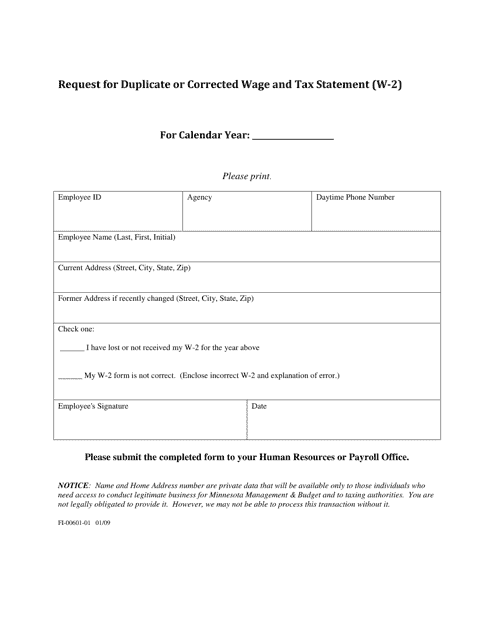

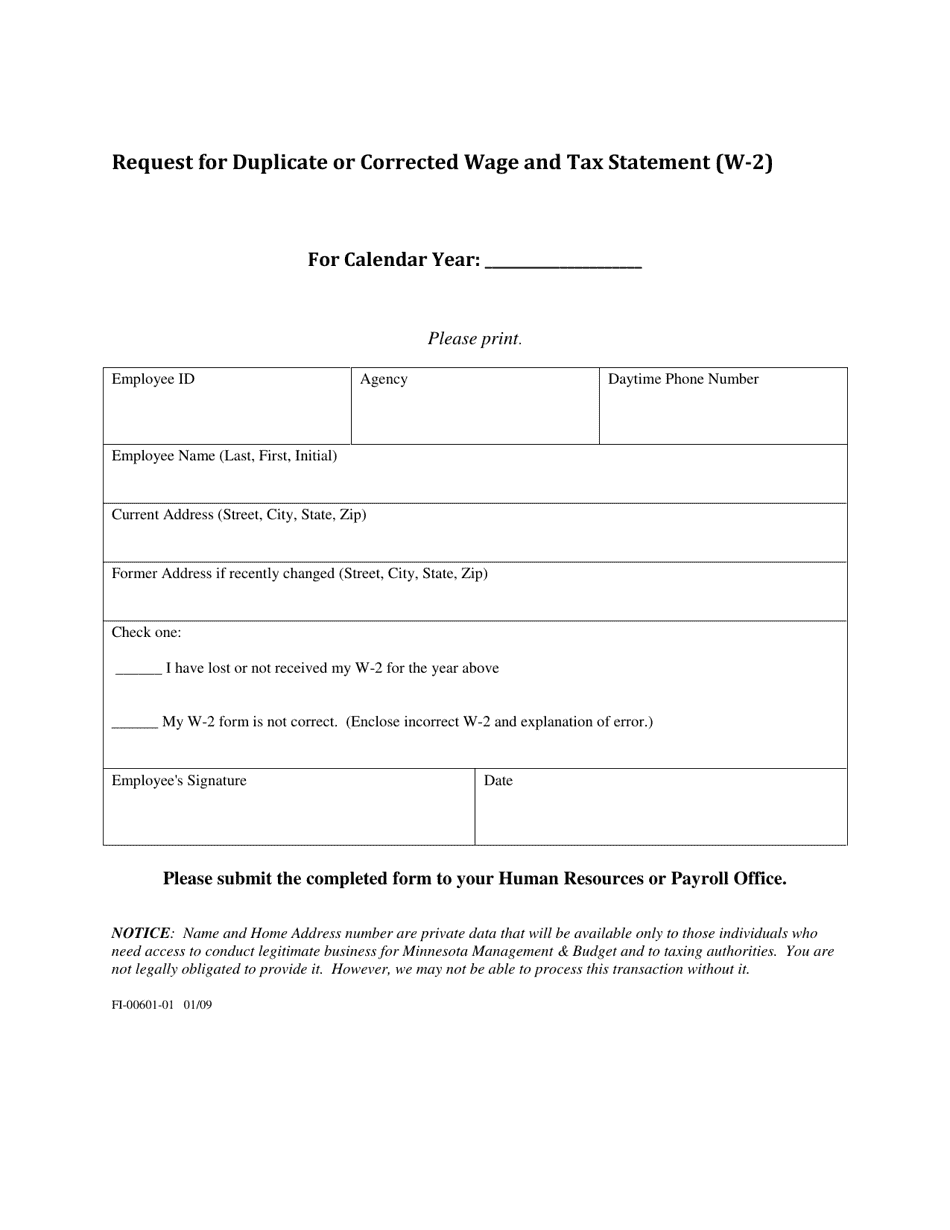

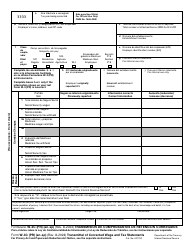

Form FI-00601-01 Request for Duplicate or Corrected Wage and Tax Statement (W-2) - Minnesota

What Is Form FI-00601-01?

This is a legal form that was released by the Minnesota Management and Budget - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FI-00601-01?

A: Form FI-00601-01 is the Request for Duplicate or Corrected Wage and Tax Statement (W-2) specific to Minnesota.

Q: What is a Wage and Tax Statement (W-2)?

A: A Wage and Tax Statement (W-2) is a form that summarizes an employee's earnings and tax withholdings for a specific year.

Q: Why would I need a duplicate or corrected W-2?

A: You may need a duplicate or corrected W-2 if the original form is lost, incorrect, or incomplete.

Q: Who can use Form FI-00601-01?

A: Form FI-00601-01 is specifically for individuals who need a duplicate or corrected W-2 for Minnesota.

Q: Is there a deadline to submit Form FI-00601-01?

A: There is no specific deadline to submit Form FI-00601-01, but it is recommended to do so as soon as possible.

Q: What information do I need to provide on Form FI-00601-01?

A: You will need to provide your personal information, the tax year for the W-2, details of the original form, and the reason for requesting a duplicate or correction.

Q: Is there a fee for requesting a duplicate or corrected W-2?

A: There is currently no fee for requesting a duplicate or corrected W-2 in Minnesota.

Q: How long does it take to process Form FI-00601-01?

A: The processing time for Form FI-00601-01 may vary, but you can expect it to take a few weeks.

Q: What should I do with the duplicate or corrected W-2 once I receive it?

A: Once you receive the duplicate or corrected W-2, you should review it for accuracy and use it for tax filing purposes if necessary.

Form Details:

- Released on January 1, 2009;

- The latest edition provided by the Minnesota Management and Budget;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FI-00601-01 by clicking the link below or browse more documents and templates provided by the Minnesota Management and Budget.