This version of the form is not currently in use and is provided for reference only. Download this version of

Form 0741E

for the current year.

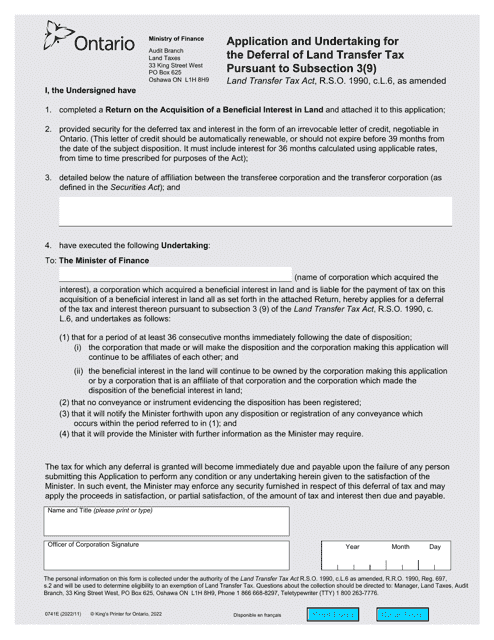

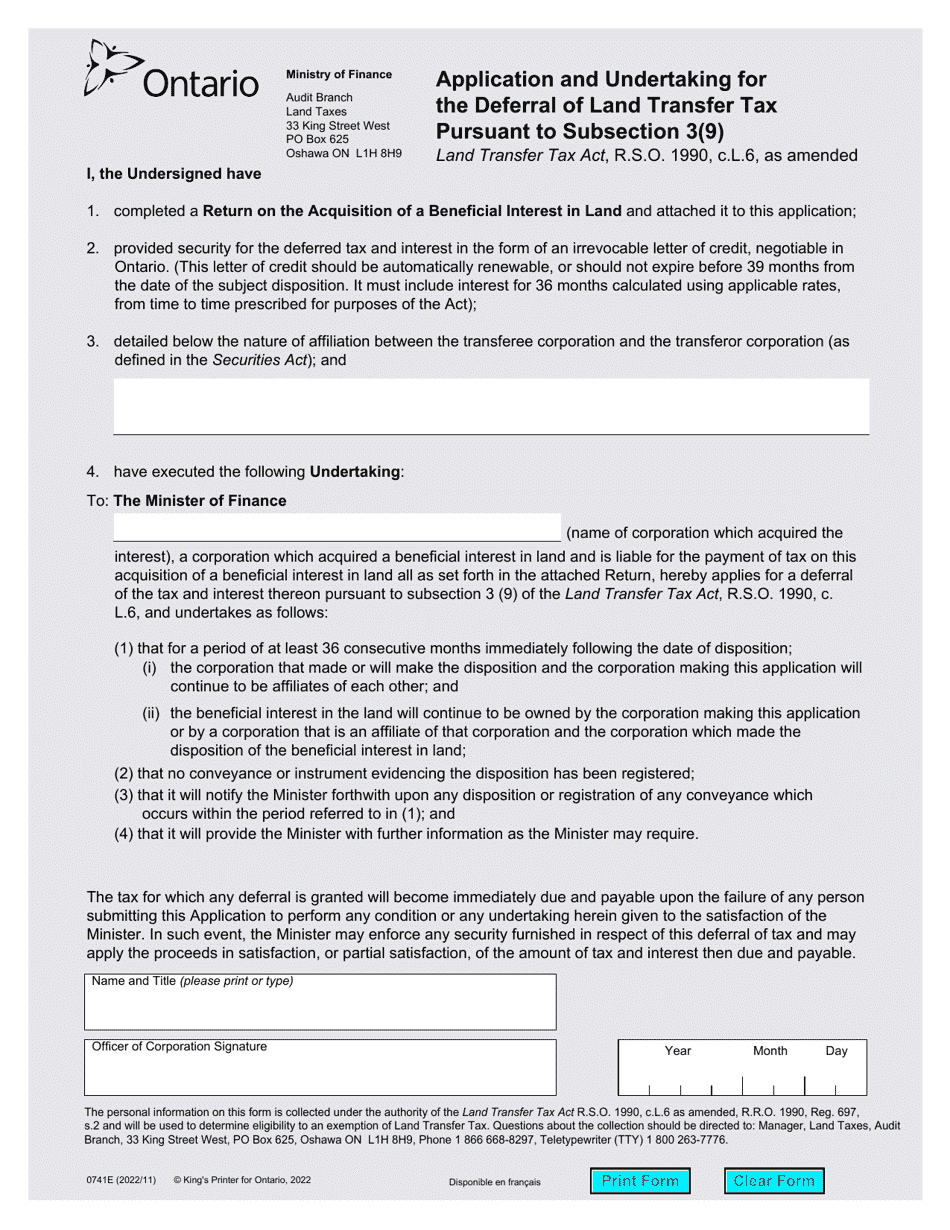

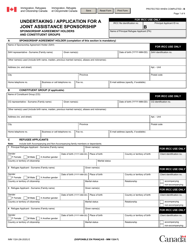

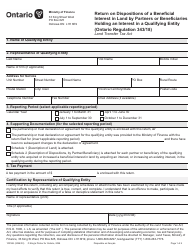

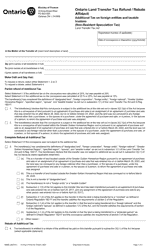

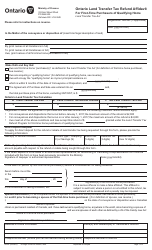

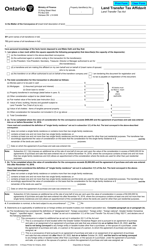

Form 0741E Application and Undertaking for the Deferral of Land Transfer Tax Pursuant to Subsection 3(9) - Ontario, Canada

Form 0741E Application and Undertaking for the Deferral of Land Transfer Tax is used in Ontario, Canada to apply for deferral of land transfer tax payment according to Subsection 3(9). This form is specifically for individuals who qualify for the deferral and wish to delay the payment of land transfer tax.

The buyer's solicitor or legal representative typically files the Form 0741E Application and Undertaking for the Deferral of Land Transfer Tax on behalf of the buyer in Ontario, Canada.

FAQ

Q: What is Form 0741E?

A: Form 0741E is an application and undertaking for the deferral of land transfer tax in Ontario, Canada.

Q: What is the purpose of Form 0741E?

A: The purpose of Form 0741E is to request a deferral of land transfer tax payment in Ontario, Canada.

Q: Who can use Form 0741E?

A: Form 0741E can be used by individuals or corporations who are eligible for a deferral of land transfer tax in Ontario, Canada.

Q: What is land transfer tax?

A: Land transfer tax is a tax imposed on the transfer of land or property ownership in Ontario, Canada.

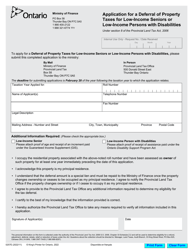

Q: What is a deferral of land transfer tax?

A: A deferral of land transfer tax is when the payment of land transfer tax is postponed to a later date, usually until certain conditions are met.

Q: What are the eligibility criteria for a deferral of land transfer tax?

A: The eligibility criteria for a deferral of land transfer tax differ depending on the specific circumstances. It is best to consult the instructions and guidelines provided with Form 0741E.