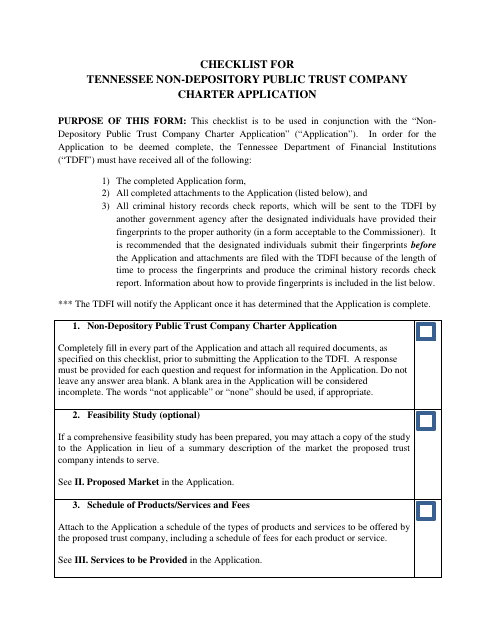

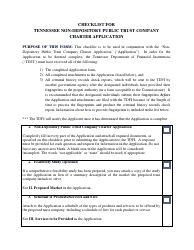

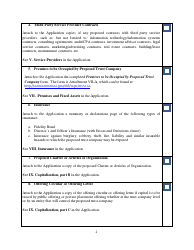

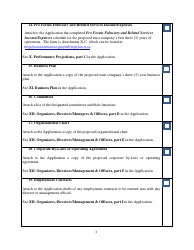

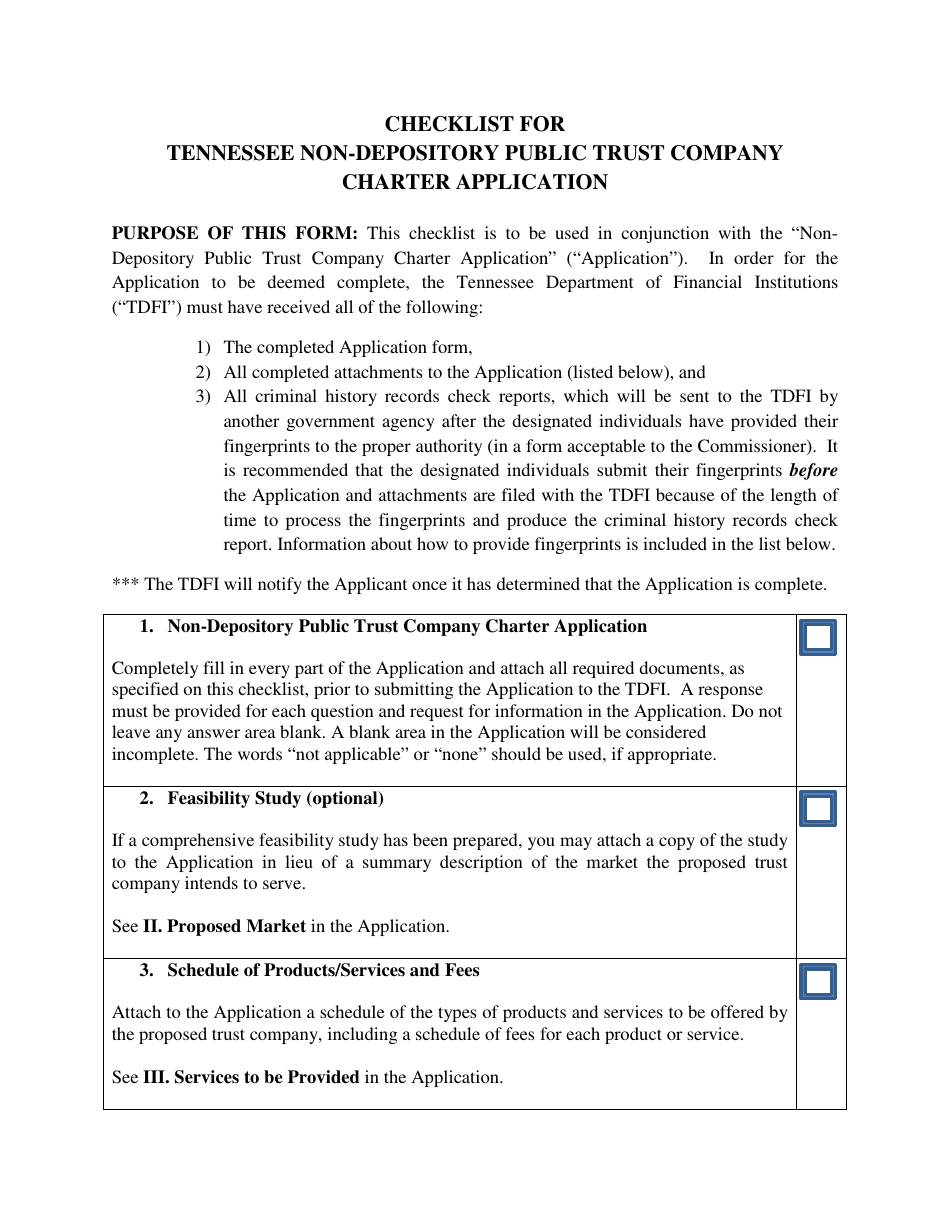

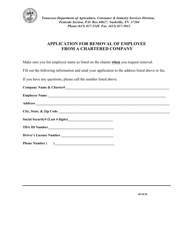

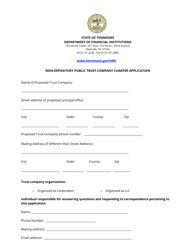

Checklist for Tennessee Non-depository Public Trust Company Charter Application - Tennessee

Checklist for Tennessee Non-depository Public Trust Company Charter Application is a legal document that was released by the Tennessee Department of Financial Institutions - a government authority operating within Tennessee.

FAQ

Q: What is a non-depository public trust company?

A: A non-depository public trust company is a type of financial institution that provides trust services but does not accept deposits.

Q: What is a public trust company charter application?

A: A public trust company charter application is the process of applying for a charter in Tennessee to establish a non-depository public trust company.

