamestown-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)

![Document preview: Form RP-485-I [AMSTERDAM SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733928/form-rp-485-i-amsterdam-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)