This version of the form is not currently in use and is provided for reference only. Download this version of

Form 38-ES (SFN28723)

for the current year.

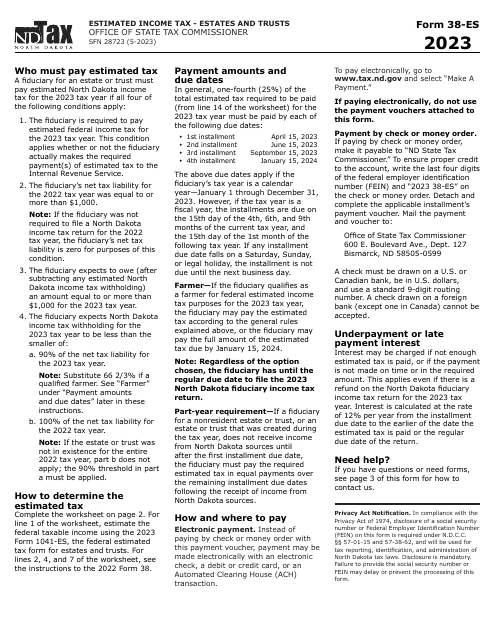

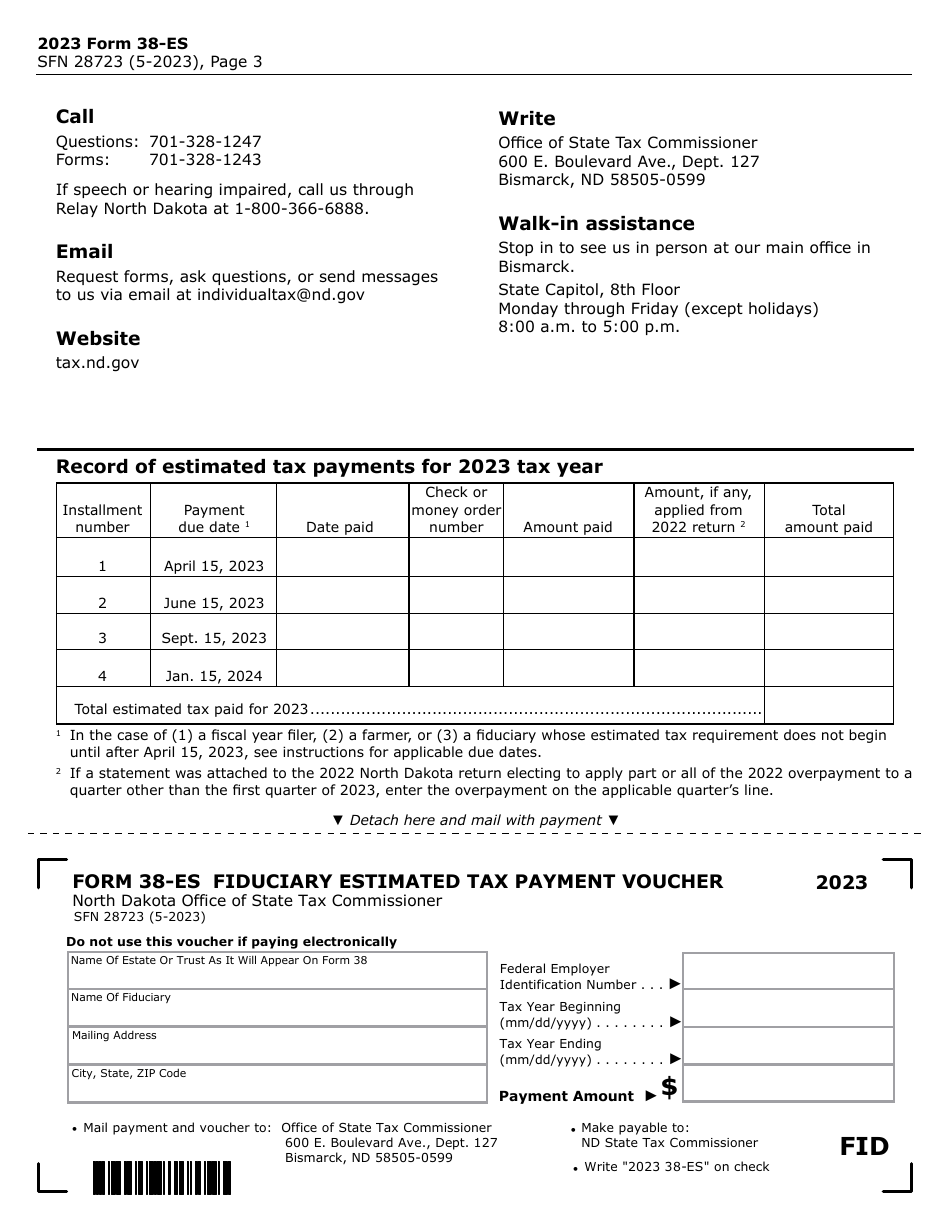

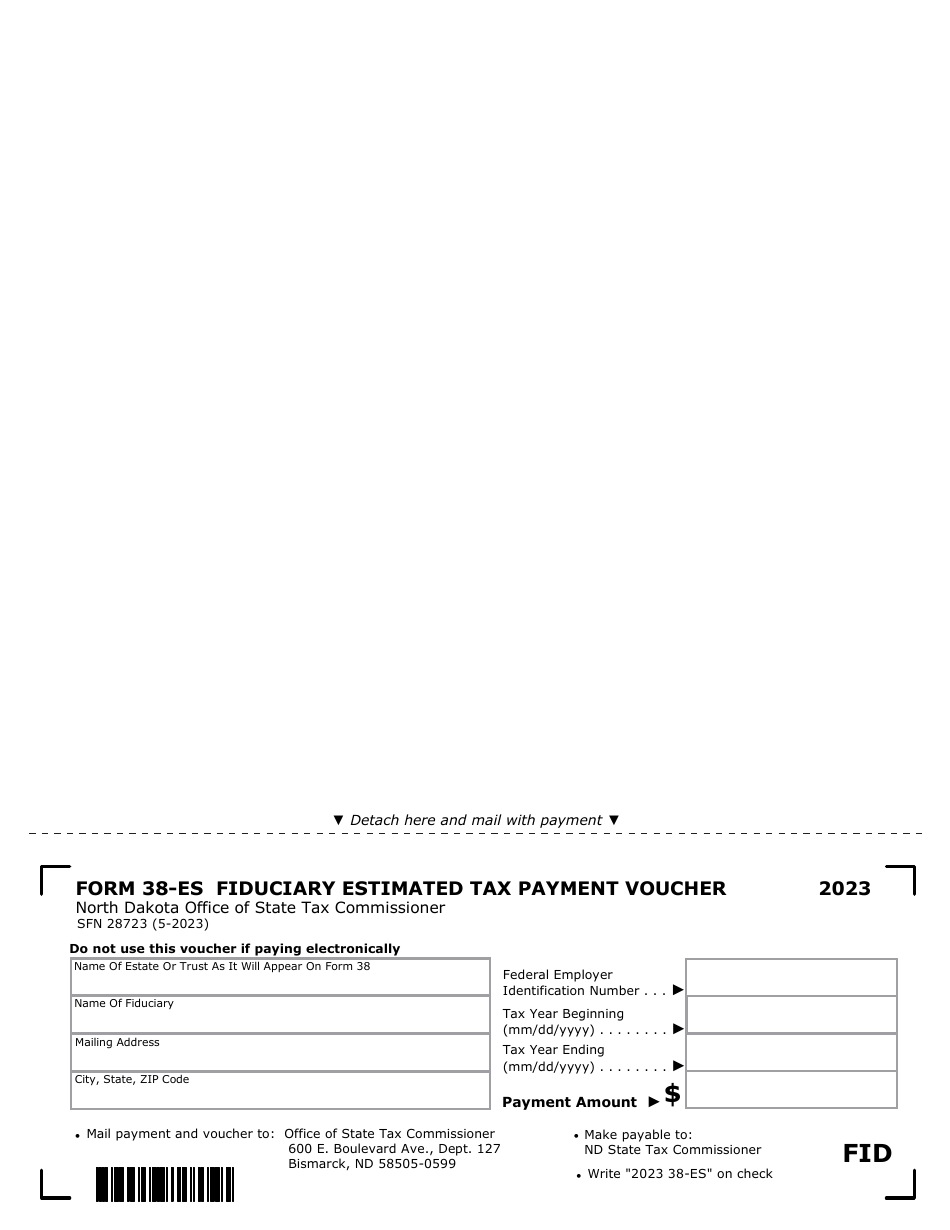