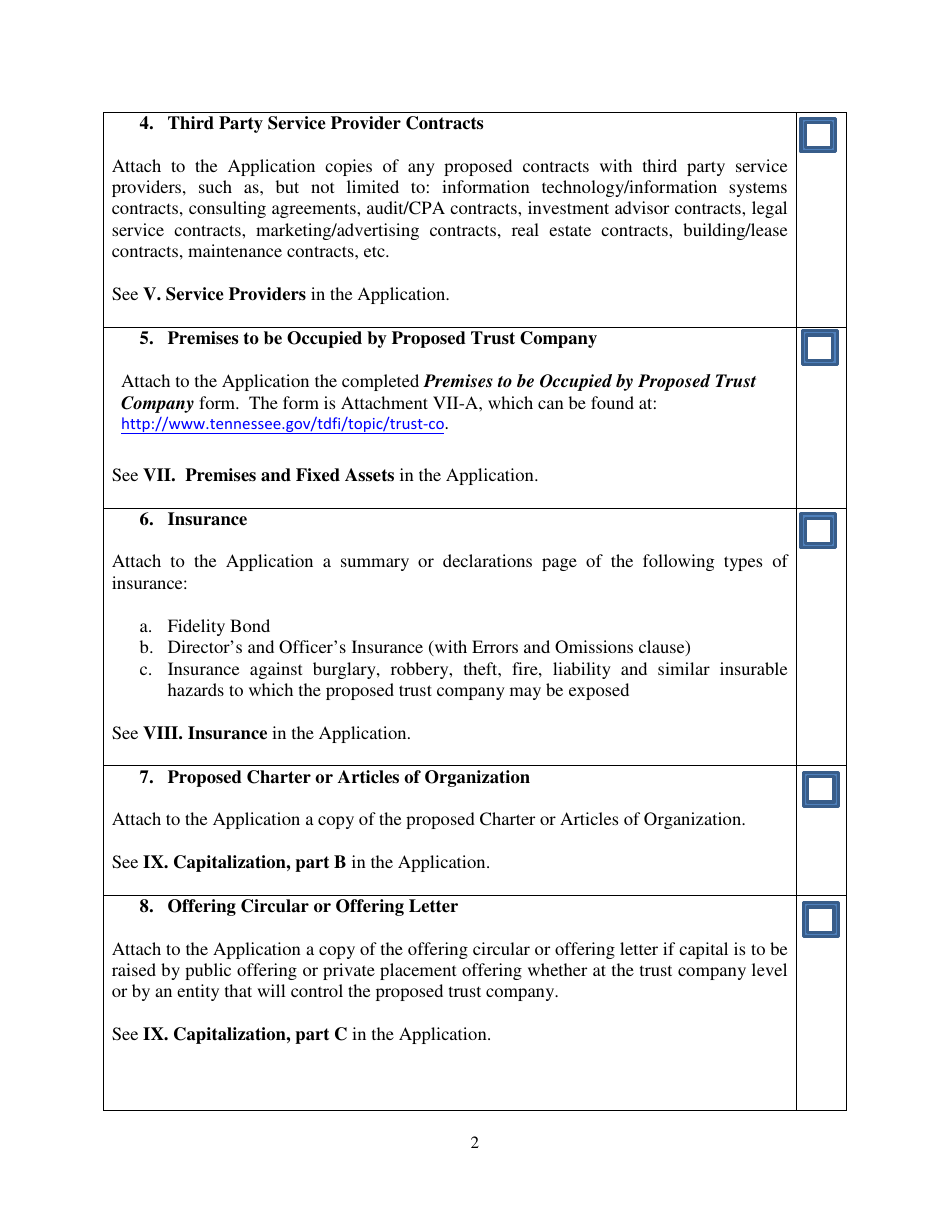

Q: What are the requirements for a non-depository public trust company charter application in Tennessee?

A: The requirements for a non-depository public trust company charter application in Tennessee include submitting an application form, providing financial statements, and meeting certain capital and licensing requirements.

Q: How do I apply for a non-depository public trust company charter in Tennessee?

A: To apply for a non-depository public trust company charter in Tennessee, you need to complete and submit a charter application form to the Tennessee Department of Financial Institutions.

Q: What is the role of the Tennessee Department of Financial Institutions in the charter application process?

A: The Tennessee Department of Financial Institutions is responsible for reviewing and approving non-depository public trust company charter applications, ensuring compliance with state laws and regulations.

Q: How long does it take to process a non-depository public trust company charter application in Tennessee?

A: The processing time for a non-depository public trust company charter application in Tennessee can vary, but it typically takes several months to complete.

Q: Are there any fees associated with a non-depository public trust company charter application in Tennessee?

A: Yes, there are fees associated with a non-depository public trust company charter application in Tennessee. The specific fees will depend on the size and type of the company.

Q: Can a non-depository public trust company operate in multiple states?

A: Yes, a non-depository public trust company can operate in multiple states, but it must obtain the necessary licenses and approvals from each state's regulatory authorities.

Q: What services can a non-depository public trust company provide?

A: A non-depository public trust company can provide a range of trust services, including asset management, financial planning, estate planning, and fiduciary services.

Q: What are the advantages of establishing a non-depository public trust company in Tennessee?

A: Establishing a non-depository public trust company in Tennessee can provide opportunities for growth, diversification of financial services, and access to a favorable regulatory environment.

Form Details:

- The latest edition currently provided by the Tennessee Department of Financial Institutions;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Tennessee Department of Financial Institutions.