This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

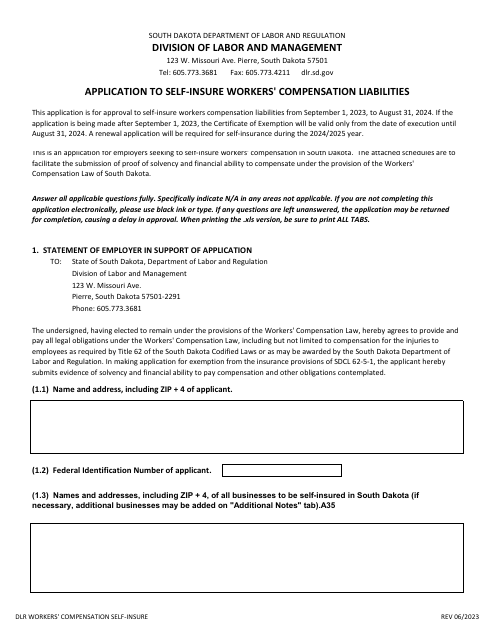

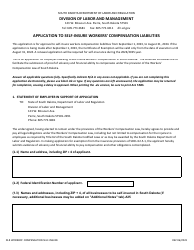

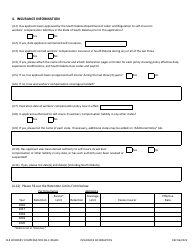

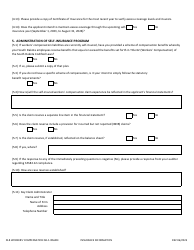

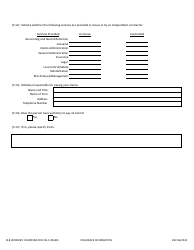

