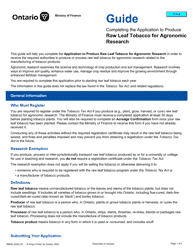

Form 2274E Guide for Completing the Tobacco Tax Non-collector Wholesaler Return - Tt101a - Ontario, Canada

Form 2274E, Guide for Completing the Tobacco Tax Non-collector Wholesaler Return - TT101A, is used in Ontario, Canada for filing tobacco tax returns by non-collector wholesalers.

FAQ

Q: What is Form 2274E?

A: Form 2274E is a guide for completing the Tobacco Tax Non-collector Wholesaler Return - TT101A in Ontario, Canada.

Q: Who needs to complete Form 2274E?

A: Tobacco tax non-collector wholesalers in Ontario, Canada need to complete Form 2274E.

Q: What is the purpose of Form 2274E?

A: The purpose of Form 2274E is to provide instructions for completing the Tobacco Tax Non-collector Wholesaler Return - TT101A.

Q: What is the TT101A form?

A: The TT101A form is the Tobacco Tax Non-collector Wholesaler Return that needs to be filed by non-collector wholesalers in Ontario, Canada.

Q: What information is required in Form 2274E?

A: Form 2274E requires information such as the wholesaler's business information, tobacco purchases and sales quantities, and applicable tax rates.

Q: Are there any penalties for not filing Form 2274E?

A: Yes, there may be penalties for non-filing or late filing of Form 2274E. It is important to comply with the filing requirements.

Q: Is Form 2274E specific to Ontario, Canada?

A: Yes, Form 2274E is specific to the province of Ontario in Canada.