This version of the form is not currently in use and is provided for reference only. Download this version of

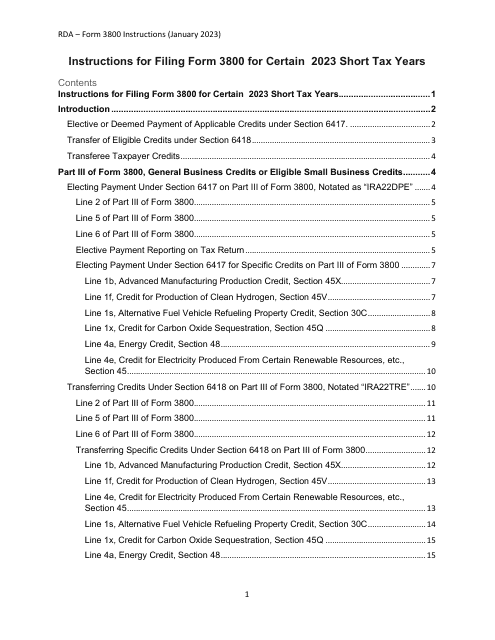

Instructions for IRS Form 3800

for the current year.

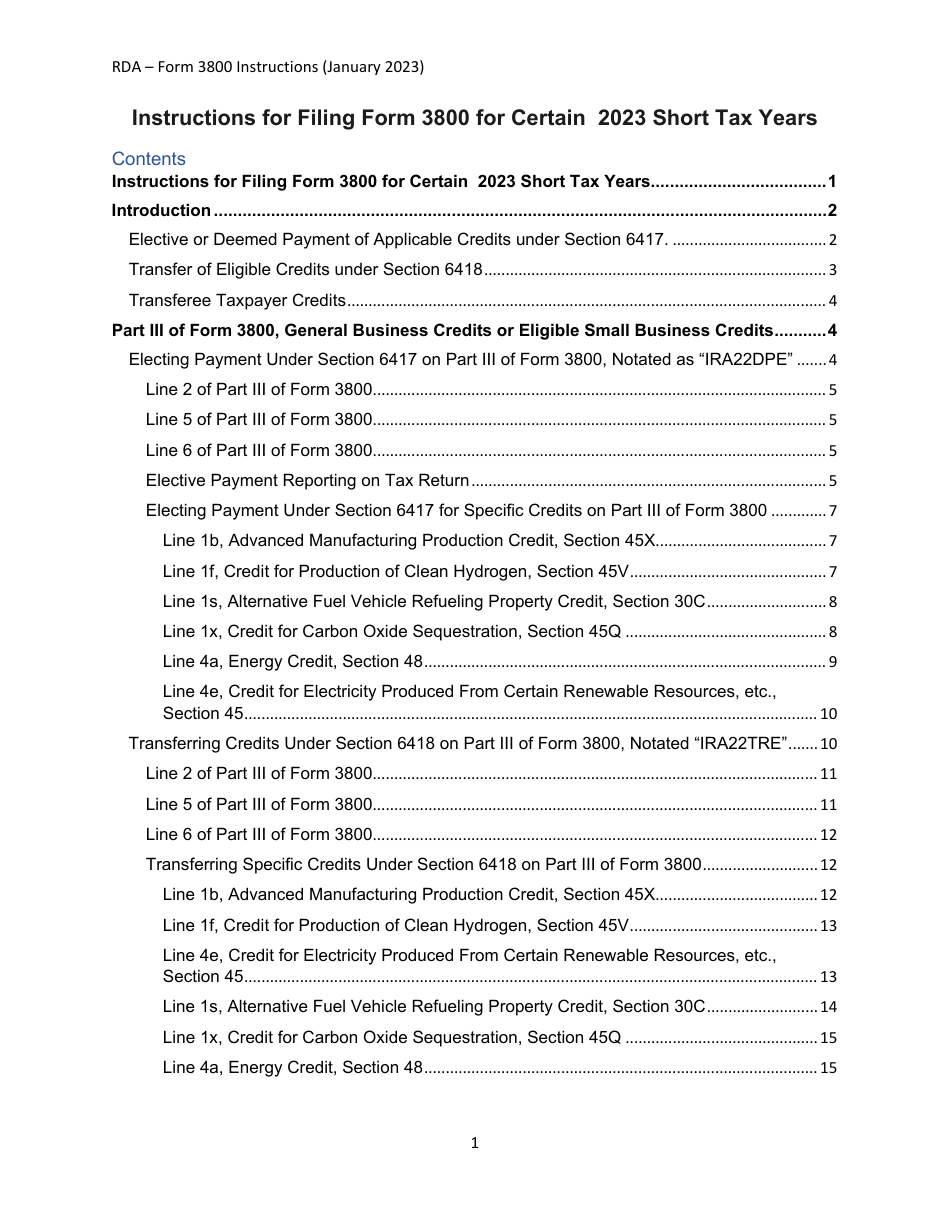

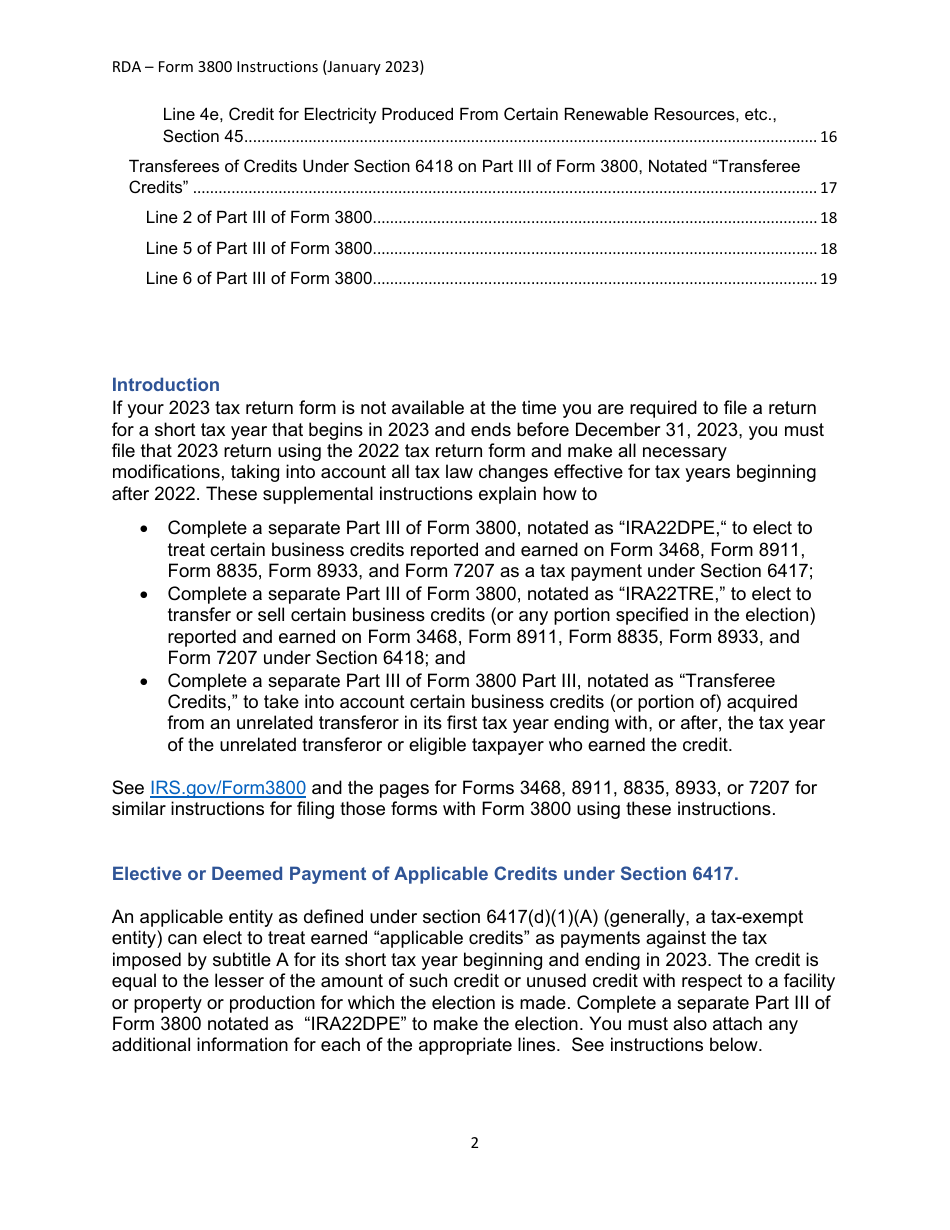

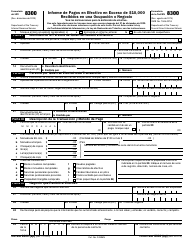

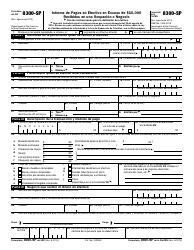

Instructions for IRS Form 3800 General Business Credit

This document contains official instructions for IRS Form 3800 , General Business Credit - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 3800?

A: IRS Form 3800 is a form for claiming the General Business Credit.

Q: What is the General Business Credit?

A: The General Business Credit is a tax credit available to certain businesses.

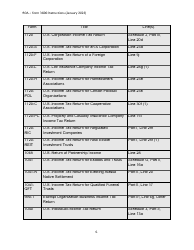

Q: Who can claim the General Business Credit?

A: Certain businesses, such as small businesses and certain types of corporations, may be eligible to claim the General Business Credit.

Q: What types of credits are included in the General Business Credit?

A: The General Business Credit includes a variety of individual tax credits, such as the investment credit, the work opportunity credit, and the low-income housing credit.

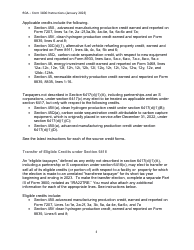

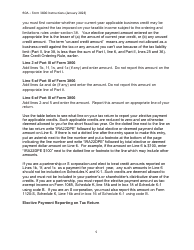

Q: How do I fill out IRS Form 3800?

A: To fill out IRS Form 3800, you will need to complete the various sections of the form, including providing information about the specific credits you are claiming.

Q: Are there any special instructions or requirements for IRS Form 3800?

A: Yes, there may be specific instructions or requirements depending on the type of credit you are claiming. It is important to read the instructions for IRS Form 3800 carefully and follow them.

Q: Can I claim the General Business Credit if my business did not make a profit?

A: Yes, in some cases you may be able to claim the General Business Credit even if your business did not make a profit.

Q: Is there a limit to how much General Business Credit I can claim?

A: Yes, there are certain limits on the amount of General Business Credit you can claim based on your specific circumstances.

Instruction Details:

- This 19-page document is available for download in PDF;

- These instructions will be used to file next year's taxes. Choose a previous version to file for the current tax year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.