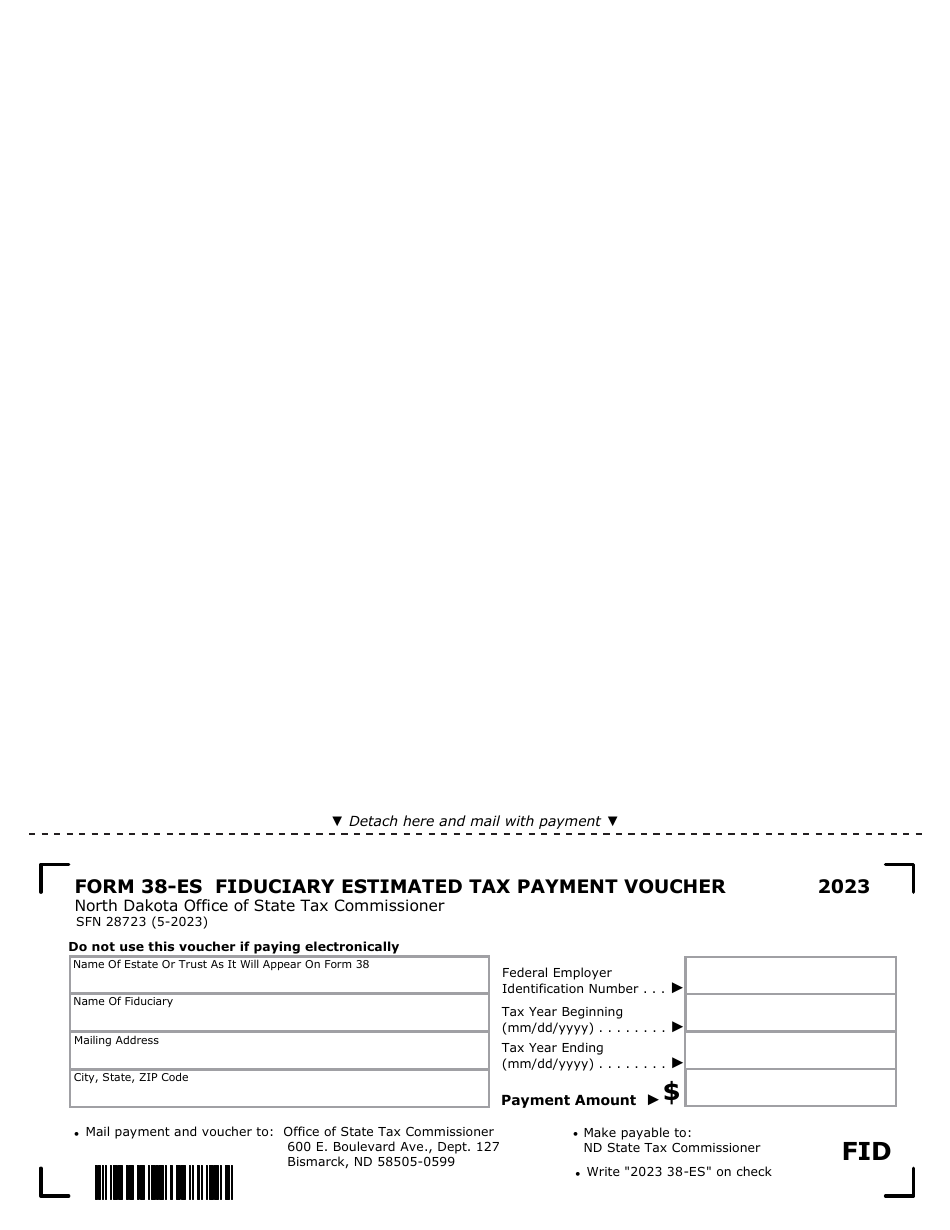

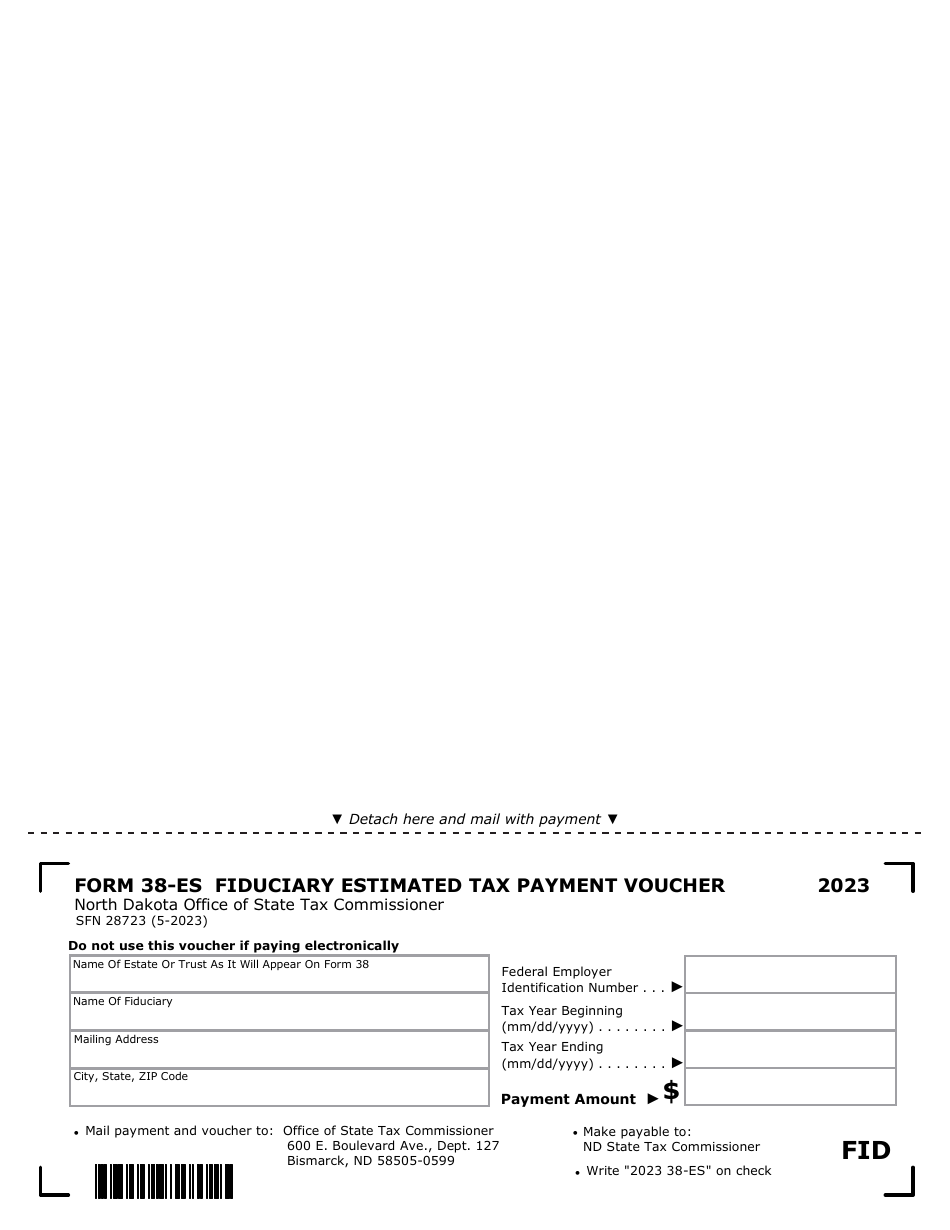

Form 38-ES (SFN28723) Estimated Income Tax - Estates and Trusts - North Dakota

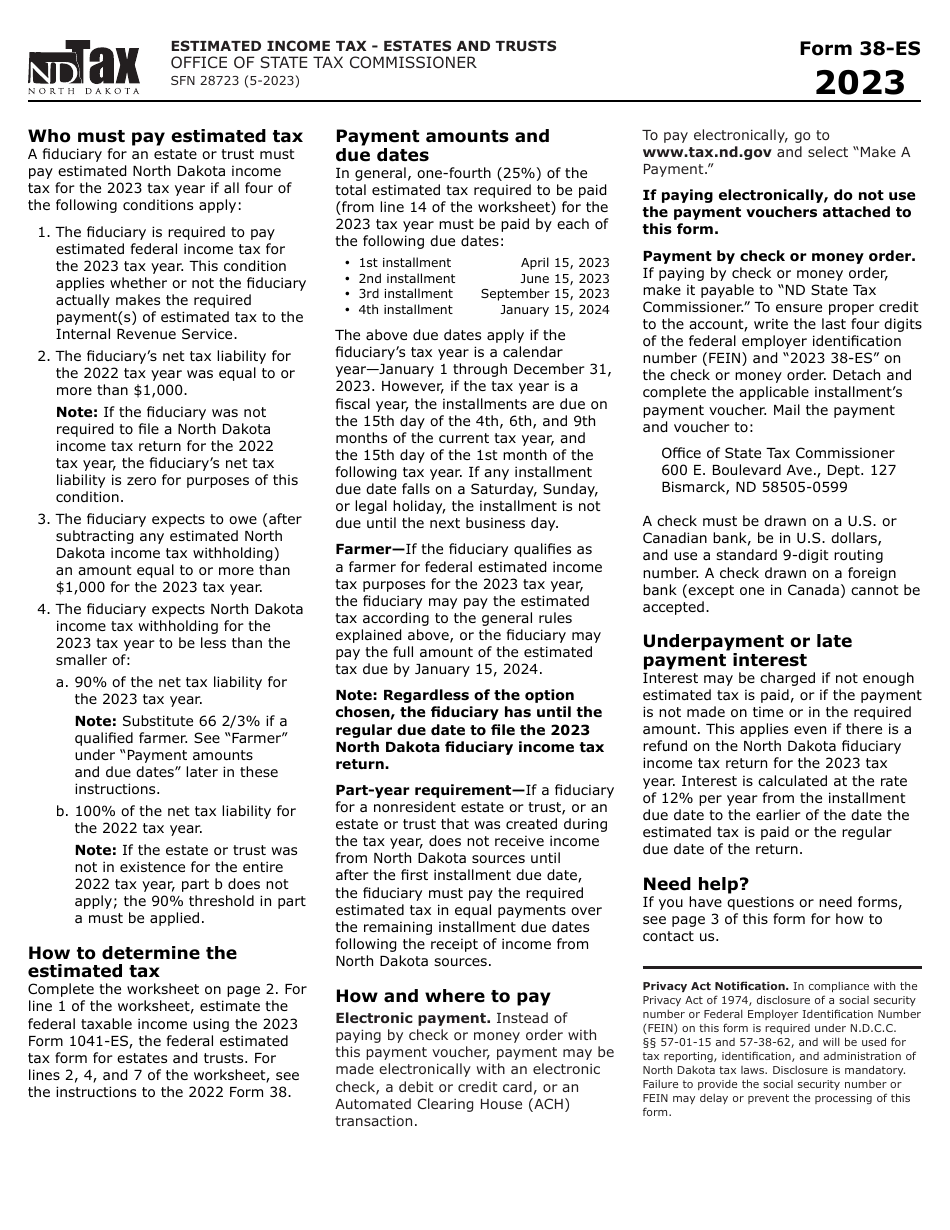

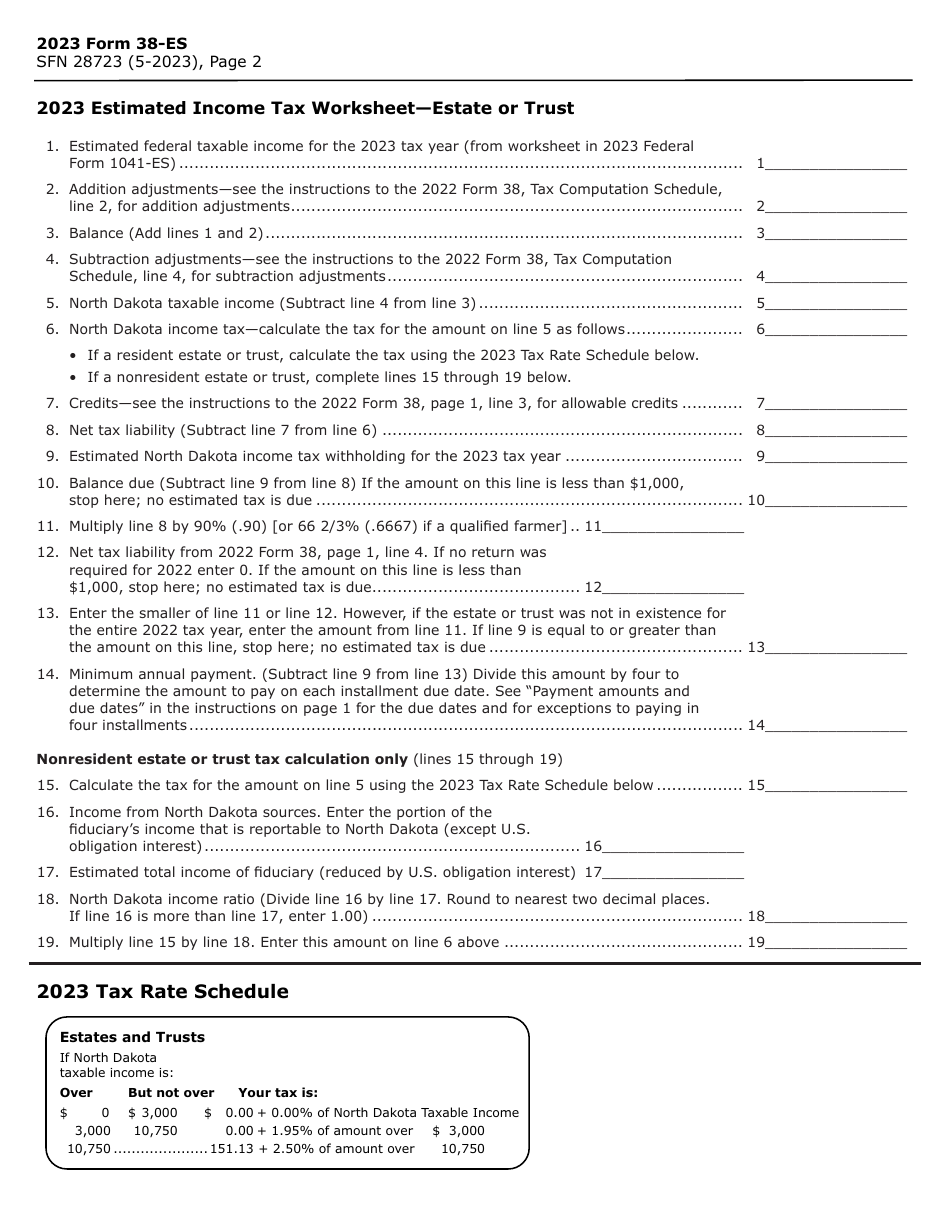

What Is Form 38-ES (SFN28723)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 38-ES (SFN28723)?

A: Form 38-ES (SFN28723) is a form used for estimating income tax for estates and trusts in North Dakota.

Q: Who needs to use Form 38-ES (SFN28723)?

A: Estates and trusts in North Dakota that need to estimate their income tax liability should use Form 38-ES (SFN28723).

Q: What is the purpose of Form 38-ES (SFN28723)?

A: The purpose of Form 38-ES (SFN28723) is to help estates and trusts in North Dakota estimate their income tax liability and make quarterly estimated tax payments.

Q: When is Form 38-ES (SFN28723) due?

A: Form 38-ES (SFN28723) must be filed and the first quarterly estimated tax payment must be made on or before April 15th of the tax year.

Q: Are there penalties for not filing Form 38-ES (SFN28723)?

A: Yes, estates and trusts that are required to file Form 38-ES (SFN28723) but fail to do so may be subject to penalties and interest on underpaid estimated tax.

Form Details:

- Released on May 1, 2023;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 38-ES (SFN28723) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.