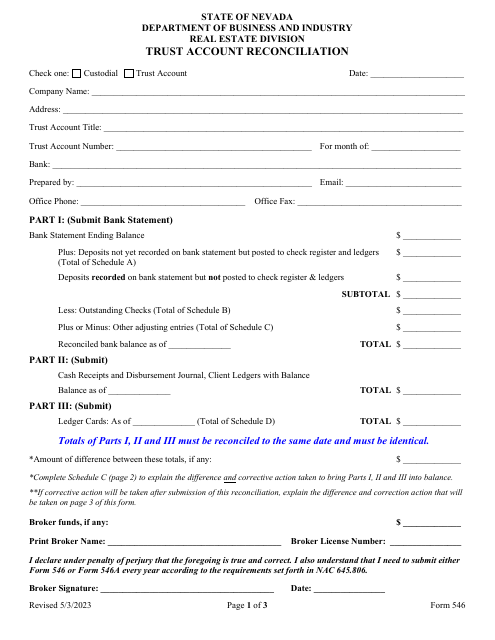

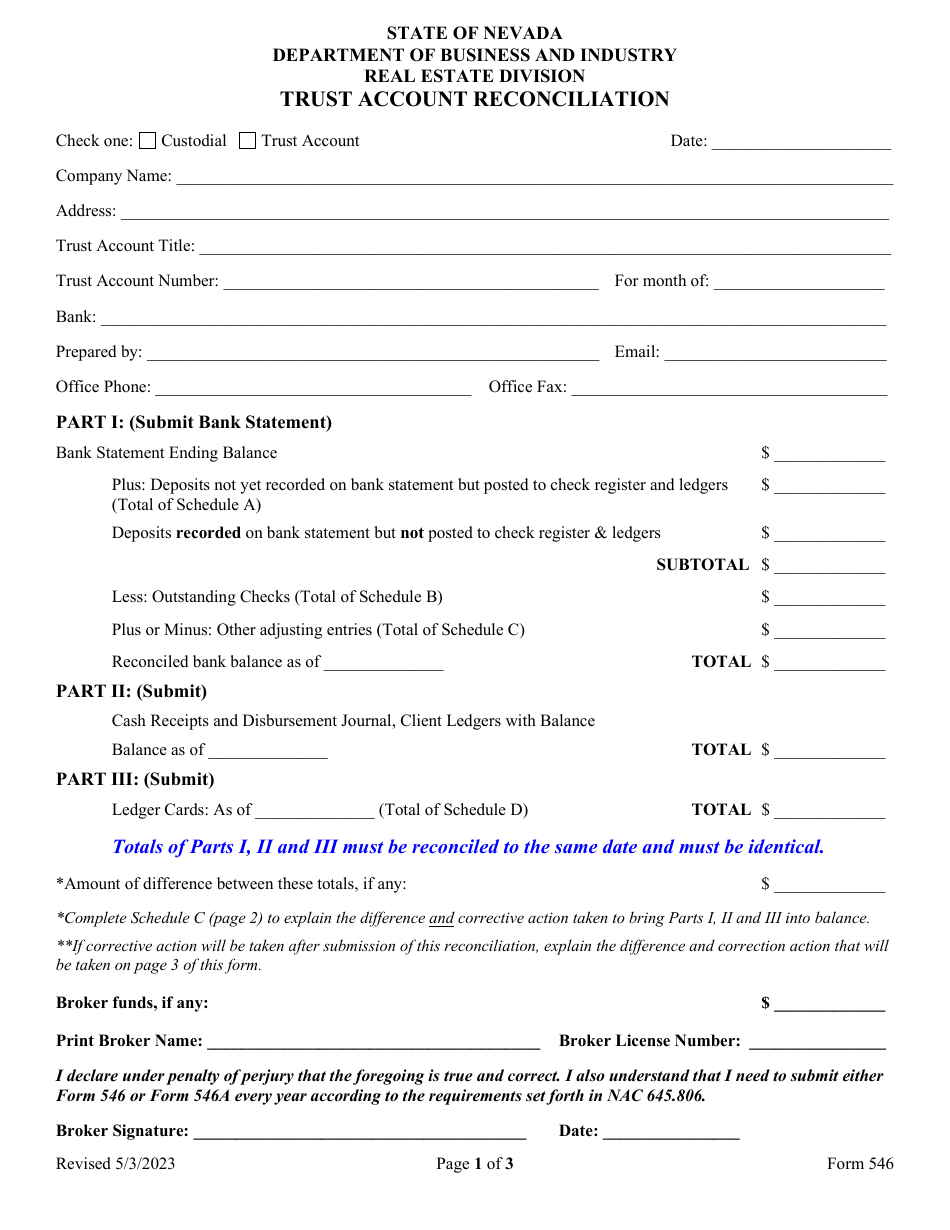

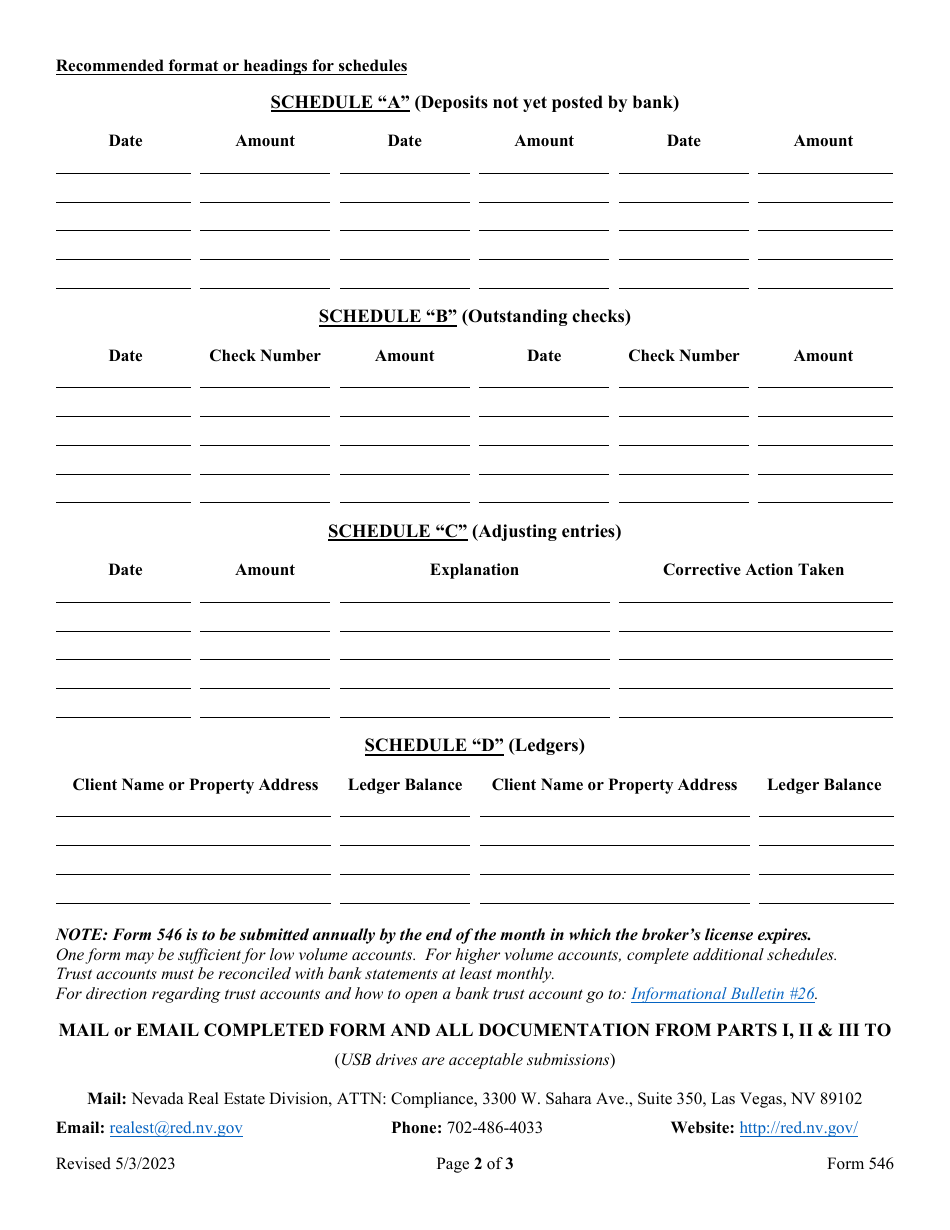

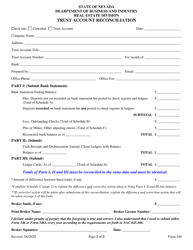

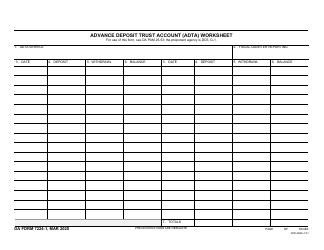

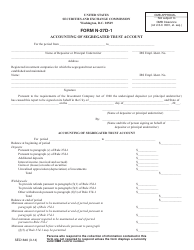

Form 546 Trust Account Reconciliation - Nevada

What Is Form 546?

This is a legal form that was released by the Nevada Department of Business and Industry - Real Estate Division - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 546?

A: Form 546 is a Trust Account Reconciliation form used in Nevada.

Q: Who is required to file Form 546?

A: Individuals or entities that hold trust accounts in Nevada are required to file Form 546.

Q: What is the purpose of Form 546?

A: The purpose of Form 546 is to reconcile the trust account balances and transactions.

Q: When is Form 546 due?

A: Form 546 is due on a quarterly basis, with the deadline falling on the last day of the month following the end of the quarter.

Q: Are there any penalties for late or non-filing of Form 546?

A: Yes, there are penalties for late or non-filing of Form 546, including late filing fees and possible disciplinary action.

Form Details:

- Released on May 3, 2023;

- The latest edition provided by the Nevada Department of Business and Industry - Real Estate Division;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 546 by clicking the link below or browse more documents and templates provided by the Nevada Department of Business and Industry - Real Estate Division.