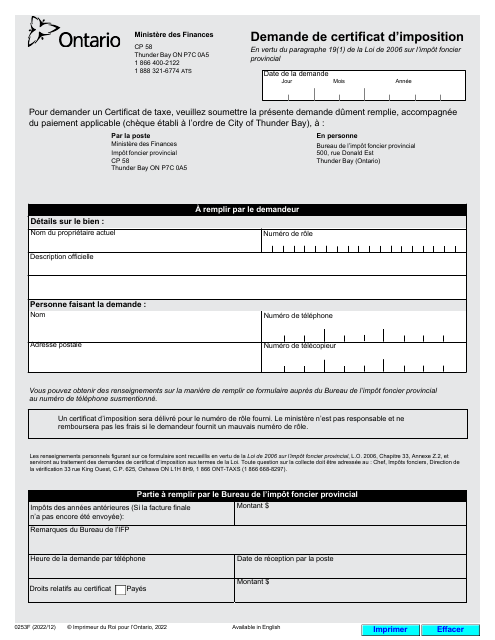

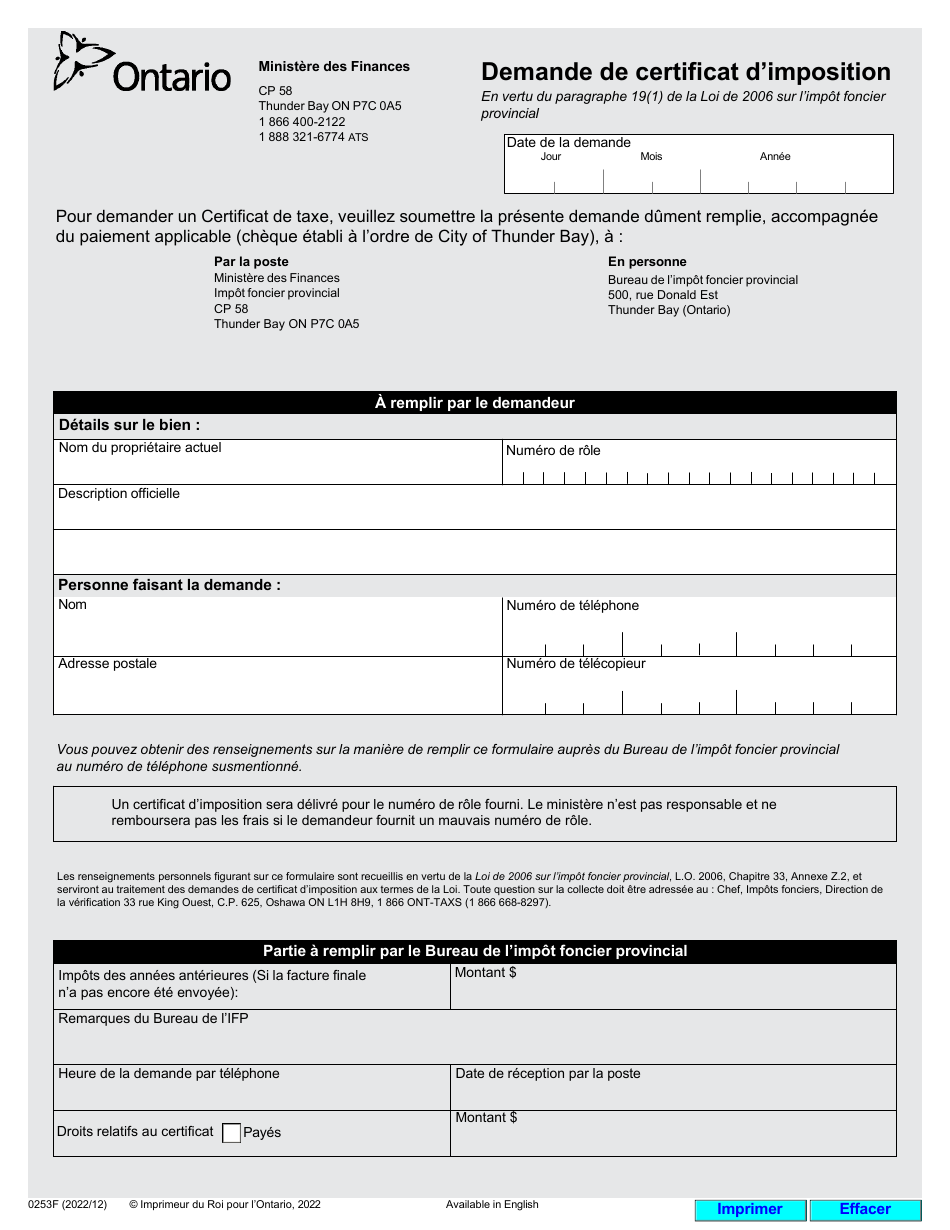

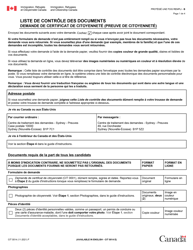

Forme 0253F Demande De Certificat D'imposition - Ontario, Canada (French)

Forme 0253F Demande De Certificat D'imposition is a French document from Ontario, Canada for requesting a tax certificate. This form is typically used by taxpayers who need proof of their tax payments or tax status. The form may ask for information like the taxpayer's full name, address, social insurance number, and the tax year for which they are requesting a certificate.

Forme 0253F Demande De Certificat D'imposition - Ontario, Canada (French) is a tax certificate request form. It is typically filed by property owners or their legal representatives in Ontario, Canada when they require proof of their property taxes. Also, accountants, lawyers, and financial institutions may use this form for obtaining precise property tax information for their clients or for legal or financial transactions. The form needs to be submitted to the local municipality or county where the property is located.

FAQ

Q: What is Forme 0253F Demande De Certificat D'imposition?

A: The Forme 0253F Demande De Certificat D'imposition is a French document used in Ontario, Canada. It's a form requesting a tax certificate or certificate of assessment detailing an individual's tax obligations.

Q: What information is required to fill out Forme 0253F Demande De Certificat D'imposition?

A: Although the specifics can vary, usually forms like the Forme 0253F Demande De Certificat D'imposition require personal identification details, income details, and possibly details of deductions or credits the individual is claiming.

Q: What is the purpose of Forme 0253F Demande De Certificat D'imposition?

A: The Forme 0253F Demande De Certificat D'imposition is used to request a tax certificate. The document outlines tax liability information and is typically used for official or legal reasons to prove an individual's tax status.

Q: Do I need to use this form if I live in the USA?

A: No, if you are a USA resident, you do not need to fill out the Forme 0253F Demande De Certificat D'imposition. This form is specific to the Ontario province in Canada. In the USA, you would use an equivalent IRS form.

Q: How is the tax system in Ontario, Canada different from the US system?

A: The tax systems of Ontario, Canada, and the USA differ in several ways including the rates, the number of tax brackets, what is considered taxable income, and how health care is covered. In Ontario, residents often pay higher taxes, which provide for more extensive public services, including healthcare.