This version of the form is not currently in use and is provided for reference only. Download this version of

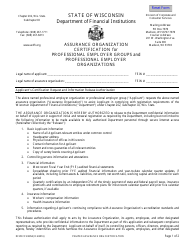

Form UCT-673-E

for the current year.

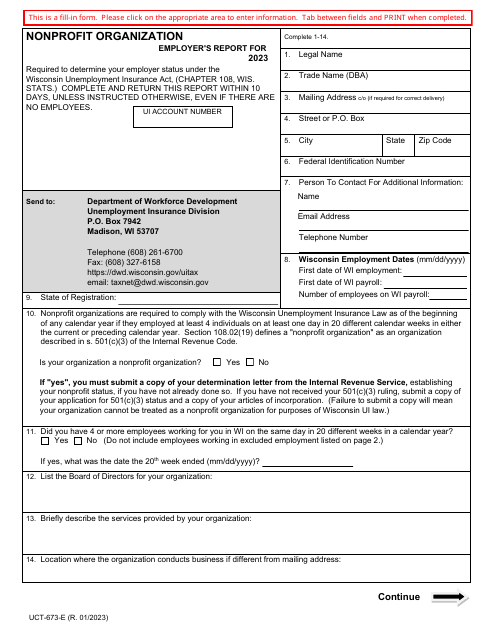

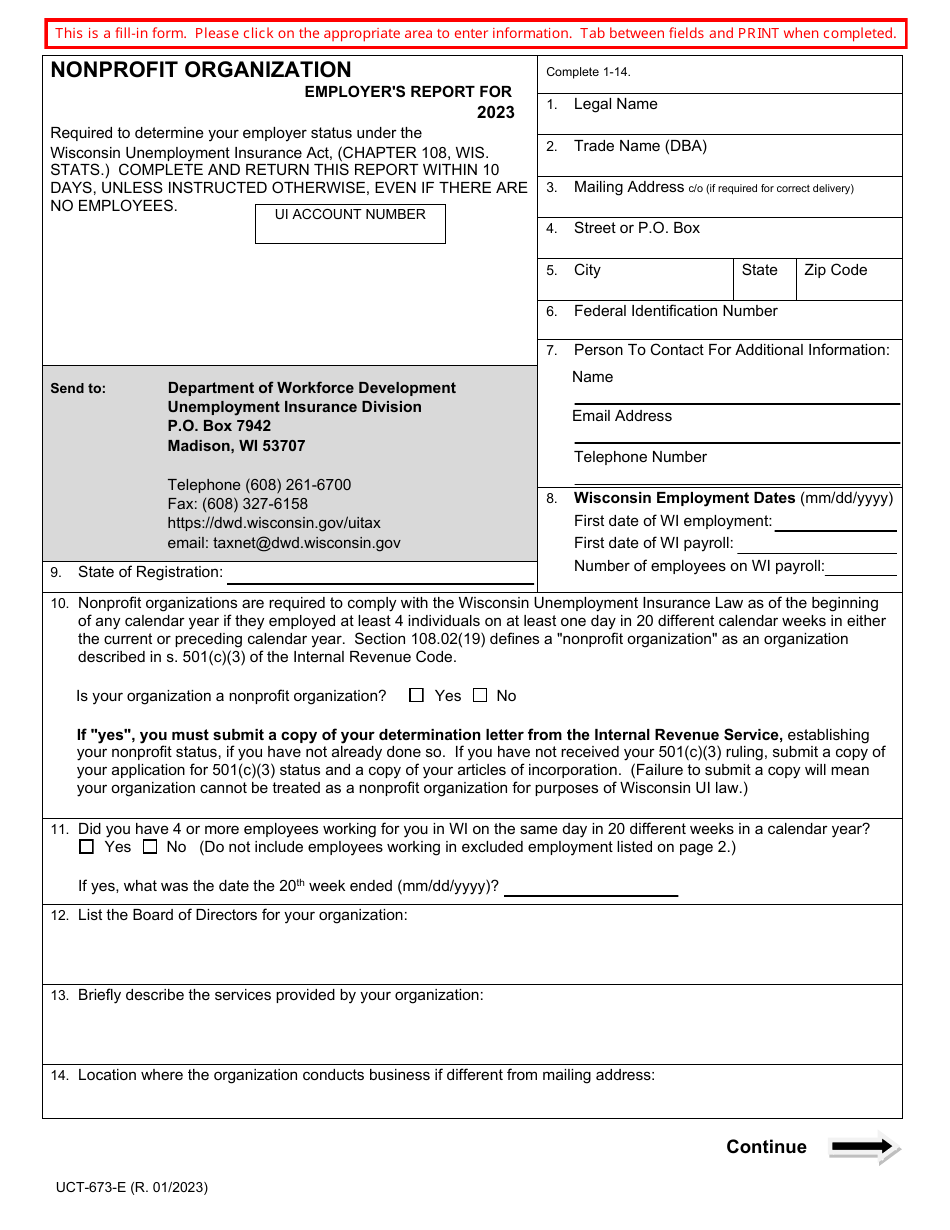

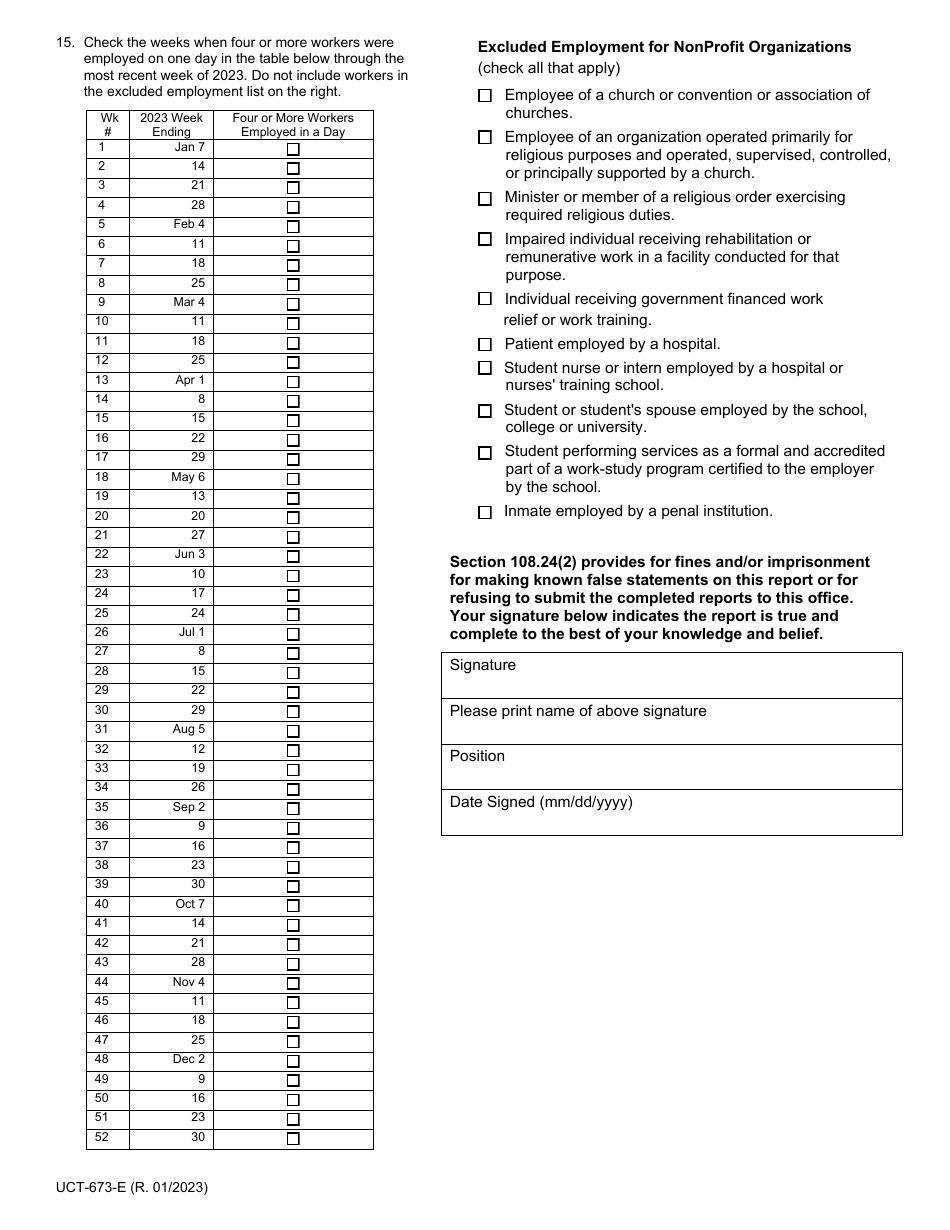

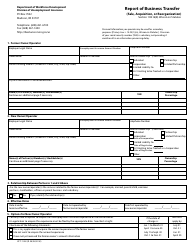

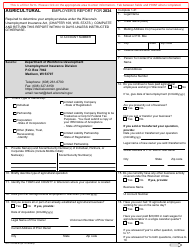

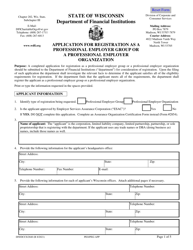

Form UCT-673-E Nonprofit Organization Employer's Report - Wisconsin

What Is Form UCT-673-E?

This is a legal form that was released by the Wisconsin Department of Workforce Development - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UCT-673-E?

A: Form UCT-673-E is a Nonprofit Organization Employer's Report specific to Wisconsin.

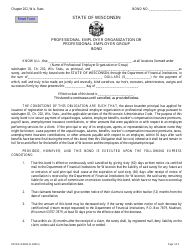

Q: Who needs to file Form UCT-673-E?

A: Nonprofit organizations in Wisconsin that have one or more employees need to file Form UCT-673-E.

Q: What is the purpose of Form UCT-673-E?

A: The purpose of Form UCT-673-E is to report wages and employment information for nonprofit organization employees in Wisconsin.

Q: When is Form UCT-673-E due?

A: Form UCT-673-E is due on the last day of the month following the end of each calendar quarter.

Q: What information is required on Form UCT-673-E?

A: Form UCT-673-E requires information such as employer details, employee details, wages paid, and other employment-related information.

Q: Are there any penalties for not filing Form UCT-673-E?

A: Yes, failure to file Form UCT-673-E or filing incorrect information may result in penalties and interest charges.

Q: Can I amend a filed Form UCT-673-E?

A: Yes, you can file an amended Form UCT-673-E to correct any errors or omissions.

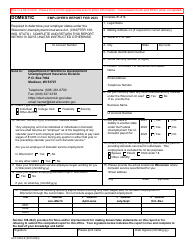

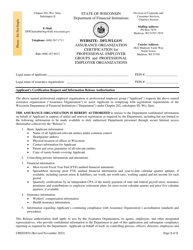

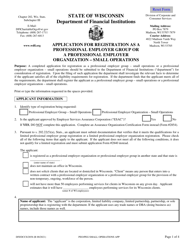

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Wisconsin Department of Workforce Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UCT-673-E by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Workforce Development.