This version of the form is not currently in use and is provided for reference only. Download this version of

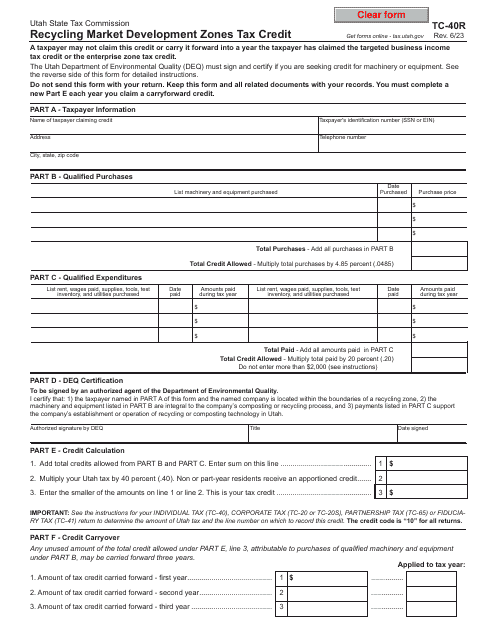

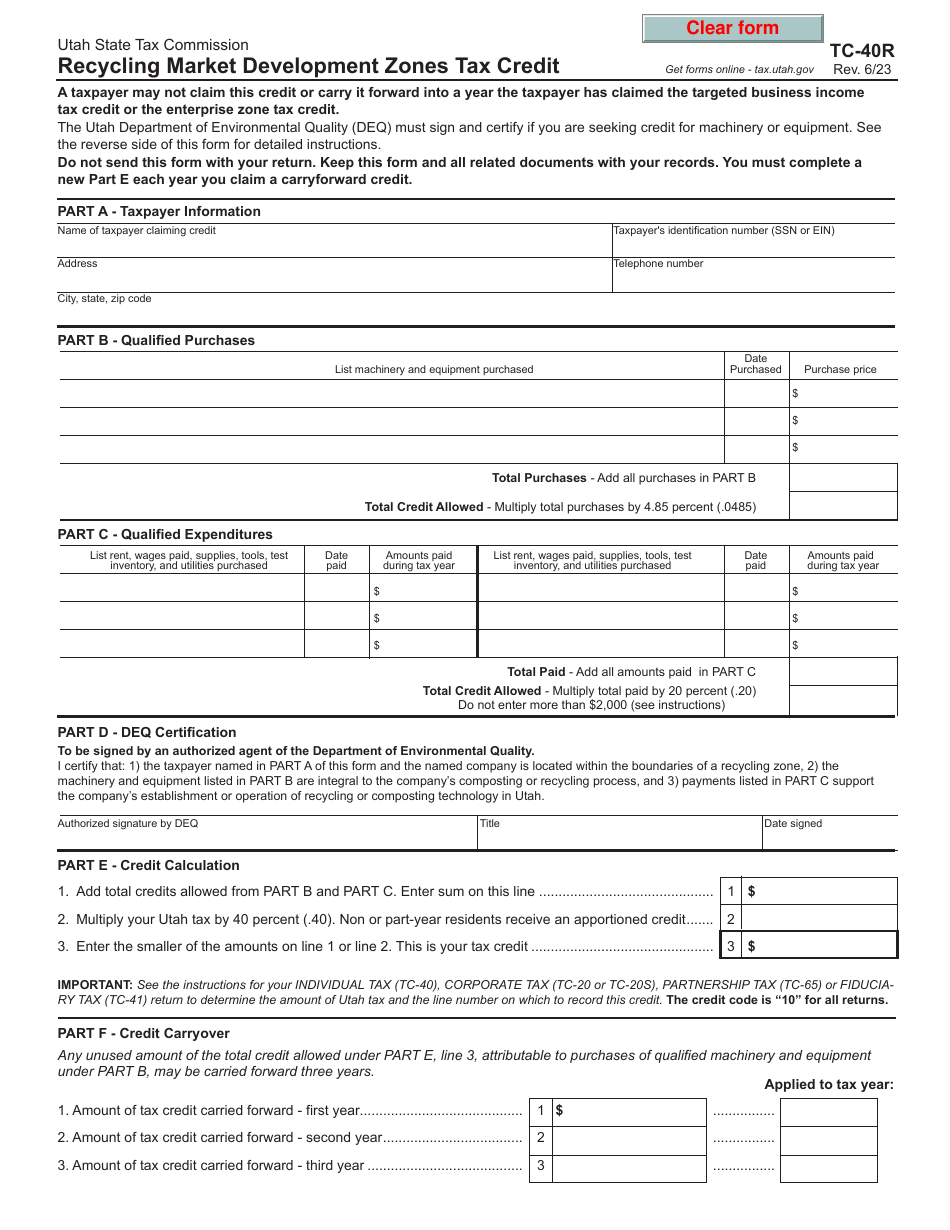

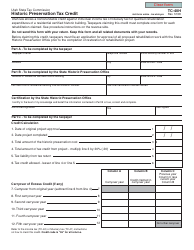

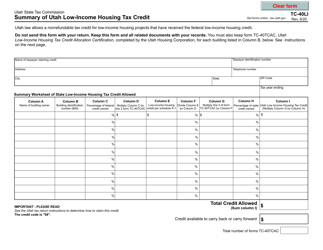

Form TC-40R

for the current year.

