This version of the form is not currently in use and is provided for reference only. Download this version of

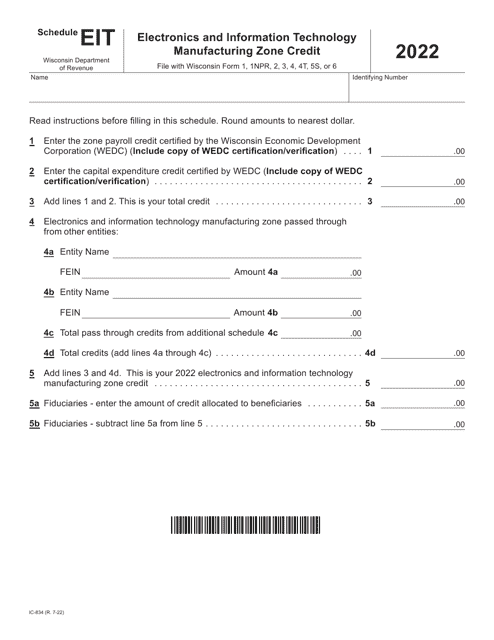

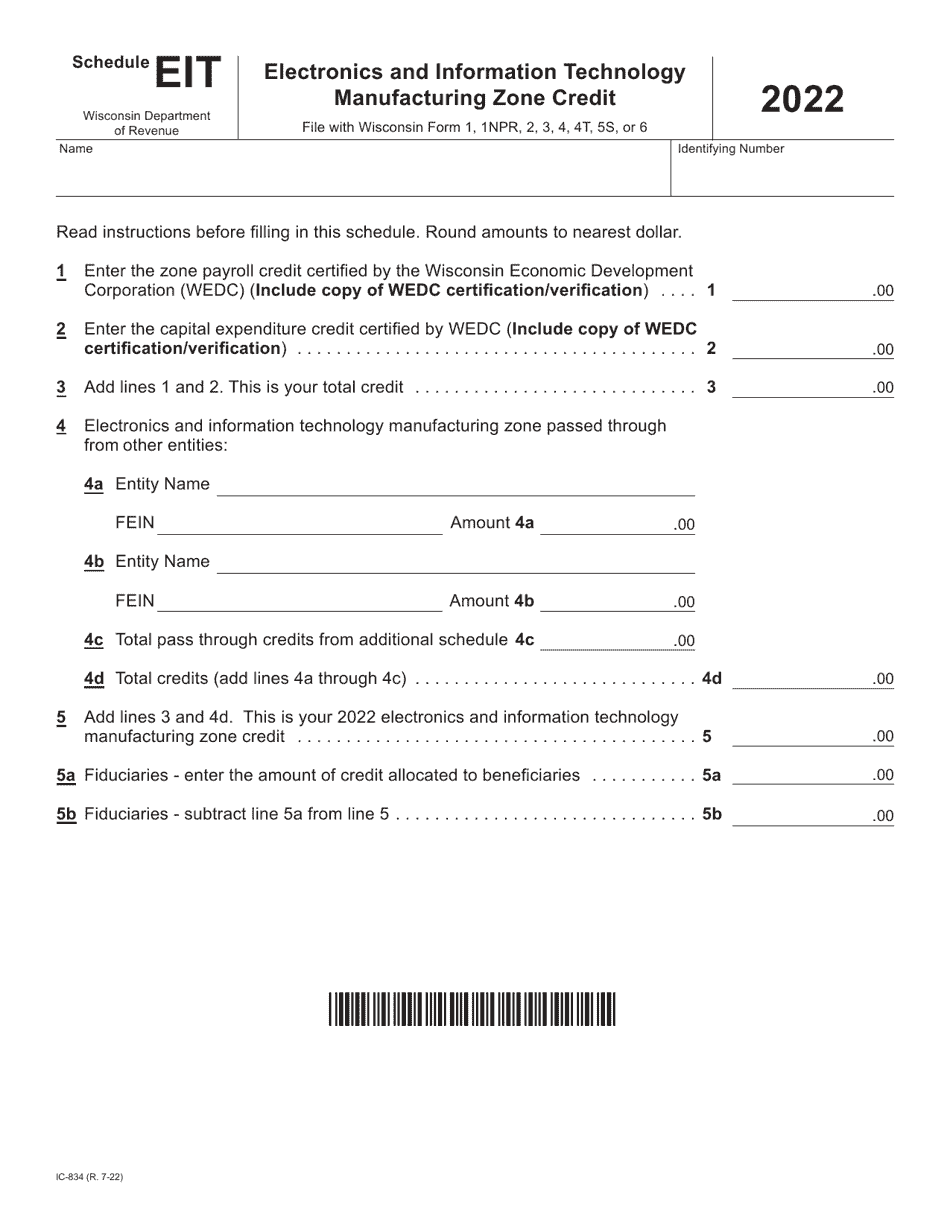

Form IC-834 Schedule EIT

for the current year.

Form IC-834 Schedule EIT Electronics and Information Technology Manufacturing Zone Credit - Wisconsin

What Is Form IC-834 Schedule EIT?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IC-834?

A: Form IC-834 is a tax form used for claiming the Electronics and Information Technology (EIT) Manufacturing Zone Credit in Wisconsin.

Q: What is the EIT Manufacturing Zone Credit?

A: The EIT Manufacturing Zone Credit is a tax credit available to businesses that are located in designated Electronics and Information Technology Manufacturing Zones in Wisconsin.

Q: Who can claim the EIT Manufacturing Zone Credit?

A: Businesses that are located in designated Electronics and Information Technology Manufacturing Zones in Wisconsin can claim the EIT Manufacturing Zone Credit.

Q: What is the purpose of the EIT Manufacturing Zone Credit?

A: The purpose of the EIT Manufacturing Zone Credit is to incentivize businesses in the electronics and information technology sector to invest and create jobs in designated zones in Wisconsin.

Q: How do I claim the EIT Manufacturing Zone Credit?

A: To claim the EIT Manufacturing Zone Credit, you need to fill out and submit Form IC-834 along with your Wisconsin state tax return.

Q: Is the EIT Manufacturing Zone Credit refundable?

A: No, the EIT Manufacturing Zone Credit is not refundable. It can only be used to offset your Wisconsin state tax liability.

Q: Are there any eligibility requirements for the EIT Manufacturing Zone Credit?

A: Yes, businesses must meet certain criteria and be located within designated Electronics and Information Technology Manufacturing Zones in Wisconsin to be eligible for the EIT Manufacturing Zone Credit.

Q: Can I claim the EIT Manufacturing Zone Credit if my business is not located in a designated zone?

A: No, the EIT Manufacturing Zone Credit is only available to businesses that are located in designated Electronics and Information Technology Manufacturing Zones in Wisconsin.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IC-834 Schedule EIT by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.