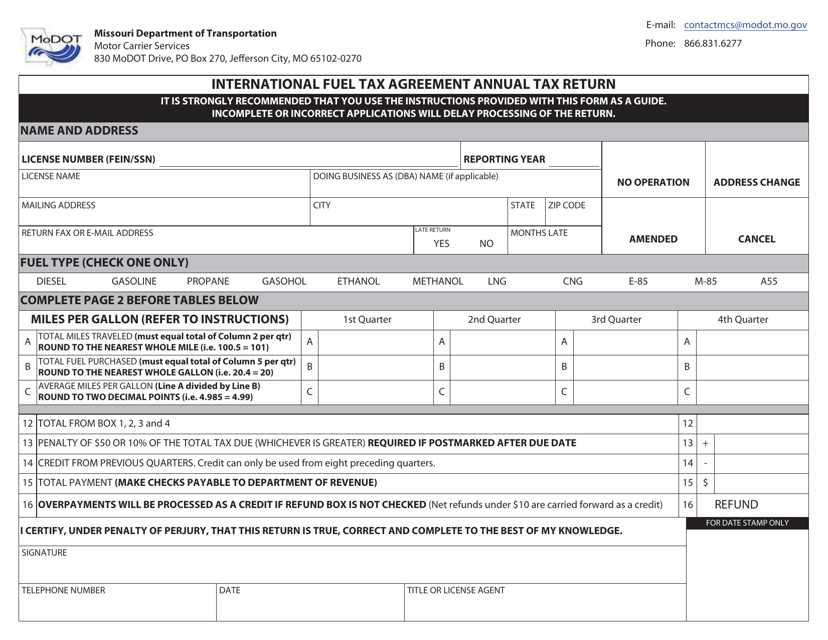

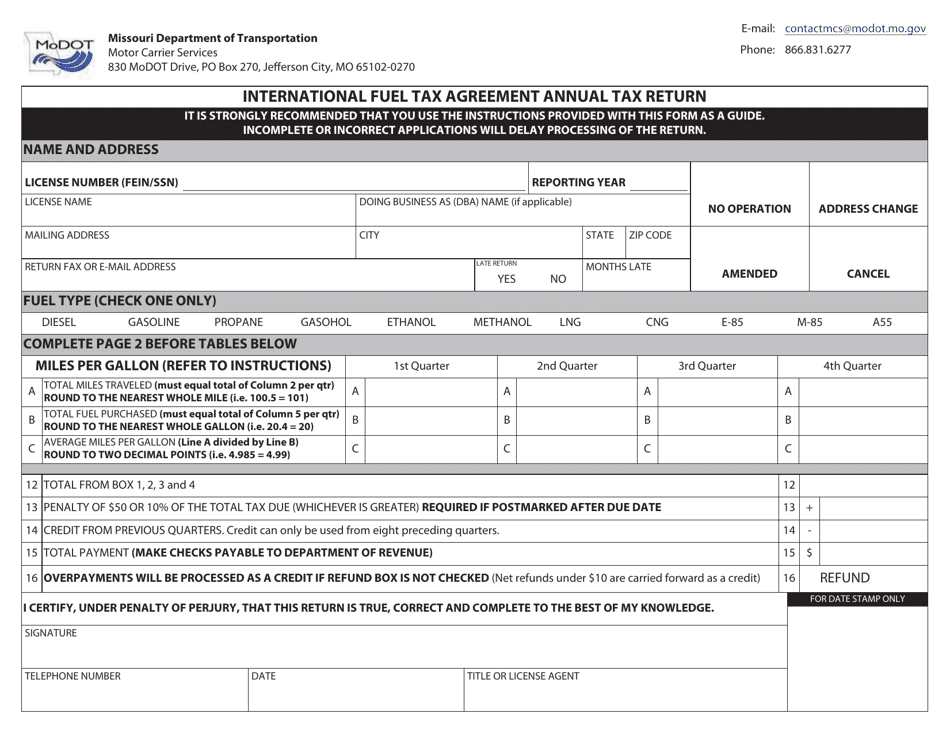

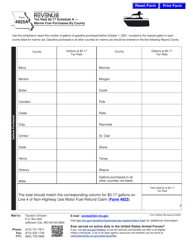

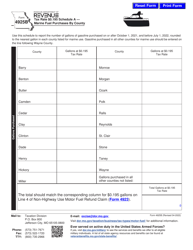

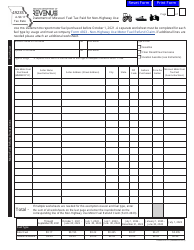

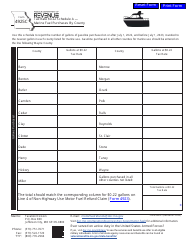

International Fuel Tax Agreement Annual Tax Return - Missouri

International Fuel Annual Tax Return is a legal document that was released by the Missouri Department of Transportation - a government authority operating within Missouri.

FAQ

Q: What is the International Fuel Tax Agreement (IFTA)?

A: The International Fuel Tax Agreement is an agreement between the lower 48 states of the United States and the Canadian provinces to simplify the reporting of fuel use taxes by motor carriers that operate in multiple jurisdictions.

Q: Who needs to file an annual tax return under the IFTA in Missouri?

A: Motor carriers who operate qualified motor vehicles in Missouri and other IFTA member jurisdictions need to file an annual tax return under the IFTA.

Q: What vehicles are considered qualified motor vehicles under the IFTA?

A: Qualified motor vehicles under the IFTA are commercial vehicles used, designed, or maintained for transporting persons or property and have two axles and a gross vehicle weight or registered gross vehicle weight exceeding 26,000 pounds, or have three or more axles regardless of weight, or are used in combination when the weight of such combination exceeds 26,000 pounds gross vehicle weight.