Form TC-40R Recycling Market Development Zones Tax Credit - Utah

What Is Form TC-40R?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-40R?

A: Form TC-40R is a tax form used in Utah for claiming the Recycling Market Development Zones Tax Credit.

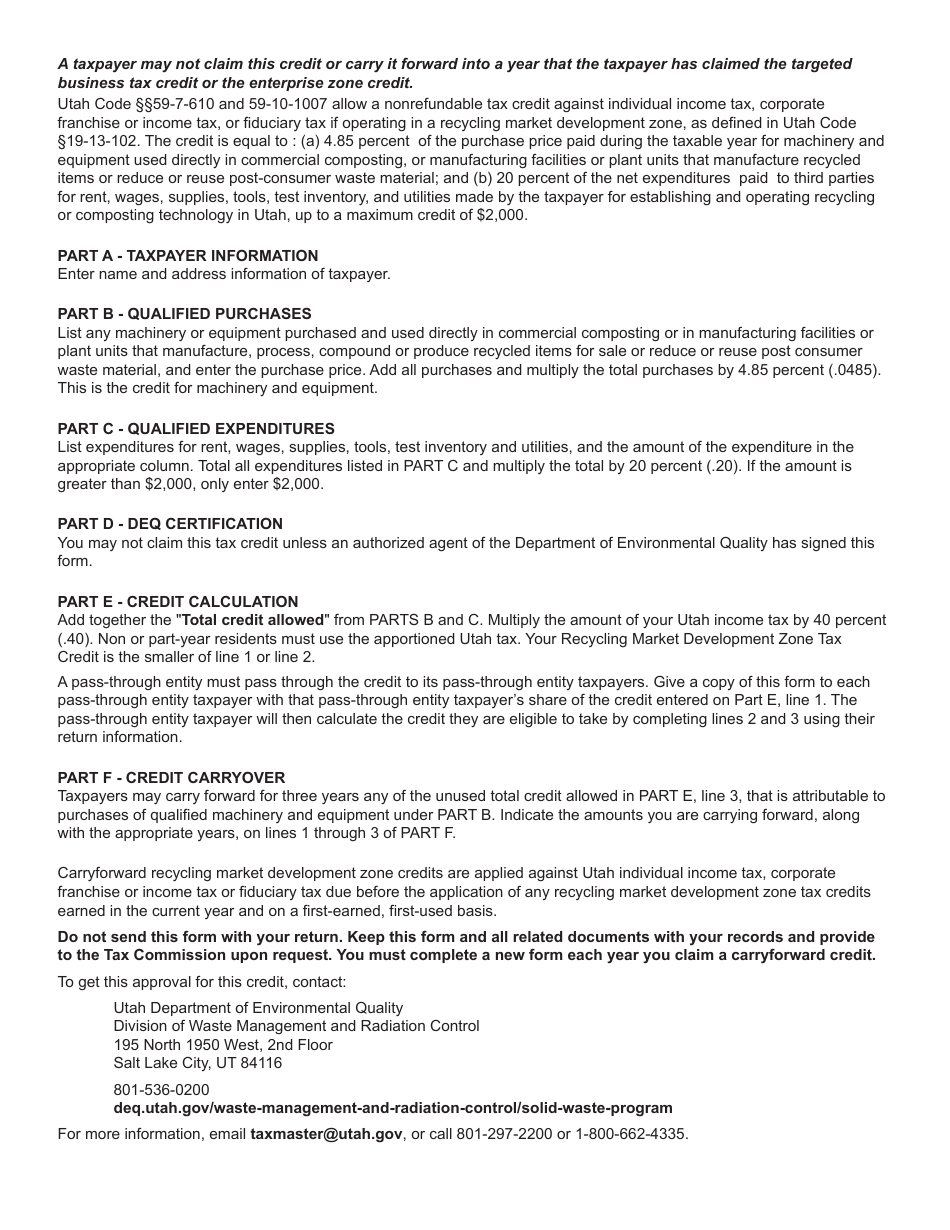

Q: What is the Recycling Market Development Zones Tax Credit?

A: The Recycling Market Development Zones Tax Credit is a tax credit available in Utah for businesses engaged in recycling activities in designated zones.

Q: How do I qualify for the Recycling Market Development Zones Tax Credit?

A: To qualify for the tax credit, you must be a business that operates within a designated recycling market development zone in Utah and engages in eligible recycling activities.

Q: What are eligible recycling activities?

A: Eligible recycling activities include the collection, processing, manufacturing, and sale of recyclable materials.

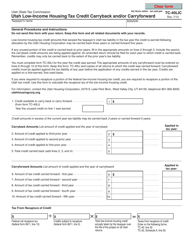

Q: How much is the tax credit?

A: The amount of the tax credit is based on the value of the qualified recycled material and ranges from $2 to $4 per ton.

Q: How do I claim the tax credit?

A: You can claim the tax credit by completing and filing Form TC-40R with the Utah State Tax Commission.

Q: Is there a deadline for claiming the tax credit?

A: Yes, the deadline for claiming the tax credit is the same as the deadline for filing your annual state tax return.

Q: Are there any additional requirements for claiming the tax credit?

A: Yes, you must also submit supporting documentation such as recycling receipts and proof of compliance with applicable laws and regulations.

Q: Can I carry forward any unused tax credit?

A: Yes, any unused tax credit can be carried forward for up to three years.

Form Details:

- Released on June 1, 2023;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-40R by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.