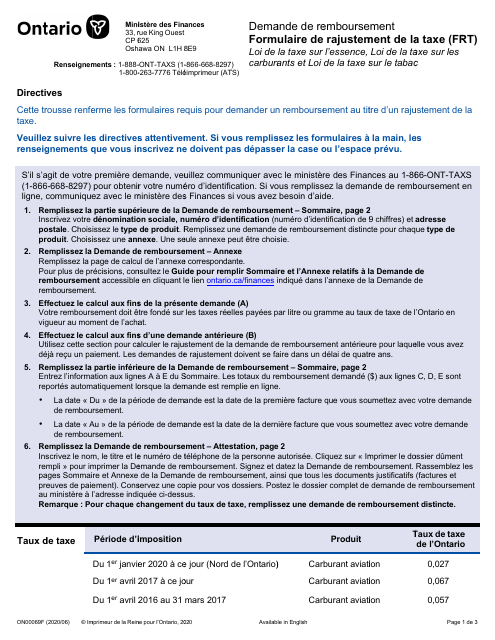

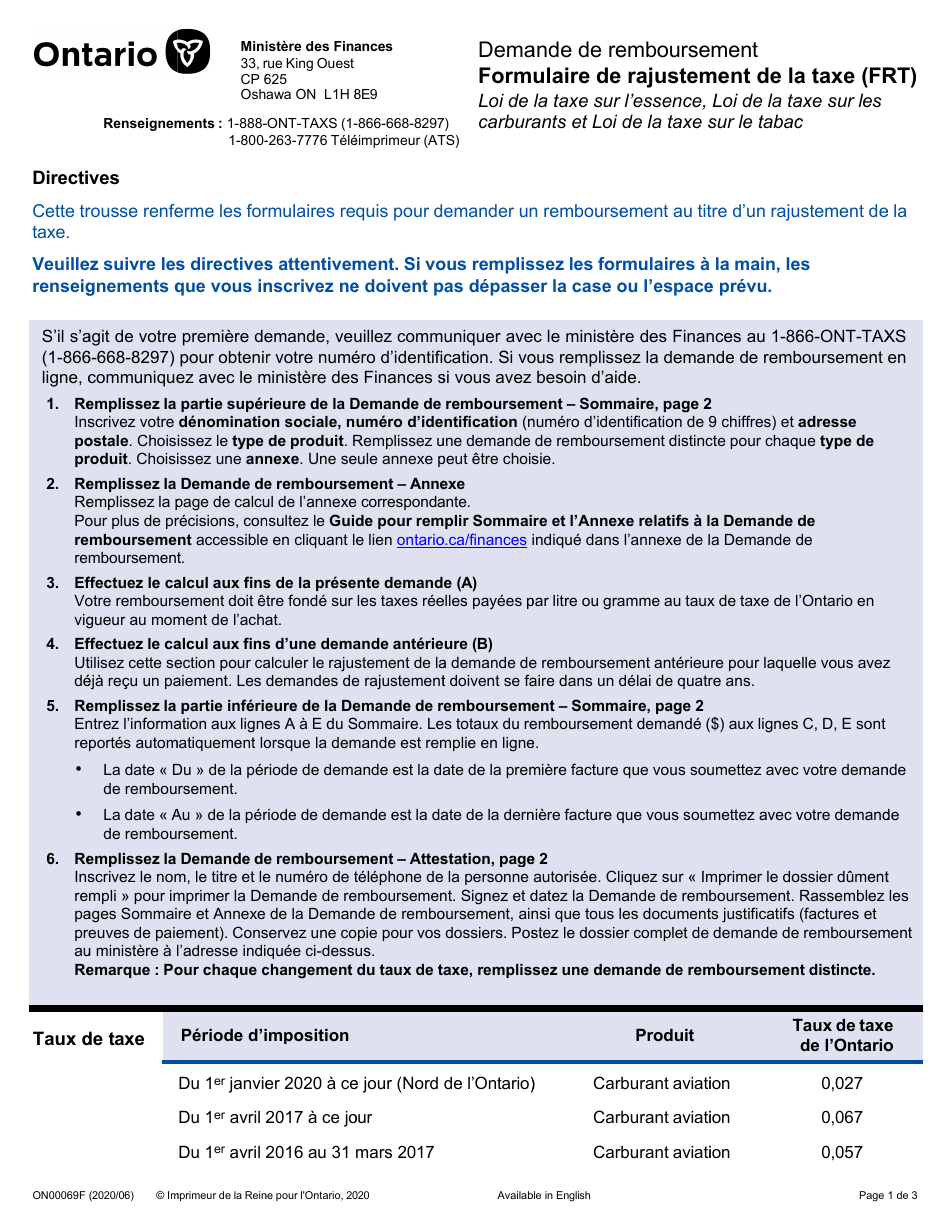

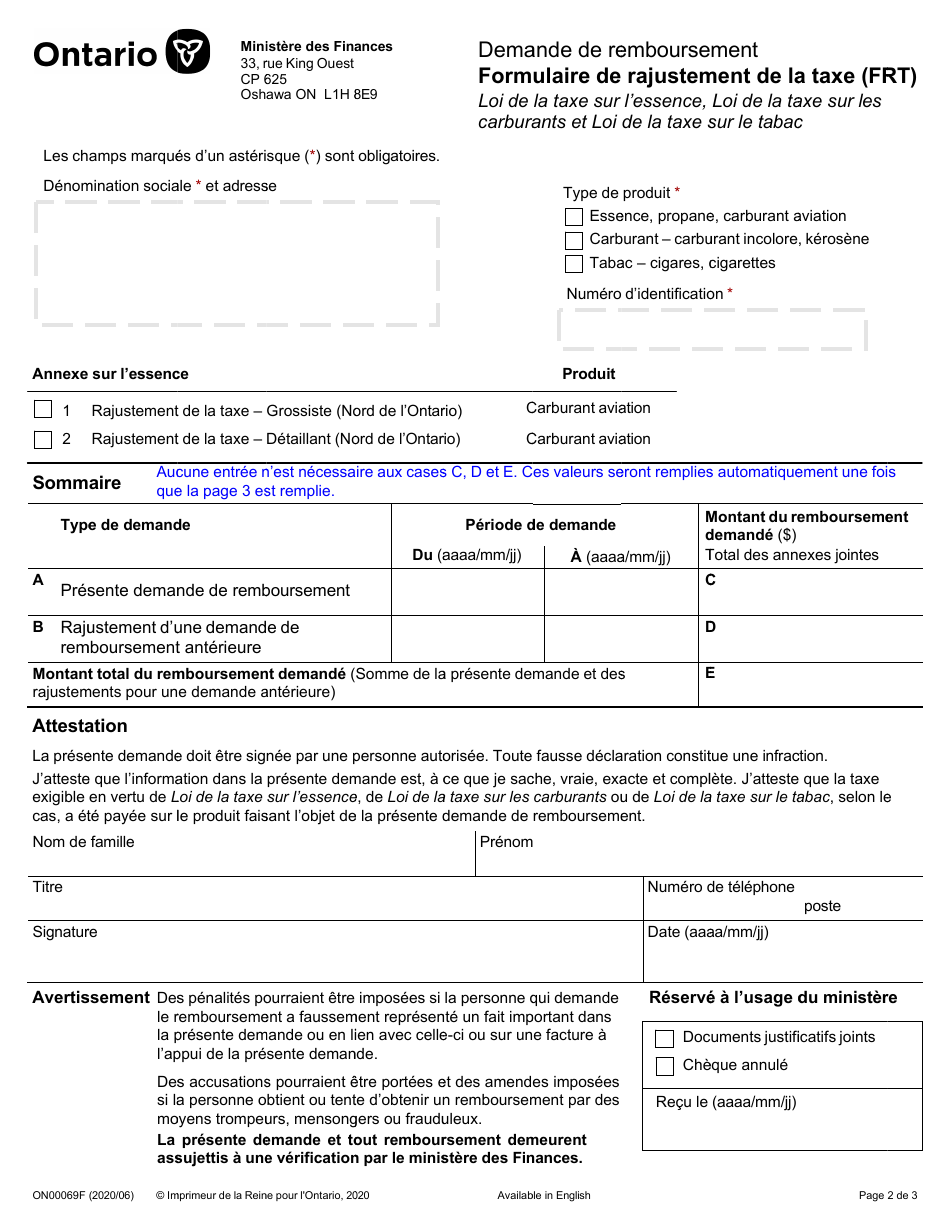

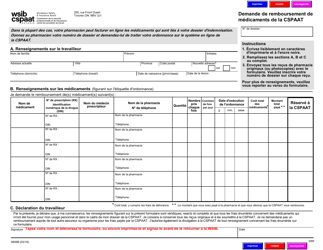

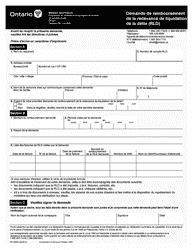

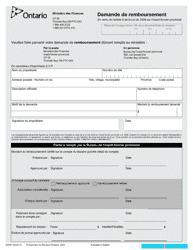

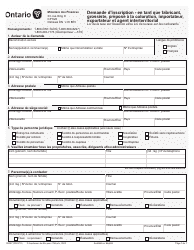

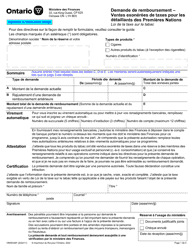

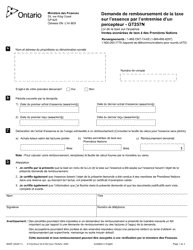

Form ON00069F Demande De Remboursement Formulaire De Rajustement De La Taxe (Frt) - Ontario, Canada

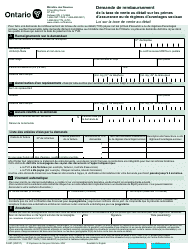

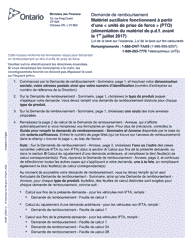

The Form ON00069F Demande De Remboursement Formulaire De Rajustement De La Taxe (Frt) is an application form used in Ontario, Canada, to request a refund or adjustment of the Harmonized Sales Tax (HST). This form is typically used by individuals or businesses who believe they have overpaid or are entitled to a refund of the HST. It allows them to provide the necessary information and documentation to support their request for a tax refund or adjustment. The form helps the government in processing the refund or adjustment request and ensuring compliance with tax laws.

The form ON00069F, Demande De Remboursement Formulaire De Rajustement De La Taxe (Frt) in Ontario, Canada, is filed by individuals or businesses who are seeking a refund or adjustment of the Harmonized Sales Tax (HST) paid on certain goods or services.

FAQ

Q: What is Form ON00069F?