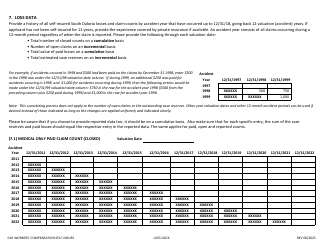

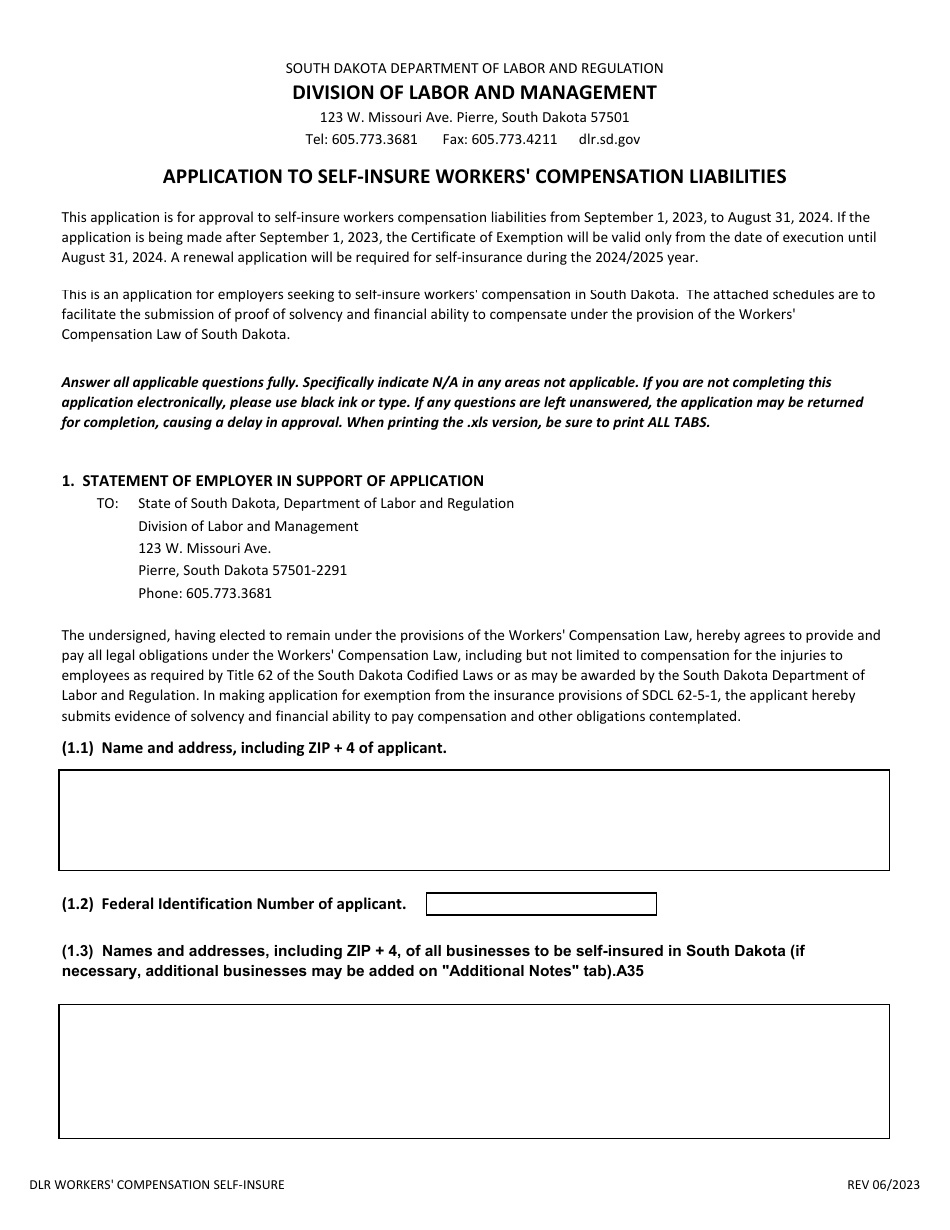

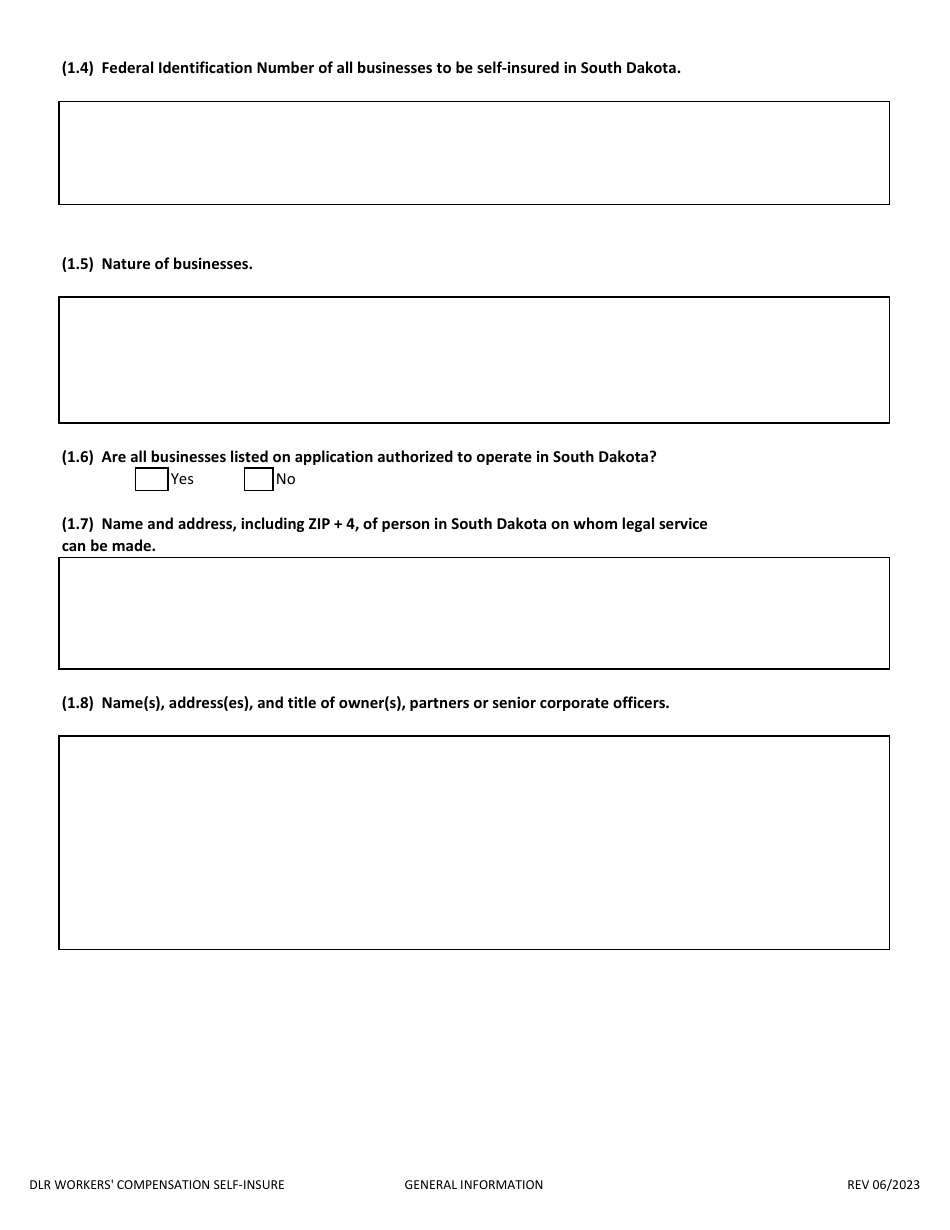

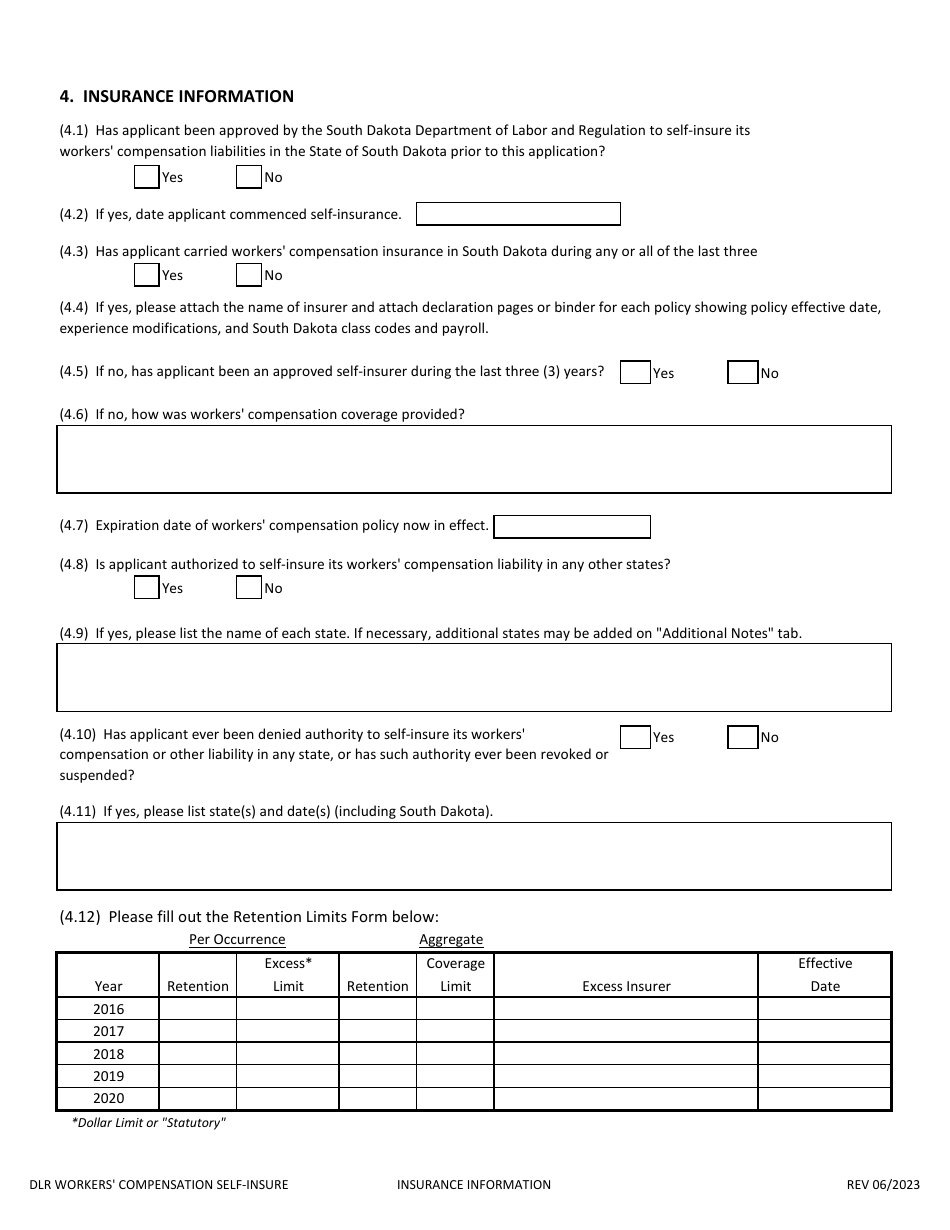

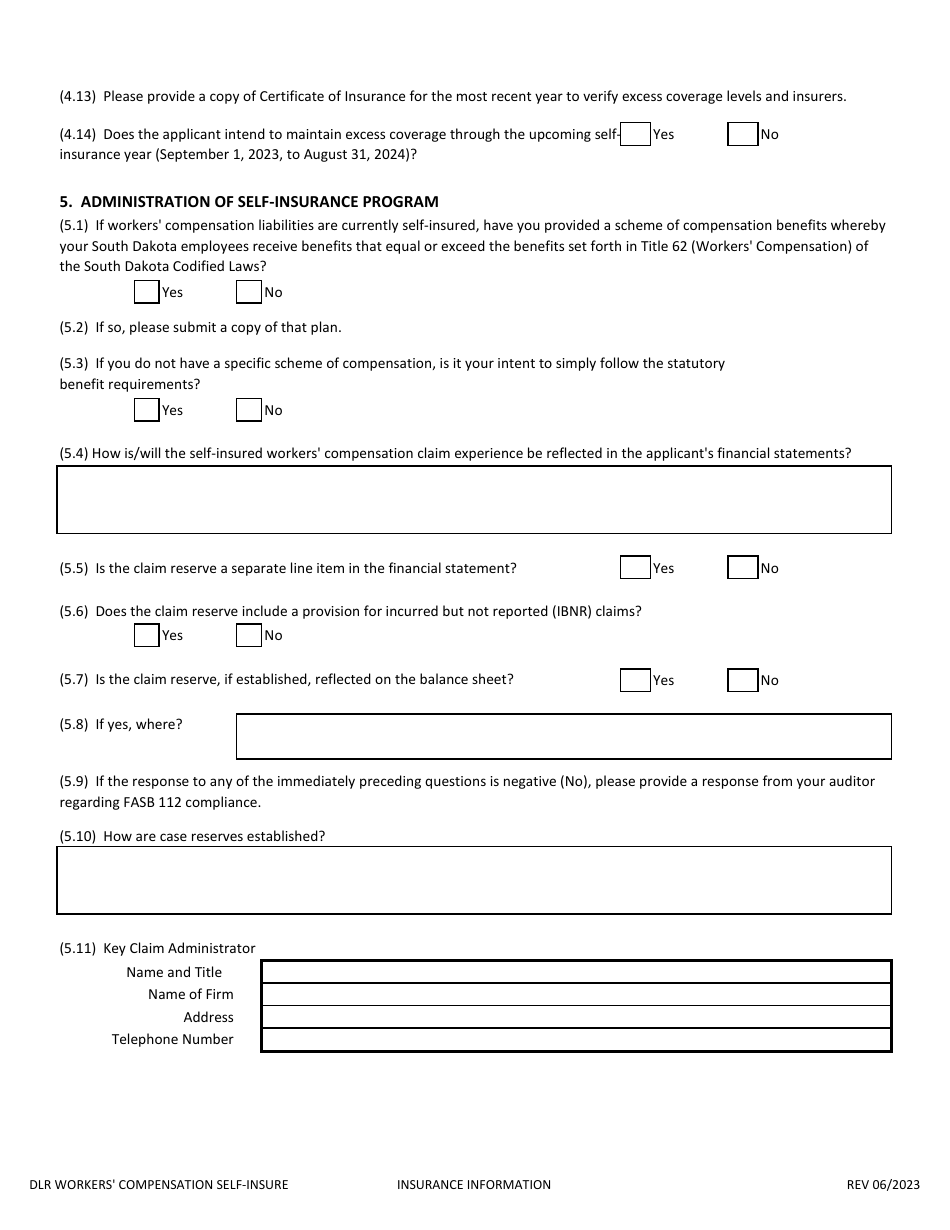

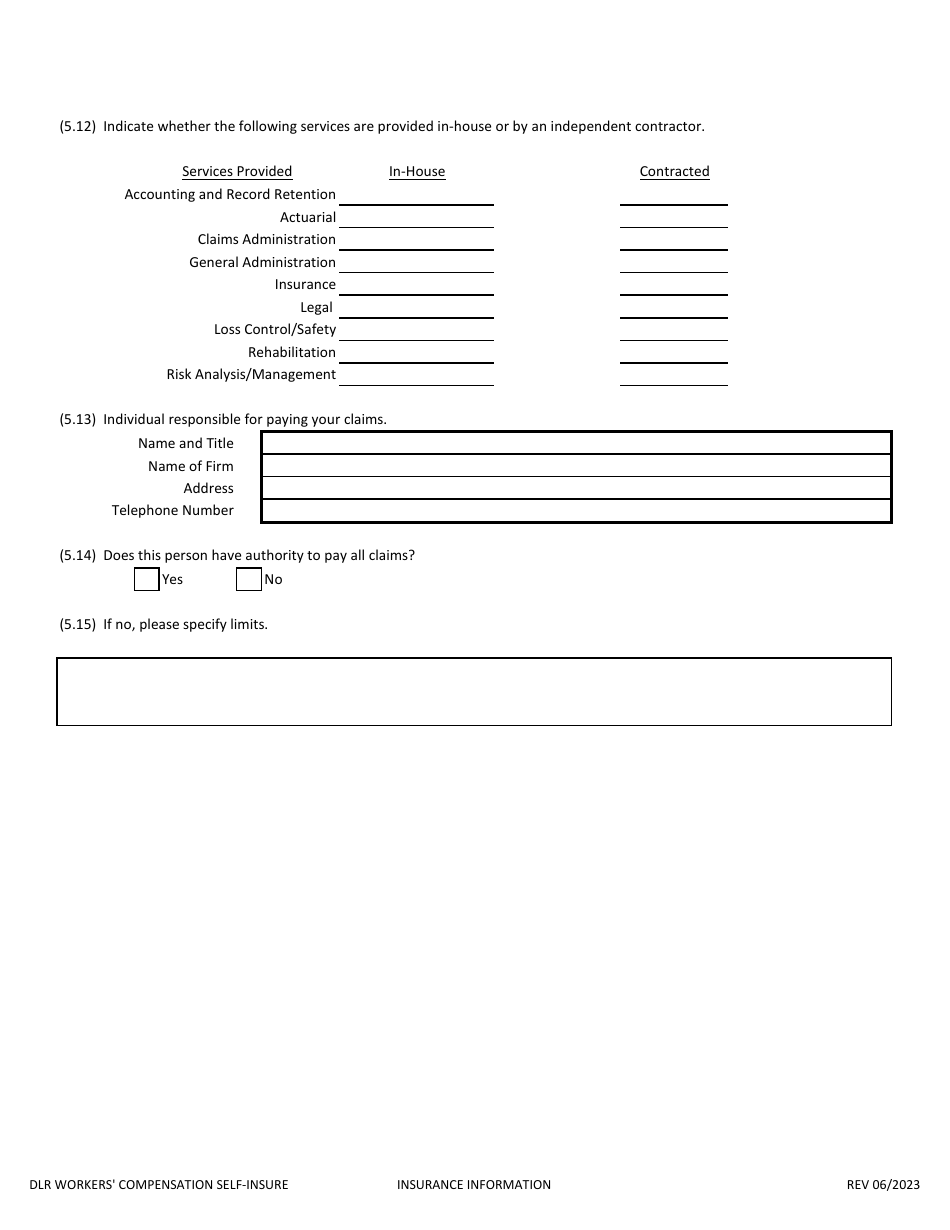

