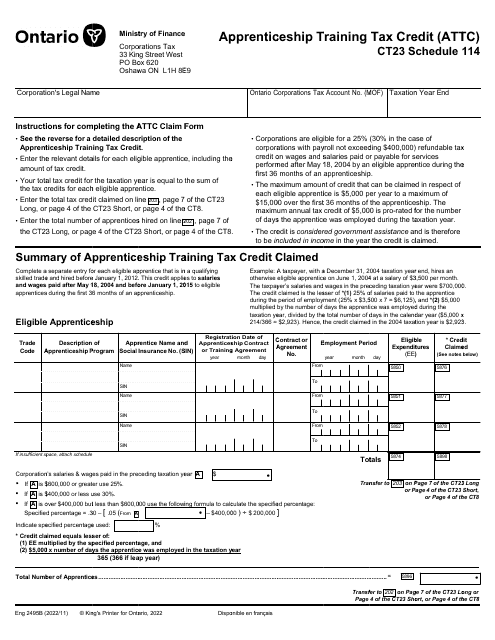

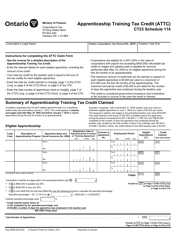

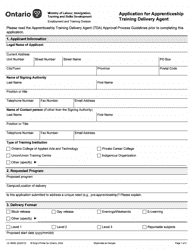

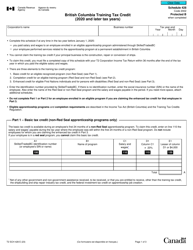

Form CT23 (2495B) Schedule 14 Apprenticeship Training Tax Credit (Attc) - Ontario, Canada