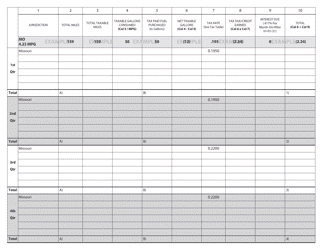

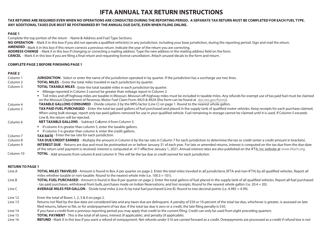

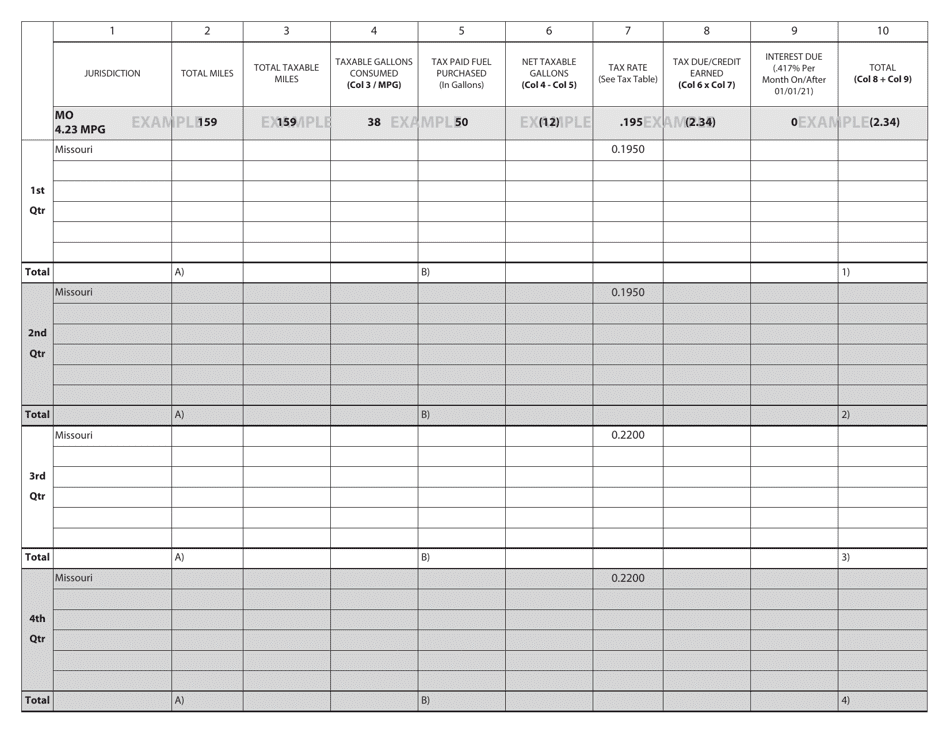

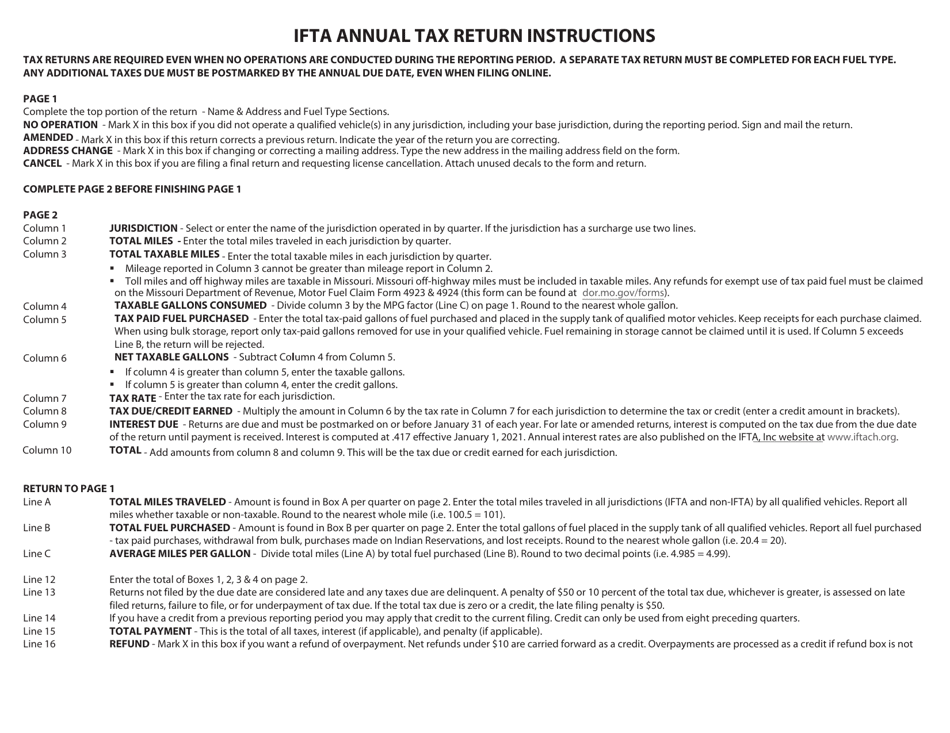

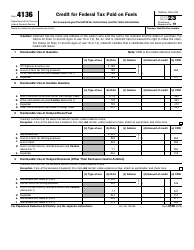

Q: What information do I need to include in my IFTA tax return?

A: In your IFTA tax return, you need to provide information about the total miles traveled in each jurisdiction, the total gallons of fuel consumed in each jurisdiction, and the fuel tax paid to each jurisdiction.

Q: When is the deadline for filing the IFTA tax return in Missouri?

A: The deadline for filing the IFTA tax return in Missouri is the last day of the month following the end of the fiscal quarter. For example, the return for the first quarter (January-March) is due by April 30th.

Q: What are the consequences of failing to file or pay the IFTA tax?

A: Failure to file or pay the IFTA tax can result in penalties and interest, and may also lead to the suspension or revocation of your IFTA license.

Q: Can I claim a refund for overpaid fuel taxes under the IFTA?

A: Yes, if you have overpaid fuel taxes in a jurisdiction, you can claim a refund by filing an amended return for that quarter.

Form Details:

- The latest edition currently provided by the Missouri Department of Transportation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Missouri Department of Transportation.