This version of the form is not currently in use and is provided for reference only. Download this version of

Form ND-1ES (SFN28709)

for the current year.

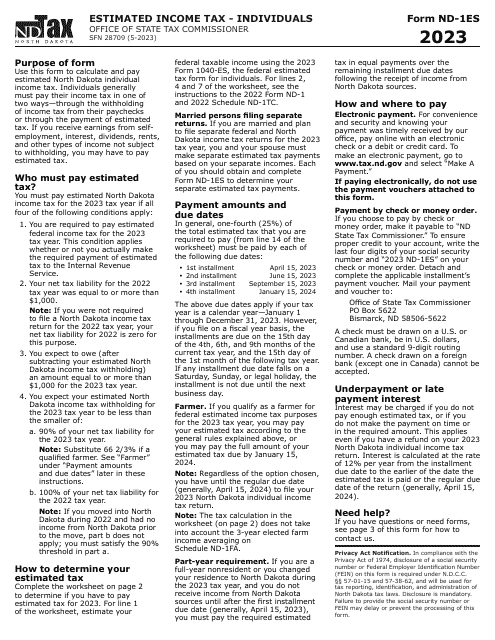

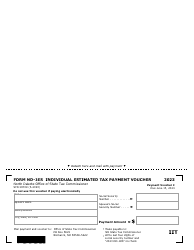

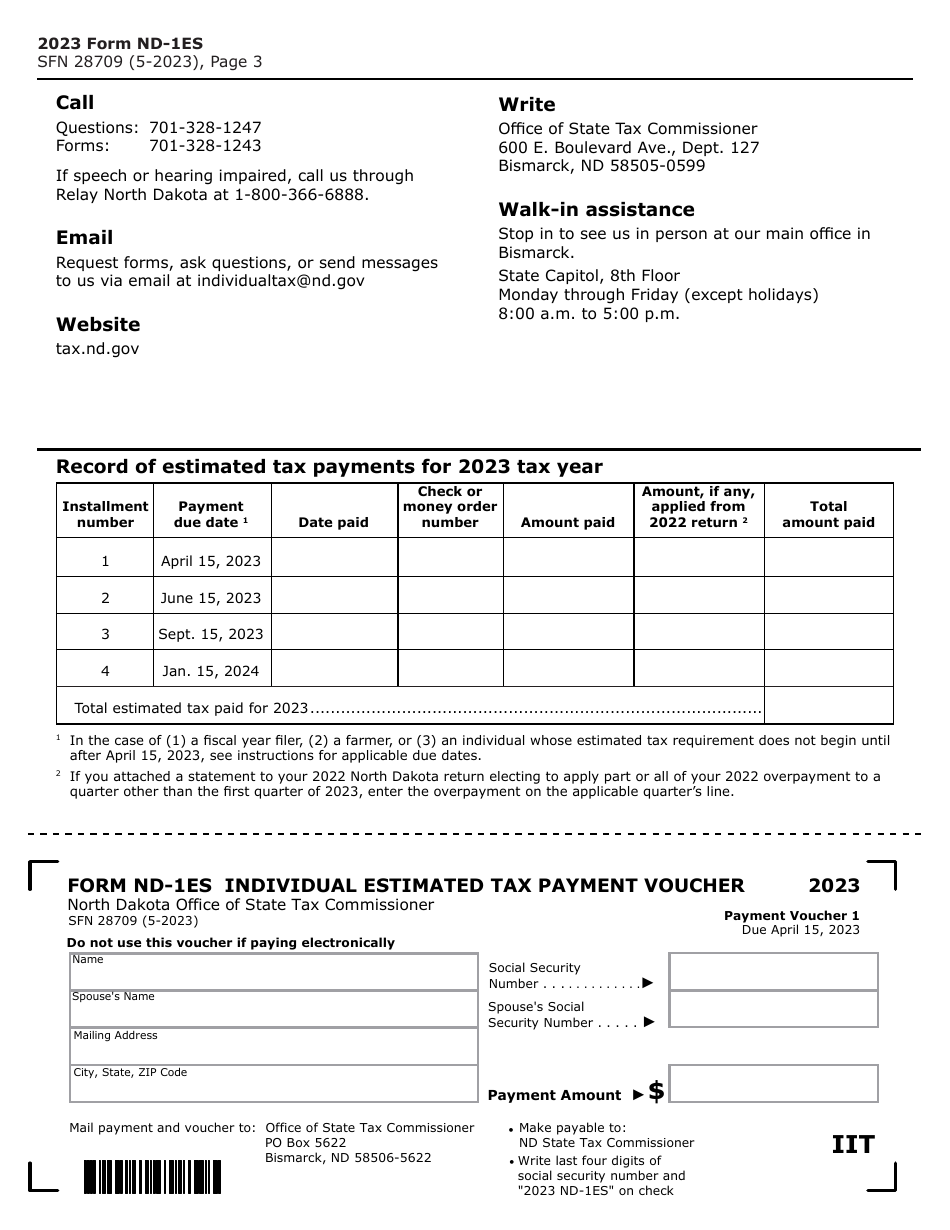

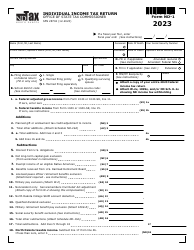

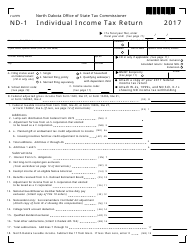

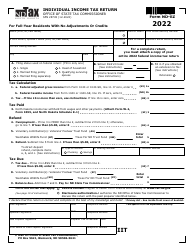