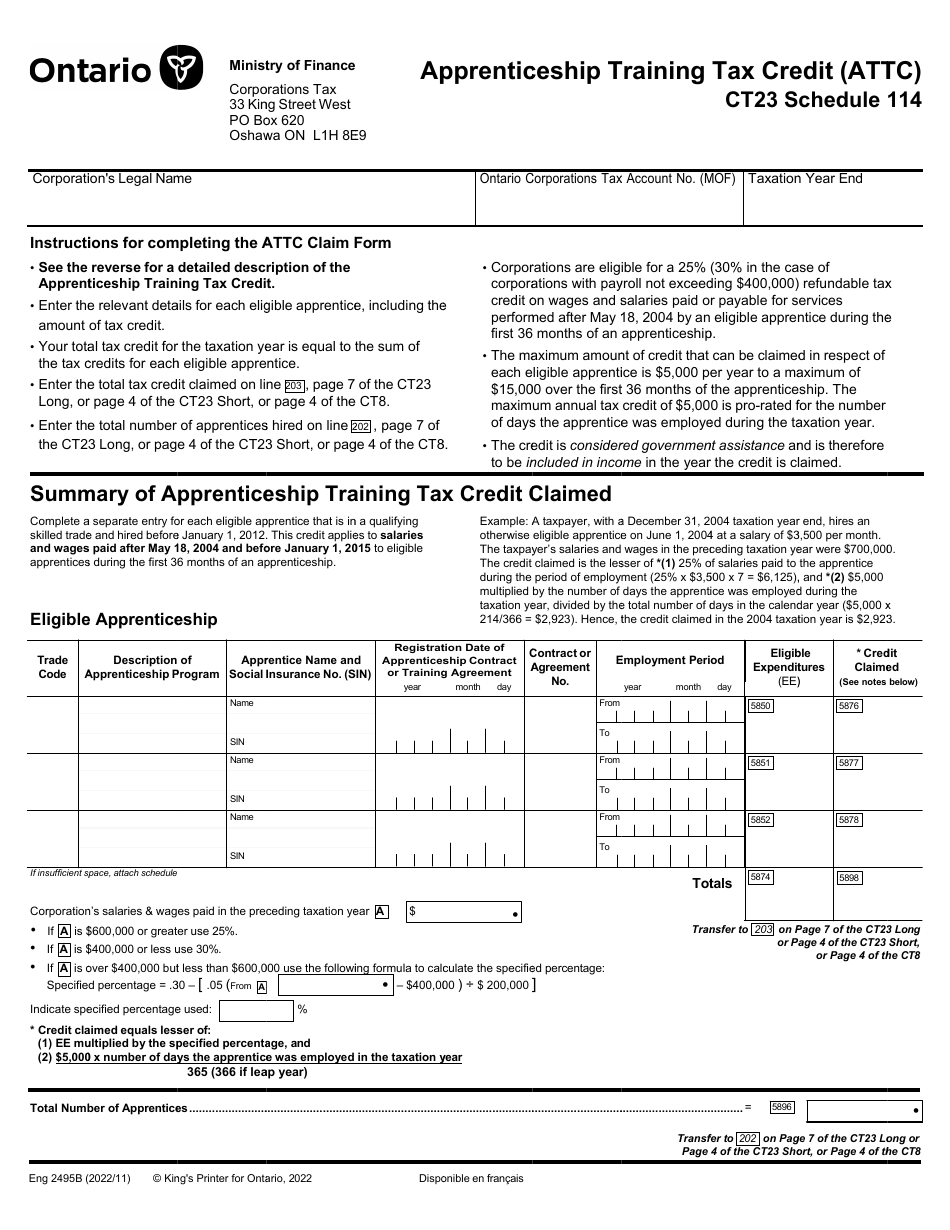

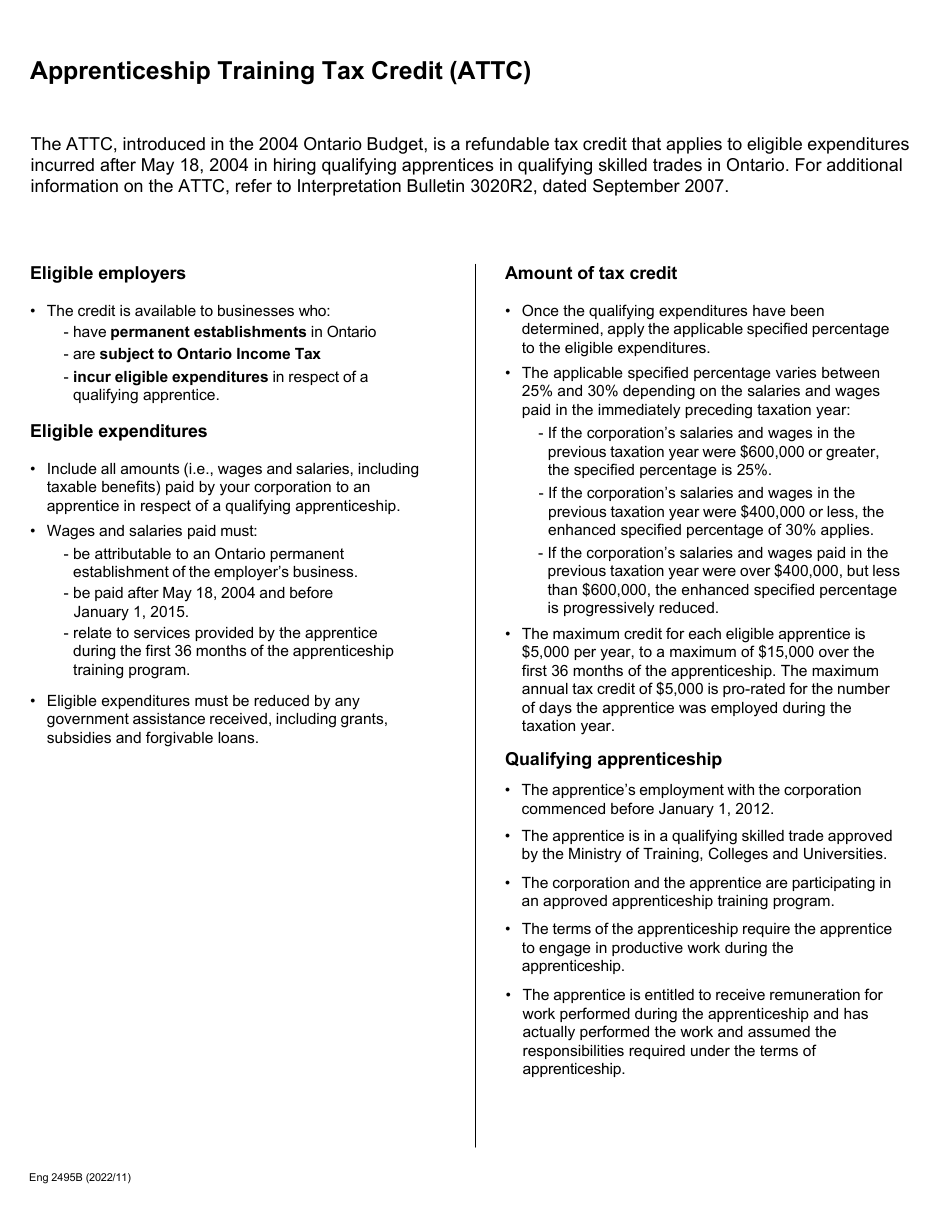

Form CT23 (2495B) Schedule 14 Apprenticeship Training Tax Credit (ATTC) is a tax form in Ontario, Canada. It is used to claim the Apprenticeship Training Tax Credit, which provides tax relief to eligible employers who hire and train qualified apprentices in specific trades. The credit helps offset the costs associated with training apprentices and encourages the growth of skilled trades in Ontario.

The employer who provided apprenticeship training in Ontario, Canada files the Form CT23 (2495B) Schedule 14 Apprenticeship Training Tax Credit (ATTC).

FAQ

Q: What is Form CT23 (2495B)?

A: Form CT23 (2495B) is a tax form used in Ontario, Canada.

Q: What is Schedule 14?

A: Schedule 14 is a specific section of Form CT23 (2495B) that pertains to the Apprenticeship Training Tax Credit (ATTC).

Q: What is the Apprenticeship Training Tax Credit (ATTC)?

A: The Apprenticeship Training Tax Credit (ATTC) is a tax credit available to businesses in Ontario, Canada that hire and train eligible apprentices.

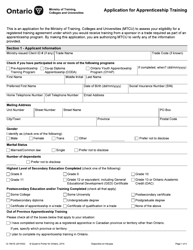

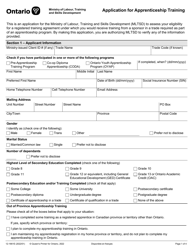

Q: Who is eligible for the ATTC?

A: Businesses in Ontario, Canada that hire and train eligible apprentices are eligible for the Apprenticeship Training Tax Credit (ATTC).

Q: What is the purpose of the ATTC?

A: The purpose of the Apprenticeship Training Tax Credit (ATTC) is to incentivize businesses in Ontario, Canada to hire and train apprentices.

Q: How do businesses claim the ATTC?

A: Businesses claim the Apprenticeship Training Tax Credit (ATTC) by completing Schedule 14 of Form CT23 (2495B) and including it with their corporate income tax return.

Q: Are there any limitations or restrictions on the ATTC?

A: Yes, there are limitations and restrictions on the Apprenticeship Training Tax Credit (ATTC) including a maximum credit amount per eligible apprentice and eligibility criteria for both the business and the apprentice.