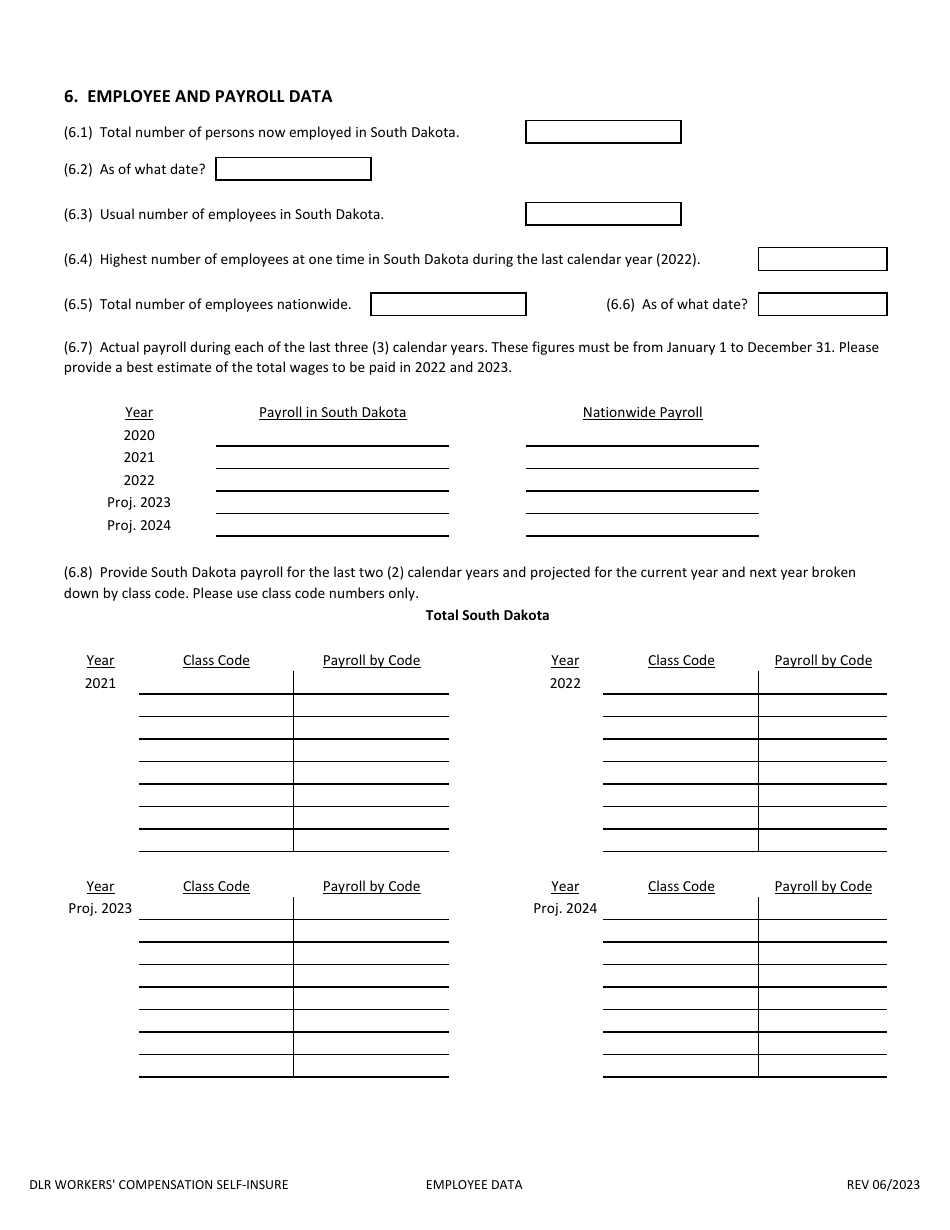

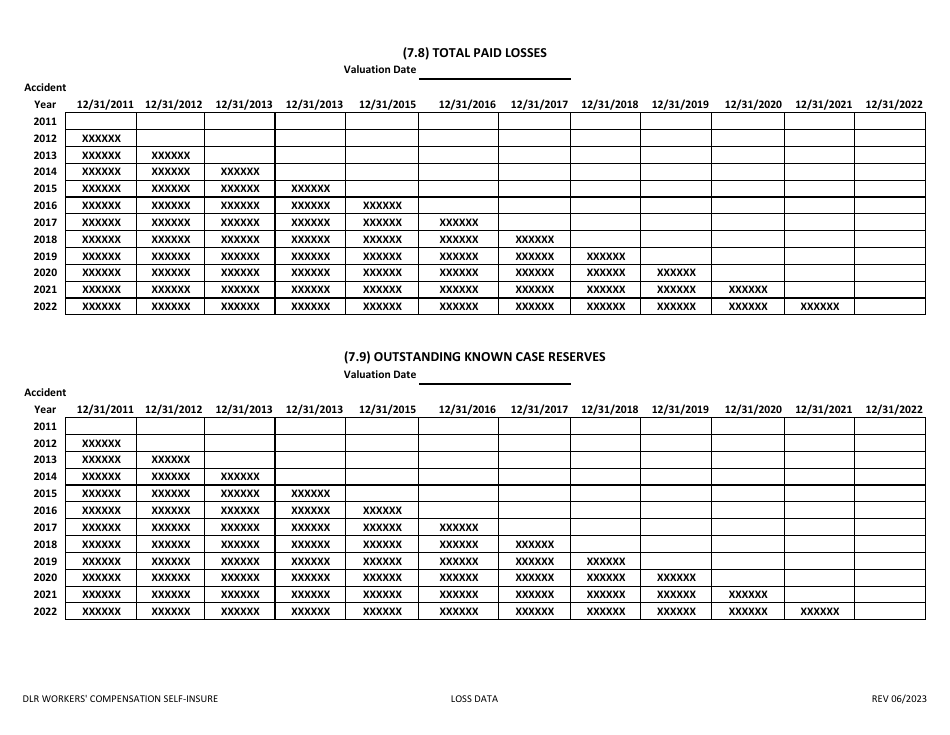

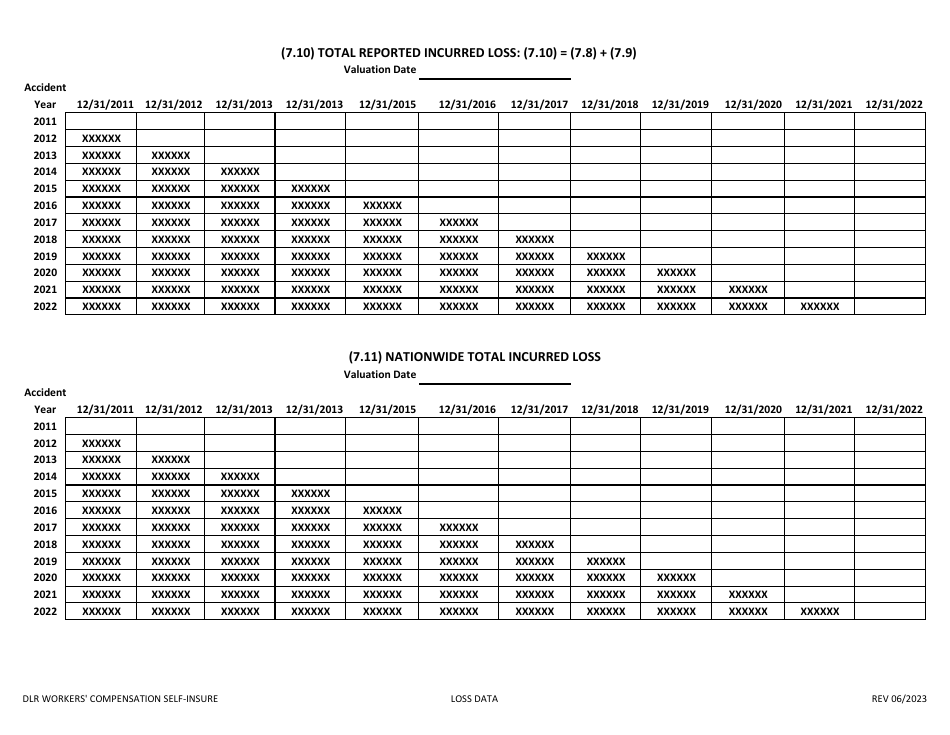

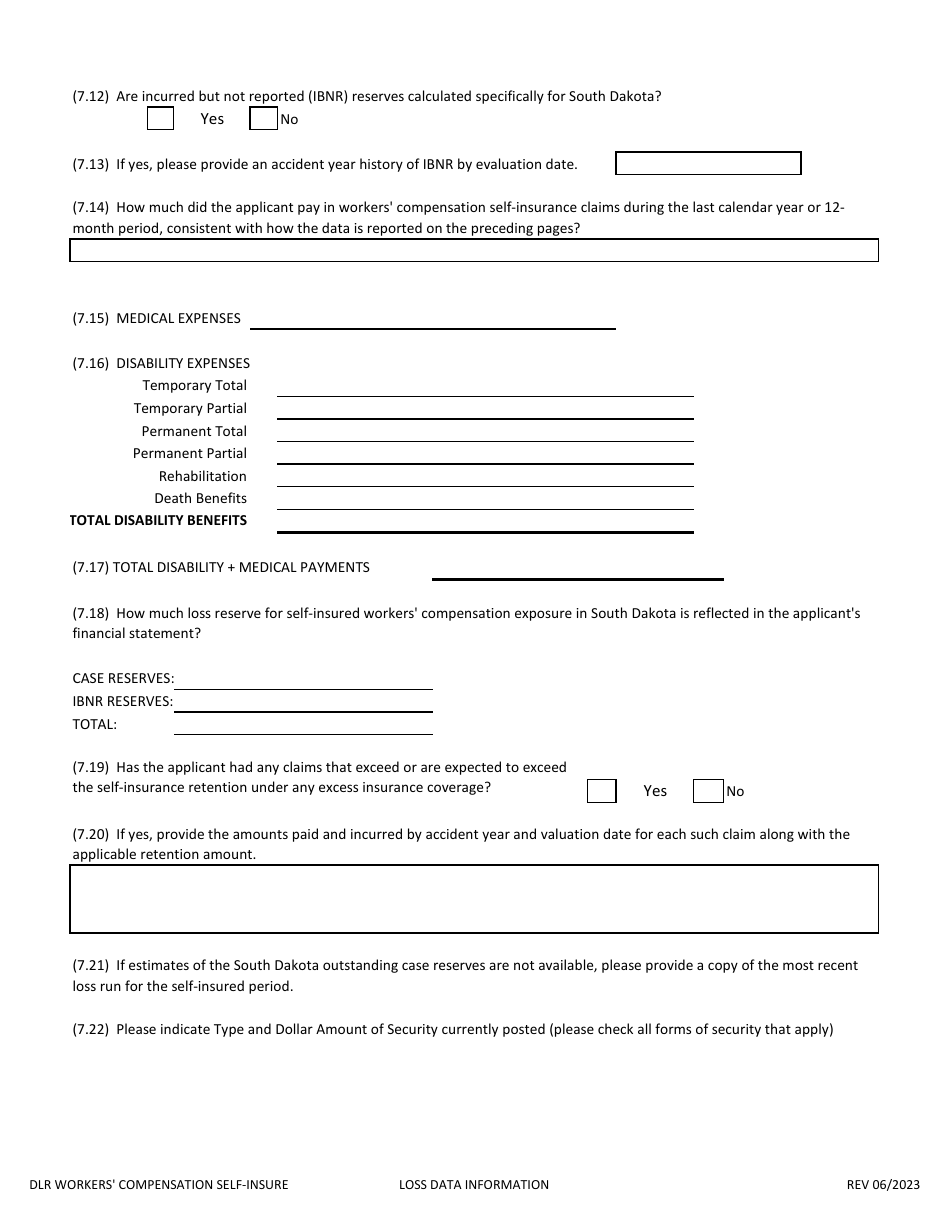

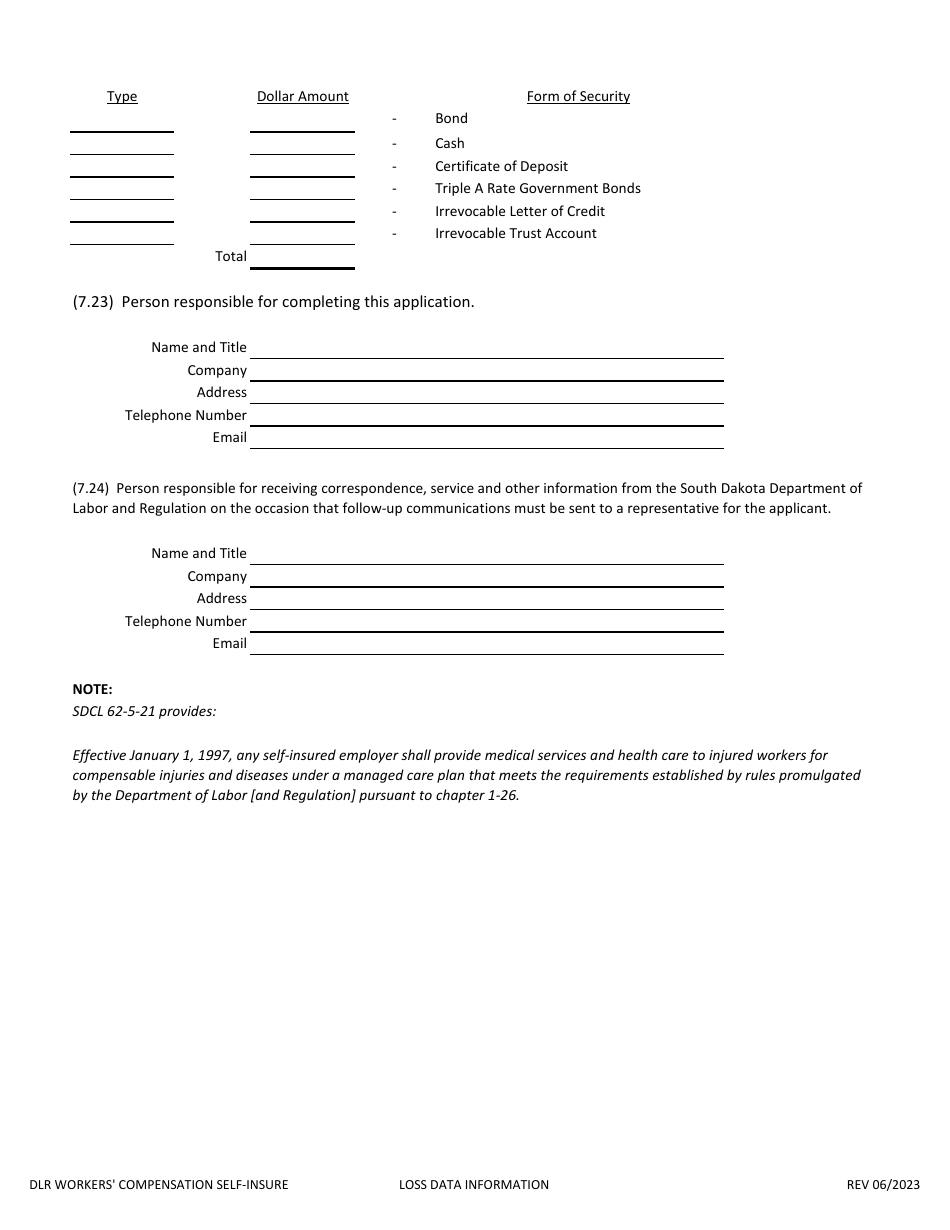

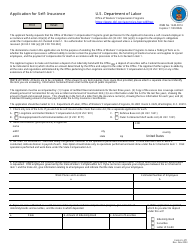

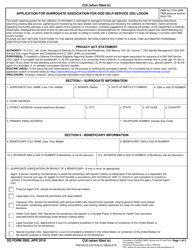

Application to Self-insure Workers' Compensation Liabilities - South Dakota

Application to Self-insure Workers' Compensation Liabilities is a legal document that was released by the South Dakota Department of Labor & Regulation - a government authority operating within South Dakota.

FAQ

Q: What is the Application to Self-insure Workers' Compensation Liabilities?

A: The Application to Self-insure Workers' Compensation Liabilities is a form that allows businesses in South Dakota to apply for permission to self-insure their workers' compensation liabilities.

Q: Why would a business choose to self-insure their workers' compensation liabilities?

A: Businesses choose to self-insure their workers' compensation liabilities to have more control over their claims process, potentially reduce costs, and have flexibility in their coverage.

Q: Who is eligible to apply for self-insurance of workers' compensation liabilities in South Dakota?

