This version of the form is not currently in use and is provided for reference only. Download this version of

Form 10016E

for the current year.

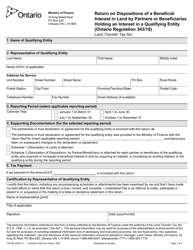

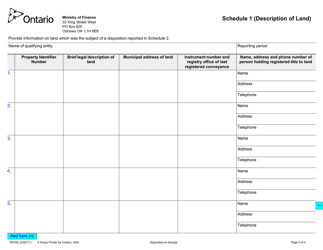

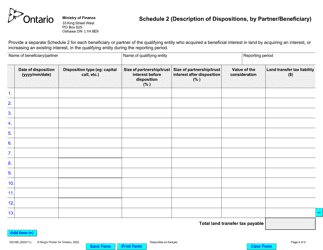

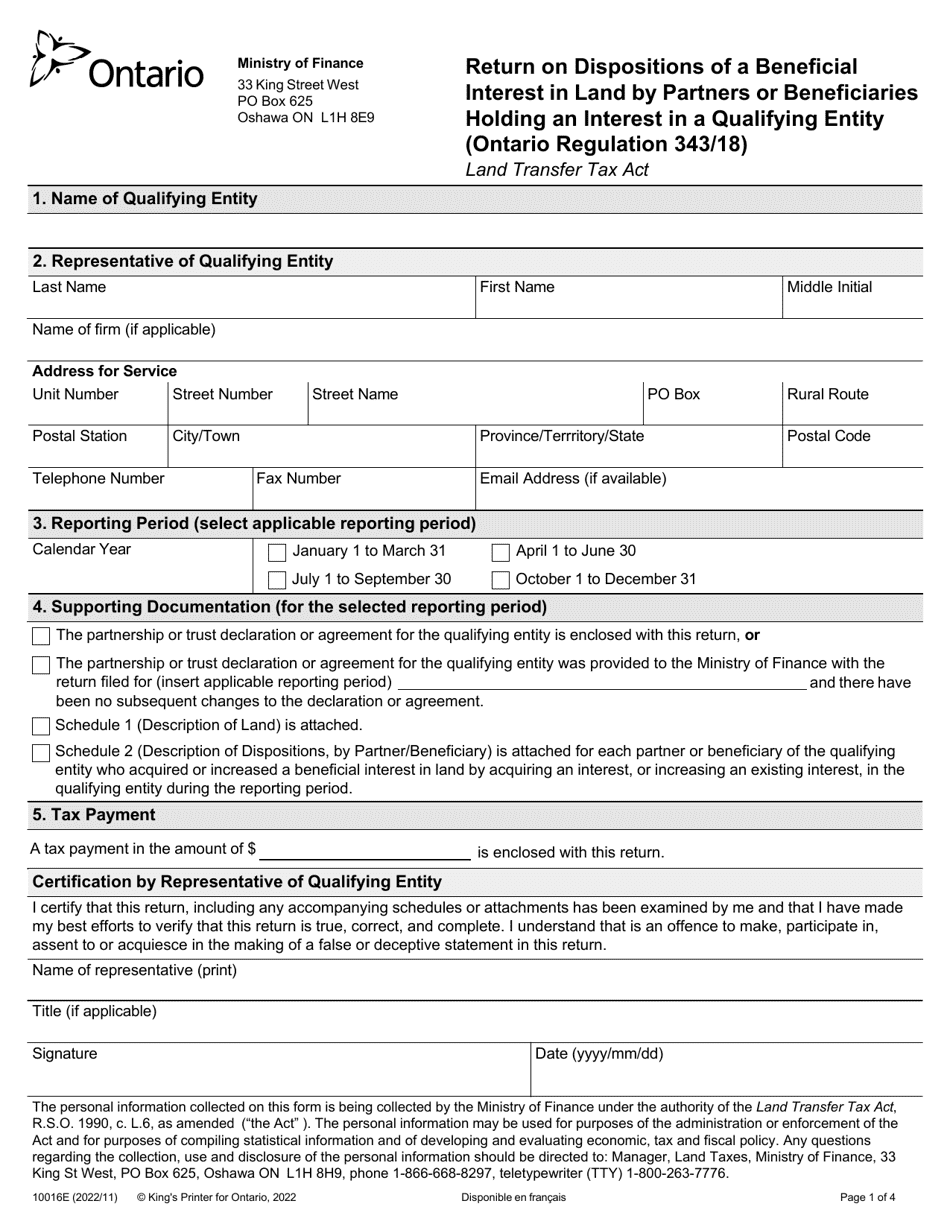

Form 10016E Return on Dispositions of a Beneficial Interest in Land by Partners or Beneficiaries Holding an Interest in a Qualifying Entity (Ontario Regulation 343 / 18) Land Transfer Tax Act - Ontario, Canada