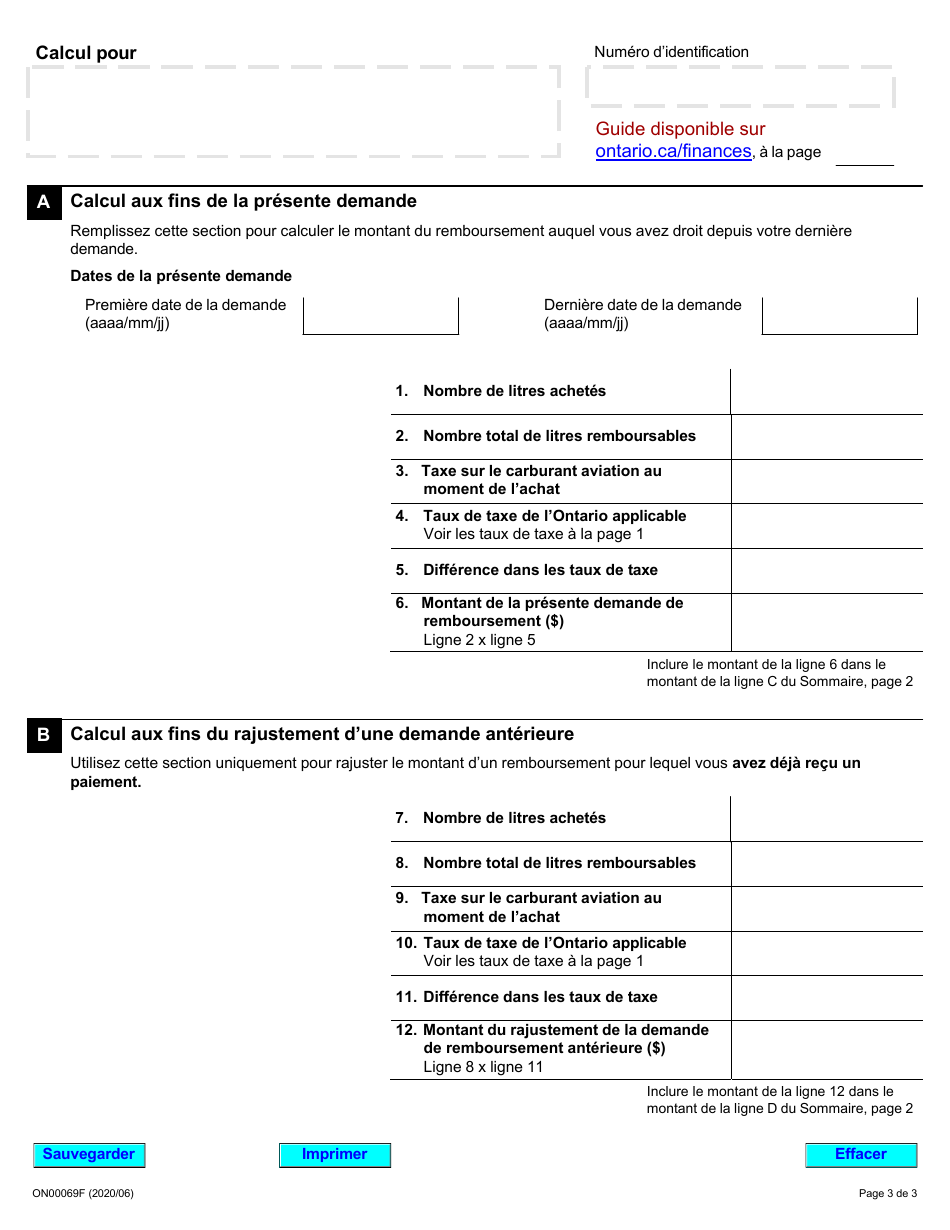

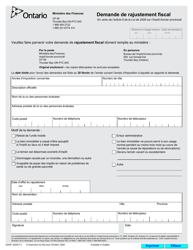

A: Form ON00069F is a request for refund form for adjustment of the Fuel Tax (FRT) in Ontario, Canada.

Q: Who can use Form ON00069F?

A: This form can be used by individuals, businesses, and organizations that are eligible for a refund of the Fuel Tax (FRT) in Ontario, Canada.

Q: What is the purpose of Form ON00069F?

A: The purpose of Form ON00069F is to request a refund for the adjustment of the Fuel Tax (FRT) in Ontario, Canada.

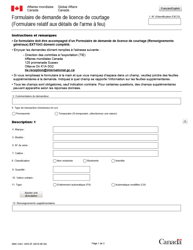

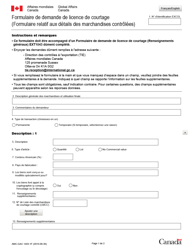

Q: How do I fill out Form ON00069F?

A: To fill out Form ON00069F, you need to provide your personal or business information, details of the fuel purchases, and the reason for the refund request.

Q: Are there any deadlines for submitting Form ON00069F?

A: Yes, there are deadlines for submitting Form ON00069F. You should refer to the instructions provided with the form or contact the Ontario Ministry of Finance for specific deadlines.

Q: What supporting documents are required with Form ON00069F?

A: The supporting documents required with Form ON00069F may include receipts or other proof of fuel purchases, business registration documents, and any other relevant documentation to support your refund request.

Q: How long does it take to process Form ON00069F?

A: The processing time for Form ON00069F may vary. It is recommended to contact the Ontario Ministry of Finance for the most up-to-date information on processing times.

Q: What happens after I submit Form ON00069F?

A: After you submit Form ON00069F, the Ontario Ministry of Finance will review your refund request and supporting documents. If approved, you will receive a refund for the adjustment of the Fuel Tax (FRT) in Ontario, Canada.