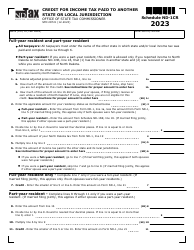

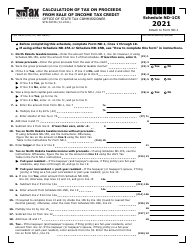

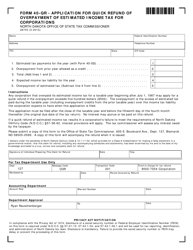

Form ND-1ES (SFN28709) Estimated Income Tax - Individuals - North Dakota

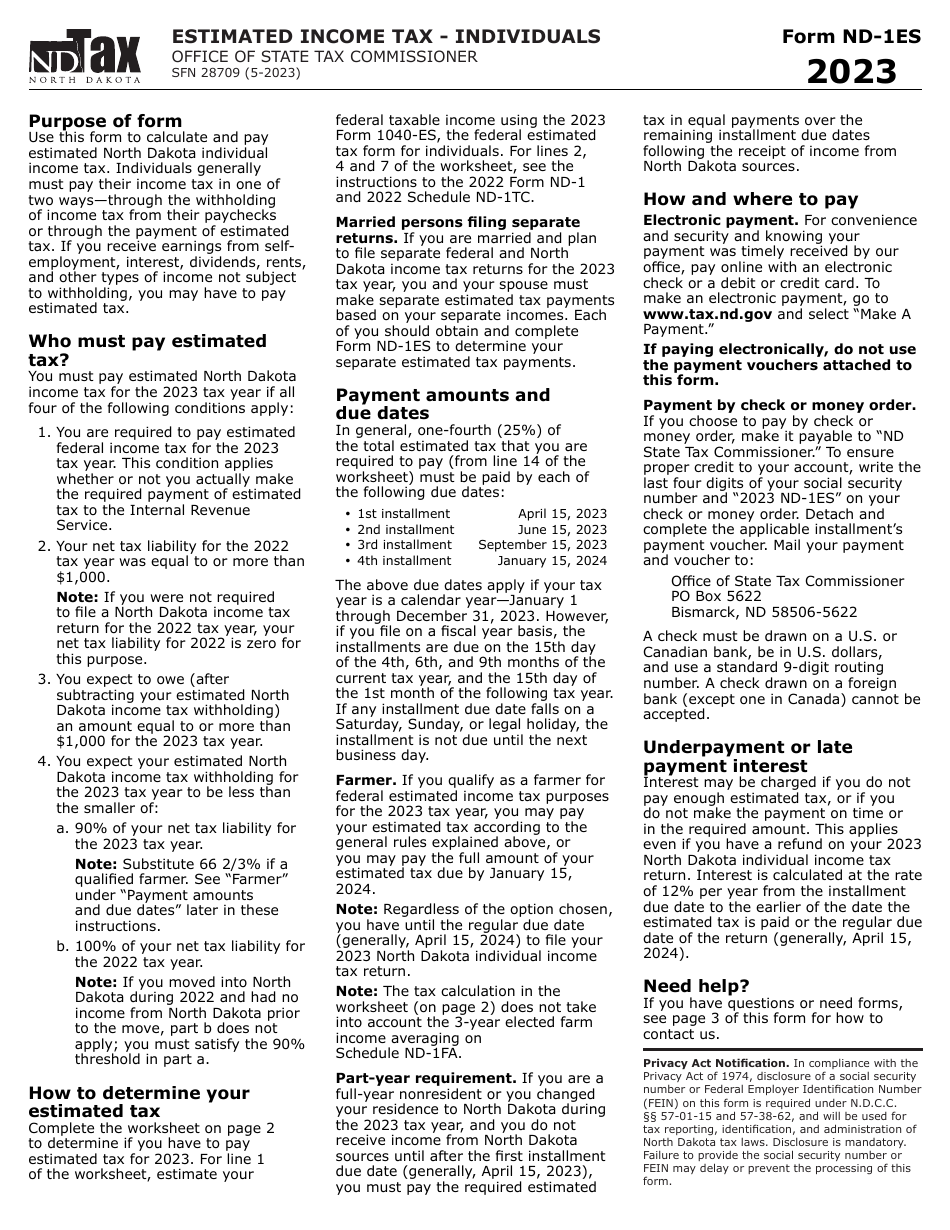

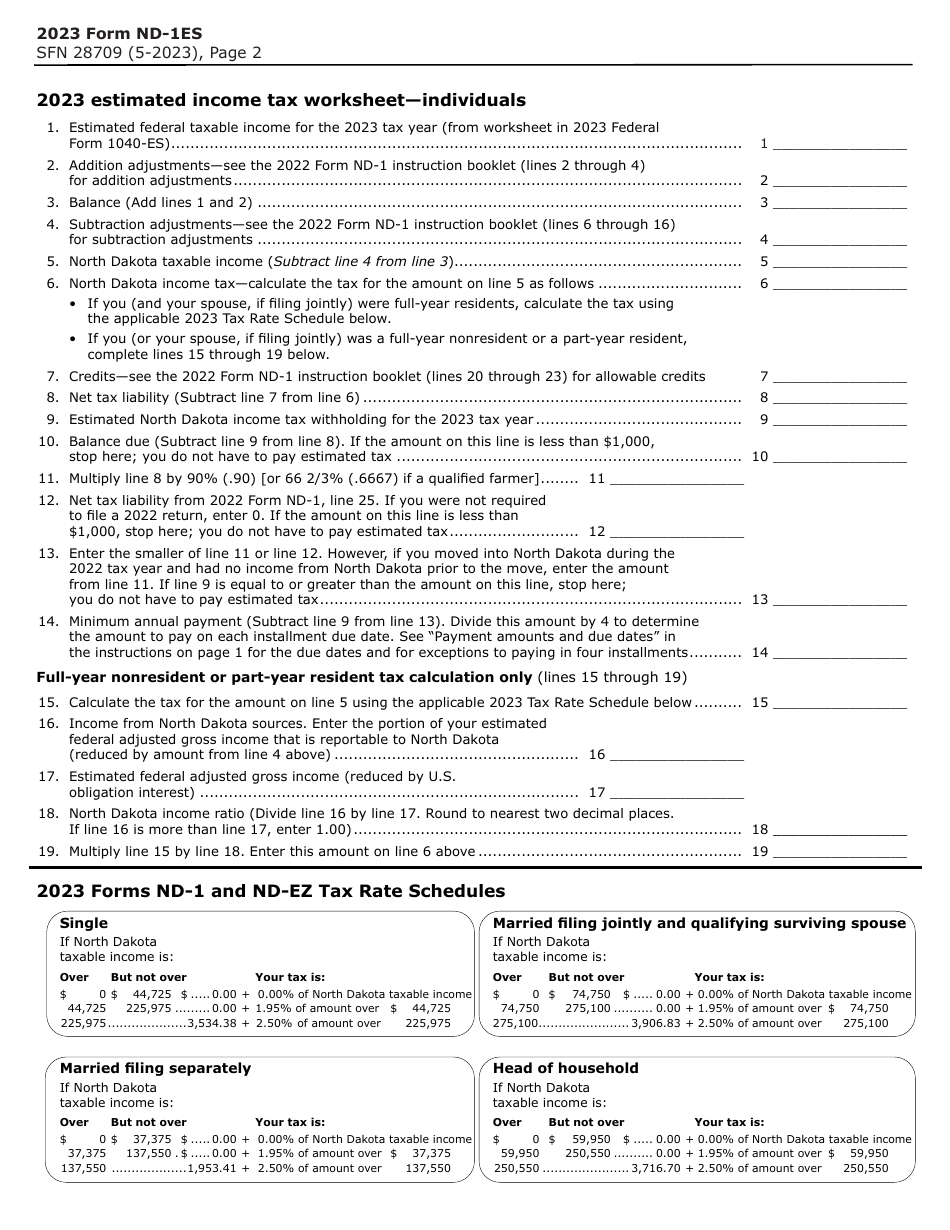

What Is Form ND-1ES (SFN28709)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ND-1ES?

A: Form ND-1ES is an Estimated Income Tax form for individuals in North Dakota.

Q: What is the purpose of Form ND-1ES?

A: The purpose of Form ND-1ES is to calculate and pay estimated income tax for the current tax year.

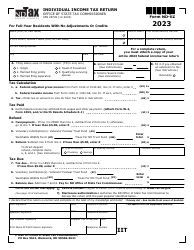

Q: Who needs to file Form ND-1ES?

A: Anyone who expects to owe $500 or more in income tax for the current tax year should file Form ND-1ES.