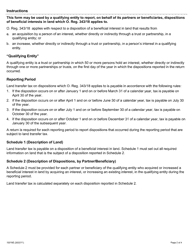

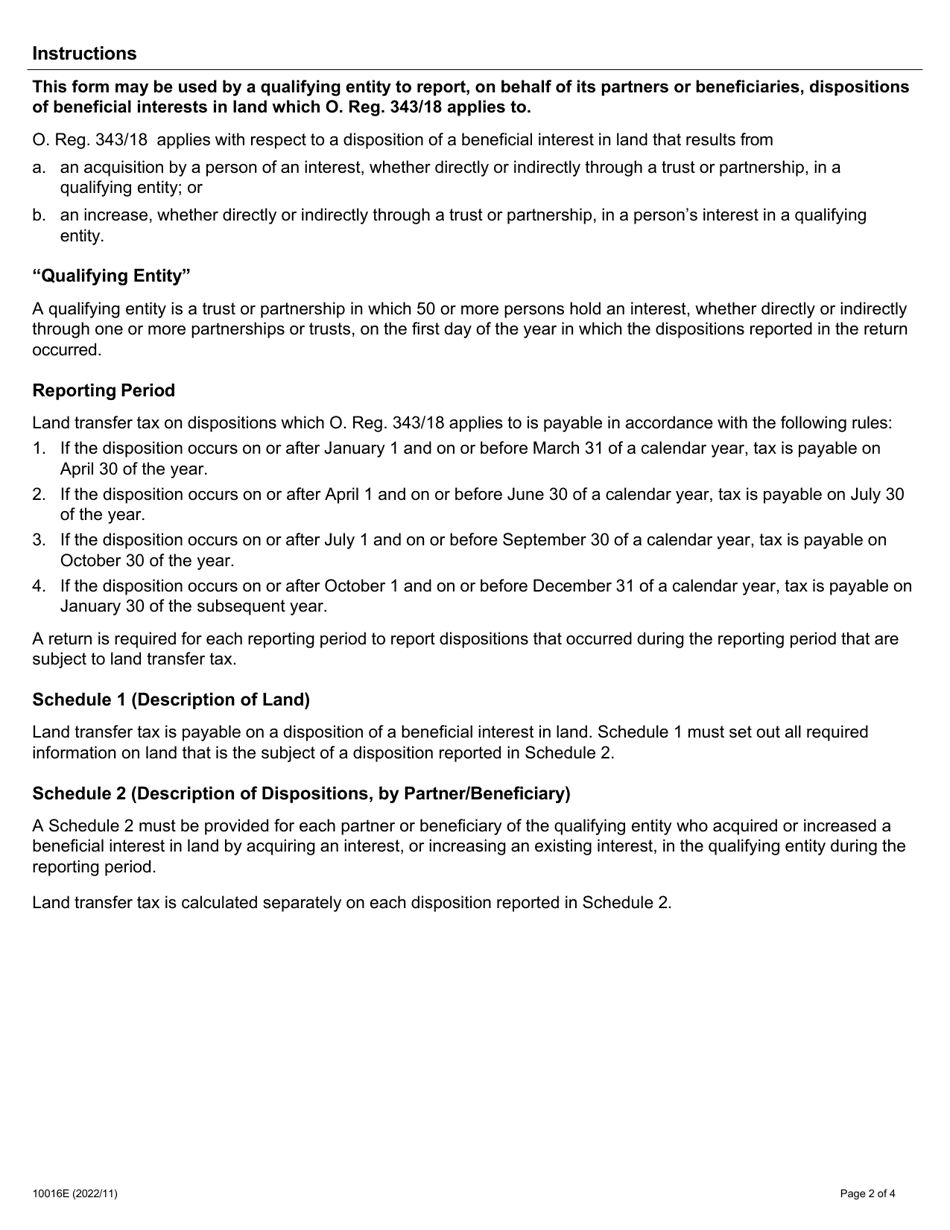

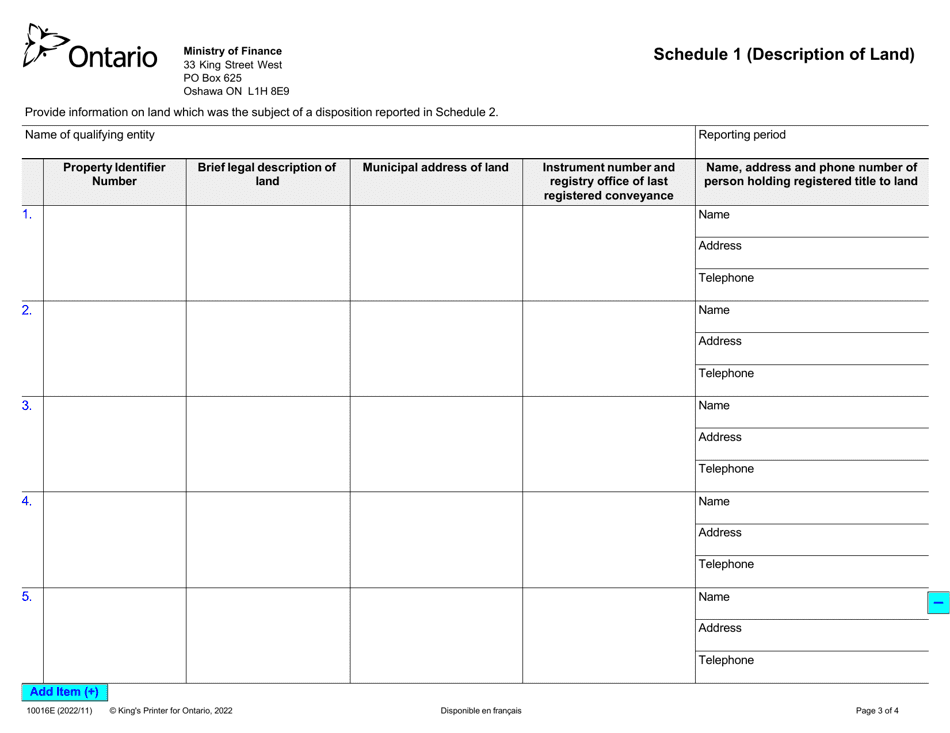

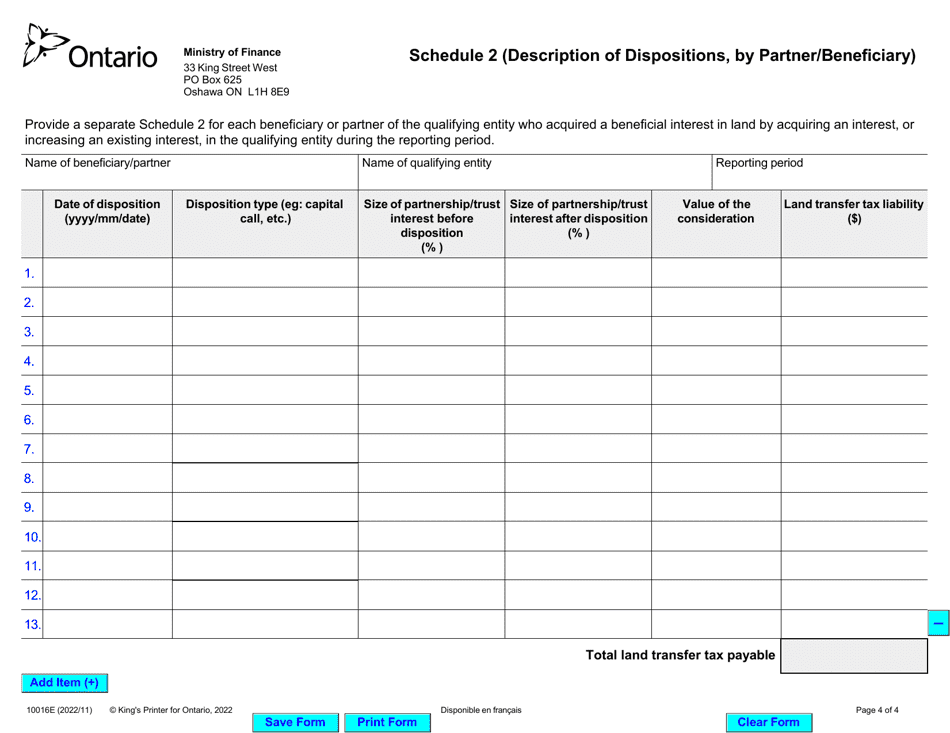

Form 10016E Return on Dispositions of a Beneficial Interest in Land by Partners or Beneficiaries Holding an Interest in a Qualifying Entity is used in Ontario, Canada, for reporting and calculating the land transfer tax when there is a transfer of a beneficial interest in land by partners or beneficiaries holding an interest in a qualifying entity. This form ensures that the necessary taxes are paid in accordance with the Land Transfer Tax Act in Ontario.

FAQ

Q: What is Form 10016E?

A: Form 10016E is a tax return form for reporting dispositions of a beneficial interest in land by partners or beneficiaries holding an interest in a qualifying entity in Ontario, Canada.

Q: Who needs to file Form 10016E?

A: Partners or beneficiaries holding an interest in a qualifying entity in Ontario, Canada need to file Form 10016E if they dispose of a beneficial interest in land.

Q: What is a qualifying entity?

A: A qualifying entity refers to a partnership or a trust that holds an interest in land.

Q: Why do I need to file Form 10016E?

A: Filing Form 10016E is necessary to comply with the Land Transfer Tax Act in Ontario, Canada.

Q: When should I file Form 10016E?

A: Form 10016E should be filed within 30 days of the disposition of the beneficial interest in land.

Q: Is there a fee for filing Form 10016E?

A: There is currently no fee for filing Form 10016E.

Q: What happens if I fail to file Form 10016E?

A: Failure to file Form 10016E may result in penalties and interest charges.

Q: Are there any exceptions or exemptions to filing Form 10016E?

A: There are certain exceptions and exemptions outlined in the Ontario Regulation 343/18. It is important to review the regulation or consult with a tax professional for specific circumstances.