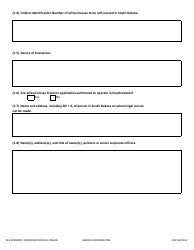

A: Any employer in South Dakota can apply for self-insurance of workers' compensation liabilities, but they must meet certain financial requirements and have a favorable claims history.

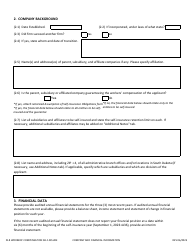

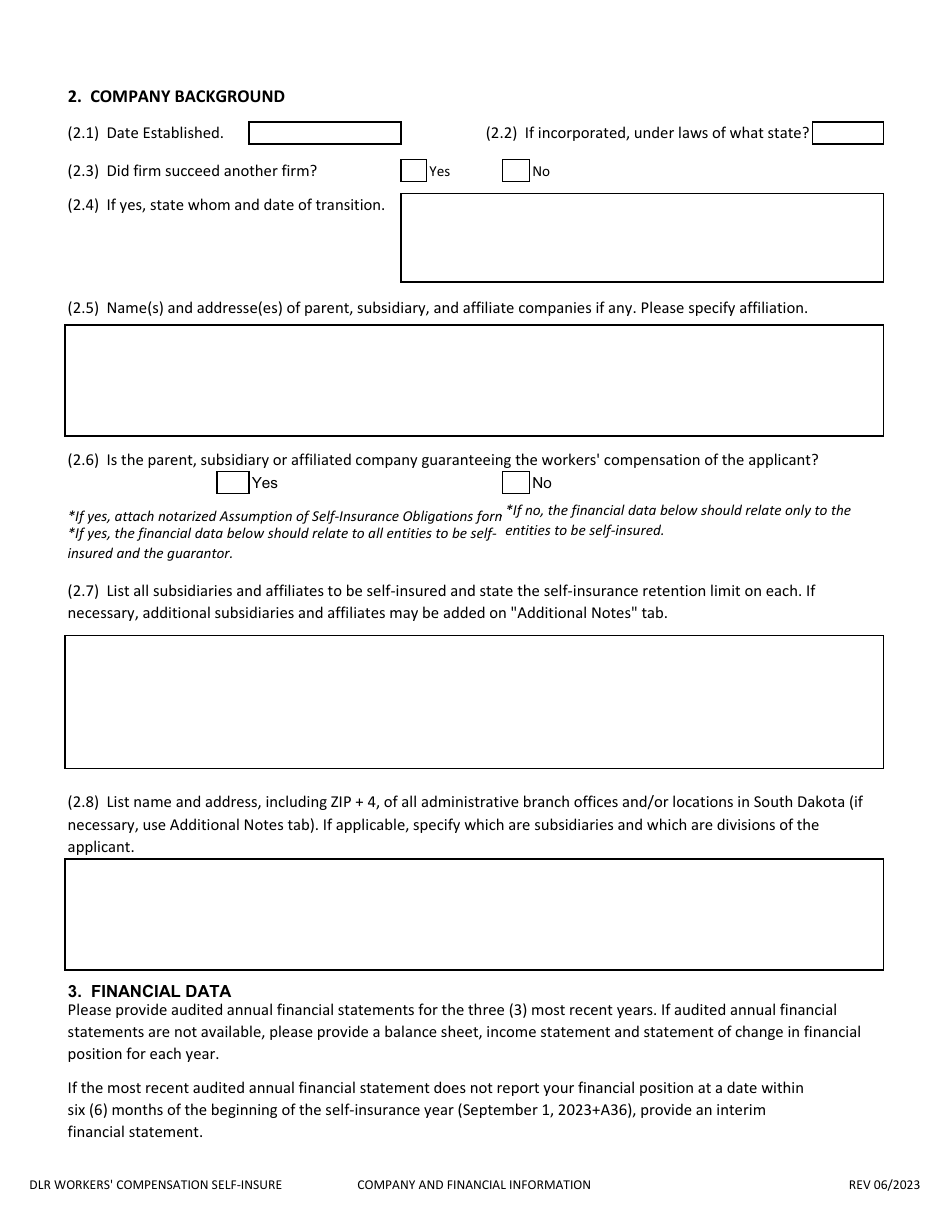

Q: What are the financial requirements for self-insurance of workers' compensation liabilities?

A: To qualify for self-insurance, businesses must have a minimum net worth and tangible net worth, meet certain liquidity requirements, and obtain a surety bond.

Q: What is a surety bond in the context of self-insurance of workers' compensation liabilities?

A: A surety bond is a financial guarantee that ensures the business has the financial resources to cover their workers' compensation liabilities.

Q: How can businesses apply for self-insurance of workers' compensation liabilities?

A: Businesses can apply for self-insurance of workers' compensation liabilities by completing and submitting the Application to Self-insure Workers' Compensation Liabilities form to the South Dakota Department of Labor and Regulation.

Q: What happens after a business applies for self-insurance of workers' compensation liabilities?

A: After the application is submitted, the South Dakota Department of Labor and Regulation will review the application, assess the financial condition of the business, and make a determination on whether to grant self-insurance status.

Q: Are there any ongoing requirements for businesses that are granted self-insurance status?

A: Yes, businesses that are granted self-insurance status must continue to meet the financial requirements, maintain appropriate levels of insurance coverage, and fulfill reporting and record-keeping obligations.

Form Details:

- Released on June 1, 2023;

- The latest edition currently provided by the South Dakota Department of Labor & Regulation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the South Dakota Department of Labor & Regulation.