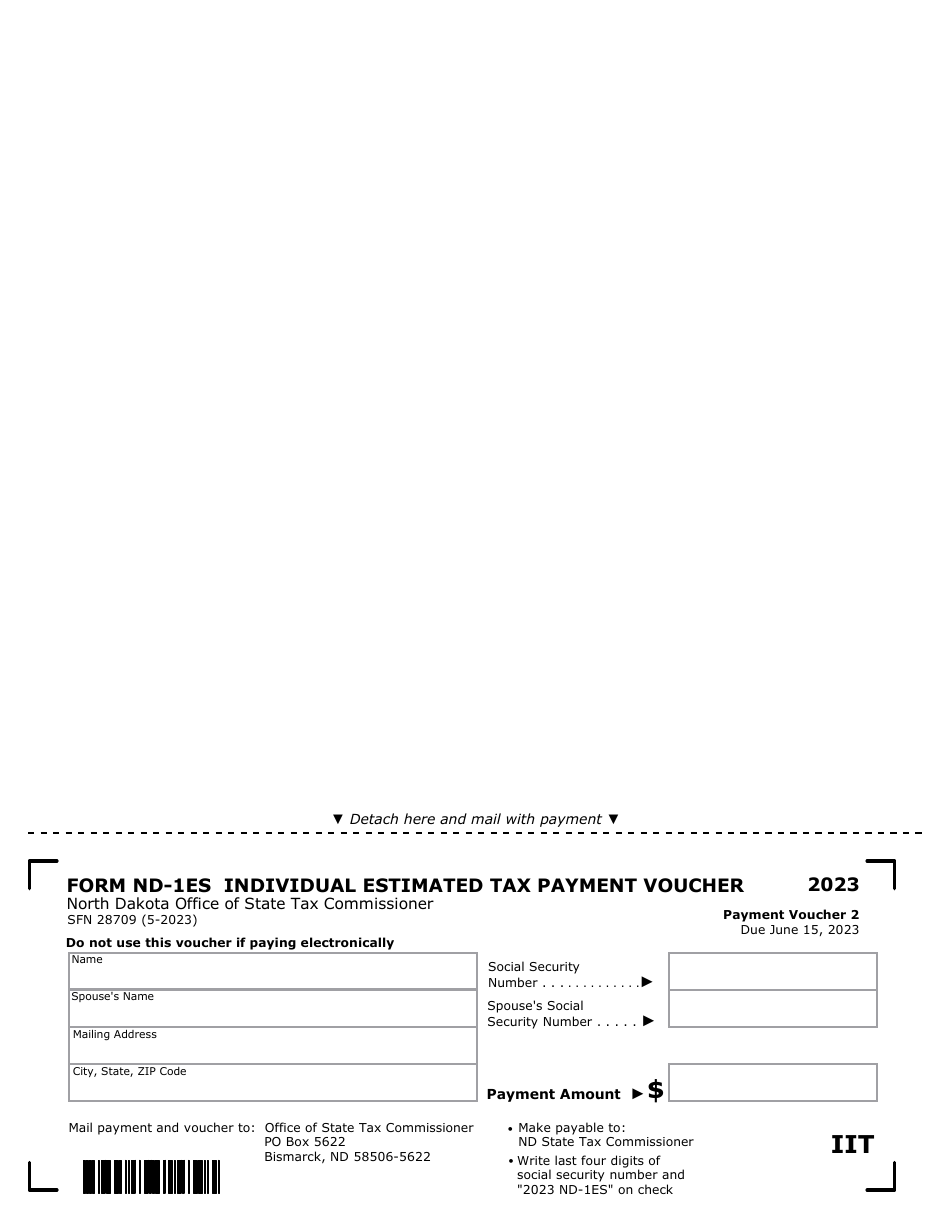

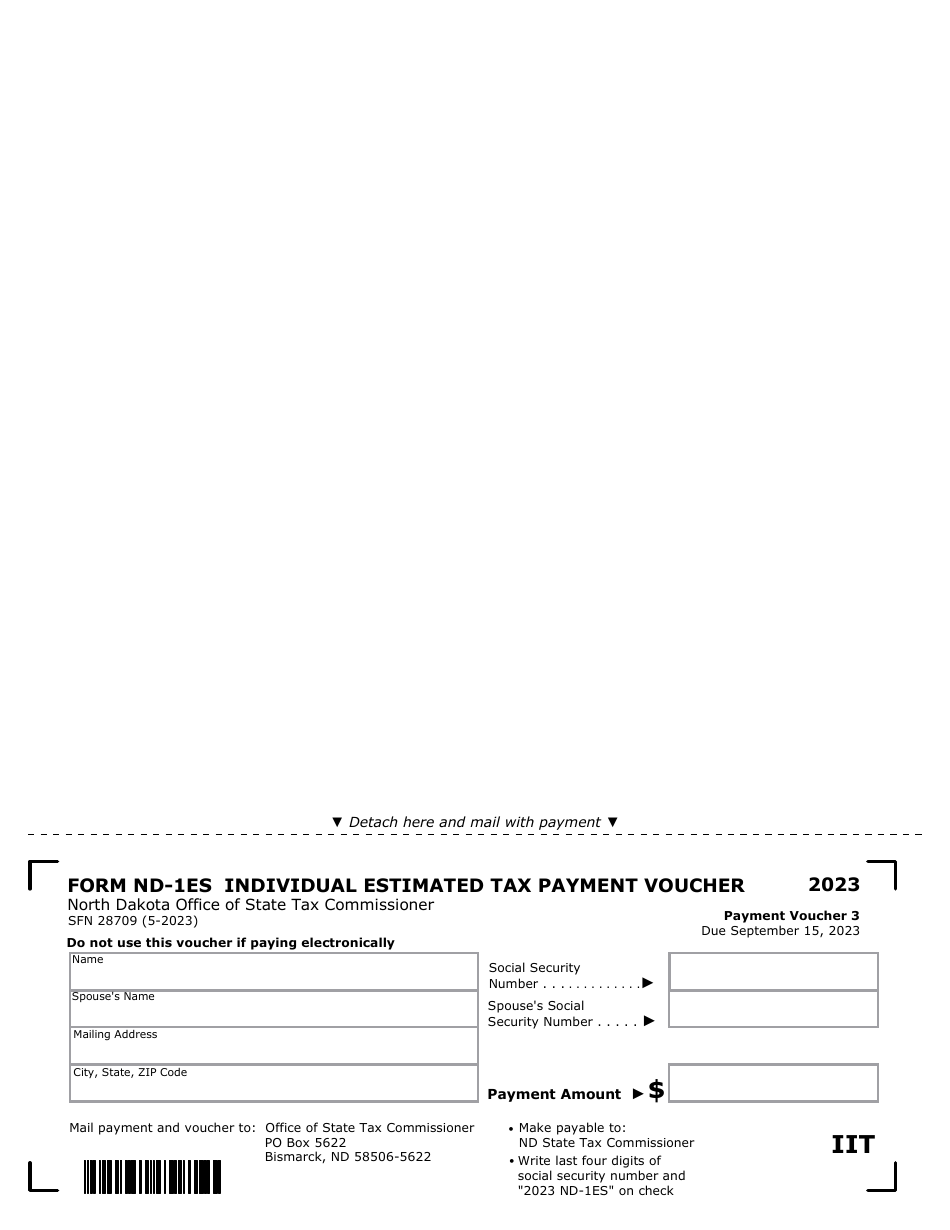

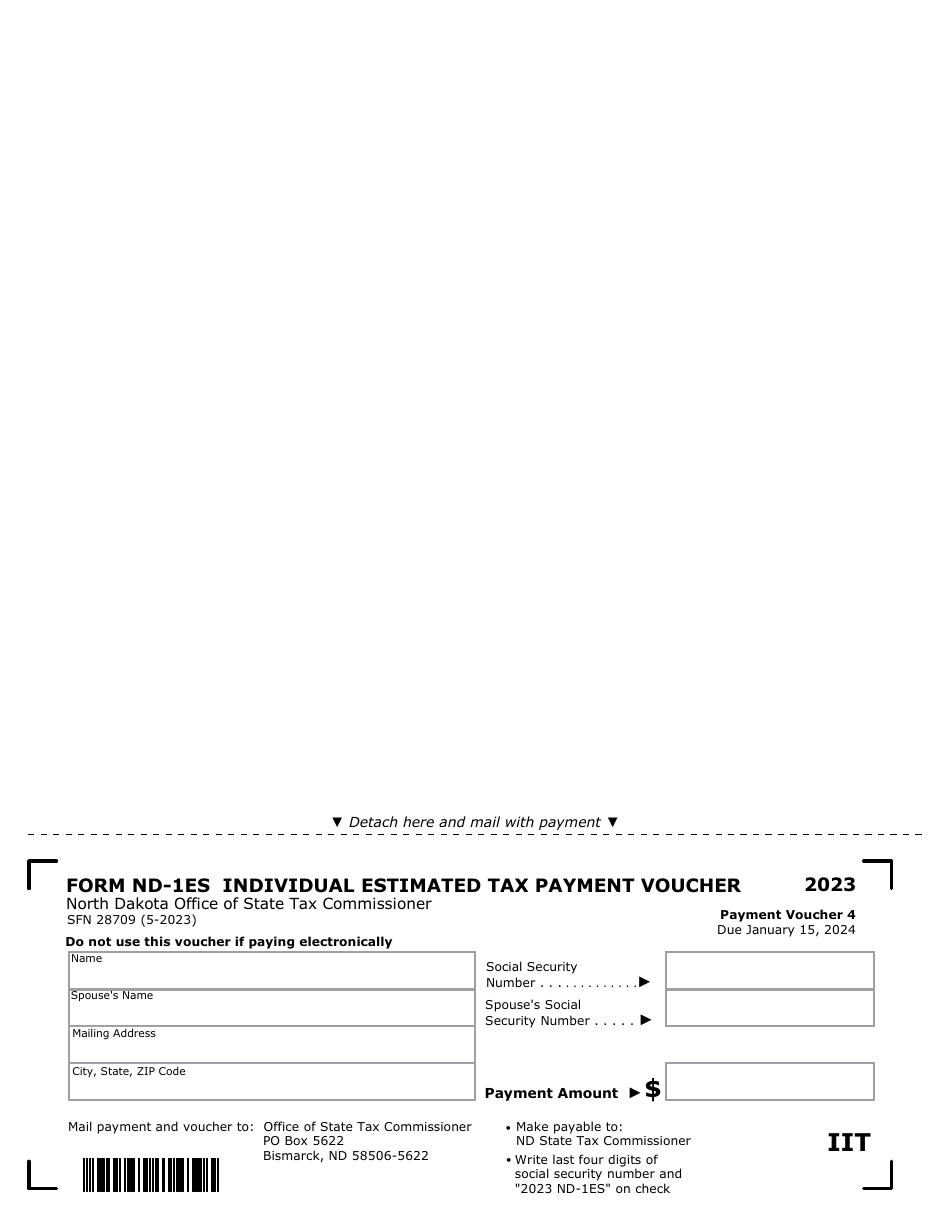

Q: When is Form ND-1ES due?

A: Form ND-1ES is generally due and payable in four equal installments on April 15, June 15, September 15, and January 15 of the following year.

Form Details:

- Released on May 1, 2023;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ND-1ES (SFN28709) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.