This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form LM-3

for the current year.

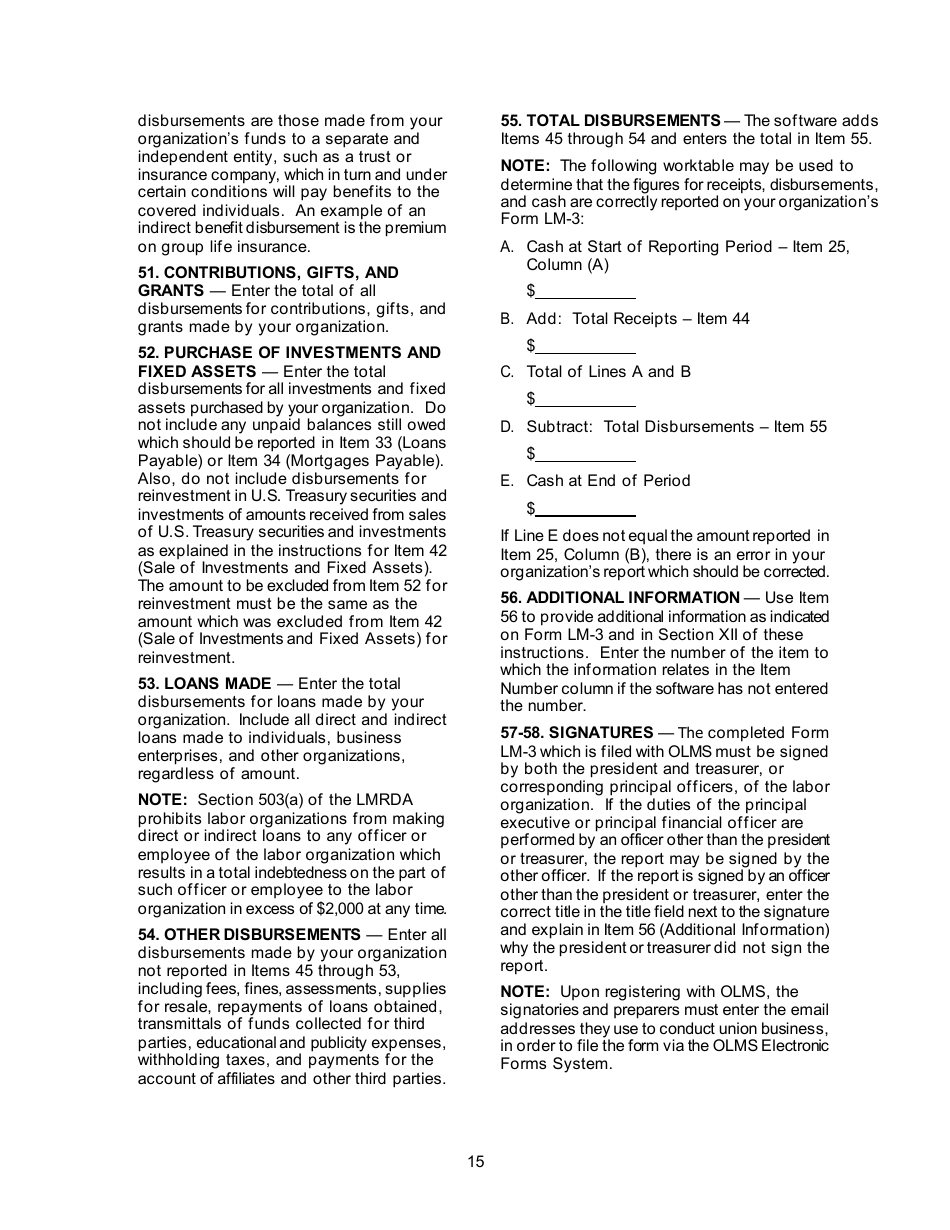

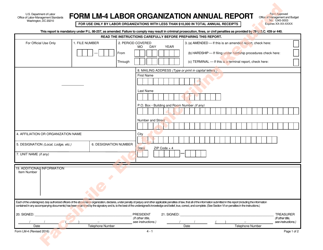

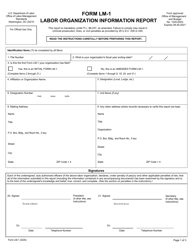

Instructions for Form LM-3 Labor Organization Annual Report

The Instructions for Form LM-3 Labor Organization Annual Report is a guide that helps labor organizations in the United States understand how to properly fill out Form LM-3. This form represents an annual report that labor organizations need to submit to the U.S. Department of Labor. It provides financial details and outlines organizational structures, including information about income, expenses, assets, liabilities, and financial transactions that occurred during the fiscal year. The goal is to ensure transparency and accountability in the way labor organizations manage their funds.

The Instructions for Form LM-3 Labor Organization Annual Report is filed by labor organizations in the USA. This includes unions and similar labor-related entities. The form is filed with the U.S. Department of Labor's Office of Labor-Management Standards (OLMS). The purpose of this form is to provide transparency around labor organization's financial conditions and operations.

FAQ

Q: What is Form LM-3?

A: Form LM-3 is a labor organization annual report form that labor organizations are required to submit in the United States. This document is issued by the Department of Labor and is used to disclose certain financial conditions and operations of the labor organization.

Q: Who needs to fill out Form LM-3?

A: Form LM-3 needs to be filled out by labor organizations with total annual receipts of $250,000 or less. It is typically completed by the reporting officer of the labor organization.

Q: When is the Form LM-3 due?

A: The Form LM-3 is due within 90 days after the end of the labor organization's fiscal year. If the due date falls on a Saturday, Sunday or a federal holiday, the next business day is considered as the deadline.

Q: How to submit Form LM-3?

A: Form LM-3 can be submitted electronically through the Department of Labor's OLMS Electronic Forms System (EFS). It can also be submitted via mail or hand-delivered to the Department's Office of Labor-Management Standards (OLMS).

Q: What kind of information is required in Form LM-3?

A: Form LM-3 requires information about the labor organization’s financial conditions and operations including assets, liabilities, receipts, and disbursements. It also requires details about officers and employees, loans, sale of assets, etc.

Q: Is electronic filing of Form LM-3 mandatory?

A: No, electronic filing of Form LM-3 is not mandatory. Labor organizations can choose to file the form electronically or by mail. However, electronic filing is encouraged for faster processing and convenience.

Q: What happens if Form LM-3 is not filed on time?

A: If Form LM-3 is not filed on time, the labor organization may face penalties. Failure to file the form can lead to criminal prosecution and civil penalties for the responsible individuals.